Abstract:

- The S&P Survey reveals that monetary literacy varies broadly throughout international locations, with solely 33% of adults worldwide understanding primary monetary ideas, and important gaps current by gender, revenue, age, and training, significantly in India the place simply 24% are financially literate.

High 10 With Highest Monetary Literacy

| SL | Nation/Economic system | % Adults Who Are Financially Literate |

|---|---|---|

| 1 | Denmark | 71% |

| 2 | Norway | 71% |

| 3 | Sweden | 71% |

| 4 | Canada | 68% |

| 5 | Israel | 68% |

| 6 | United Kingdom | 67% |

| 7 | Germany | 66% |

| 8 | Netherlands | 66% |

| 9 | Australia | 64% |

| 10 | Finland | 63% |

1. What’s Monetary Literacy and Why It’s Necessary?

Folks with higher perceive of the fundamental monetary ideas may be stated to be financially literate. Monetary literacy provides one the flexibility to make higher choices on cash associated thigs like saving, investing, borrowing, and so forth.

In right this moment’s world why monetary literacy has turn into vital for folks? It’s as a result of advanced monetary merchandise like bonds, shares, mutual funds, REITs, ETFs, and so forth have turn into very accessible to frequent folks. Now, nearly anybody with a sensible cellphone, checking account, and a buying and selling account can entry these merchandise.

Furthermore, the governments internationally additionally desires folks to make use of monetary companies that is performed with a broader objective of economic inclusion. In consequence, increasingly folks lately have financial institution accounts and credit score associated merchandise (like loans, bank cards, and so forth). It is just logical to anticipate that individuals who use these merchandise ought to have the talent to raised perceive and use these monetary companies.

These, nearly all governments desires folks to take management of their very own retirement, i.e. to have monetary safety after they retire from their job or enterprise. Authorities and employers don’t need to maintain the burden of supporting folks after retirement. For that, such pension associated merchandise are designed the place the choice making is extra within the fingers of the folks. Therefore, folks should be financially literate to deal with such retirement associated monetary merchandise.

People who find themselves financially savvy are likely to turn into higher buyers of cash. They have a tendency to select their investments higher and likewise have a tendency of unfold cash correctly to diversify the danger of loss.

2. Why Monetary Ignorance Should Be Averted

There are large prices related to monetary ignorance.

For instance, individuals who don’t perceive the idea of compounding returns (curiosity) are typically extra debt dependent and lean a riskier life. In consequence their credit score scores turn into unhealthy they usually need to pay extra curiosity on their loans. It creates a vicious spiral for which might lure them underneath debt for an extended time horizons. These are identical people who find themselves saving much less cash from their revenue.

3. About Monetary Literacy Survey

3.1 Survey Fundamentals

There was this survey performed by S&P known as “S&P World FinLit Survey” throughout the international locations of the world. On this survey, they collected knowledge on monetary literacy.

Within the 12 months 2014 greater than 1.5 Lakhs folks had been interviews to evaluate their monetary literacy ranges. The folks (randomly chosen adults) had been representatives of greater than 140 international locations.

To evaluate and measure the monetary literacy of those folks query had been requested to them by the analysis workforce being face-to-face. These questions had been rigorously picked to entry the fundamental monetary data of the folks.

The questions had been associated to 4 elementary ideas which assists folks in monetary choice making.

- Data of Curiosity Charges

- Perceive of curiosity compounding

- Consciousness about inflation, and

- Understanding of the idea of threat diversification.

“Primarily based on this survey, it was discovered that on the common world stage, solely 33.33% (one third) adults are financially literate.”

What does it imply? Because the survey says and I quote, “Not solely monetary illiteracy widespread, however there are massive variations amongst international locations and teams.”

3.2 Who Have been Extra Financially Literate

What are the variations? For instance, ladies, the poor, and decrease training are much less financially conscious, or we will say they are typically extra illiterate. This development is frequent for developed and creating economies, these three units of individuals are typically extra financially illiterate.

3.3 Impact of Financial institution Account & Credit score

This development was additionally frequent, individuals who had financial institution accounts and had been utilizing some credit score devices like mortgage or bank cards had been financially extra literate. It’s doable due to their publicity to those merchandise that they’ve constructed this understanding. Regardless of no matter was their revenue stage, folks utilizing these two monetary merchandise had been financially extra sound.

Even poor folks, who has financial institution accounts had been financially extra literate. Financial institution accounts give these folks the entry to credit score. This publicity made them higher in monetary literacy as in comparison with poor individuals who had no financial institution accounts.

On this survey, this perceive was clear that use of credit score gave folks extra monetary consciousness. Wealthy or poor individuals who use credit score (mortgage, bank cards, and so forth) have significantly better monetary literacy.

This survey additionally factors at two vital common observations. First, rising financially literacy will result in sooner monetary inclusion. Second, when folks begin utilizing monetary merchandise like financial institution accounts or bank cards, their monetary abilities begins to develop.

3.4 Use of The Survey

It provides us an concept concerning the unfold of economic literacy throughout the globe. This survey factors within the course the place monetary literacy is excessive and the place it’s missing.

As a monetary blogger, this sort of knowledge set is beneficial for me to tune my contents in a course the place it’s extra wanted.

