Ok E C Worldwide Ltd – Constructing Sustainable Infrastructure

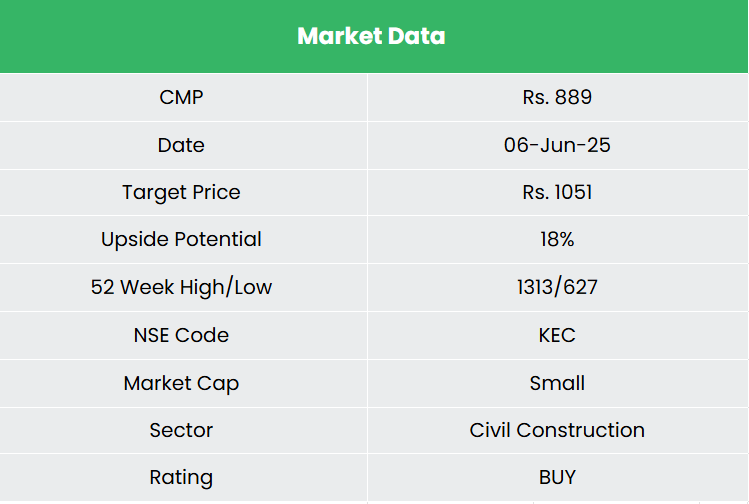

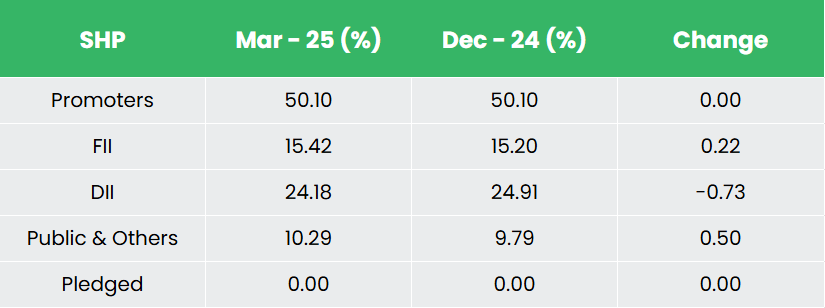

Integrated in 2005 and headquartered in Mumbai, Ok E C Worldwide Ltd. is a worldwide chief in infrastructure options. The flagship firm of RPG Group, KEC is an Engineering, Procurement, and Building (EPC) main delivering tasks in key infrastructure sectors akin to energy transmission & distribution, civil, transportation, renewables, oil and gasoline pipelines and cables. As of 31 March 2025, the corporate has 8 manufacturing amenities and 275+ ongoing tasks in 8 strategic enterprise models unfold throughout 110+ international locations.

Merchandise and Providers

KEC Worldwide is primarily engaged within the following enterprise:

- Infrastructure Tasks (EPC) – The corporate undertakes Engineering, Procurement, and Building (EPC) tasks throughout a spread of sectors, together with utilities, railways, buildings, industrial amenities, and civil infrastructure. Its core focus areas embrace the development, erection, and upkeep of energy transmission strains, railway methods, and different civil engineering works.

- Electrical Tools Manufacturing – KEC additionally manufactures electrical gear, with a key emphasis on the manufacturing of electrical wires and cables.

Subsidiaries: As of FY24, the corporate has 17 subsidiaries and 1 affiliate firm.

