Abstract Factors:

- Fiem Industries shines in two-wheeler lighting.

- Moneycontrol charges it “Chubby” for long-term.

- My Inventory Engine offers it an General rating of 63.25%.

- Development and moat are Fiem’s strengths.

- Worth seems overvalued, profitability wants work.

- Each analyses provide precious funding insights. Leap right here to see the comparability

Introduction

I’ve poured my coronary heart and soul into constructing the Inventory Engine app. It’s an algorithm I coded myself to investigate shares and spotlight a number of high quality shares. Right now, I wish to present you how does my Inventory Engine’s evaluation stack up in opposition to a giant identify like Moneycontrol? To check this, we’ll take a look at Fiem Industries. It’s an auto ancillary firm which has attracted moneycontrol’s consideration lately (learn this text). So, enable me to current to you a comparative evaluation between what moneycontrol is saying about Fiem and the way my Inventory Engine sees it.

I think about Moneycontrol as a dependable and go-to portal for inventory evaluation. It has gained the trusts of individuals during the last a few years. Because it is part of the CNBCTV18 group, offers it that additional bonus factors.

Alternatively, my Inventory Engine is like my very own child. I constructed it from scratch to investigate shares utilizing a particular algorithm that appears at six key parameters: Worth, Development, High quality of Administration, Profitability, Financial Moat, and Monetary Well being. Based mostly on these six parameters, it offers an total rating to a inventory.

Now, let’s see how Fiem Industries fares in each analyses and whether or not my Inventory Engine can maintain its personal in opposition to Moneycontrol.

About Fiem Industries

Here’s a fast image of Fiem Industries.

It’s an organization that makes lighting options (auto ancillary), primarily for two-wheelers like bikes and scooters. They’re additionally moving into passenger autos (PV) and electrical autos (EV), that are rising markets worldwide.

In India two phase itself rising quick, due to rising rural incomes and new mannequin launches. Fiem looks as if an organization with a number of potential.

As of date, Fiem Industries is a small Rs.3500 crore market firm. I believed, why not take it for example to show how my Inventory Engine’s evaluation fare compared to what moneycontrol is speaking about it.

What Does Moneycontrol Say About Fiem?

The Moneycontrol’s report paints a fairly optimistic image of Fiem.

They begin by saying that Fiem is an efficient decide as a result of it’s not too affected by world commerce tensions. Another outstanding auto ancillary suppliers like NSE:MOTHERSON is effected extra severely by the US tariff insurance policies below Donald Trump. Since Fiem focuses on the Indian market, it’s considerably insulated from all that drama.

They provide Fiem an “Chubby” ranking, which implies moneycontrol assume it’s to be thought-about for a long run holding objective.

Moneycontrol highlights a number of key factors that make them bullish on Fiem.

- They discuss concerning the firm’s sturdy efficiency within the two-wheeler phase. Fiem’s gross sales grew by 22% in Q3 FY25. It was primarily because of the rising demand for LED lights. New shoppers like Yamaha and Royal Enfield additionally contributed to the gross sales development.

- Moneycontrol additionally point out Fiem’s entry into the passenger automobile phase. Apparently, they’ve already delivered their first product to Mercedes and obtained approval from Mahindra & Mahindra to start out manufacturing in Q1 FY26.

- Plus, Fiem is tapping into the EV market. They’re supplying to corporations like Ola and Okinawa, and even collaborating with Gogoro for EV elements.

All of those elements makes Moneycontrol consider that Fiem has a vibrant future.

In the case of valuation, Moneycontrol says the inventory’s worth corrected by 23% from its 52-week excessive, bringing it to Rs.1,373 with a market cap of Rs.3,610 crore. They mission that by FY27, Fiem will commerce at a price-to-earnings (P/E) ratio of 15.2x, which they name “snug” and engaging for long-term traders.

Moneycontrol has additionally shares a number of monetary projections:

- Income rising from Rs.2,029 crore in FY24 to Rs.2,924 crore in FY27.

