Think about a world the place your investments don’t simply develop—they gasoline the longer term. You might enter Vitality Mutual Funds, the powerhouses of the funding panorama in India. These funds channel your cash into the dynamic vitality sector, from conventional oil and gasoline giants to renewable trailblazers in photo voltaic, wind, and inexperienced hydrogen.

With India’s vitality calls for skyrocketing and the federal government’s push for sustainable energy, vitality mutual funds are your ticket to tapping into this high-voltage development story. Whether or not you’re a fan of the regular reliability of conventional vitality or excited concerning the eco-friendly promise of renewables, these funds allow you to revenue from India’s vitality evolution.

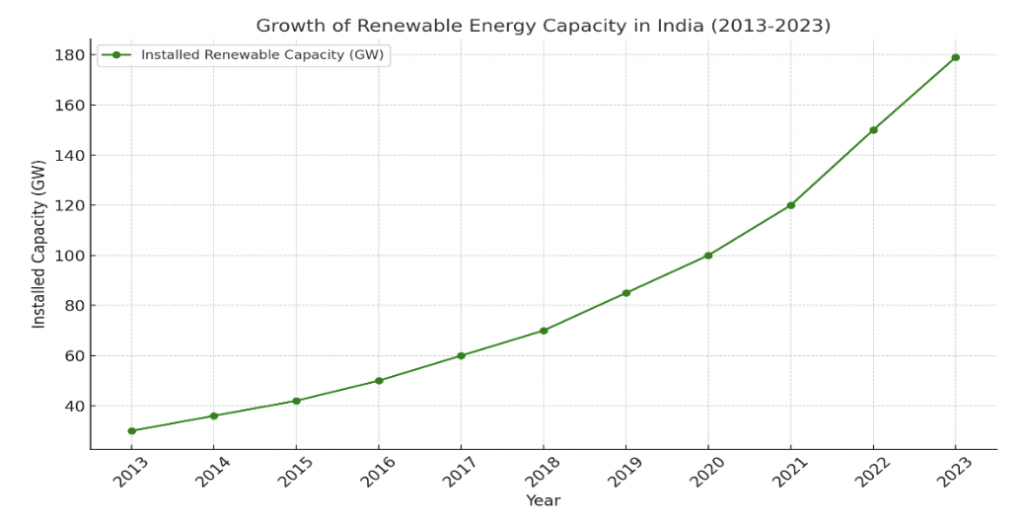

The Development of Vitality Sector in India Over the Final 10 Years

Over the previous decade, India’s vitality sector has skilled important development, marked by a considerable improve in renewable vitality capability. As of Could 31, 2023, the nation’s put in renewable vitality capability reached 179 GW, with photo voltaic and wind vitality contributing 67 GW and 43 GW, respectively (ITA). This enlargement aligns with India’s dedication to sustainable improvement and its efforts to satisfy rising vitality calls for by means of cleaner sources. Moreover, India’s vitality consumption has doubled since 2000, reflecting the nation’s financial development and improved residing requirements (IEA, Monetary Occasions).

Supply: Derived from aggregated knowledge reported by the Ministry of New and Renewable Vitality (MNRE), Authorities of India (GoI)

The above development line is exhibiting the expansion of India’s renewable vitality put in capability during the last 10 years. The chart highlights a gradual improve from 30 GW in 2013 to 179 GW in 2023, reflecting India’s dedication to increasing its renewable vitality infrastructure. Regardless of this progress, challenges stay in balancing vitality safety, affordability, and environmental sustainability.

Let’s Have a Have a look at The Rising Recognition of Energy Sector or Vitality Funds in India

The rising reputation of energy and vitality funds in India mirrors the speedy transformation of the nation’s vitality sector. With the Indian authorities focusing on 500 GW of renewable vitality capability by 2030 (MNRE), investor curiosity on this sector has surged. Energy sector funds present a beautiful alternative to take part on this development, channeling investments into corporations driving innovation in photo voltaic, wind, and different clear vitality sources, in addition to conventional vitality infrastructure. The push for vitality safety, sustainability, and technological developments has made these funds a most popular selection for traders in search of long-term returns whereas supporting India’s vitality transition.

Are you able to supercharge your portfolio? You might put money into vitality mutual funds at this time and light-weight up your monetary future!