Funding Rationale

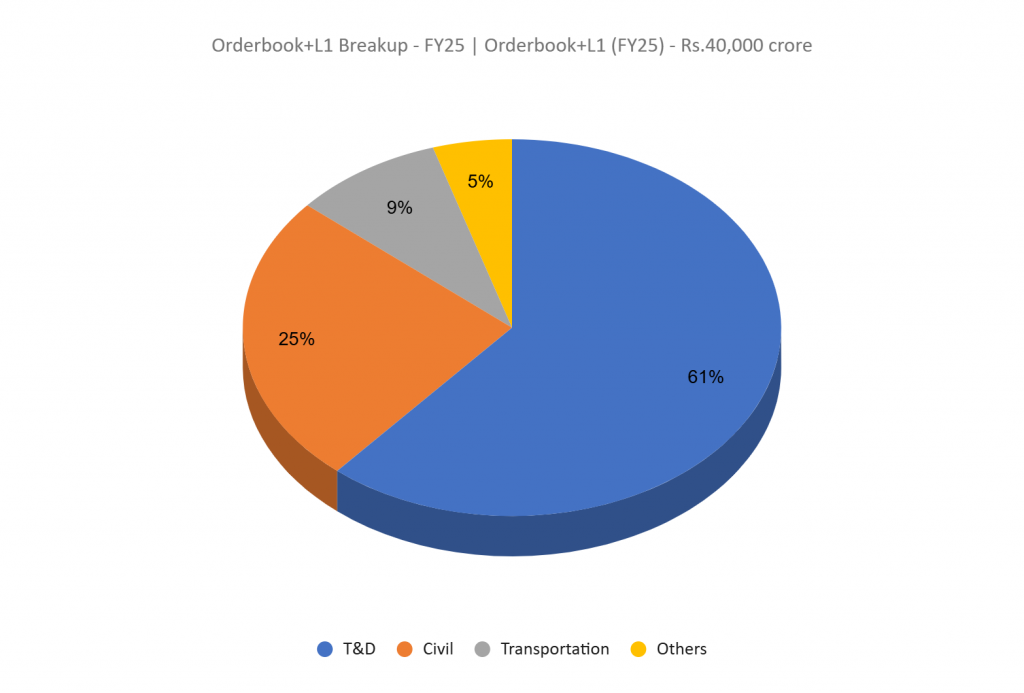

- Increasing order guide – KEC Worldwide has considerably expanded its order guide, recording a 36% YoY progress in FY25 with complete orders value Rs.24,689 crore, led primarily by the Transmission & Distribution (T&D) phase, which contributed 70% of the consumption. The corporate secured various orders throughout geographies, together with key wins in India, the Center East, and the Americas, and marked its entry into new segments akin to semiconductors and upstream metal tasks. Notable achievements embrace its first STATCOM order and elevated common order dimension from Rs.200 crore to Rs.325 crore. The order guide stood at Rs.33,398 crore on the finish of FY25, with the order guide plus L1 pipeline exceeding Rs.40,000 crore, offering sturdy income visibility for the subsequent 6 – 8 quarters. The corporate has received a number of orders from Energy Grid Company of India Ltd, notably within the excessive margin HVDC (Excessive-Voltage Direct Present) phase. FY26 YTD order consumption is at Rs.4,200, a strong 40% YoY progress.

- Segmental efficiency – The corporate is concentrating on sturdy progress in its Transmission & Distribution (T&D) phase. In Q4FY25, the phase reported income of Rs.12,833 crore, marking a 23% YoY improve. Order consumption surged by 60% to Rs.18,000 crore. To leverage rising alternatives, the corporate is increasing tower manufacturing capability at its Dubai, Jaipur, and Jabalpur amenities. The transportation phase additionally gained momentum, recording order inflows of Rs.2,200 crore, together with preliminary orders within the ropeway and gauge conversion sectors. In the course of the fiscal 12 months, the corporate efficiently accomplished its first Prepare Collision Avoidance System (TCAS) mission below the Kavach initiative and secured further orders. In the meantime, the cables enterprise achieved its highest-ever income, revenue, and order consumption. The corporate additionally commissioned an aluminium conductor plant and is now working to double its capability. Investments have been made towards an e-beam facility and elastomeric cable manufacturing, each of that are progressing as deliberate.

- Q4FY25 – In the course of the quarter, the corporate generated income of Rs.6,872 crore, a rise of 11% in comparison with the Rs.6,165 crore of Q4FY24. Working revenue elevated from Rs.388 crore of Q4FY24 to Rs.539 crore of Q4FY25, a progress of 39%. The corporate reported web revenue of Rs.268 crore, a rise by 76% YoY in comparison with Rs.152 crore of the corresponding interval of the earlier 12 months.

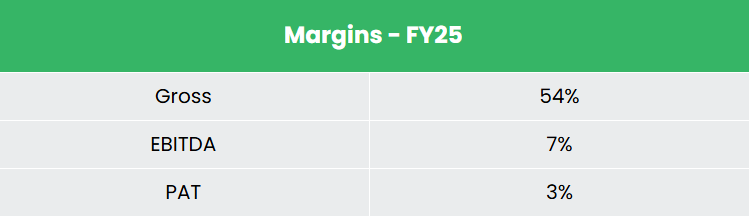

- FY25 – In the course of the FY, the corporate generated income of Rs.21,847 crore, a rise of 10% in comparison with the FY24 income. Working revenue is at Rs.1,504 crore, up by 24% YoY. The corporate reported web revenue of Rs.571 crore, a rise of 65% YoY.