- EBITDA margin barely dipping from 15% to 13.8%.

- Internet revenue margin hovering round 8.1%.

The report additionally talked about dangers, like a slowdown in demand or rising uncooked materials prices, however total, they’re fairly constructive about Fiem.

What Does My Inventory Engine Say?

Now let’s take a look at how my Inventory Engine’s algorithm is viewing the efficiency of Fiem Industries. It will possibly analyze an organization primarily based on its final 5 years plus TTM quarterly knowledge.

I feel, myy algorithm is a little more structured. It scores an organization on six parameters, which I’ve talked about earlier, and offers an total rating out of 100%.

For Fiem, the total rating involves 63.25%, which is respectable however falls in need of the 75% threshold mark that my algorithm considers a minimal rating for a inventory to be “good” for consideration.

Why this rating? Let’s break it down by trying on the spider diagram, which is the center of my algorithm.

The spider diagram exhibits how Fiem scores on every of the six parameters, on a scale of 1 to five. Fiem does rather well in some areas. For instance:

- It scores 3.72 in Development,

- 4.08 in High quality of Administration,

- 4.15 in Financial Moat, and

- 3.59 in Monetary Well being. These are all strong rankings. Not many corporations can get a rating of “near-four” scores out of the overall of 5.

However Fiem struggles in two areas:

- Profitability (2.59) and

- Worth (2.87) – indicating overvaluation.

Let’s dig deeper into My Inventory Engine’s Evaluation

Worth Valuation

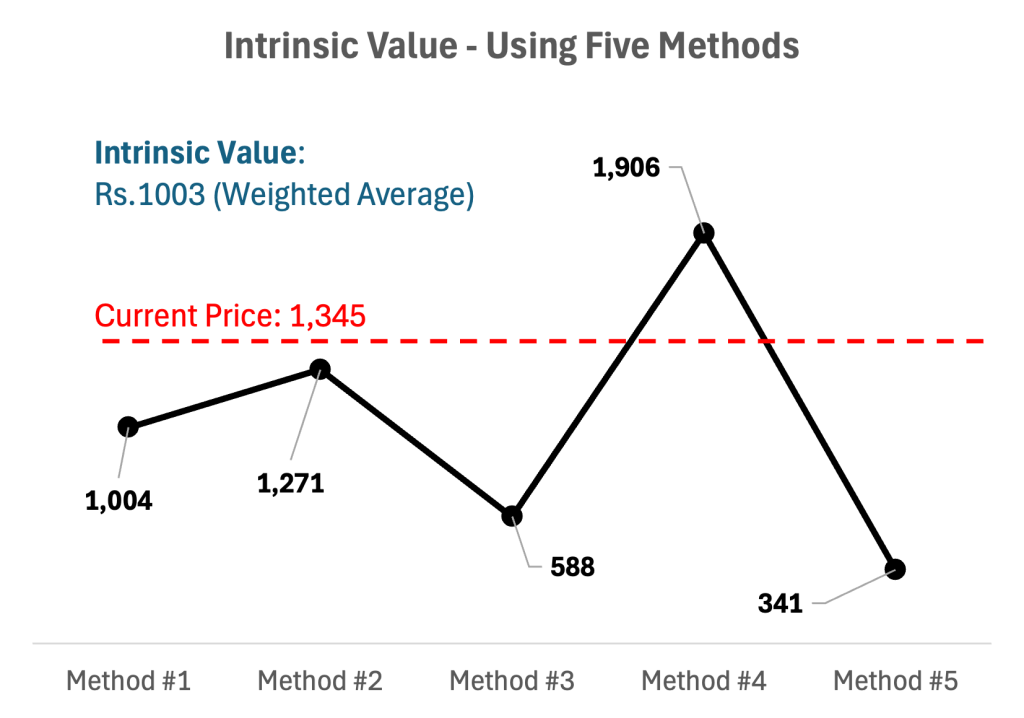

On the present worth of Rs.1,374.45 is greater than the algorithm’s estimated intrinsic worth of Rs.1003 (about 37% greater). However simply to provide you an perception into how my algorithm has arrived on the Rs.1003 determine, let’s dig additional.

