Silver has lengthy been considered a retailer of worth, second solely to gold within the valuable metals hierarchy. However in recent times, silver has moved past its conventional function as merely a retailer of worth.

At this time, silver performs a twin function: a valuable steel and a important industrial enter in sectors corresponding to photo voltaic vitality, electronics, and electrical autos. This evolving utility has introduced renewed consideration to silver as an asset class.

The end result? A noticeable rise in silver-focused mutual funds and ETFs, reflecting rising investor curiosity.

However does silver really advantage a spot in your portfolio or is it only a passing development?

Let’s discover out..

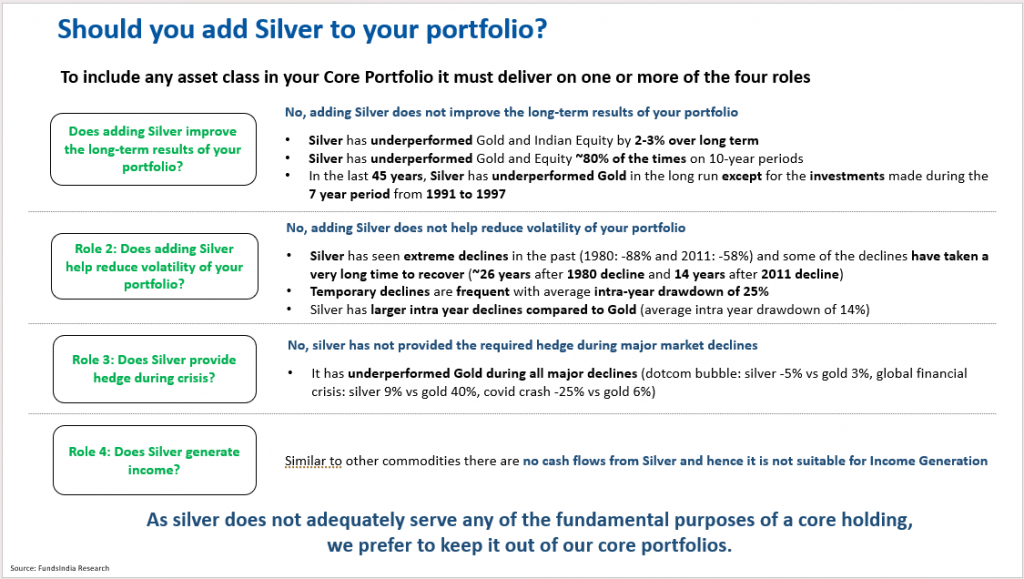

The 4 Roles of a Core Portfolio Asset

Earlier than including any asset to your ‘Core Portfolio’, it should serve a clear goal. Broadly, an asset ought to ship on a number of of the next 4 roles:

- Function 1: Improve Lengthy Time period Returns

- Function 2: Cut back Portfolio Volatility

- Function 3: Act as a Disaster Hedge

- Function 4: Generate Common Earnings

Let’s test if Silver delivers on any of those roles

Function 1: Does including Silver enhance the long-term returns of your portfolio?

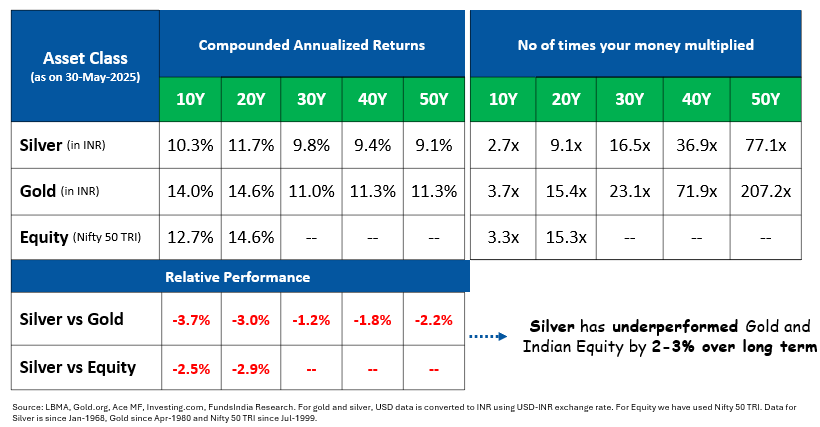

To evaluate whether or not silver enhances long-term portfolio returns, we in contrast its efficiency towards gold and Indian equities (Nifty 50) throughout totally different lenses.