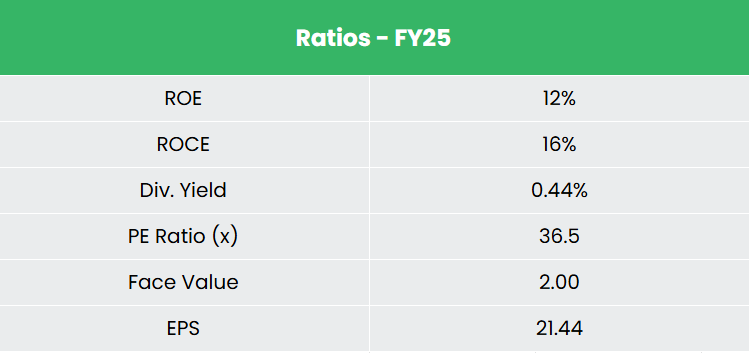

- Monetary Efficiency – The three-year income and web revenue CAGR stands at 17% every between FY23 – 25. TTM gross sales and web revenue progress is at 10% and 65%. Common 3-year ROE and ROCE is round 9% and 15% for FY23-25 interval. Debt to fairness ratio is at 0.74.

Trade

India’s electrical gear market is projected to develop from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, at a powerful CAGR of 11.7%. The engineering sector, which underpins infrastructure and manufacturing, stays a strategic pillar of the Indian financial system, supported by aggressive benefits in price, expertise, and innovation. Energy infrastructure continues to see heavy funding, with over US$ 107 billion earmarked for transmission growth by 2032. The sector is transitioning towards clear power and common entry, pushed by coverage assist and rising demand. Concurrently, the development gear market is predicted to develop at 8.3% CAGR by way of 2030. Formidable tasks like metro expansions and Indian Railways’ modernization additional strengthen long-term business prospects.

Development Drivers

- With the intention to just about triple its renewable power capability and guarantee 24×7 energy entry nationwide, India plans to take a position over Rs. 9.15 lakh crore (US$ 107 billion) by 2032 to construct further transmission strains.

- The federal government has de-licensed the engineering sector with 100% FDI permitted.

- Authorities has allowed 100% FDI within the railway sector and renewable power sector.

Peer Evaluation

Rivals: Kalpataru Tasks Worldwide Ltd.

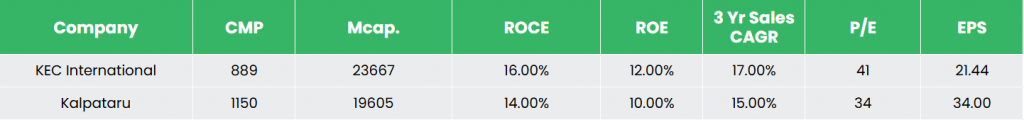

In comparison with its opponents, the corporate is producing secure returns from invested capital backed by a constant improve in gross sales, indicating the administration’s prudent capital allocation methods.

Outlook

The administration has projected a income progress of 15% for FY26, together with an EBITDA margin goal of 8% to eight.5%. Order consumption for FY26 is predicted to be roughly Rs.30,000 crore, with the Transmission & Distribution (T&D) phase contributing round 70%. The corporate continues to prioritize increasing capability inside its current product strains, whereas additionally exploring alternatives in area of interest markets. The order pipeline stays sturdy throughout all key enterprise segments. Going ahead, well timed execution of orders and efficient price optimization shall be important areas to watch.

