You may need heard of the breathless disclaimer, “Mutual funds are topic to market danger…learn…earlier than investing.”

Sure, whereas mutual funds investing can provide wealth technology alternatives, there may be potential dangers complementing potential returns in mutual funds.

Mutual funds investing can have various levels of various mutual fund danger varieties in several funds and schemes.

To make sure relevance, through the years, the way in which danger is introduced in mutual funds India has considerably advanced, adapting to the complexities of monetary markets and the altering wants of buyers.

On this weblog, we’ll discover the evolution of danger illustration in mutual funds and the instruments accessible to evaluate funding danger. We can even learn the way buyers can leverage this information to construct smarter portfolios.

What’s Mutual Funds Riskometer?

Early danger assessments relied on quantitative measures resembling Customary Deviation and Sharpe Ratio to check mutual fund returns. These metrics allowed goal fund comparability, however had limitations, particularly for common buyers because of the following causes:

1. Historic Bias

These are judgements primarily based solely on previous efficiency, providing no predictive perception into future dangers.

2. Incomplete Danger Protection

This includes missed key dangers resembling liquidity danger (ease of promoting property) and credit score danger (borrower default potential).

3. Complexity

This may come up if one has used technical monetary jargon, making it troublesome for non-experts to interpret and apply successfully.

Investor’s Want for simplified Danger Communication

Recognising the restrictions of purely quantitative danger measures, the mutual fund business explored simplifying danger communication. Buyers wanted intuitive methods to evaluate danger past advanced formulation. This led to danger profiling – assessing an investor’s willingness and skill to take dangers.

The monetary business launched danger profiling to make sure the next:

- Make danger simpler to grasp.

- Deal with various monetary literacy ranges.

- Improve transparency in regulatory disclosures.

- Think about investor psychology and biases.

Danger-o-Meter Origins

The evolution of danger presentation in mutual funds India has considerably advanced, adapting to monetary market complexities and investor wants. The mutual funds riskometer is a visible instrument to assist buyers perceive the danger degree of mutual fund schemes. The SEBI (Securities and Change Board of India) has launched it to offer a standardised manner of representing danger, transferring past generic phrases. The preliminary design was easy, utilizing a linear scale or gauge to point danger, from low to excessive. The first purpose was to reinforce transparency and allow straightforward comparability of danger throughout completely different mutual fund returns.

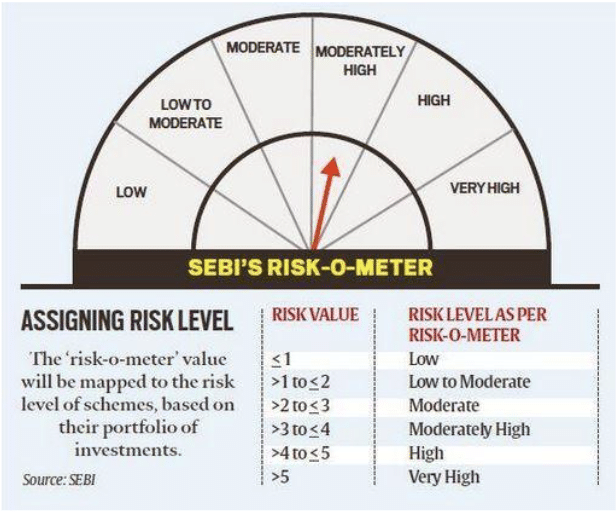

Right here is meter diagram to your reference:

As seen above, the mutual funds riskometer is a visible instrument to assist buyers perceive the danger degree of mutual fund schemes, transferring past generic phrases and enabling straightforward comparability of danger throughout completely different mutual fund returns. An investor on the lookout for a debt fund for secure mutual fund returns can use the mutual funds riskometer to determine debt funds with a “low to reasonable” danger score, specializing in funds that put money into high-quality debt securities. As soon as buyers perceive their danger profile, they’ll use the Danger-o-Meter to match themselves to acceptable mutual fund classes and search probably increased mutual fund returns.

Present Danger-o-Meter Methodology

The first purpose of the mutual funds riskometer was to reinforce transparency and allow straightforward comparability of danger throughout completely different mutual fund returns to make sure a greater mutual fund return.

The present methodology includes a complete evaluation of things, which embrace the next:

- Asset Allocation: Larger fairness allocation typically means increased danger.

- Funding Technique: Impacts danger degree; sure methods are extra susceptible to market volatility.

- Historic Volatility: Funds with a historical past of great worth fluctuations are sometimes assigned increased danger ranges.

- Credit score Danger: Funds that put money into lower-rated debt securities are thought-about riskier.

- Liquidity Danger: Funds that put money into illiquid property could face challenges in promoting rapidly, rising danger.

The SEBI gives pointers on how these components needs to be evaluated and weighted. Fund homes have to disclose the Danger-o-Meter score in scheme-related paperwork and advertising and marketing supplies.

Matching Your Danger Urge for food to the Proper Mutual Fund Returns

Danger profiling assesses an investor’s monetary targets, time horizon, funding information, and tolerance for losses. Buyers are categorised into danger profiles, resembling aggressive, reasonable, or conservative so their portfolio is weighted in the direction of shares, together with development and worldwide shares with a very good mutual fund return.

- A younger investor with a very long time horizon could be comfy with a higher-risk portfolio as a result of they’ve extra time to recuperate from potential losses and get a greater mutual fund return.

- An older investor nearing retirement would possibly want a lower-risk portfolio to guard financial savings and prioritise a secure mutual fund return over aggressive development.

The mutual fund business goals to offer a extra personalised strategy to perceive danger, accounting for particular person circumstances and preferences by assigning buyers to those danger profiles. Nonetheless, buyers have to understand that previous danger rankings are primarily based on historic knowledge and should not precisely predict future market situations or fund efficiency.

Within the dynamic panorama of mutual funds India, buyers can utilise the mutual funds riskometer to align their danger tolerance with appropriate mutual fund classes.

| Investor Sort | Really useful Mutual Fund |

|---|---|

| Conservative | Debt funds (low danger) |

| Average | Balanced funds (medium danger) |

| Aggressive | Fairness funds (excessive danger) |

Actual-World Examples for Evaluating Mutual Funds Riskometer

Under are just a few examples of how buyers can use the Danger-o-Meter:

Instance 1

A reasonable danger profile investor contemplating a balanced fund can use the Danger-o-Meter to check completely different balanced funds and select one with a “reasonable” danger score.

Instance 2

An investor on the lookout for a debt fund for secure returns can use the Danger-o-Meter to determine debt funds with a “low to reasonable” danger score, specializing in funds that put money into high-quality debt securities.

Instance 3

An investor keen to tackle excessive danger for probably increased returns and is contemplating a small-cap fairness fund can use the Danger-o-Meter to make sure the fund has a “excessive” danger score, confirming it aligns with their danger tolerance.

Due to this fact, buyers could make knowledgeable selections and construct acceptable portfolios by utilizing the Danger-o-Meter with their danger profile.

Wrapping Up

Understanding danger is crucial for profitable investing in any of the monetary merchandise in India. Danger profiling and instruments just like the Danger-o-Meter assist buyers make knowledgeable selections and construct portfolios that align with their danger tolerances. For a complete technique, search steerage from a professional monetary advisor to satisfy your particular wants and targets. Buyers can enhance their probabilities of reaching their monetary aims and constructing long-term wealth by understanding danger and utilizing accessible instruments.

Serious about how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Is UPI Killing the Toffee Enterprise?