Picture supply: Getty Photos

A gradual easing of rates of interest has pushed Lloyds (LSE:LLOY) shares sharply increased during the last 12 months.

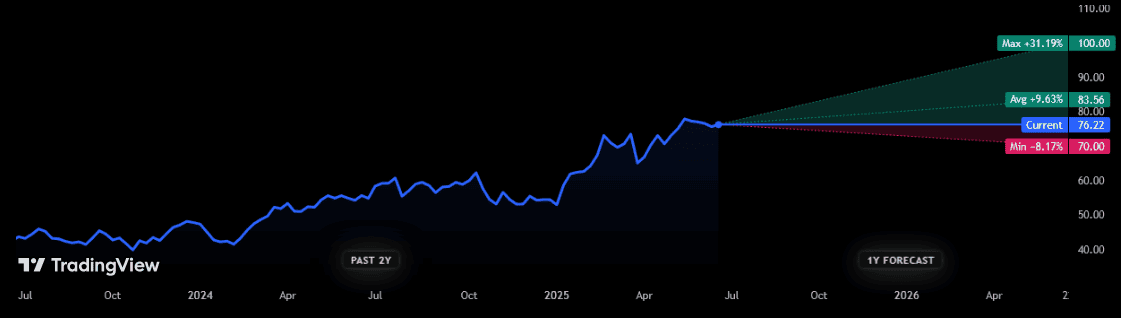

At 76.2p per share, the FTSE 100 financial institution has risen a formidable 36% in worth. Traders have piled in on hopes that looser Financial institution of England (BoE) financial coverage will stimulate the UK economic system, which is crucial for Lloyds given its restricted abroad publicity.

Hopes of sustained rate of interest reductions have additionally fed hypothesis of a powerful housing market restoration, one other key section for the Black Horse financial institution.

Value forecasts

Whereas Lloyds’ share value features have been spectacular, Metropolis analysts consider the financial institution’s bull run has extra gas within the tank.

There are at the moment 16 brokers who’ve scores on the financial institution’s shares. And the consensus is that they are going to rise by one other 10% over the approaching 12 months.

It’s crucial to notice, nonetheless, that these analysts aren’t united of their bullishness for Lloyds shares. Whereas one believes the Footsie agency will rise to 100p, one other thinks it may reverse again to 70p.

Dividend estimates

Largely talking although, issues are wanting constructive from the Sq. Mile’s standpoint. Equally, forecasters are broadly optimistic that dividends will proceed rising over the brief time period, predicting:

- A complete dividend of 34.4p per share in 2025, up 9% 12 months on 12 months.

- An annual payout of 41p subsequent 12 months, up 19%.

Based mostly on these forecasts, the financial institution carries wholesome yields of 4.5% and 5.4% for 2025 and 2026, respectively. Each figures comfortably beat the FTSE 100 common of three.4%.

What’s extra, predicted progress over the interval surpasses the 1.5% to 2% enhance that’s tipped for the broader blue-chip complicated.

I’m not shocked by the Metropolis’s confidence given Lloyds’ steadiness sheet at present. As of March, its widespread fairness tier (CET) 1 ratio was 13.5%. That’s half a proportion level forward of the financial institution’s goal, and comfortably beats the regulatory requirement of 12%.

Underlining its monetary power, in February Lloyds introduced a £1.7bn share buyback programme for the present 12 months.

Is Lloyds a purchase?

Whereas Metropolis analysts are bullish on the corporate over the close to time period, I’m not satisfied in regards to the firm’s prospects. My view is that its share value features are overextended given broader business situations, leaving it weak to a doable correction.

As I say, the rate of interest cuts which have blown Lloyds’ shares increased might preserve boosting revenues and decreasing impairments. Nonetheless, such BoE motion additionally threatens to tug internet curiosity margins (which have been already skinny at 3.03% in quarter one) even decrease.

In addition to, the UK economic system might proceed struggling no matter central financial institution motion, reflecting broader macroeconomic elements (like commerce tariffs), authorities insurance policies and long-running structural issues.

Lloyds faces different issues as nicely, like mounting competitors from challenger banks, and the potential for billions of kilos in misconduct fines. The Supreme Courtroom will rule whether or not the corporate mis-sold automobile finance a while in July.

I believe demand for its dwelling loans may stay sturdy as rates of interest fall. And its distinctive model energy may assist it successfully restrict the influence of aggressive threats. However on steadiness, I believe it is a UK share traders ought to take into account avoiding.