1. Annualised Returns Over 50 Years – Silver has delivered decrease returns in comparison with each gold and fairness over multi-decade horizons.

- Over the long run, silver has underperformed each gold and fairness by 2–3% yearly.

- Over a 50 12 months interval, Rs 1 lakh invested in Silver multiplied ~77x i.e. Rs 77 lakh vs Gold at ~207x i.e. Rs 2.07 crores

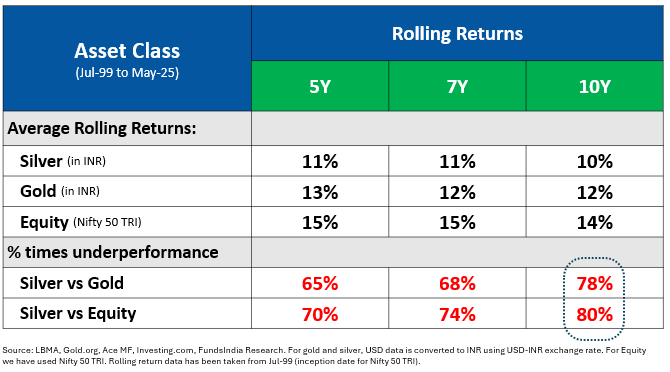

2. Rolling Return Evaluation – Silver has not often outperformed Gold and Fairness over 10Y holding intervals.

We checked out 5, 7, and 10-year rolling returns to judge efficiency throughout time, no matter begin date.

- Throughout all 10-year rolling intervals, silver underperformed gold and fairness ~80% of the time.

