How Does The Economic system Work

Introduction

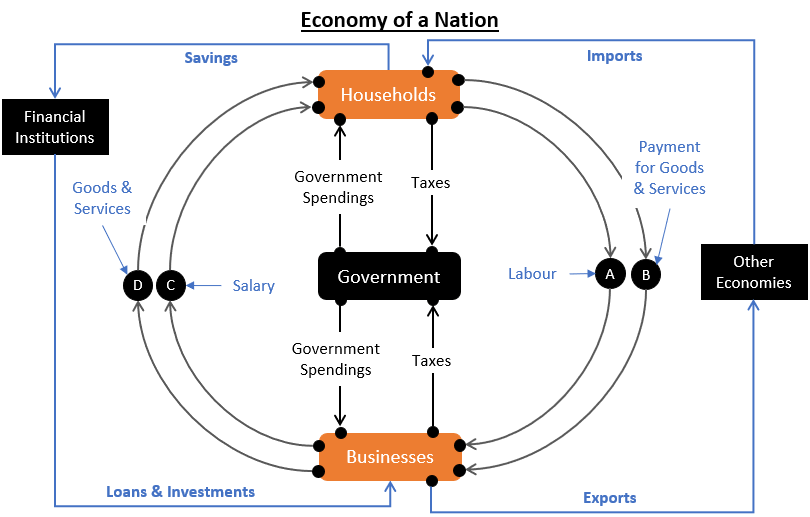

An economic system is a system the place the brokers of the economic system work together with one another to ascertain commerce. In an economic system, a number of trades can occur at a time. There are three essential brokers at play: households, companies, and the federal government. They work together when companies supply employment/work to households to supply items and providers (G&S). The produced G&S are purchased by the households to fulfill their wants. The federal government primarily performs the a part of a policymaker who administers and controls the economic system as per the established guidelines. For fast solutions, learn the FAQs.

Introduction

What’s an economic system? For a layman, the economic system is sort of a “large sport” that individuals play to purchase and promote issues. It’s like, your loved ones (a family) going for dinner in a restaurant (a enterprise). Right here, each entities are participating in a little economic system. On a much bigger scale, there are a number of households and companies shopping for and promoting issues concurrently. They use the cash to set up commerce. A wholesome economic system in flip generates jobs and ensures revenue within the palms of individuals.

Video

How Does The Economic system of a Nation Work?

A nation’s economic system is a posh system that entails the manufacturing, distribution, and consumption of products and providers. At a primary degree, it may be understood via the interplay of three essential brokers: households, companies, and the federal government.

- Households are the shoppers of products and providers. They provide labor and different inputs to companies. In change for work, they earn revenue.

- Companies are the producers of products and providers. They rent labor and different inputs from households to supply these items and providers for onward promoting.

- The federal government performs a job in regulating and offering public items and providers. In addition they work to redistribute revenue and wealth. Aside from the regulatory features, it additionally collects taxes. The taxes so collected are used for the general good thing about the economic system. The federal government’s various supply of revenue is the dividends they obtain from their public sector corporations (like ONGC, BHEL, IOCL, HPCL, and many others).

In a market-driven economic system, households and companies work together to have an effect on demand and provide. The worth is the set off that impacts the demand and therefore the provision.

The federal government additionally performs the function of the economic system supervisor. They do it by taking coverage choices similar to financial coverage and monetary coverage.

- Financial coverage: Right here the federal government controls the cash provide and rates of interest to affect financial exercise.

- Fiscal coverage: Right here the federal government spends cash they’ve collected as taxes to stimulate the economic system. It’s achieved to fulfill the financial targets of the nation. Few targets will be like GDP development or decreasing revenue inequality.

Total, the economic system of a nation is a posh and dynamic system. However the principle characters of an economic system are households and companies. The federal government has the function of a faculty principal. It retains a watch and controls the economic system to achieve a typical aim of a nation.

Examples to know how the economic system works

This can be a step-by-step clarification of how the economic system of a nation works, with examples:

- Step #1: Households provide labor and different assets to companies. In change, they take a wage from the work they render for the corporate. For instance, a pc engineer may work at Google and obtain a wage in change for his effort and time.

- Step #2: Companies use their assets, together with what’s provided by households, to supply items and providers. For instance, Google may use their pool of engineers to develop a cell phone like Google Pixel. Different assets of the corporate will be within the type of invested capital by shareholders. Google can use this capital to do R&D of the Pixel vary.

- Step #3: Households use their revenue to buy and eat items and providers. For instance, a trainer may use his wage to purchase a Google Pixel cellphone, groceries, pay for healthcare, or spend on holidays.

- Step #4: Companies promote their items and providers to households and different clients. For instance, a automotive producer may promote its autos to particular person shoppers. A expertise firm like TCS can promote its software program experience to put in cloud computing for an organization like Britannia.

