Synopsis– Discover out the highest Tier-2 and Tier-3 cities in India that promise enticing rental yields in 2025. From rising enterprise hubs to fast-growing residential markets, discover out the place your subsequent property funding may repay large.

India’s property market is altering gears in 2025, as Tier-2 and Tier-3 cities take heart stage for buyers searching for regular revenue. Whereas Tier-1 cities equivalent to Mumbai are plateauing at 2–3% yields, these new-age cities are providing 3–7% yields, pushed by infrastructure developments, IT hubs, and migration. Residential gross sales throughout Tier-2/3 cities rose 20% YoY to ₹1.2 lakh crore in H1 2025, with yields hovering between 4.5–5.5%—increased than the nationwide common of 4.8%. In response to studies from prime property consultants, right here’s a listing of the highest 10 Tier-2/3 cities delivering excessive rental yields, with reasonably priced entry factors (₹50–80 lakh for 2BHKs) and 10–15% appreciation potential.

1. Thane

- Yield Snapshot: 4–7%; Common hire of ₹30,000 in Ghodbunder

- Causes to Make investments: Inexpensive proximity to Mumbai with 95% occupancy; perfect for households

- Key Drivers: New metro traces and Ghodbunder Street upgrades that slash commute occasions

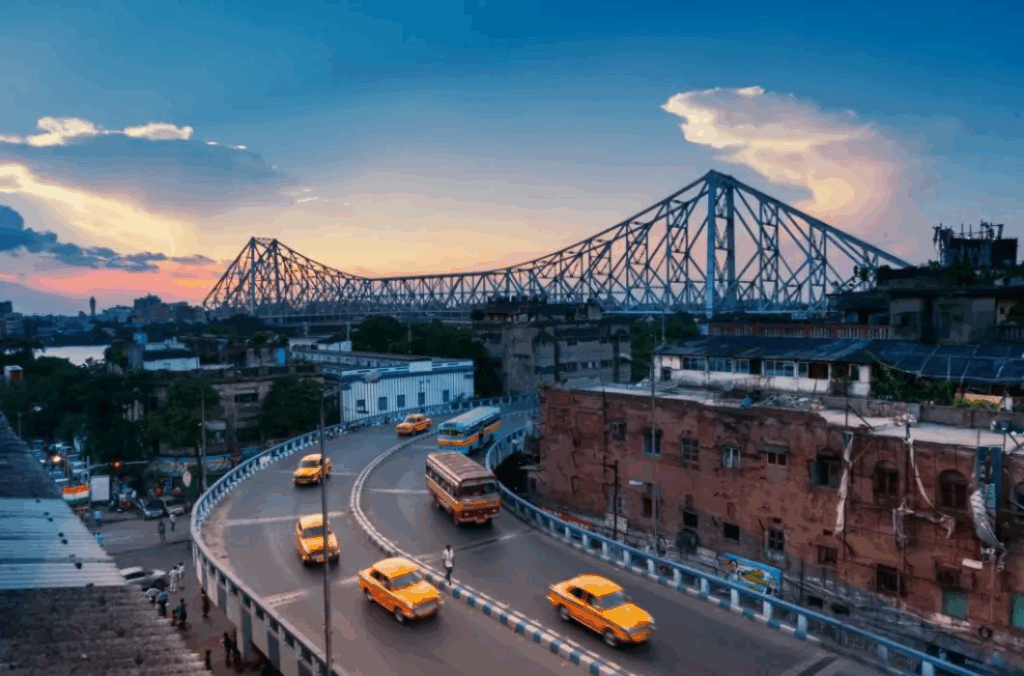

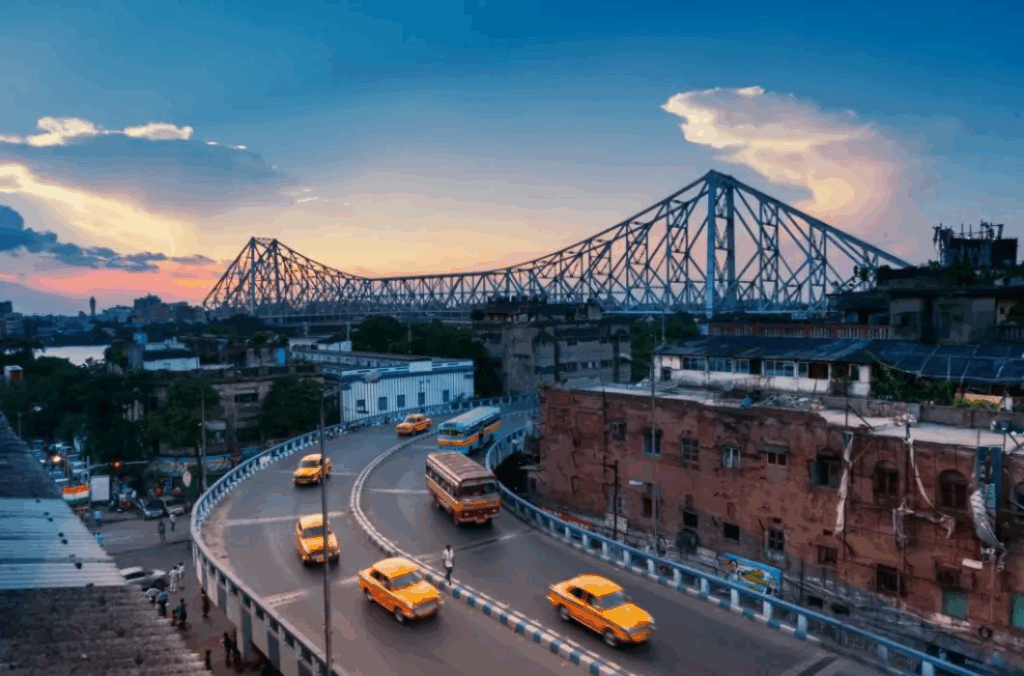

2. Kolkata

- Yield Snapshot: 3.5–6.3%; Common hire of ₹25,000 for a 2BHK

- Causes to Make investments: The IT and training increase is attracting younger tenants, with rents in New City rising 25%.

- Main Issue: Metro enlargement and IT parks in Salt Lake are driving demand.

3. Surat

- Yield Snapshot: As much as 6%; Common hire ranges from ₹20,000–₹28,000.

