Lockheed Martin Company (NYSE: LMT) on Tuesday reported a pointy fall in earnings for the second quarter of fiscal 2025, damage by pre-tax losses on applications and different prices. The aerospace firm additionally reaffirmed its FY25 gross sales steerage.

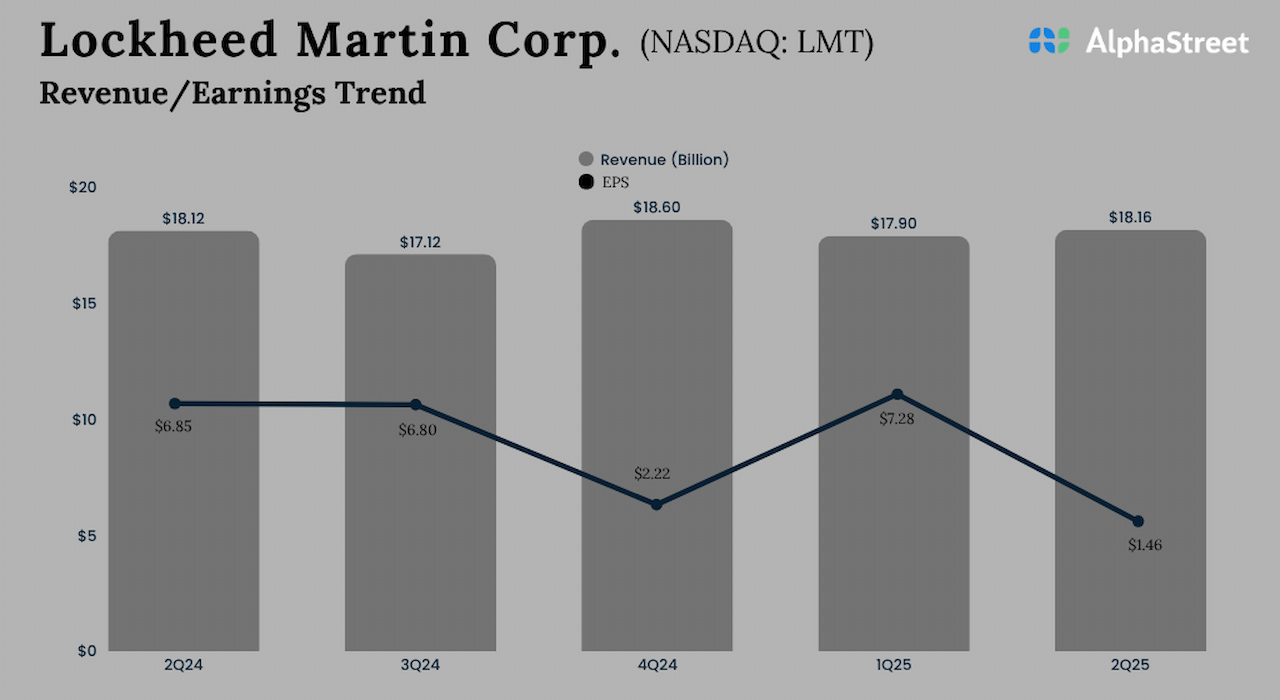

The corporate reported internet gross sales of $18.16 billion for the June quarter, which is broadly unchanged from the $18.12 billion gross sales it generated within the year-ago quarter. It returned $1.3 billion of money to shareholders by way of dividends and share repurchases.

Internet earnings declined sharply to $342 million or $1.46 per share within the second quarter from $1.64 billion or $6.85 per share within the corresponding quarter of 2024, impacted by pre-tax losses on applications and different prices.

The administration reaffirmed its fiscal 2025 gross sales steerage within the vary of $73.75 billion to $74.75 billion. It continues to count on full-year free money move to be between $6.60 billion and $6.68 billion.

“Over the course of the previous few months, Lockheed Martin programs and platforms as soon as once more proved extremely efficient in fight operations and in deterring additional aggression. Our F-35s, F-22s, PAC-3, THAAD, Aegis, and plenty of others, crewed by the troopers, airmen, sailors, marines, and guardians of the U.S. and its Allies, and supported by our personal devoted teammates, carried out extraordinarily nicely in essentially the most essential and difficult conditions,” mentioned Lockheed Martin’s CEO Jim Taiclet.