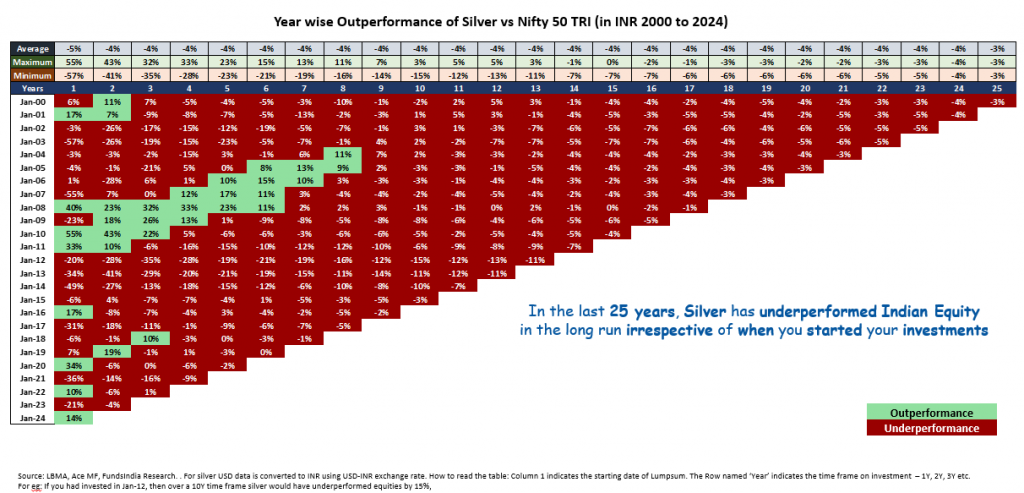

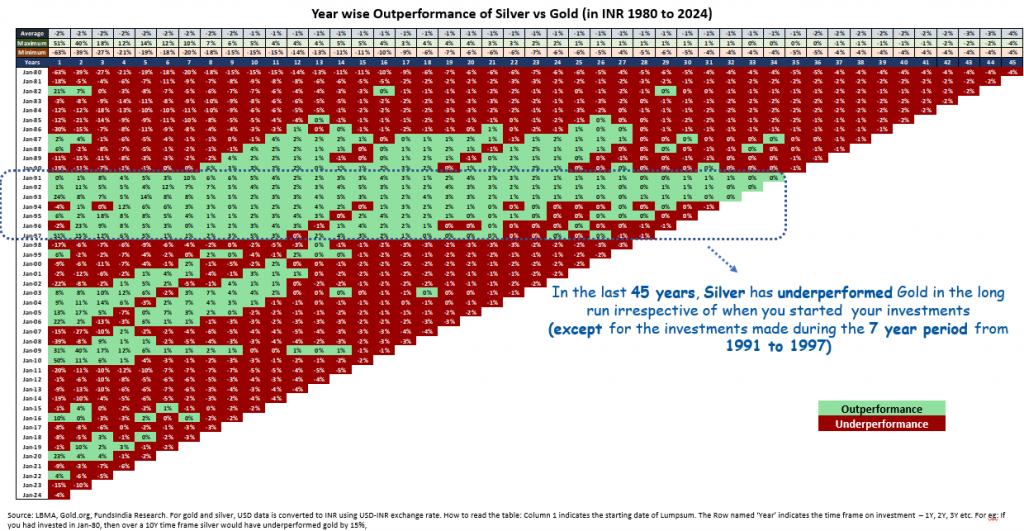

3. Lump Sum Return Matrix – Silver’s historic underperformance has been persistent and widespread.

One other means to take a look at the long run returns is thru the lumpsum matrix given under the place inexperienced/purple point out outperformance/underperformance of Silver vs Fairness and Gold.

The above matrix clearly reveals:

- Silver constantly underperformed fairness, regardless of funding timing.

- It additionally lagged gold in most intervals – besides whenever you invested in Silver between 1991–1997.

Conclusion

Conclusion

Based mostly on historic return knowledge, silver doesn’t enhance the long-term return potential of a portfolio – particularly when in comparison with conventional core belongings like fairness and gold.

Function 2: Does including Silver assist scale back volatility of your portfolio?

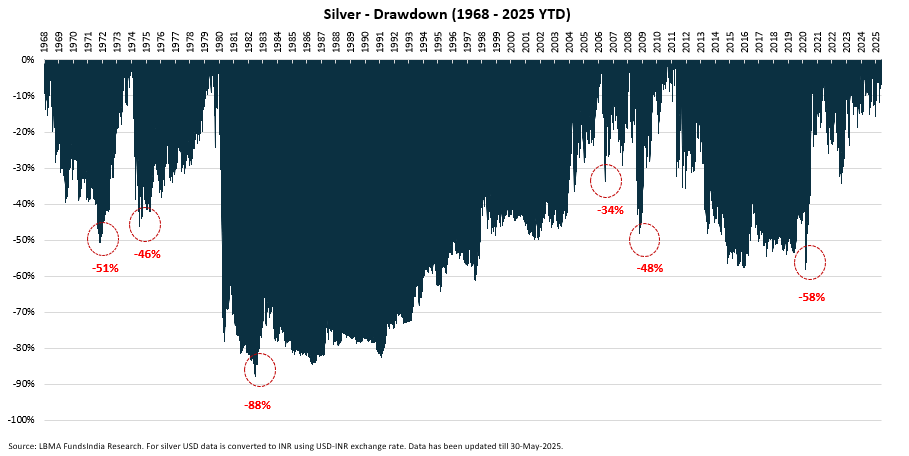

To guage silver’s capacity to decrease portfolio volatility, we examined its historic drawdowns and restoration intervals over the previous 57+ years (since Jan 1968).

1. Deep Historic Declines – Silver is extremely risky and has traditionally gone by excessive declines.

Silver has skilled a number of sharp declines, with the most extreme decline reaching practically 88%!

