Picture supply: Getty Photographs

Palantir Applied sciences (NASDAQ:PLTR) has changed into an absolute monster synthetic intelligence (AI) inventory. In simply two years, it has skyrocketed by simply over 1,000%, turning each £20k invested into greater than £200k.

The share worth chart is the stuff of desires for many buyers.

Spectacular development

Frustratingly, I checked out Palantir inventory in 2023 when it was buying and selling for lower than $10 (it’s now at $160). However I didn’t make investments.

Wanting again by means of my notes from the time, I see I had a few considerations that now appear trivial with the advantage of hindsight. For instance, I anxious {that a} slowdown in authorities contract wins might harm income development.

Nonetheless, Palantir had simply launched its Synthetic Intelligence Platform (AIP), a form of safe AI working system for an organisation’s information. AIP was about to place rocket boosters underneath its business enterprise.

In Q2 2025, US business income surged by a staggering 93% yr on yr — and 20% quarter on quarter — to $306m. Buyer rely grew 43% to 849, whereas Palantir booked its first $1bn quarter sooner than Wall Avenue anticipated.

One other concern I had was valuation. The worth-to-sales (P/S) ratio on the time was about 15, which I assumed seemed a bit excessive. Once more although, I completely underestimated the corporate’s means to speed up income development.

Unapologetically pro-American

Lastly, I famous to myself that Palantir could be considerably controversial. It’s unapologetically pro-American/Western, and administration has frequently spoken out towards ‘woke’ tradition.

My worry was that some companies, liberal governments, and buyers wouldn’t wish to be related to this, finally limiting its market alternative. However I used to be spectacularly unsuitable about that (clients are prioritising AI-driven effectivity and product high quality above all else).

We nonetheless imagine America is the chief of the free world, that the West is superior, that we have now to combat for these values, that we should always give American firms and, most significantly, our authorities an unfair benefit.

CEO Alex Karp

The 12-month goal

Palantir helps a whole lot of firms turn into radically extra environment friendly. For instance, Citibank has reduce onboarding from 9 days to seconds utilizing Palantir, whereas Fannie Mae can now spot mortgage fraud nearly immediately.

Main by instance, Karp is aiming to develop Palantir’s income by 10 instances over the subsequent few years whereas lowering the workforce. If this occurred over 10 years, income would find yourself at roughly $41bn, equal to a compound annual development charge of about 26%.

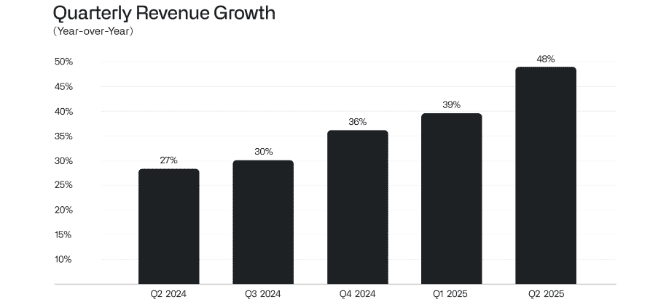

This yr, the highest line is predicted to extend 45%, then one other 35% in 2026 and 2027. So this goal doesn’t appear far-fetched to me.

My drawback right here is how a lot I must pay now for this potential future development. The P/S a number of is 118, whereas the ahead price-to-earnings ratio is 256. I usually don’t thoughts paying up for excessive high quality, however this simply seems to be like an excessive a number of.

At this sky-high valuation, even a small development wobble might set off a major share worth pullback.

In the meantime, the 12-month worth goal is $155. Based mostly on this, a £20,000 funding would make a damaging return, although loads of forecasts have been rubbished by Palantir’s efficiency since 2023.

Weighing issues up, I feel I’ve missed the boat by a mile. I’ll look forward to any massive inventory dip earlier than deciding whether or not to pounce.