Is Kaynes Applied sciences a Good Purchase Now?

Kaynes Know-how India Restricted is a distinguished participant within the Digital System Design and Manufacturing (ESDM) {industry} (ESDM Sector). The corporate has been a robust performer within the Indian inventory market as a result of its spectacular monetary efficiency, modern know-how, and strategic enlargement plans. As an investor, understanding “is Kaynes Applied sciences a great purchase now”, requires an in depth take a look at its latest development trajectory, monetary well being, market positioning, and future development potential within the context of the increasing electronics and Indian IoT market. Allow us to focus on the main points of “Is Kaynes Applied sciences a Good Purchase Now?”.

The ESDM Sector in India: A Promising Panorama

The Digital System Design and Manufacturing (ESDM) sector in India has emerged as a serious part of the nation’s industrial development. Pushed by growing demand for digital merchandise, authorities help, and strong {industry} investments, the sector is positioned to develop strongly within the coming years.

In keeping with a Frost & Sullivan report on the ESDM {industry} in India, the sector is predicted to attain a compound annual development price (CAGR) of 32.5% from 2022 to 2027, projecting a market measurement of ₹3,372 billion by the tip of the interval. This speedy enlargement is propelled by India’s ambition to turn into a world electronics manufacturing hub and the rising development of import substitution.

Development Drivers in The ESDM Sector in India

Elevated native demand for digital items, particularly in client electronics, automotive, healthcare, and telecom, has boosted home manufacturing necessities. As India’s center class expands and the nation advances towards digital transformation, demand for smartphones, IoT gadgets, medical electronics, and many others is predicted to drive the ESDM sector in India.

Supportive authorities insurance policies just like the Manufacturing Linked Incentive (PLI) scheme, launched by the Authorities of India, incentivize native manufacturing and intention to scale back dependency on imports additional boosting this {industry}. The PLI scheme, together with different help packages, not solely stimulates investments but additionally encourages corporations to arrange and develop operations inside India.

Moreover, the federal government’s “Make in India” and “Digital India” initiatives align with the strategic targets of the ESDM sector, supporting infrastructure growth and fostering an ecosystem for home and worldwide gamers.

Is Kaynes Applied sciences a Good Purchase Now?

Allow us to analyse if the Kaynes applied sciences a great purchase now for traders those that want to spend money on a rising ESDM sector and IOT market participant.

Kaynes Know-how exemplifies the potential of the ESDM sector in India. As a number one design-led electronics producer with experience throughout numerous {industry} purposes—starting from automotive to aerospace and medical gadgets—Kaynes is well-positioned to leverage the {industry}’s development.

The corporate’s dedication to R&D, give attention to IoT and embedded design capabilities, and strategic investments in manufacturing services spotlight its pivotal function in advancing the ESDM sector in India.