Valuation

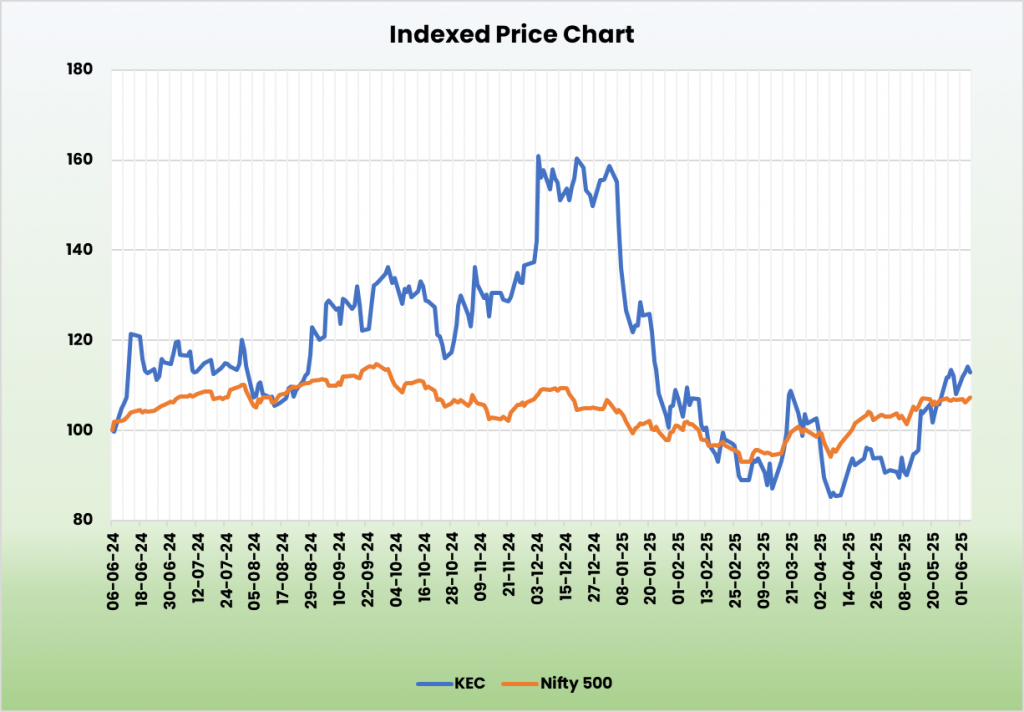

The federal government’s elevated concentrate on transmission and distribution (T&D), coupled with rising energy demand and the corporate’s strategic efforts to develop its cables enterprise, positions the corporate as a powerful and dependable funding alternative. We advocate a BUY ranking within the inventory with the goal value (TP) of Rs.1,051, 31x FY27E EPS.

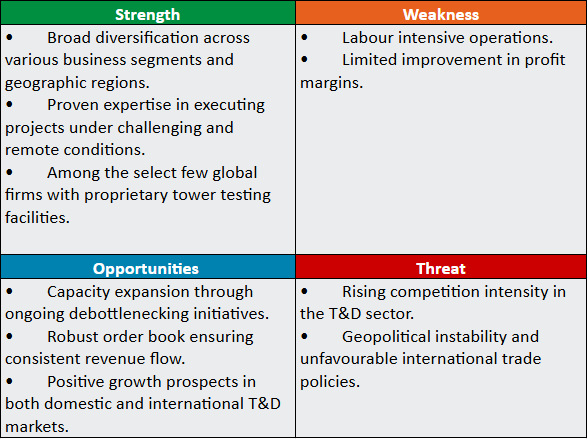

SWOT Evaluation

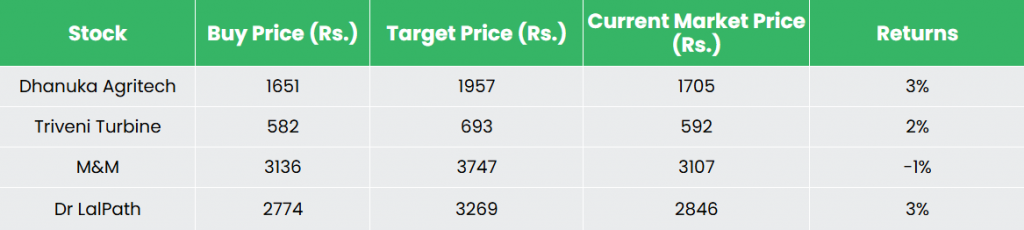

Recap of our earlier suggestions (As on 06 June 2025)

Dhanuka Agritech Ltd

Triveni Turbine Ltd

Mahindra & Mahindra Ltd

Dr Lal Pathlabs Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please word that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM by no means assure the efficiency of the middleman or present any assurance of returns to buyers.

For extra particulars, please learn the disclaimer.

Different articles chances are you’ll like

Submit Views:

27