- Causes to Make investments: Affluence from the diamond commerce is driving luxurious leases, with a 30% YoY rise in rents.

- Main Components: Diamond Bourse and Surat Metro are attracting worldwide companies.

4. Chandigarh

- Yield Snapshot: As much as 6%; Common hire of ₹22,000 for high-end items.

- Causes to Make investments: Rising prosperity is attracting professionals, whereas IT hub Mohali ensures regular leases.

- Key Drivers: Pre-planned infrastructure and proximity to Delhi add cross-border attraction.

Additionally learn: Bengaluru vs Mumbai Micro-Markets: The place Ought to You Put money into 2025?

5. Coimbatore

- Yield Snapshot: As much as 5%; Common hire ranges from ₹18,000–₹25,000 in Coimbatore.

- Causes to Make investments: The economic–IT combine is ready to make sure simple tenancies within the coming 12 months, with costs already up 16.7%.

- Key Drivers: TIDEL Park and the Avinashi Flyover will additional increase the realm’s connectivity.

6. Kochi

- Yield Snapshot: 3–5%; common hire of ₹22,000 in Kakkanad.

- Causes to Make investments: Seasonal demand pushed by tourism and NRI inflows, coupled with advantages from the Good Metropolis initiative.

- Key Drivers: The Kochi Water Metro and Section 2 renovations of the airport will considerably enhance accessibility.

7. Indore

- Yield Snapshot: 4–5.5%; common hire ranges from ₹15,000–₹20,000.

- Causes to Make investments: The town’s “Clear Metropolis” standing attracts households, college students, and professionals, with costs appreciating 16.7%.

- Key Drivers: Growth of the Yellow Line Metro and the Tremendous Hall is enhancing connectivity for IT hubs.