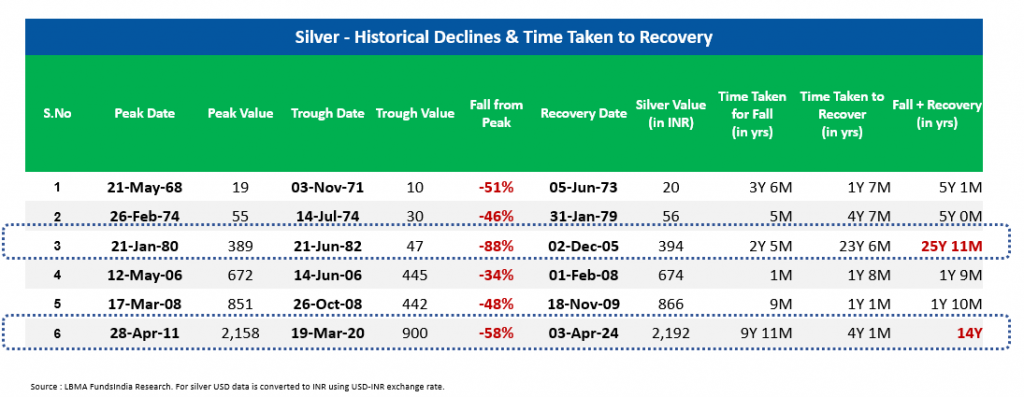

2. Lengthy Restoration Intervals – Main Silver drawdowns have taken a decade or extra to get better, making it much less appropriate for portfolios looking for stability.

The depth of silver’s corrections has additionally been matched by extended restoration instances:

- 1980 crash: Took ~26 years to get better.

- 2011 peak: Took ~14 years to get better.