Kaynes Know-how income development projections

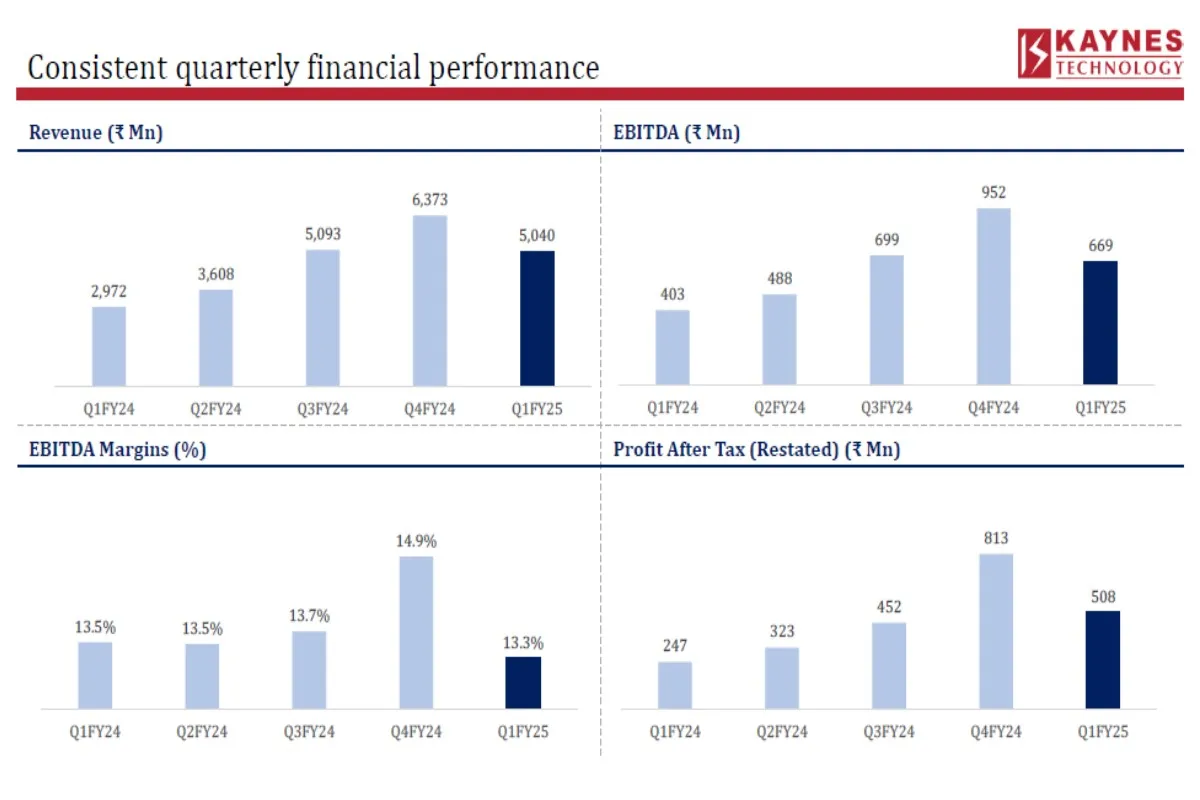

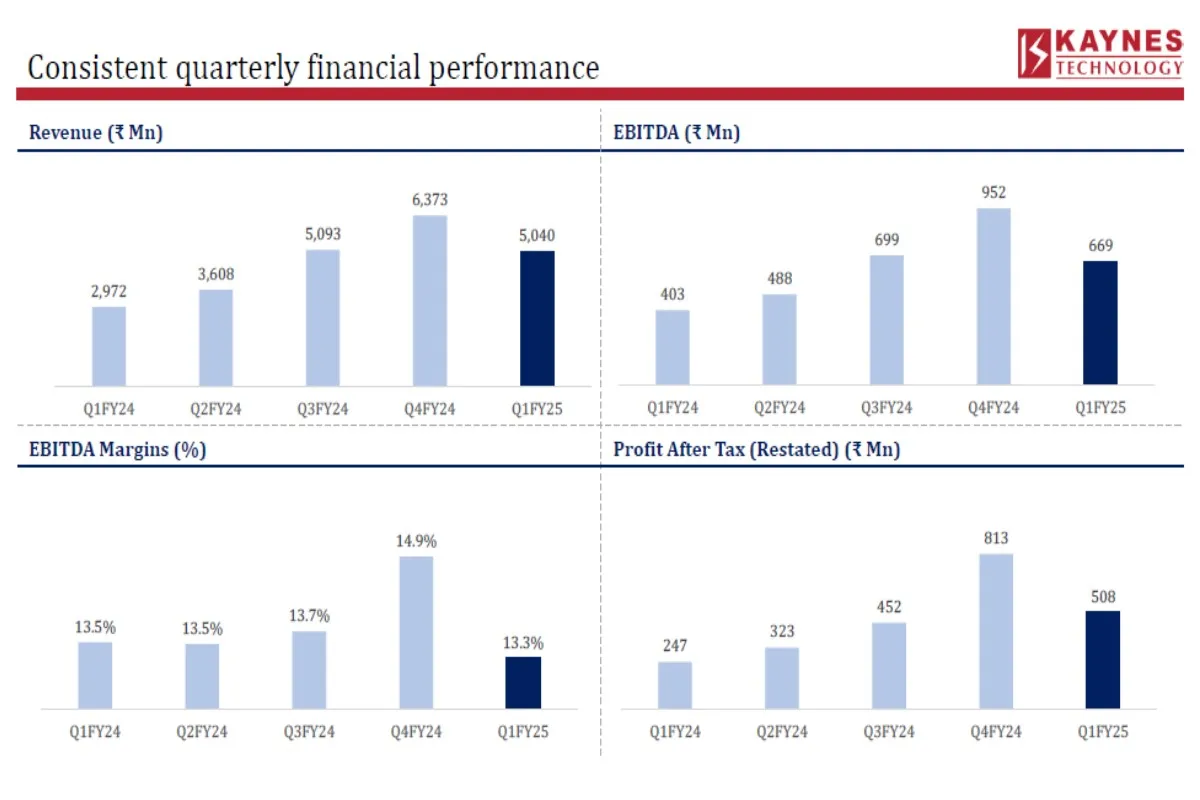

Kaynes has proven constant and strong monetary development in recent times, underscoring its stability and operational effectivity. For the fiscal yr ending 2023, the corporate posted a 59% income development, reaching ₹11,261 million, with Revenue After Tax (PAT) surging by 128% year-over-year to ₹952 million.

Its efficiency continued in Q1 FY25, the place income grew 70% year-over-year, alongside a rise in PAT margin to 10.1%, pushed by a robust order guide price ₹50,386 million—an increase from ₹41,152 million in FY24. This spectacular development in income and profitability alerts a well-managed operational technique, enhancing the corporate’s attractiveness from an funding perspective.

Furthermore, Kaynes’ EBITDA margin is steady at roughly 14.9%, reflecting effectivity in managing operational prices amid income development. The corporate’s near-zero debt-to-equity ratio additional showcases monetary prudence, which helps long-term resilience and positions it effectively for sustainable development.

Kaynes Know-how future development potential evaluation

Whereas discussing about “is Kaynes Applied sciences a great purchase now” we have to perceive the market place of the corporate. Kaynes Know-how has strategically positioned itself within the burgeoning ESDM sector.

Kaynes has established a multi-industry presence, serving high-demand sectors like automotive, industrial, aerospace, and medical, which not solely broadens its income base but additionally mitigates the danger of sector-specific downturns.

