Do you need to eliminate your previous a reimbursement insurance coverage, however are confused for those who ought to “give up” or make it “paid up”?

Immediately I’ll clarify which one is the best choice amongst the 2.

Give up vs Paid-up choice in Insurance coverage insurance policies

All these assured insurance coverage which your mother and father made you purchase out of your pleasant neighbourhood uncle is nothing lower than a excessive premium low return insurance policies with no more than 1-5% CAGR return.

These insurance policies don’t present sufficient life insurance coverage cowl neither they create sufficient wealth for you to your long run targets like youngsters training, youngster marriage or retirement and on prime of that, these insurance policies have pathetic returns worth if you wish to shut them earlier than maturity and take again your cash.

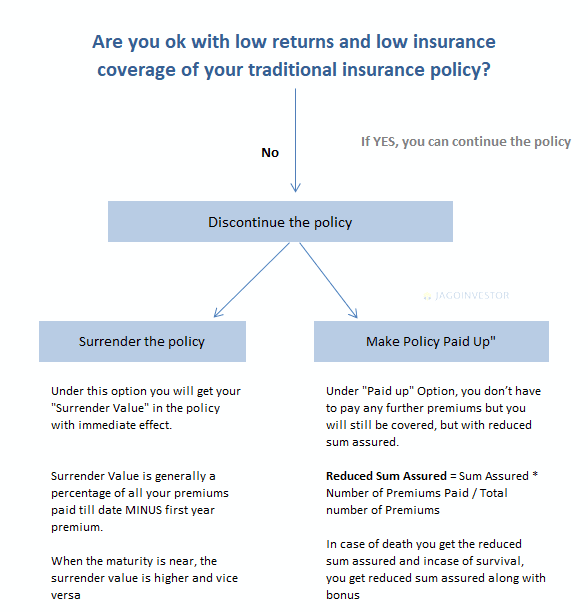

Primarily there are two methods to discontinue these insurance coverage insurance policies that are –

- Paid-up Coverage

- Give up Coverage

What’s “paid up” choice?

Beneath this selection, if a coverage holder doesn’t shut the coverage, however stops paying any additional premium. Nevertheless, word that this selection is mostly relevant solely after one has paid for not less than 3 yrs. (nonetheless, test your coverage wordings for precise years)

The quantity which you’ll obtain at maturity might be decreased, in proportion to the premiums paid. This sum assured is named the paid up worth. It’s calculated utilizing the next formulation:

Paid up worth = Unique sum assured x (No. of premiums paid / No. of premiums payable)

Instance – A standard insurance coverage coverage with sum assured of Rs. 10 Lakhs for 20 years with a premium of Rs. 30,000 p.a. paid for 8 years. Let’s discover out what might be its paid up worth if one desires to cease paying additional premiums.

Paid up worth = 10,00,000 * 8/20 = 4,00,000

At a excessive degree, the numbers don’t look again. You’ll get 4 lacs, however you paid simply 2.8 lacs total, nonetheless, keep in mind that you’re going to get this 4 lacs after so a few years and you’ll lose the buying energy due to inflation.

You possibly can merely say that actual value of Rs. 4 lac acquired after 12 years is Rs. 1,58,000 in the present day, taking inflation at 8%.

Subsequently, in case you are selecting coverage paid up choice, understand that changing the coverage right into a paid-up coverage will lock your cash for the remaining time period of the coverage and likewise, precise value of the quantity, which you’ll obtain in later years might be very much less if the maturity of the coverage could be very removed from now.

What’s “give up coverage” choice?

Beneath this selection, you shut the coverage fully and take again your cash. The cash you get might be some share of your premiums paid minus the primary yr premium. And this share will increase relying on what number of years the coverage premium has been paid.

A coverage usually acquires any give up worth solely after 3 yrs of premium cost, which implies that for those who select to give up your insurance coverage coverage earlier than 3 yrs, you lose all of your cash and don’t get again something.

Observe that the give up worth begins with 30% and goes up relying on the variety of years you might have paid the premium.