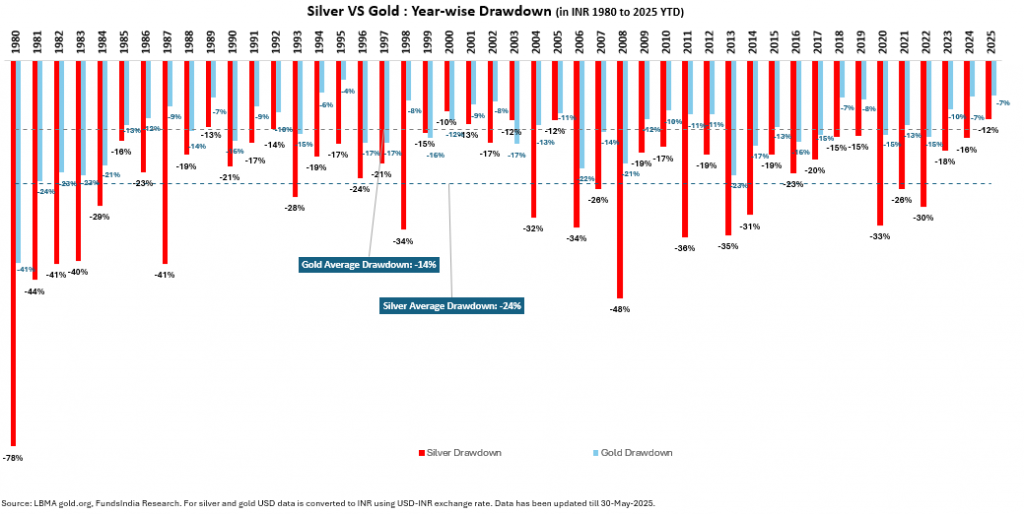

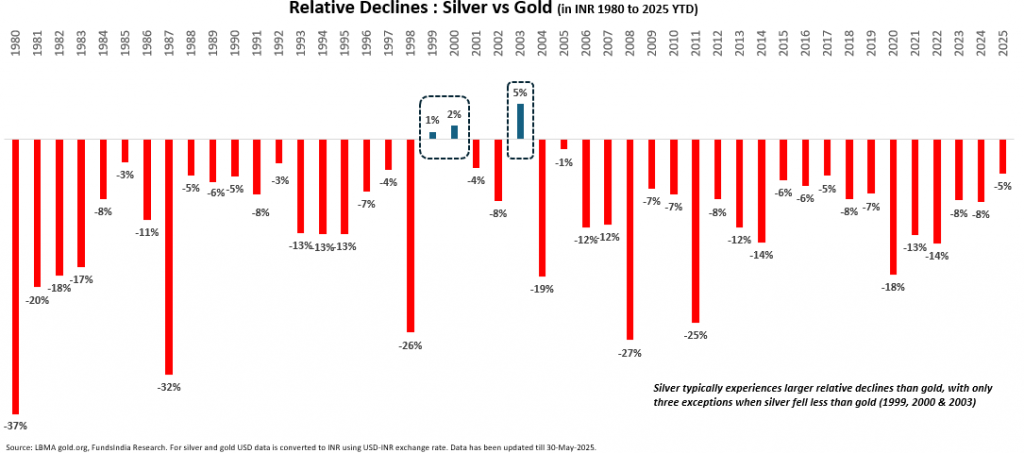

3. Frequent and Extreme Intra-12 months Declines – Silver tends to exhibit bigger and extra frequent drawdowns in comparison with gold.

Common intra-year decline in silver at ~24% is a lot higher than Gold’s common intra-year decline at ~14%…

Silver fell extra than gold in practically yearly – besides 1999, 2000, and 2003…

Conclusion

Conclusion

From each depth and frequency of drawdowns, silver introduces extra volatility, not much less, to a portfolio. It doesn’t serve the function of decreasing portfolio threat – in contrast to belongings corresponding to gold or high-quality mounted revenue

Function 3: Does Silver present hedge throughout a disaster?

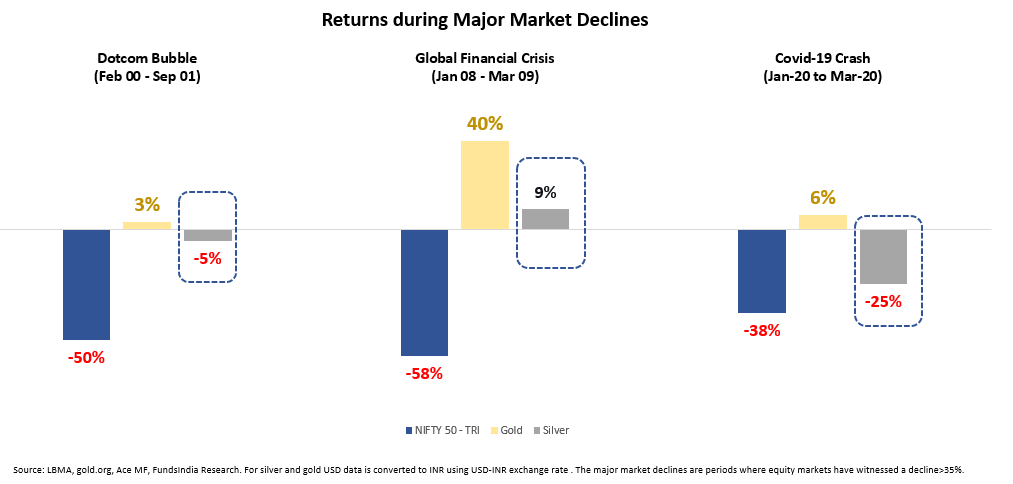

To guage silver’s effectiveness throughout market stress, we in contrast the efficiency of silver, gold, and Indian equities throughout main fairness market declines (drawdowns >35%).

Key Commentary – In each main market decline, silver underperformed gold and in lots of circumstances, additionally fell considerably alongside equities.

Conclusion

Conclusion

Silver doesn’t function a dependable disaster hedge like Gold. In truth, its tendency to fall throughout broad fairness market declines limits its function as a defensive asset – in contrast to gold, which has a confirmed observe report of doing effectively throughout turbulent instances.

Function 4 – Does Silver generate revenue?

Silver, like most commodities, doesn’t generate any revenue or money flows. In contrast to belongings corresponding to actual property (hire) or bonds (curiosity), silver gives no yield, dividend, or common payout.

Conclusion

Conclusion

Silver is a non-income producing asset, making it unsuitable for buyers looking for secure money flows from their portfolio.

Last Verdict: Does Silver Deserve a Place in Your Core Portfolio?