The corporate has been increasing its manufacturing capability, with main plans underway to reinforce services in Mysuru and Manesar and set up a brand new web site in Chamarajanagar, Karnataka. These expansions, backed by strategic capital allocations, are more likely to allow Kaynes to satisfy the rising demand from India’s ESDM sector.

Aggressive Benefit within the ESDM Sector and IoT Market in India

As a design-led ESDM producer, Kaynes stands out with its give attention to superior IoT-enabled options, embedded design capabilities, and Gallium Nitride know-how. These capabilities are extremely wanted in a market leaning closely in direction of automation, connectivity, and good applied sciences. The corporate’s mental property in Industrial IoT (IIoT) options offers an edge, particularly as industries more and more demand related methods and good capabilities of their merchandise.

Moreover, Kaynes’ skill to design, manufacture, and help Authentic Design Manufacturing (ODM) options tailor-made for complicated industrial and client purposes offers it a aggressive benefit within the ESDM panorama. This functionality is especially related within the context of India’s rising give attention to native manufacturing and import substitution, which additional positions Kaynes as a most well-liked associate for home and world OEMs.

Kaynes Know-how has demonstrated robust monetary fundamentals, with a positive debt-to-equity ratio of almost zero, reflecting low monetary leverage and a wholesome steadiness sheet. Publish-IPO proceeds have additional bolstered its monetary standing, lowering the necessity for exterior financing as the corporate pursues enlargement and development tasks.

