Market volatility is a short-term oscillation in inventory costs pushed by market demand and provide forces, that are brought on by various geopolitical tensions, world financial occasions, inflation, and dipping financial development fears. Response to company earnings, rising inflation disrupts retail demand, and financial coverage modifications influence borrowing prices for companies. Furthermore, fiscal coverage dynamics pushed by authorities interventions additionally set off securities market volatility extraordinarily. For example, capital positive factors tax modifications in Price range 2024 introduced a big dip out there.

Delicate geopolitical conditions reminiscent of concern of imposition of excessive tariffs by Trump authorities, menace of HMPV, falling rupee, FII flows, and many others. are triggering market volatility at current.

Regardless of short-term dangers, Morgan Stanley initiatives that sturdy earnings development, macro stability, and home investments may propel India’s Sensex to 1,05,000 in 2025. Nonetheless, dangers embrace world slowdowns and rising oil prices.

In such a situation, mutual funds can play a big position in serving to you attain your monetary objectives, even amid market volatility and inflation, by providing diversified, skilled funding administration tailor-made to your aims. SEBI Chief Madhabi Puri Buch at NSE’s Samvad Symposium on January 10, 2025, mentioned, “The expansion of mutual funds in our nation may be very sturdy.” She highlighted the sector’s sturdy governance and disclosure practices which are benefiting extra residents in wealth creation.

Allow us to see how mutual funds may help you:

Mutual funds put money into a various array of belongings, together with shares, bonds, and different securities, by pooling the cash of a number of contributors. This range helps management market volatility by lessening the influence of anyone funding’s poor efficiency. For example, on one aspect, for long-term aims, fairness funds have the power to develop sooner than inflation even within the face of short-term market swings, and on the opposite aspect, debt funds are perfect for short- to medium-term aims, as they supply better stability and lowered threat throughout risky durations.

In addition to, sure kinds of mutual funds are designed to defend towards inflation. For example, diversified fairness funds, dividend yield funds, solution-orientated funds for various buyers with totally different monetary objectives could also be for kids’s schooling, retirement, and many others.

Additionally, many mutual funds supply systematic plans reminiscent of Systematic Funding Plans (SIPs), Systematic Withdrawal Plans (SWPs), and Systematic Switch Plans (STPs), which promote disciplined and strategic investing.

- SIPs allow you to make investments often, leveraging rupee value averaging to cut back the influence of market volatility whereas constructing wealth persistently;

- SWPs present regular money stream throughout retirement or for periodic bills;

- STPs permit a gradual shift between funds to handle threat.

These plans are perfect for navigating market fluctuations and staying aligned with long-term monetary objectives. Debt or hybrid funds could also be appropriate for short-term monetary objectives (reminiscent of financing school or buying a automobile). Nonetheless, fairness funds can supply superior returns to offset inflation for long-term aims (reminiscent of retirement or dwelling possession).

Furthermore, mutual funds are managed by skilled fund managers who regulate the portfolio in response to altering market situations. This lively administration helps mitigate dangers throughout market fluctuations and inflation.

Moreover, most mutual funds supply excessive liquidity and allow you to redeem your funding when wanted. Such flexibility lets you align investments with life modifications and unexpected bills.

Mutual funds additionally present tax benefits, reminiscent of exemptions on long-term capital positive factors (as much as a sure restrict) or advantages from investing in tax-saving funds (ELSS). Tax-efficient investing may help you keep extra of your returns to fulfill your monetary objectives.

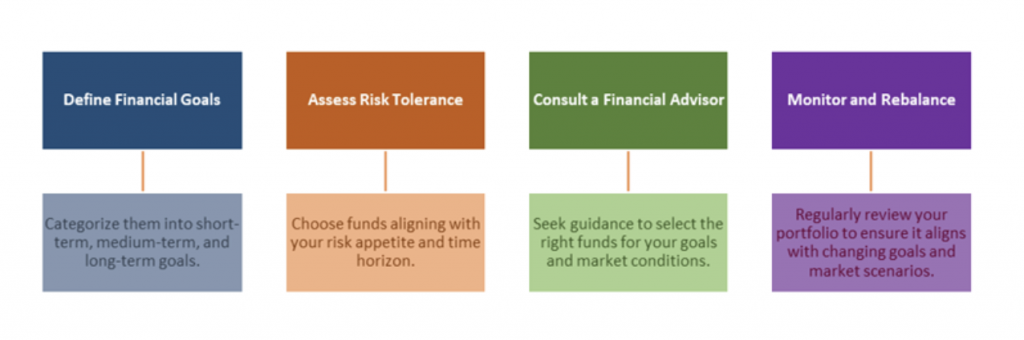

Allow us to see the steps to leverage mutual funds:

Aside from the above, whereas initiating your mutual fund funding journey in 2025, you could know numerous mutual fund classes. As per SEBI tips on Categorisation and Rationalization of schemes issued in October 2017, mutual fund schemes are categorized as:

- Fairness Schemes

- Debt Schemes

- Hybrid Schemes

- Resolution-Oriented Schemes—For Retirement and Youngsters

- Different Schemes: Index Funds & ETFs and Fund of Funds

These classes are additional bifurcated into sub-categories reminiscent of large-cap, mid-cap, and small-cap, amongst numerous others. Therefore, it’s best to know the next fund classes for investments in 2025:

1. Giant-Cap Funds

They put money into the highest 100 firms by market capitalisation, providing stability and constant returns. In 2024, large-cap funds delivered a 1-year absolute return of 16.33%, reflecting their reliability in producing regular development over time.

2. Flexi-Cap Funds

They supply flexibility by investing throughout large-cap, mid-cap, and small-cap shares, adapting to market situations. In 2024, these funds achieved a 1-year absolute return of 20.42%, showcasing their dynamic strategy to balancing threat and return.

3. Worth Funds

These funds give attention to undervalued shares with sturdy fundamentals, aiming for long-term appreciation. In 2024, worth funds recorded a 1-year absolute return of 20.65%, indicating their potential for substantial development.

4. Aggressive Hybrid Funds

A mixture of fairness and debt devices, providing development potential with lowered threat, these funds achieved a 1-year absolute return of 16.82% in 2024, reflecting their balanced efficiency throughout market cycles.

Furthermore, it’s of integral significance that you simply preserve abreast of market tendencies and financial indicators. For instance, small-cap funds have proven vital development, with belongings beneath administration rising from ₹51,161 crore in January 2020 to ₹318,281 crore in November 2024. Nonetheless, it’s important to evaluate whether or not this development aligns along with your threat tolerance and funding aims.

Frequently reviewing your portfolio’s efficiency and adjusting your investments to remain aligned along with your monetary objectives could possibly be an appropriate funding approach.

Nonetheless, it’s best to allocate your investments throughout numerous asset lessons and sectors to unfold threat and take into account together with debt funds or gold funds to hedge towards inflation and market downturns. For example, sectoral and thematic funds attracted double the funding month-on-month in December 2024, reaching ₹153.32 billion, aided by the launch of 12 new funds.

Wrapping Up

To sum up, investing in 2025 amid market fluctuations and inflation requires a disciplined and strategic strategy, with mutual funds providing a flexible answer. By leveraging diversified fund choices, systematic plans like SIPs, and common portfolio opinions, you’ll be able to successfully handle dangers and align investments along with your monetary objectives. Staying knowledgeable and looking for skilled recommendation ensures your technique stays adaptive to altering market situations.

Taken with how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Traders