To advantage inclusion in a Core Portfolio, any asset should fulfill a number of of the next roles:

| Function | Does Silver Ship? |

| 1. Enhance Returns | ❌ No — Silver has constantly underperformed Gold and Fairness |

| 2. Cut back Volatility | ❌ No — Silver provides volatility, not stability |

| 3. Disaster Hedge | ❌ No — Silver fails to behave as a dependable disaster hedge |

| 4. Generate Earnings | ❌ No — Silver generates no revenue |

Whereas silver might have tactical or thematic enchantment, it doesn’t fulfill any of the 4 core roles required for strategic portfolio allocation.

For many buyers, particularly these looking for long-term stability and affordable returns, silver is healthier suited as a satellite tv for pc or opportunistic holding – not a core asset.

Visible Abstract

Whereas silver might not qualify for a core portfolio, may it nonetheless function a tactical alternative?

At first look, silver’s cyclical nature and potential for sharp rallies make it appear interesting for tactical publicity. Nevertheless, its excessive volatility and unpredictable cycles demand exact timing – making the margin for error fairly slim.

Historic Cycle Evaluation (Since Jan 1971)

Traditionally, Silver has proven a sample of:

- Upcycles lasting 8–10 years

- Adopted by downcycles of seven–10 years

So a poorly timed entry can expose you to steep losses throughout a downcycle, whereas a poorly timed exit can erase beneficial properties made through the upcycle – leaving total returns muted and even destructive.

In case you nonetheless want to discover tactical alternatives in silver…

Two evidence-based indicators can enhance timing odds:

- Indicator 1 – Silver Provide Surplus or Deficit development:

- Indicator 2 – Silver’s Relative Efficiency vs Gold

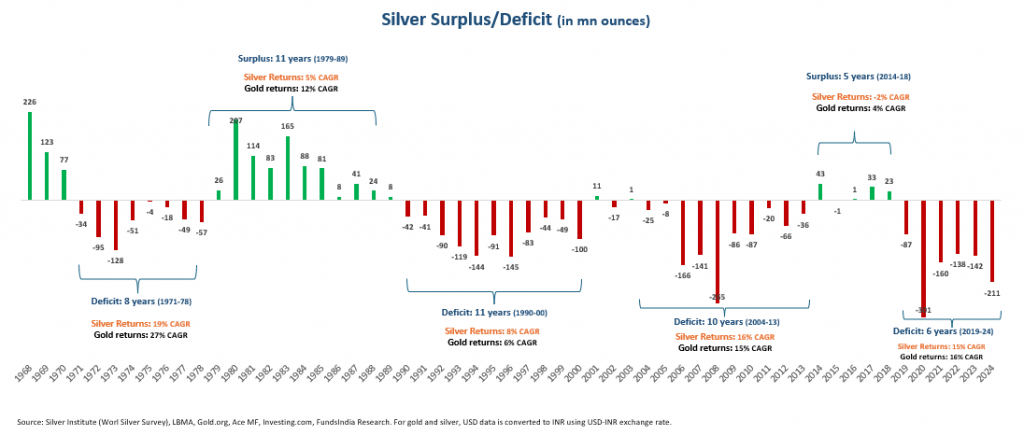

Indicator 1: Silver Provide Deficit or Surplus Development

- Historic knowledge reveals that deficit cycles sometimes final 8–10 years.

- Within the final 4 deficit phases, silver outperformed gold in solely 2 out of 4 – and even then, the outperformance was modest (~1–2% CAGR).

Present Standing

- Silver has been in deficit for 6 consecutive years. If historic patterns maintain, provide might catch up quickly, probably reversing the deficit and capping additional upside.

- Implication: The tailwind from the present deficit cycle could also be nearing its finish.