This fiscal prudence not solely enhances Kaynes’ credibility out there but additionally shields it from rate of interest fluctuations—a vital think about risky financial situations. This solutions your query on “is Kaynes Applied sciences a great purchase now?”

Moreover, Kaynes’ return on fairness (ROE) and return on capital employed (ROCE) stay aggressive, with ROE at 17.4% in Q1 FY25 and ROCE at 18.8%, indicating efficient use of shareholder capital and environment friendly administration practices. For traders, such metrics counsel Kaynes’ capability to generate stable returns on investments, making it a worthwhile consideration for value-focused portfolios.

I consider Kaynes Know-how inventory forecast 2025 may be like Dixon Know-how share worth in 2024. This inventory has the potential to achieve the destiny of Dixon Applied sciences by 2025.

Investing in Indian ESDM corporations for development

Nevertheless, the ESDM sector is extremely aggressive, with a number of gamers already out there, and new gamers are additionally coming into into the ESDM sector in India. Fluctuations in demand from vital sectors, similar to automotive and industrial, might affect revenues, significantly if provide chain disruptions persist globally.

Kaynes Know-how operates inside a extremely aggressive Digital System Design and Manufacturing (ESDM) Sector in India, with a number of distinguished gamers throughout numerous enterprise fashions and companies attempting to seize the market share.

Dixon Applied sciences

Identified for its substantial footprint within the EMS and client electronics sectors, Dixon Applied sciences focuses on a spread of digital merchandise, from cellphones to residence home equipment, making it a serious participant in India’s ESDM market. This is likely one of the finest Shares to purchase as we speak within the ESDM sector in India.

Bharat FIH

Previously generally known as Rising Star Cell India, Bharat FIH offers end-to-end design and manufacturing options with a robust presence in cell phone manufacturing and is likely one of the bigger gamers in India.

Amber Enterprises

Primarily engaged in HVAC methods, Amber additionally competes within the ESDM sector by providing electronics manufacturing for numerous purposes, significantly within the client electronics section.

SFO Applied sciences

Working in numerous fields together with aerospace, industrial, and medical electronics, SFO is a major ESDM supplier with complete design and manufacturing companies throughout a number of industries.

Syrma SGS Know-how

Syrma gives product growth and manufacturing companies, significantly in high-tech electronics for the automotive, healthcare, and industrial sectors, aligning intently with Kaynes in high-value ESDM choices. This is likely one of the finest Shares to purchase within the ESDM sector in India.

Elin Electronics

Targeted on motor and lighting merchandise, Elin Electronics serves each the buyer and industrial electronics markets and offers a spread of producing options throughout these segments.

Avalon Applied sciences

Identified for its EMS and ODM capabilities, Avalon competes intently with Kaynes by offering end-to-end options in electronics design, manufacturing, and testing throughout sectors. This is likely one of the finest Shares to purchase within the ESDM sector in India.

Lastly, Is Kaynes Applied sciences a Good Purchase Now?

Contemplating its robust monetary efficiency, well-rounded development technique, and positioning inside a high-growth sector, Kaynes Know-how presents a compelling funding alternative. The corporate’s multi-pronged method, spanning capability enlargement, IoT-focused innovation, and monetary resilience, underscores its potential for delivering worth to shareholders over the long run.

Kaynes’ dedication to sustainability, coupled with its superior capabilities in ESDM, gives traders a singular alternative to take part in a market poised for vital development. I hope you bought your reply on “is Kaynes Applied sciences a great purchase now?”. Undoubtedly it’s a good purchase now with correction.

Extra From Throughout our Web site

We endeavor that can assist you to grasp totally different facets of an organization earlier than you spend money on the corporate’s IPO. Study all firm insights for funding in new corporations within the Indian share market in 2023. To know extra details about firm insights for funding, and enterprise overview of corporations for funding, listed here are some instructed readings on firm insights for funding – Inexperienced Hydrogen Shares in India, 10 Greatest IPOs in 2022, Tata Motors Inventory Value, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Inventory Value, Tata Applied sciences IPO, AI Shares in India.