- Step #5: The authorities gives public items and providers and regulates the economic system. For instance, the federal government may construct roads and bridges to enhance the infrastructure of its nation. It will possibly additionally present primary schooling (Kendra Vidyalaya) and better schooling (IITs, AIIMS, IIMs) to residents to enhance their working expertise. It will possibly additionally present authorities hospitals to make healthcare providers accessible to the underprivileged.

- Step #6: Costs coordinate the interactions between households and companies. For instance, the worth of a automotive alerts to each the producer and the buyer how a lot the automotive is price and the way a lot it ought to price. If the worth is simply too excessive, shoppers might select to purchase a distinct automotive or maintain off on their buy, whereas the producer might select to decrease the worth or produce a distinct sort of automotive.

- Step #7: The federal government makes use of insurance policies to handle the general economic system. For instance, the federal government lowers rates of interest to encourage borrowing. When borrowings rise, households and companies spend extra thereby enhancing the GDP development price. The federal government itself can resolve to spend on infrastructure-building initiatives to create jobs and stimulate financial development.

These steps and examples present a primary overview of how the economic system of a nation works. Consultants may say that it’s an oversimplified model of how the economic system works. However this exemplified description of the economic system might help newcomers perceive the fundamentals of how economies perform.

Now that we’ve understood what’s an economic system and the way it works, let’s get deeper into the topic and discover what’s an financial cycle.

An Financial Cycle

Now we have seen what’s an economic system. It’s the system that produces, distributes, and consumes items and providers inside a society. The system consists of characters like households, companies, authorities, and attributes like value, and insurance policies.

Alternatively, an financial cycle refers to fluctuations in financial exercise. Whereas the economic system is a steady and ongoing system, financial cycles are characterised by intervals of enlargement (development) and contraction (recession). These cycles will be influenced by the insurance policies of the federal government. We’ll additionally discuss in regards to the function of debt that makes economies develop in cycles as an alternative of linear development.

The analogy of an financial cycle is a rollercoaster trip.

- Financial Growth:: Generally the economic system is rising actually quick. Throughout such instances a lot of folks have jobs and are earning profits. That is known as an enlargement.

- Financial Contraction: Generally the economic system slows down. Throughout such instances folks begin dropping their jobs and companies wrestle. That is known as a contraction.

These ups and downs occur time and again. They are often influenced by issues like authorities insurance policies, market tendencies, and different components. So, the financial cycle is sort of a large wave that the economic system rides, and all of us really feel the results of it.

By measuring the financial exercise taking place in a society, one will know if presently the economic system is increasing or contracting. How you can measure financial exercise? By monitoring indicators similar to gross home product (GDP), employment, and inflation.

The 4 phases of an financial cycle

- Development: Throughout the development part, financial exercise is on the rise. Individuals are spending extra and therefore companies are producing extra and making extra gross sales and earnings. In consequence, the GDP of the nation can also be rising. Throughout these instances employment is growing. Inflation additionally will rise because the demand for items and providers will increase.

- Peak: On the peak of the cycle, the economic system has reached its most degree of development. The labor market will likely be tight, and inflation might also be at its peak. It’s the time of most euphoria out there.

- Recession: Throughout the recession part, financial exercise slows down, and households start to get conservative and spend much less. It lowers the demand for items and providers, therefore companies begin producing much less. The economic system begins to shrink and GDP declines, unemployment rises. The companies additionally make decrease earnings. Inflation can also be falling.

- Backside: On the backside of the cycle, the economic system has hit its lowest level, minimal GDP, most unemployment, highest rates of interest, and minimal inflation.

After the underside, the cycle sometimes begins over once more. The economic system will see one other interval of development. The size and severity of every part can differ relying on quite a lot of components, together with authorities insurance policies, market sentiments, international cues, and many others.

The Position of Debt in Financial Cycles

Debt performs an essential function in financial cycles. In truth, had there been no debt within the economic system, the fluctuations between peak and backside would have been insignificant. This implies slower development and a extra subdued influence of the recession.

Throughout the development part, the federal government retains the rates of interest low, therefore the borrowing improve. Each the character of the economic system, households, and companies borrow extra. Below the affect of debt, spending rise and consequently GDP additionally grows sooner. This financial development can contribute to rising asset costs, similar to shares and actual property costs.

Credit score fuelled development takes the GDP to its peak. Nonetheless, because the economic system reaches its peak, inflation additionally turns into too excessive. It wants taming, therefore rates of interest are hiked. Henceforth, a recession part begins.

Throughout the recession part, enterprise expertise a dip in gross sales and earnings. Therefore, greater money owed on their stability sheets change into an issue. They discover it troublesome to repay their money owed, resulting in mortgage defaults and bankruptcies. Equally, households face job losses and their debt compensation functionality takes successful. Individuals begin defaulting on their dwelling loans, automotive loans, and private loans. Not in a position to pay again the mortgage? What are the principles?