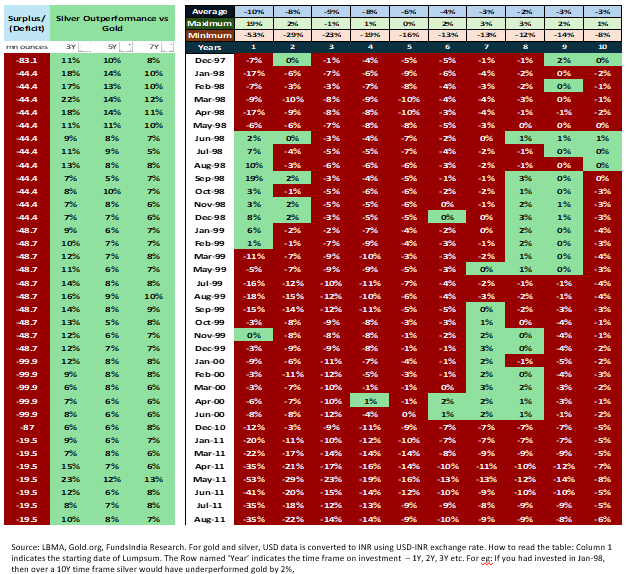

Indicator 2: Silver’s Relative Efficiency vs Gold

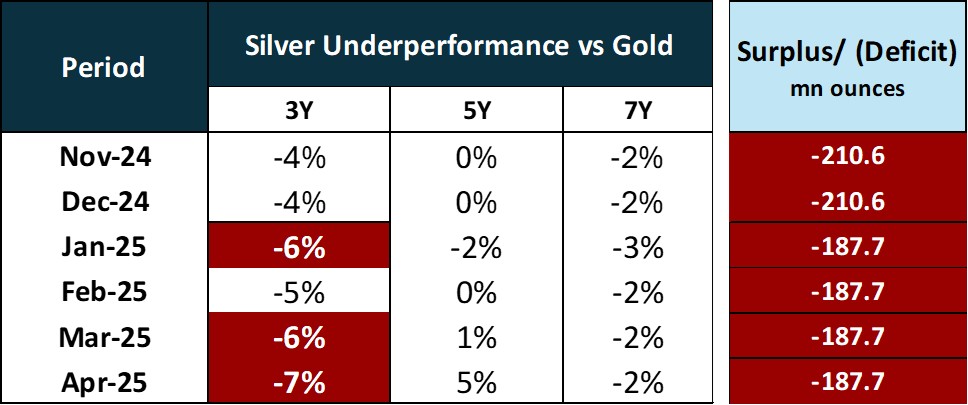

Within the chart under we take a look at the silver deficit/surplus, relative efficiency over 3Y,5Y,7Y intervals and the next outperformance/underperformance.

When Silver considerably underperforms Gold over 3Y, 5Y, and 7Y intervals and coincides with a provide deficit, it has traditionally outperformed Gold in subsequent years.

Conversely, when silver considerably outperforms gold over 3Y,5Y and 7Y intervals, it tends to underperform within the intervals that comply with.

Present Standing

- When Silver considerably underperforms Gold over 3Y, 5Y, and 7Y intervals and is Provide Deficit – it often outperforms within the subsequent intervals. At the moment as seen under, silver underperforms gold over 3Y and 7Y however outperforms over 5Y. Additionally, the underperformance over the 7Y interval shouldn’t be important.

Our View: The present indicators don’t help a compelling tactical case for silver right now.

Parting Ideas

Silver’s twin id – half valuable steel, half industrial commodity – makes it an attention-grabbing asset. Nevertheless, curiosity alone isn’t a purpose to speculate.

- As a core portfolio asset, silver fails to ship on any of the 4 important roles: it neither enhances long-term returns, reduces volatility, acts as a disaster hedge, nor generates revenue.

- As a tactical allocation, silver’s potential is closely dependent on exact timing – each entry and exit. Present indicators, together with a maturing provide deficit and blended relative efficiency versus gold, don’t current a powerful tactical alternative.

Backside Line: Whereas silver continues to draw curiosity and carries a powerful narrative, the proof doesn’t help a significant allocation – whether or not within the core or tactical portfolio.

A disciplined, data-driven strategy centered on belongings that constantly ship throughout cycles will proceed to serve you higher over the long run.

Completely happy Investing as all the time 🙂

Different articles you could like

Publish Views:

69