Additionally learn: High 5 Indian States That Recorded the Highest Digital Transactions in August 2025

8. Lucknow

- Yield Snapshot: 3.5–4.5%; common hire of ₹16,000 in Gomti Nagar.

- Causes to Make investments: Inexpensive luxurious attracts authorities staff, with a 20% improve in demand.

- Key Drivers: Metro Section 2 and airport upgrades act as catalysts for migration.

9. Ahmedabad

- Yield Snapshot: 3.9–4.1%; common hire of round ₹20,000 alongside SG Freeway.

- Causes to Make investments: Low entry value (₹60 lakh on common), with costs anticipated to rise 25–30%, bringing rents nearer to Tier-1 metropolis ranges.

- Key Drivers: GIFT Metropolis and anticipated bullet practice initiatives are anticipated to drive business progress.

10. Trivandrum

- Yield Snapshot: As much as 4%; common hire of ₹18,000 close to Technopark.

- Causes to Make investments: Rising IT hub with low competitors, providing steady leases for households.

- Key Drivers: Growth of the Digital Science Park and Kazhakkoottam space is enhancing progress potential.

Components Driving Excessive Rental Yields in Smaller Cities

The substantial rental yields in these cities aren’t unintended; they’re a results of a number of robust financial and social components:

- Financial Diversification: These cities are transferring away from being reliant solely on conventional industries. They’re beginning to rework into employment hubs for IT, manufacturing, training, and providers, creating jobs and stimulating migrant employment.

- Low Property Costs: Property costs in Tier-2 and Tier-3 cities present a really low entry barrier in comparison with main metros, the place property costs are stratified. This permits buyers to spend money on property at a fraction of the price and propels rental yield share.

- Enchancment in Infrastructure: The Federal and Native governments are closely investing in these cities by growing new airports, new expressways, and new metro. These initiatives is not going to solely enhance turns, but in addition stimulate financial exercise and demand for actual property.

- Influx of Migrants: As a result of companies are transferring operations to those cities to avoid wasting enterprise prices, that are additionally contributing to worldwide college students enrolling in prime universities for employability functions, this gives for a relentless influx of scholars and younger employees, which creates a steady and excessive demand for rental housing.

- Authorities Initiatives: The present insurance policies, equivalent to Make in India and Industrial Hall Initiative, are contributing to manufacturing and industrial progress in these cities which helps with regional economies and actual property necessities.

Calculating Rental Yield: A Primary Overview

To know the anticipated return in your funding you’ll first must know the way to calculate rental yield. The yield is represented as a share and could be measured in two alternative ways:

1. Gross Rental Yield: That is the easier calculation and doesn’t think about any bills.

- System: (Annual Rental Revenue / Complete Worth of Property) x 100

- For instance, for those who bought a property for ₹50 lakh, and earned ₹20,000 a month in hire, the annual revenue can be ₹2,40,000. (₹2,40,000 / ₹50,00,000) x 100 = 4.8%

2. Internet Rental Yield: This provides a significantly better total image of realistically unfastened rental yield to calculating all annual bills like taxes, property upkeep, and emptiness prices and many others.

- System: ((Annual Rental Revenue – Annual Bills) / Complete Worth of Property) x 100

- This metric nonetheless, is extra relied upon for an advance calculation.

Conclusion

In 2025, Tier-2 and Tier-3 cities, equivalent to Kolkata and Surat, current alternatives for yield sought buyers as they stand to mix 4-6% returns & 12-18% appreciation with India reaching GDP progress of round 7%. Their proximity to owned/managed Tier-1 cities mixed with the decentralization of urbanization gives them with an extra buffer of resiliency towards financial volatility, offering methods for shorter response occasions with fast returns, via skilled/scholar leases. RERA (Actual Property Regulatory Authority) additionally gives satisfactory protections, whereas inexperienced improvement can also be on the rise for extra choices. Now could be a time to spend money on various areas: the important thing for max returns will probably be to penetrate micro-markets a brief distance from established metros. Good investments in Tier-2 and Tier-3 areas will symbolize not solely cash-flowing belongings, however the profitability of 1’s imaginative and prescient for India’s subsequent story of sustainable progress.

Written By Rachna Rajput