Be a part of Our Telegram channel to remain updated on breaking information protection

China’s Ant Digital Applied sciences, a unit of the Jack Ma-owned Ant Group, is tokenizing over $8 billion price of vitality infrastructure by itself blockchain community.

That’s in accordance with a Bloomberg report that cited sources accustomed to the matter as saying the unit is within the means of tokenizing 60 billion yuan ($8.4 billion) of energy infrastructure on the AntChain community.

The report stated Ant Digital Applied sciences has been monitoring the facility output and outages for 15 million new vitality gadgets in China, together with photo voltaic panels and wind generators, and importing the information to its blockchain.

Ant Digital Applied sciences Plans To Difficulty Tokens For Power Infrastructure

It has already raised round 300 million yuan ($42 million) to finance three clear vitality tasks. The unit now plans to concern tokens linked to these property.

One in every of plans on the unit’s roadmap is to additionally provide tokens on offshore decentralized exchanges (DEXs) to create extra liquidity for the property.

That will probably be topic to regulatory approval, in accordance with the nameless sources cited within the report.

This isn’t the primary transfer by the unit to tokenize vitality property. In August final 12 months, Ant Digital Applied sciences raised $14 million for the vitality agency Longshine Expertise Group, and linked 9,000 of the corporate’s electrical charging items to AntChain.

In December, the unit additionally secured greater than $28 million for GCL Power Expertise by connecting photovoltaic property to its blockchain.

RWA Sector Soars To Report Excessive This Week

The transfer by Ant Digital Applied sciences to tokenize vitality property and probably concern tokens for them is a part of a rising development of tokenizing real-world property (RWAs).

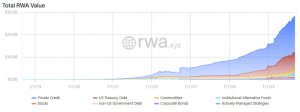

The sector remains to be in its early phases, however is beginning to acquire momentum. Simply this week, the worth of tokenized RWAs soared to a report excessive of $28.4 billion, knowledge from RWA.xyz exhibits. That is nearly double the worth seen in the beginning of the 12 months.

RWA on-chain worth (Supply: RWA.xyz)

Greater than half of the digital RWA worth is non-public credit score that has been tokenized on the blockchain. Over 1 / 4 of the worth can also be tokenized US Treasurys.

Different tokenized property embody commodities ($2 billion), institutional different funds ($1.8 billion), public fairness ($421.2 million) and non-US authorities debt ($340.2 million).

The Ethereum blockchain stays the blockchain of selection for tokenized RWA issuers, and has a 57% share of the market.

Ant Group Wanting To Get Into The Booming Stablecoin Area

Ant Group isn’t simply concerned within the vitality infrastructure house, however can also be reportedly trying to be a part of the booming stablecoin market.

In July, a report stated that the group plans to include Circle’s USD Coin (USDC), which is the second-largest stablecoin by market cap, into its blockchain community.

Ant Group had additionally collaborated with ecommerce big JD.com to foyer the Individuals’s Financial institution of China (PBOC) to approve stablecoins backed by the Chinese language Yuan.

That occurred throughout the identical month that US President Donald Trump signed the GENIUS Act into regulation, which is the primary invoice on the federal stage that units regulatory necessities for issuers within the US to adjust to.

A few of these necessities embody sustaining a 1:1 backing with the stablecoin’s underlying asset, in addition to abiding by Anti-Cash Laundering (AML) and Counter Terrorism legal guidelines.

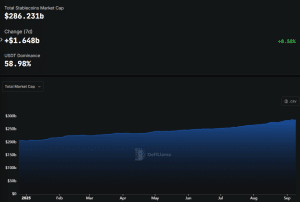

Because the GENIUS Act was signed into regulation in July, the stablecoin market cap has climbed from $260.715 billion to a report excessive $286.231 billion, in accordance with DeFiLlama knowledge.

Stablecoin market cap (Supply: DeFiLlama)

Just like the RWA sector, Ethereum is the popular blockchain for stablecoin issuers.

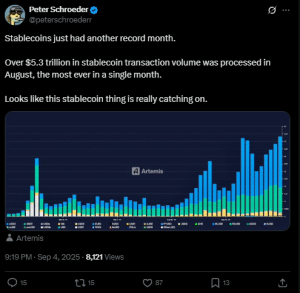

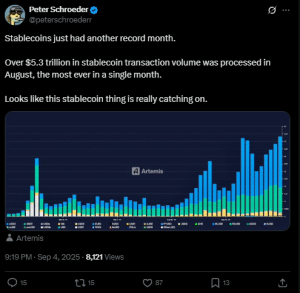

Stablecoin transaction volumes spike in August (Supply: X)

Along with vitality asset tokenization and stablecoins, Ant Digital Applied sciences has additionally invested in a public blockchain known as Pharos Community Expertise. The challenge is led by a former Ant worker.

The unit has additionally entered into an settlement with a monetary providers agency based mostly in Hong Kong known as Yunfeng Monetary Group. As a part of the strategic cooperation settlement, the 2 will leverage Pharos’s platform to discover areas together with RWA tokenization.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection