Firm overview

Integrated in 1992 and headquartered in Mumbai, Hexaware Applied sciences Ltd. is a world digital and know-how providers agency with synthetic intelligence (AI) at its core. The corporate delivers its providers by AI-enabled digital platforms – “RapidX” for digital transformation, “Tensai” for AI-powered automation and “Amaze” for cloud adoption. The corporate serves clients throughout the Americas, Europe and Asia-Pacific (together with India and Center East) catering to industries resembling Monetary Companies (28.3%), Healthcare and Insurance coverage (21.2%), Manufacturing and Client (17%), Hello-Tech and Skilled Companies (16.9%), Banking (8.5%), and Journey and Transportation (8.1%). At the moment it’s caters to 31 of the Fortune 500 organizations. As of September 30, 2024, the corporate’s international supply mannequin included 32,536 workers throughout 39 supply facilities and 16 workplaces in 28 international locations.

Objects of the supply

- Obtain the advantages of itemizing the Fairness Shares on the Inventory Exchanges.

- Perform supply on the market of Fairness Shares of face worth Rs.1 every aggregating as much as Rs.87,500 million by the Promoting Shareholders.

Funding Rationale

- Superior area experience – The corporate gives a variety of providers throughout 6 industries, with a give attention to a number of sub-verticals inside every phase. Between FY21-23, the corporate achieved regular income progress throughout all six operational segments. Its choices cater to numerous shopper wants, resembling launching new merchandise, driving core transformations utilizing digital applied sciences, securing, operating, and optimizing IT operations, leveraging AI and machine studying to show information into actionable insights and predictions, optimizing enterprise processes and cloud methods, in addition to cloud modernization, migration, and managed providers. The corporate has been acknowledged as one of many high 25 IT providers manufacturers globally by Model Finance. It additionally gained the 2024 OnCon Icon High 50 Expertise 317 Workforce Award and the 2024 Associate Excellence Award from Guidewire.

- AI-led digital capabilities – The corporate is delivering its providers by 3 AI-enabled digital platforms – RapidX, Tensai and Amaze. RapidX is a Gen AI-based platform for contemporary software program engineering that contains a set of AI material specialists and brokers, every of which focuses on a particular facet of the software program growth lifecycle to enhance effectivity and high quality. Tensai is an automation platform designed to remodel enterprise IT processes and allow safe, fast and automatic launch of code, environment friendly and AI-driven operations. Amaze is a cloud migration, cloud transformation, information and software modernization platform that may allow portfolio transformation to business-aligned IT.

- Innovation as a key pillar – The corporate has 20 patents granted and 119 emblems registered in lots of international locations, two copyrights registered in India, and 49 domains registered worldwide. The 119 emblems comprise of 9 product marks and 98 service marks, with sure emblems being registered as product marks in addition to service marks. Additional, it has filed functions for 45 patents and 23 emblems, comprising 6 product marks and 14 service marks, with some emblems being utilized for as product marks in addition to service marks, in lots of international locations. The corporate’s innovation capabilities are additional supported by its labs situated in Chennai, Amsterdam, and Berlin.

- Monetary efficiency – The corporate reported income of Rs.10,380 crore in FY23 as in opposition to Rs.9,200 crore in FY22, a rise of 13% YoY. The income grew at a CAGR of 20% between FY21-23. The EBITDA of the corporate in FY23 is at Rs.1,590 crore and EBITDA margin is at 15%. The PAT of the corporate in FY23 is Rs.998 crore and PAT margin is at 10%. The CAGR between FY21-23 of EBITDA and PAT is 15% every.

Key dangers

- OFS threat – The IPO consists of solely an Supply for Sale of Fairness Shares price as much as Rs.87,500 million by the Promoting Shareholders, together with the corporate Promoter. All the proceeds from the Supply for Sale will probably be paid to the Promoting Shareholders, and the Firm is not going to obtain any such proceeds. The supply contains the sale of stake price Rs.87,500 million by promoter CA Magnum Holdings.

- Attrition threat – Any incapacity of the corporate to successfully appeal to, retain, practice and make the most of extremely expert professionals may adversely have an effect on the enterprise, outcomes of operations and profitability.