The Inventory Engine’s algorithm estimates the intrinsic worth primarily based on these 5 strategies: (1) Worth to Gross sales methodology (business averages), (2) Worth to ebook worth methodology (once more business common can also be considered), (3) internet present asset worth methodology (NCAVPS), (4) DCF, and eventually utilizing the (5) PE & EPS pattern. The Inventory Engine considers the weighted common of those metrics because it estimated intrinsic worth.

On the present worth ranges, the trailing twelve-month (TTM) P/E of Fiem is about 18.00x. Evaluating this to Moneycontrol’s projected P/E of 15.2x for FY27, it seems like the corporate’s earnings (EPS) is predicted to develop quicker at the very least until FY27.

Although my algorithm is extra cautious concerning the inventory’s pricing mechanism. It depends extra on the estimated intrinsic worth as a substitute of future projection of the corporate. Future projected earnings I consider are much less dependable. However for perspective, it’s a quantity value remembering. Although, I’ll not embrace it in my scoring matrix.

Development

On Development, my Inventory Engine agrees with Moneycontrol that Fiem is doing effectively. It offers a rating of three.72 out of 5, which is above common.

- Over the past 5 years, Fiem’s working income has grown at 11% per yr,

- Internet revenue has grown at 16%.

- However there’s a small crimson flag, working money stream development is damaging at -8%. It means the corporate isn’t producing as a lot money correctly.

Although, Moneycontrol doesn’t point out these metrics particularly, however they do speak about Fiem’s development within the two-wheeler phase (22% gross sales enhance) and new alternatives in PV and EV, which aligns with my algorithm’s findings of income and internet revenue development.

Administration

In the case of High quality of Administration, my Inventory Engine offers Fiem a excessive rating of 4.08 out of 5. The algorithm is coded in a technique to estimate this “high quality” parameter and converts it right into a quantifiable quantity.

- It’s because the corporate has grown its working revenue and earnings per share (EPS).

- It has additionally used its capital properly, and might comfortably pay its dividends.

- Nonetheless, the expansion in working revenue and EPS isn’t constant, which is a slight concern.

Moneycontrol doesn’t straight rating administration, however they suggest that Fiem’s management is powerful by highlighting strategic strikes like coming into the PV phase and securing large shoppers like Mercedes.

Profitability

Profitability is one other space the place Inventory Engine raises one other concern (like worth). It offers Fiem a rating of two.59 out of 5, which is common.

- The revenue after tax (PAT) margin has been regular at 6.79% during the last 5 years.

- The EBITDA margin is 13.17%, with a small enchancment over time.

As per Moneycontrol’s projections, the web revenue margin is round 8.1% and the EBITDA margin is 13.8% by FY27. Even if you happen to evaluate the Inventory Engine’s estimate, the algorithm too estimates the worth very very similar to moneycontrol. However as per it, profitability is a weaker space of FIEM.

Why there’s a distinction between PAT Margin? I feel Moneycontrol is specializing in future potential, whereas my Inventory Engine seems at historic knowledge and flags that the present profitability isn’t as sturdy because it could possibly be.

Financial Moat

Financial Moat is one other space the place Fiem scores good in my Inventory Engine (rating of 4.15 out of 5). It’s a stong signal of a large moat.

Large moat means Fiem has a robust aggressive benefit. Inventory Engine’s algorithm compares it to its rivals like Motherson Sumi and Varroc Engineering.

Moneycontrol doesn’t use the time period “moat,” however they suggest one thing comparable by speaking about Fiem’s management in two-wheeler lighting and its rising consumer base, like Yamaha and Mercedes.

Monetary Well being

Monetary Well being will get a rating of three.59 out of 5 in my Inventory Engine.

- Fiem has excessive liquidity (present ratio of 1.74).

- Its additionally shows a really low debt dependency (debt-to-equity ratio). Presently it’s debt-free, even within the final 5 years, it has managed with solely very low money owed.