Following is an indicative desk which reveals the give up worth as a share of premiums paid

[su_table responsive=”yes” alternate=”no”]

| Time of Give up | % of premium paid – first yr premium |

| After 3 years | 30% of premium paid |

| After 5 years as much as 8 years | 50% of premium paid |

| After 8 years | 65% of premium paid |

| Final 2 years to coverage maturity | 90% of premium paid |

[/su_table]

This share can change from firm to firm and relies on elements resembling the kind of coverage. Each coverage brochure mentions particulars about give up worth however, it’s not obligatory that each one the businesses point out this share which can also be referred to as the give up worth issue of their brochures.

Instance of give up coverage

Mr Pratik has purchased a standard insurance coverage plan of 20 years with a sum assured of 6 Lakhs premium quantity is Rs. 20,000 per yr. After paying the premium of 6 years, he desires to give up the coverage.

Give up Worth = 50% of (premium paid – first yr premium)

= 50% of (120000 – 20000)

= 50% of 1,00,000

= Rs. 50,000

You possibly can see that he’ll simply get Rs 40,000 from surrendering the coverage even when he paid Rs 1,20,000

When to decide on “Give up” and “Paid up” choice?

Surrendering a coverage is usually recommended when

- You aren’t in a position to pay the premiums

- You want cash for some motive

- When remaining variety of years in coverage is greater than 8-10 yrs

This feature is usually recommended since you nonetheless have a few years left and you’ll pay the identical premium quantity in a greater product which can do wealth creation for you.

Making a coverage paid up is usually recommended when

- You don’t want cash however don’t need to pay additional premiums

- While you don’t need to pay premiums, however nonetheless need the coverage to run

- When your coverage maturity could be very close to (2-4 yrs)

Making a coverage paid up is mostly not prompt, however lots of instances, buyers usually are not in a position to take the ache of getting the decreased quantity from their coverage and really feel like “they are going to get one thing in future”, nonetheless contemplating “time worth of cash“, it’s not an important choice.

Easy methods to cope with the emotional half “I’m dealing with a lot loss”?

In each the choices, there might be a loss for certain. A refund insurance coverage are designed to provide low yields and penalize you for those who stop in between.

I feel coping with closure of insurance coverage insurance policies is extra of a psychological battle You recognize you’ve got a incorrect product and its dangerous to your future, however folks can’t cope with the truth that they’re dealing with a lot of loss – “I paid 8 lacs, and I’ll get again solely 4 lacs, I’ll lose 4 lacs”

Observe that for those who take into account TIME VALUE, issues might be simpler to determine.

In case your good friend borrows Rs 100 from you and returns you Rs 110 after 10 yrs, you aren’t in revenue, you’re really in LOSS. Since you may have created Rs 250 with an alternate funding and now you simply have Rs 110, that’s Rs 140 loss.

Simply taking a look at it from absolute numbers level doesn’t make sense.

For instance, think about a sum assured of Rs 10 lacs with a yearly premium of approx. Rs 53000 per yr. Now if an individual has already paid 5 premiums and needs to give up the coverage, they are going to simply get again round Rs 85000 (assuming 40% of 4 premiums, as one premium is deducted). The fast lack of thoughts is for Rs 1.8 lacs (paid 2.65 lacs and getting again 85,000)

This can be a powerful scenario for the thoughts and really powerful to deal with. An individual feels why to take a loss when one will not be recovering the quantity paid additionally and simply continues the coverage until the top. The individual will get again something between 15-18 lacs, relying on the bonus quantity declared.

This interprets to solely 5.69% and this the very best case (it would get higher for those who die early after taking the coverage, however I’m certain you wouldn’t prefer it)

Now if the identical individual reinvests the identical 85,000 together with Rs 53,000 premiums yearly into some equity-based merchandise like fairness mutual funds or index funds, even when assume a modest 12% returns which have occurred in previous, the wealth one may have might be 24.5 lacs and the IRR might be approx. 7.4% of the entire state of affairs. This second choice additionally offers you higher liquidity and exit choice everytime you want to get cash.