- Foreign exchange threat – The corporate is uncovered to overseas change dangers, because it conducts good portion of operations from worldwide markets in foreign exchange. Fluctuations in change charges might have an effect on its monetary efficiency.

Outlook

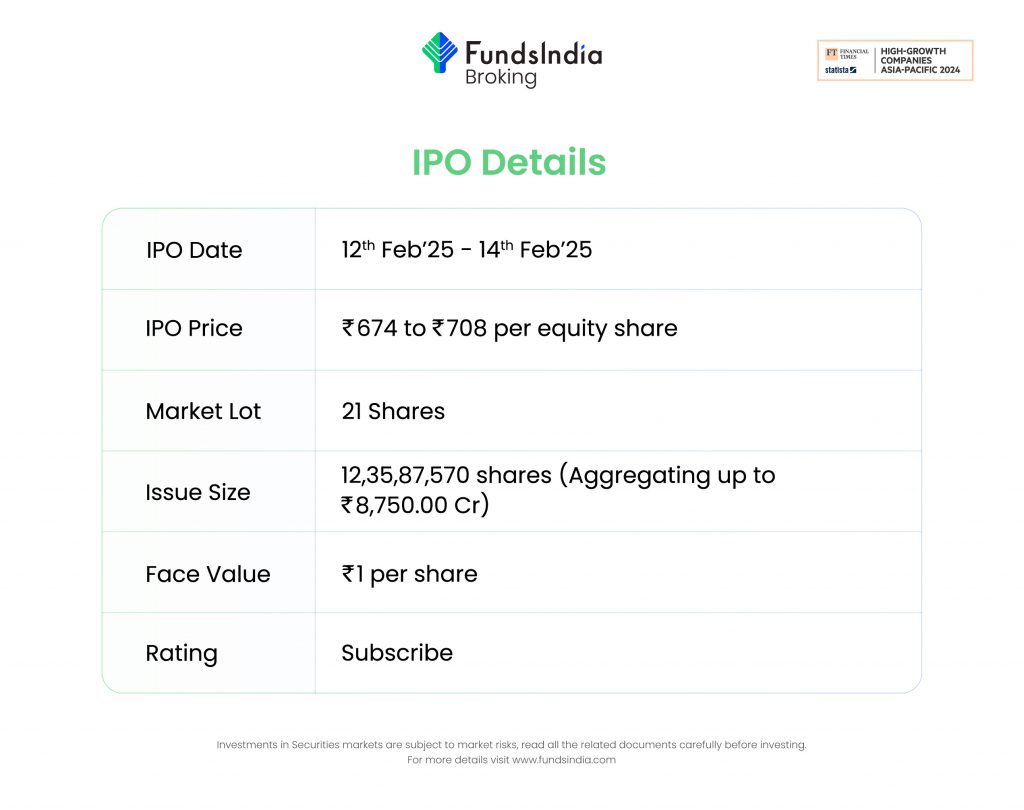

The corporate has established long-term relationships with quite a few clients, with a median tenure of 15 years for its high 5 and 10 shoppers, and 12 years for its high 20. At the moment, it’s concentrating on constructing relationships with new clients throughout the Americas, Europe, and APAC. This technique is anticipated to offer secure billing, enhanced income visibility, and progress alternatives. In response to RHP, Persistent Techniques Restricted, Coforge Restricted, LTIMindtree Restricted and Mphasis Restricted are the one listed rivals for Hexaware Applied sciences. The friends are buying and selling at a median P/E of 55x with the very best P/E of 84x and the bottom being 34x. On the larger value band, the itemizing market cap of Hexaware Applied sciences Ltd. will probably be round ~Rs.42,982 crore and the corporate is demanding a P/E a number of of 43.09x primarily based on submit challenge diluted FY23 EPS of Rs.16.43. Compared with its friends, the difficulty appears to be absolutely priced in (pretty valued). Based mostly on the above views, we offer a ‘Subscribe’ score for this IPO for a medium to long-term Holding.

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles chances are you’ll like

Put up Views:

71