- It additionally has return on capital employed (ROCE) of 20.51%.

- However there are issues as effectively. ROCE and return on fairness (ROE) are trending downward, and the debt-to-equity ratio is rising quick. That is the rationale why the algorithm has given it a rating of three.59 out of 5. Otheriwse, from these

Moneycontrol doesn’t dive into these metrics, however they do point out dangers like a possible demand slowdown or rising uncooked materials prices, which may not directly have an effect on monetary well being.

A Comparability Desk

| Parameter | Moneycontrol | Inventory Engine | Similarities | Variations |

|---|---|---|---|---|

| Worth | P/E 15.2x (FY27E); “snug” valuation. | Overvalued (Intrinsic Worth Rs.1003); TTM P/E 19x. | – | Moneycontrol sees it as engaging; Inventory Engine flags it as overvalued. Although the evaluation of Inventory Engine seems extra grounded |

| Development | 22% gross sales development in Q3 FY25; PV & EV potential. | Inventory Engine offers it a development rating of three.72/5 | Each see sturdy development in two-wheeler, PV, and EV segments. | Inventory Engine gives particular development charges, notes damaging money stream. |

| High quality of Administration | Implied as sturdy through strategic strikes (e.g., Mercedes order). | Rating: 4.08/5; good capital use, inconsistent development in revenue/EPS. | Each acknowledge efficient administration by way of strategic choices. | Inventory Engine offers an in depth rating, highlights inconsistency. |

| Profitability | Internet revenue margin: 8.1% (FY27e); EBITDA margin: 13.8%. | Rating: 2.59/5; PAT margin: 6.79%; EBITDA margin: 13.17%. | Each notice steady margins over time. | Moneycontrol initiatives greater future margins; Inventory Engine sees it as common. |

| Financial Moat | Implied through management in two-wheeler lighting, large shoppers. | Rating: 4.15/5; huge moat, excessive TTM EPS vs. rivals. | Each agree on aggressive edge by way of market place. | Inventory Engine explicitly scores moat, compares with rivals. |

| Monetary Well being | Mentions dangers (e.g., demand slowdown, uncooked materials prices). | Rating: 3.59/5; excessive liquidity, low D/E, however rising debt. | Each see a steady monetary base for development. | Inventory Engine gives metrics (e.g., liquidity, debt traits); Moneycontrol focuses on dangers. |

The place Do They Agree, and The place Do They Differ?

Now that we’ve seen each analyses, let’s speak about the place Moneycontrol and my Inventory Engine agree and the place they differ.

One factor is obvious: each experiences see Fiem as an organization with sturdy development potential.

Moneycontrol highlights the 22% gross sales development within the two-wheeler phase and new alternatives in PV and EV, whereas my Inventory Engine offers a strong development rating of three.72 (out of 5).

Each additionally agree that Fiem has a aggressive edge. Moneycontrol factors to its management in two-wheeler lighting and massive shoppers, whereas my Inventory Engine offers a large moat rating of 4.15 / 5.

However there are some large variations too, and that is the place I need you to focus your consideration.

- The largest disagreement is on Worth. Moneycontrol says Fiem’s valuation is “snug” after a 23% correction, with a projected P/E of 15.2x by FY27, making it purchase for the long run.

- My Inventory Engine, then again, flags the inventory as overvalued. Its present worth of Rs.1,374.45 is about 37% above the estimated intrinsic worth of Rs.1003. On TTM foundation, the P/E of the inventory is about 19x.

This makes me marvel, is Moneycontrol being too optimistic concerning the future, or is my algorithm being too strict by specializing in the current?

- One other distinction is in Profitability. Moneycontrol initiatives a internet revenue margin of 8.1% and an EBITDA margin of 13.8% by FY27, which they see as wholesome.

- My Inventory Engine, nevertheless, offers a profitability rating of two.59 out of 5, calling it common, with a historic PAT margin of 6.79%. I feel this distinction comes right down to perspective. Moneycontrol is what Fiem may obtain sooner or later, whereas my Inventory Engine is grounded in what the corporate has carried out to this point.

