Not blissful together with your mutual fund efficiency?

Do you suppose its a foul mutual fund, as a result of it’s not doing properly from final a few years?

Numerous mutual funds traders lose their endurance their mutual fund’s returns after they make investments for 2-3 yrs. Its generally advised that an fairness mutual fund will carry out excellent over the long run and one can count on double-digit returns, nevertheless, if the fund doesn’t return again good returns inside 2-3 yrs itself, the traders get very nervous and begin judging their mutual fund high quality and marvel in the event that they made a proper alternative or not!

In the present day I’ll inform you the way to choose the returns of mutual funds utilizing “Rolling Returns” evaluation, which is able to aid you to get extra confidence in your mutual fund and can aid you be taught many elements!

Let’s begin!

You Returns will make investments loads relying on if you invested!

Earlier than we go into rolling returns, let’s perceive the problem!

Take HDFC Midcap alternatives progress for instance

- 10 yrs CAGR return: 14.96%

- 5 yrs CAGR return: 11.26%

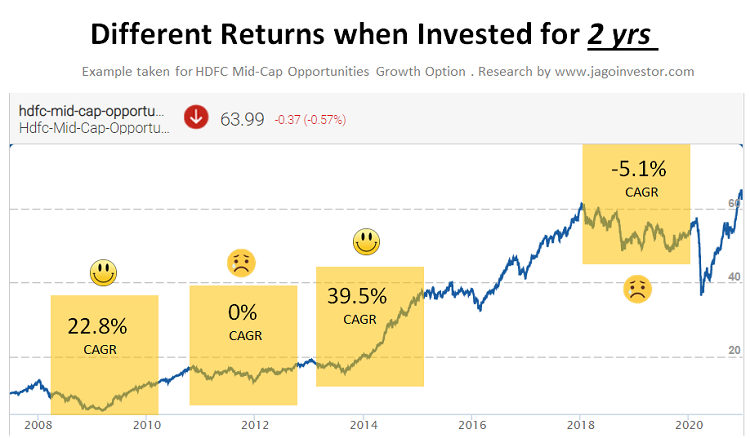

On the time of writing this text, the returns from this fund are excellent. However can this fund give unhealthy returns in a 2 yr interval. The reality is that this identical “good fund” can provide very totally different form of returns in a 2/3 yr interval relying on if you purchased the fund.

Right here is a few information.

You’ll be able to see that the two yrs return could be 22.8%, 0%, 39.5% or -5.1% relying on when an individual entered the fund. So loads will depend on if you entered within the fund.

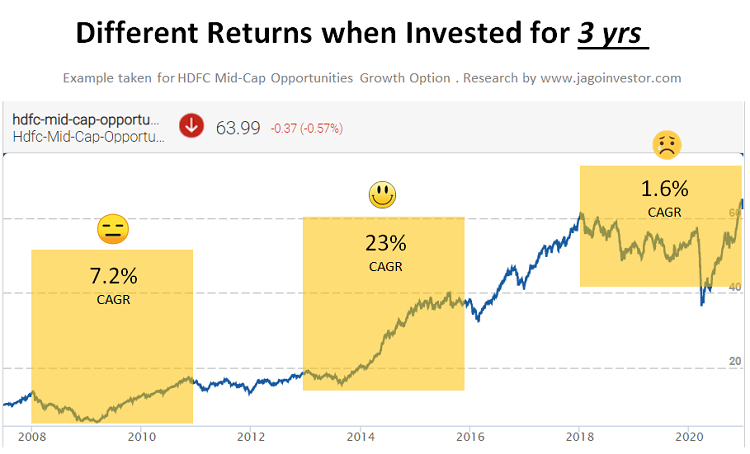

Now let’s see the identical factor for 3 yr timeframe.

Once more, you’ll be able to see that for a 3 yr interval – the expertise could be very very totally different. It’s not at all times doable to enter on the lowest level and plenty of instances, traders make investments their cash for the long run when the close to time period returns are going to be unhealthy. Nonetheless, they by no means get ready for this.

Investor thoughts can be not designed to remain calm when returns go in damaging and that’s when traders make a unsuitable alternative of exiting the funds even when on the elementary degree, the fund has no points and its simply the volatility of the fairness which is driving the fund into damaging return zone!

You’ll be able to see that this strategy of simply wanting on the level to level return doesn’t provide you with sufficient detailed details about the fund and its volatility.

Rolling Returns – What it’s and How to have a look at it!

Rolling return means a sequence of returns information for every and on a regular basis funding for a sure timeframe.

So in our instance of HDFC Midcap alternatives, lets assume a interval of 14 yrs from 1st Jan 2007 to thirtieth Dec 2020. Thats approx 5110 days. If you happen to do a 2 yr rolling return evaluation, it signifies that a interval if investing for two yrs and you’re plotting the CAGR return for every day of funding from the beginning. (that’s 730 days of funding)

So that you make investments on

- 1st Jan 2020 and exit on 1st Jan 2022 (1st occasion)

- 2nd Jan 2020 and exit on 2nd Jan 2022 (2nd Occasion)

- third Jan 2020 and exit on third Jan 2022 (third Occasion)

- ….

- ….

- ….

- thirtieth Dec 2018 and exit on thirtieth Dec 2020 (4380 cases: 5110 – 730)

So you’ll be able to plot these 4380 information factors and that graph is known as a rolling returns graph. In the identical approach, you’ll be able to have a 3 yr, 5 yr and even 10 yr rolling return graph.