Mortgage cost defaults, each from households and companies, make banks and NBFCs hesitant to lend cash. Throughout this money crunch, spending is decreasing quick and the GDP development price can also be falling.

Financial cycles, fluctuations between peaks and bottoms, are extra outstanding because of the presence of debt within the economic system. Why? As a result of debt-fuelled development takes inflation to non-sustainable ranges. Therefore, the federal government forcefully tries to convey inflation to regular ranges (rate of interest hikes).

POV: The federal government has its inflation cut-off degree. Throughout a development part, rates of interest are lowered an excessive amount of and therefore inflation crosses its cut-off ranges. In consequence, stronger actions are wanted to tame inflation leading to a extreme recession part. If the federal government can begin controlling inflation as quickly as it’s about to achieve the cut-off restrict, managing recessions will likely be simpler.

Understanding The Economic system For an Fairness Investor

From the attitude of fairness buyers, what needs to be the aim behind figuring out “how the economic system of a nation works”? It is necessary for a number of causes:

- Figuring out funding alternatives: A deeper understanding of the economic system might help buyers determine potential sectors and industries for funding. Data of financial cycles may give a perspective about if it’s the present time to enter the market or if the longer term will supply higher alternatives. For instance, if an investor believes that the economic system is coming into a recession, they could resolve to extend their holding in blue-chip shares. Throughout such instances, such corporations commerce at higher PE multiples.

- Assessing market threat: Financial cycles can have a big influence on the fairness market. Modifications in financial situations can have an effect on company earnings and investor sentiment. Therefore, by understanding the dynamics of the economic system, buyers can higher assess the potential dangers and alternatives out there. For instance, the expansion part is right for buying and selling or revenue reserving. The recession part is sweet for growing holdings in high quality shares.

Total, for fairness buyers, understanding how the economic system of a nation works is a key part of constructing knowledgeable funding choices.

Conclusion

The economic system is a posh system to know with full readability. This text is written with the target of simplifying the complicated understanding of the economic system.

It’s important to recollect the important thing traits of an economic system, households, companies, and the federal government. From an financial viewpoint, these three characters are enjoying their half to make the nation’s GDP develop at a suitable tempo. Whereas doing so, it should additionally hold management of inflation (costs), and employment (revenue). Rate of interest adjustments, taxation insurance policies, and authorities spending assist policymakers hold management of the economic system.

One essential facet of the economic system is debt. The presence of debt highlights the 4 phases of an financial cycle: development, peak, recession, and backside. A managed debt within the economic system can work like an environment friendly development set off. However uncontrolled debt can result in a monetary disaster (like that of 2008-09). Subsequently, it’s important to stability the advantages of debt with its potential dangers. A rustic should have efficient insurance policies in place to handle debt and reduce the damaging impacts of financial cycles.

FAQs

An economic system refers back to the system by which a society produces, distributes, and consumes items and providers (G&S). It really works via the interactions between the producers of G&S (companies) and shoppers of G&S (households). The economic system is regulated by influencing the demand and provide of the G&S. The federal government has the function of a regulatory and controller of the economic system. It will possibly additionally get entangled within the means of G&S manufacturing and consumption by organising public sector companies and spending on infrastructure initiatives.

Governments affect the economic system via fiscal and financial insurance policies. Fiscal insurance policies contain authorities spending and taxation to affect financial exercise. Financial insurance policies contain central banks regulating the cash provide and rates of interest to handle inflation.

Companies contribute to the economic system by offering items and providers. In addition they generate employment for the households. In addition they pay taxes which change into the principle supply of revenue for the federal government. Equally, households contribute by buying items and providers and paying taxes. In addition they contribute by shopping for belongings similar to actual property properties and monetary devices.

Financial cycles are fluctuations in financial exercise characterised by development (enlargement) and recessions (contractions). They influence the economic system by influencing enterprise cycles, employment charges, shopper spending, and inflation.

Low interest-bearing debt can stimulate financial development by enabling funding and spending. Nonetheless, extreme debt can result in excessive inflation. To tame inflation, money owed are made costly. In consequence, debt taken by corporations through the development part turns into an issue resulting in defaults and bankruptcies. Thus, managing debt is essential for sustaining financial development and stability.

Have a contented investing.

>> Subsequent – Brief-Time period Debt Cycle

![How the Economic system Works – Understanding the Fundamentals [Explained] — Our Wealth Insights How the Economic system Works – Understanding the Fundamentals [Explained] — Our Wealth Insights](https://i2.wp.com/ourwealthinsights.com/wp-content/uploads/2019/01/What-is-economy-for-a-layman.png?w=860&resize=860,0&ssl=1)