But it surely does make me query, are we lacking one thing within the historic knowledge, or is Moneycontrol banking an excessive amount of on future development?

My Inventory Engine additionally digs deeper into areas like Monetary Well being and High quality of Administration, giving scores and stating issues like damaging money stream development (-8%) and rising debt.

Moneycontrol doesn’t go into these particulars, focusing extra on the massive image and future potential. I feel, this makes my Inventory Engine’s evaluation extra complete, but in addition extra cautious – possibly too cautious?

How I take advantage of this data?

The shares which will get highlighted by portals like moneycontrol and so forth, I make it some extent to examine how my Inventory Engine views the numbers of the corporate. As its evaluation relies on final 5 years knowledge (not on final quarter quantity solely), I discover it extra dependable.

Having mentioned that, it’s also true that the Inventory Engine sees the businesses solely within the rear-view mirror. Which evaluation (just like the one in moneycontrol) has some future views and emotions constructed into their evaluation. Therefore, I by no means ignore their experiences. I mix it with the report of Inventory Engine, then do a number of of my calculations on pen and paper. As soon as I begin feeling snug concerning the inventory, I begin studying any newest or previous information about it. I give myself at the very least someday of full studying time. On at the present time, I do nothing else. I don’t even write a weblog submit on at the present time. After studying, I once more query, is inventory value a purchase?

Which Evaluation Feels Fairer?

Now comes the massive query, which evaluation feels fairer to me?

Because the creator of Inventory Engine, I could be a bit biased, however I’ll attempt to be as trustworthy as I can.

I feel each experiences have their strengths.

- Moneycontrol’s evaluation is optimistic and forward-looking, which is nice if you happen to’re a long-term investor who believes in Fiem’s development story. They make a robust case for why Fiem could possibly be purchase, particularly with the inventory worth correction and the projected P/E of 15.2x by FY27. Their give attention to new segments like PV and EV, and massive shoppers like Mercedes, exhibits they’re excited about the longer term.

- However I additionally assume my Inventory Engine affords a extra balanced and detailed view. By scoring Fiem on six parameters, it offers a clearer image of the corporate’s strengths and weaknesses. Sure, Fiem has nice development, a large moat, and robust administration, however the overvaluation and common profitability are actual issues.

The damaging money stream development and rising debt, which Moneycontrol doesn’t point out, are additionally crimson flags that traders ought to find out about. I really feel like my Inventory Engine’s total rating of 63.25% is a good reflection of the place Fiem stands as we speak “I’ll Add to My Watchlist & Wait For Correction [Price is Overvalued But Fundamentals are Reasonable].”

I agree, it’s a firm with potential if the worth corrects additional or profitability improves.

What Ought to Be Your Precedence?

So, what does all this imply for you (my readers)?

Effectively, if you happen to’re contemplating investing in Fiem Industries after studying the moneycontrol’s report, see each the experiences.

- Moneycontrol’s report would possibly make you’re feeling extra assured concerning the long-term story.

- Whereas my Inventory Engine reminds you to be cautious concerning the present worth and profitability.

Collectively, they offer you a fuller image to make an knowledgeable resolution.

Conclusion

I wrote this weblog submit with objective.

For me, this comparability is about extra than simply Fiem Trade’s evaluation.

It’s extra about exhibiting you (my readers) how correct and dependable my Inventory Engine may be (with its personal set of limitations). Moneycontrol is a trusted identify, and I’m thrilled to see that my algorithm aligns with them on key factors like development and aggressive positioning.

The place we differ, I consider my Inventory Engine provides worth by being extra detailed and clear. It offers clear scores and metrics to again up its evaluation.

In the event you’re intrigued by this, why not give Inventory Engine a attempt? I’ve constructed it to assist traders like us make sense of the inventory market, one evaluation at a time.

I’d love to listen to your ideas, jot it down for me please within the remark part under. Till subsequent time, pleased investing, and take care.