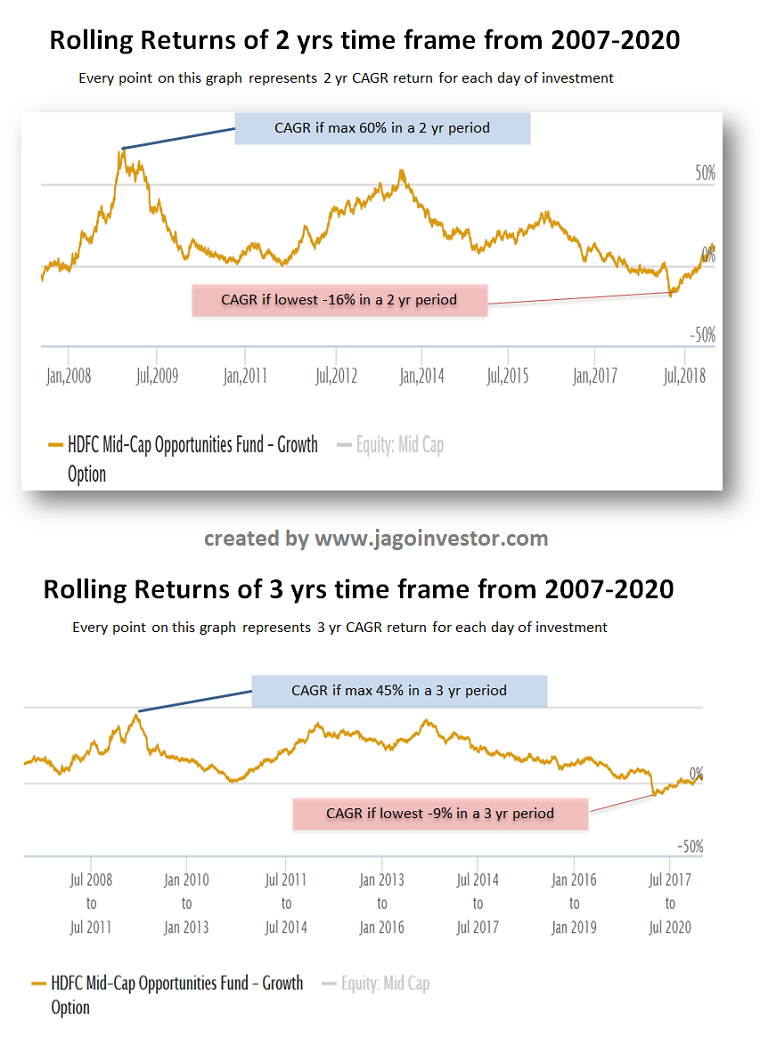

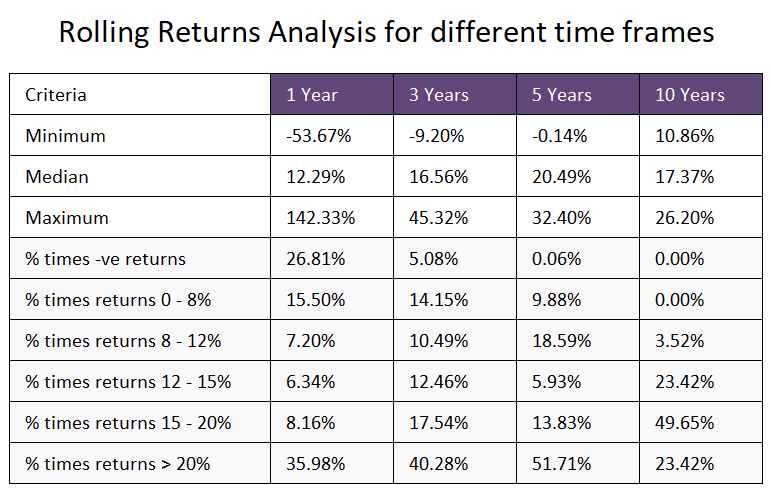

Try the instance of HDFC Midcap alternatives rolling return chart for two and three yrs interval for final 14 yrs. You’ll be able to see that in a 2 yr interval, the best CAGR has been round 60% and the bottom at -16% .. So it’s doable to see your funding go down by 16% in a 2yr interval as per outdated information. The identical form of information is there for 3 yrs interval too!

Rolling return graph offers you a deeper understanding of how risky fund returns have been and even the chance of your return being in a sure vary (solely with previous information). Notice that its solely historic information and the utmost and minimal returns can change relying on future efficiency.

If you happen to have a look at the chart above, you’ll be able to conclude that if you wish to make investments on this fund – then you’ll be able to see a draw back of as much as 10% in a 3 yr interval as a result of it has occurred up to now. Additionally, you’ll be able to see flat returns even in 5 yrs interval which has occurred up to now.

This type of evaluation tells you that due to volatility even this sort of good funds can see a interval of non-performance and flat returns.

I hope I used to be in a position to clarify what’s rolling return in a easy method.

Conclusion

Keep in mind that rolling returns train is a good software for analyzing the mutual fund, but it surely’s not the ultimate train in itself. There are numerous other forms of research which is feasible and this train alone doesn’t give any closing judgement.

In case you are not blissful together with your fund efficiency, then I recommend going by means of this train!

Do share your feedback on this!