Figuring out the favored Vitality funds in India may help you diversify your funding channels.

High 6 Vitality Mutual Funds with 1-year Returns

| S. No. | Identify of the Fund | 1 Yr return (%) | TER (%) | Fund Home |

|---|---|---|---|---|

| 1 | DSP Pure Assets & New Vitality Development Direct Plan | 17.58 | 0.99 | DSP Mutual Fund |

| 2 | Tata Assets & Vitality Development Direct Plan | 14.08 | 0.58 | Tata Mutual Fund |

| 3 | DSP International Clear Vitality FoF Development Direct Pla | 5.41 | 1.54 | DSP Mutual Fund |

| 4 | ICICI Prudential Strategic Steel & Vitality Fairness FoF Development Direct Plan | 1.77 | 1.38 | ICICI Prudential Mutual Fund |

| 5 | SBI Vitality Alternatives Development Direct Plan | NA | 0.59 | SBI Mutual Fund |

| 6 | ICICI Prudential Vitality Alternatives Development Direct Plan | NA | 0.43 | ICICI Prudential Mutual Fund |

Supply: Kuvera; December 31, 2024.

The desk signifies the next:

1. High Performers

The DSP Pure Assets & New Vitality Development Direct Plan leads the checklist with a powerful 1-year return of 17.58% and a average TER of 0.99%, making it engaging for traders in search of excessive returns with cheap prices. The Tata Assets & Vitality Development Direct Plan follows, providing a strong return of 14.08% with a decrease TER of 0.58%, highlighting its price effectivity.

2. Give attention to Clear Vitality

The DSP International Clear Vitality FoF Development Plan displays the rising curiosity in world clear vitality investments, with a 1-year return of 5.41%. Nevertheless, it has a comparatively increased TER of 1.54%, which can affect cost-conscious traders.

3. Conservative Returns

Funds like ICICI Prudential Strategic Steel & Vitality Fairness FoF Development offered a modest 1-year return of 1.77% with a TER of 1.38%, catering to traders with a desire for diversified vitality and metals publicity.

4. TER with No Returns Reported

Funds such because the SBI Vitality Alternatives Development Direct Plan and ICICI Prudential Vitality Alternatives Development Direct Plan don’t report a 1-year return however have low TERs of 0.59% and 0.43%, respectively, doubtlessly making them cost-effective choices for long-term traders.

5. The info for some funds is lacking as a result of their newer launch.

The Advantages of Vitality Funds in India

Vitality funds in India supply a number of key advantages together with:

- selling the transition to renewable vitality sources like photo voltaic and wind, which helps cut back dependence on fossil fuels;

- contribution to vitality safety by diversifying vitality provide and supporting sustainable development;

- funding clear vitality tasks, these funds additionally cut back carbon emissions, aligning with local weather objectives;

- investments within the vitality sector create jobs, stimulate native economies, and drive technological innovation.

Furthermore, vitality funds assist authorities initiatives, such because the Nationwide Photo voltaic Mission, and entice international investments. Total, they play a vital position in enhancing India’s vitality infrastructure and supporting environmental sustainability.

When Investing in Vitality Funds You Ought to Be Cautious Concerning the Following

- It’s necessary to pay attention to market volatility, as vitality costs can fluctuate as a result of geopolitical and supply-demand modifications;

- Regulatory danger can be important, as authorities insurance policies can immediately have an effect on the profitability of vitality tasks;

- Expertise and environmental dangers have to be thought-about, significantly in rising renewable sectors or fossil gasoline ventures that will face opposition;

- Rising rates of interest can improve borrowing prices for vitality tasks, impacting returns;

- Vitality funds could have restricted liquidity, making it more durable to exit investments rapidly.

Wrapping Up

From the above evaluation, we will conclude that vitality mutual funds current a novel alternative to put money into India’s evolving vitality sector, combining secure returns from conventional oil and gasoline with the high-growth potential of renewable vitality. As India’s vitality calls for soar and sustainability takes heart stage, these funds permit traders to revenue whereas supporting the nation’s inexperienced vitality transformation. Investing at this time provides each monetary development and an opportunity to gasoline a sustainable future. Nevertheless, making certain correct diversification and evaluating the fund’s administration are essential for mitigating these dangers.

Involved in how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Traders