4. What Query Have been Requested Within the Monetary Literacy Survey?

4 Kinds of Questions had been requested within the survey:

| Idea: Danger Diversification Q1: Suppose you might have some cash. Is it safer to place your cash into one enterprise or funding, or to place your cash into a number of enterprise or investments? Solutions: One Enterprise or InvestmentsA number of Companies or InvestmentsDon’t KnowRefused to reply | Idea: Inflation Q2: Suppose over the following 10 years the costs of stuff you purchase double. For those who revenue additionally doubles, will you be capable to purchase lower than you should buy right this moment, the identical you should buy right this moment, or greater than you should buy right this moment? Solutions: Much lessThe IdenticalDon’t KnowRefused to reply |

| Idea: Curiosity Charge Q3: Suppose it’s essential borrow 100 US {dollars}. Which is the decrease quantity to pay again: 105 US {dollars}, or 100 US {dollars} plus three p.c? Solutions: 105 US greenback100 USD plus 3 p.cDon’t KnowRefused to reply | Idea: Compound Curiosity This fall: Suppose you place cash within the financial institution for 2 years and the financial institution agrees so as to add 15% per 12 months to your account. Will the financial institution add extra money to your account the second 12 months than it did the primary 12 months, or will it add the identical amount of cash each years? Solutions: ExtraThe SameDon’t KnowRefused to reply |

| Idea: Compound Curiosity Q5: Suppose you had 100 US {dollars} in a financial savings account and the financial institution provides 10% per 12 months to the account. How a lot cash would you might have within the account after 5 years in the event you didn’t take away any cash from the account? Solutions: Greater than 150 {dollars}Precisely 150 dollarsLess than 150 dollarsDon’t KnowRefused to reply |

Within the survey, the rule was that, an individual can be categorized as financially literate if she or he can reply the questions on a minimum of three ideas as above. The survey clarifies that this standards to evaluate the monetary literacy stage of individuals is honest. They embrace the fundamental idea essential to take moderately sturdy monetary choices for oneself and the household.

5. Inference of the Survey

As per this standards and the scope of the survey, solely about 33.33% of individuals on this planet may be known as as financially literate.

What does this knowledge translate into? The full inhabitants of this world is about 8 billion folks. Out of those about 75% persons are above the age of 15 (adults). It means, there are about 6 billion grownup folks on this world. Amongst these 6 billion folks, solely about 2 billion are financially literate.

We should additionally be aware that, within the creating and underdeveloped nations, the share adults who’re financially literate are a lot decrease (like India has solely 24% financially literate adults).

5.1 International locations With Highest Monetary Literacy

There are solely 8 international locations whose monetary literacy quantity was greater than 65%. These had been Denmark, Norway, Sweden, Canada, Israel, UK, Germany, and Netherlands.

United States is among the many high 15 international locations with about 57% adults as financially literate.

Downunder, Australia and New Zealand are among the many most financially literate adults with survey giving them 64% and 61% literacy numbers.

Now, I’ll inform you 5 names which have shocked me probably the most:

- Bhutan (54%), Myanmar (52%): That is among the many high 20 record of nations with greater than half of their adults being financially literate. Each these international locations are India’s neighbour and are thought of too small in comparison with us. Bhutan in lots of manner are a part of India solely, however see how properly they’ve performed when it comes to monetary literacy. Myanmar can be a rustic the place the one information we hear about it’s civil struggle. However I believe, inside the fact is best for their very own folks.

- African International locations: Many of the African international locations, whom some may wouldn’t like to match with India, are financially extra literate than us. Botswana at 52% is among the many high 25 international locations. South Africa (42%) and Zimbabwe (41%) have monetary literacy a lot greater than the world’s common.

- India, China, Pakistan: Amongst these international locations, who do you suppose has the next monetary literacy rating? China is 28%, Pakistan is 26%, and India is 24%.

5.2 Monetary Literacy in Europe

On a median, the place the world common is 33.33%, monetary literacy quantity for adults in Europe is about 52%. Withing the Europe as properly, there may be massive disparity between economies.

Norther Europe tends to have significantly better monetary literacy. International locations like Finland, Sweden, Norway, Denmark, United Kingdom, Germany, Netherlands have the best monetary literacy on this planet. On a median, greater than 65% of adults on this area are financially literate.

Remainder of Europe is inferior to northers Europe. In international locations like Greece and Spain, their monetary literacy is 45% and 49% respectively. I used to be anticipating France to be within the Ligue of Germany, but it surely has a literacy variety of 52%. Italy is far decrease at 37% which is decrease than Poland’s 42% however greater than Portugal’s 26%. The international locations that shocked me had been Estonia with 54% and Latvia with 48% monetary literacy numbers. Eire was additionally excellent at 55% ranges.

International locations That Joint EU Since 2004: Most of those international locations have a relatively decrease monetary literacy ranges. For instance, Bulgaria and Cyprus’s has solely 35% adults as financially literate. In Romania, solely 22% was literate.

6. GDP Per Capita And Monetary Literacy

There may be additionally a relationship between GDP per capita and monetary literacy charges throughout international locations.

- Monetary literacy charges are typically greater in richer international locations, as measured by GDP per capita.

- This relationship holds true primarily for the richest 50% of economies, the place 38% of the variation in monetary literacy charges may be defined by variations in revenue throughout international locations.

- For the poorer half of economies (with a GDP per capita of $12,000 or much less), there is no such thing as a clear affiliation between revenue and monetary literacy.

- The report means that in poorer economies, authorities insurance policies relaed to training and so forth are possible play a extra important position in shaping monetary literacy than revenue of individuals.

7. The Understanding of The Monetary Ideas

- Globally, inflation and numeracy (rate of interest calculations) are probably the most understood ideas, with 50% of adults worldwide answering these accurately.

- Danger diversification is the least understood idea globally, with solely 35% of adults answering accurately.

- There are important disparities in understanding threat diversification between main superior economies (64% appropriate) and main rising economies (28% appropriate), a distinction of 36 proportion factors.

- Disparities for the opposite ideas are smaller: a 15-percentage-point distinction for inflation and a 10-percentage-point distinction for compound curiosity between main superior and rising economies.

8. Monetary Literacy Amongst Girls and Poor

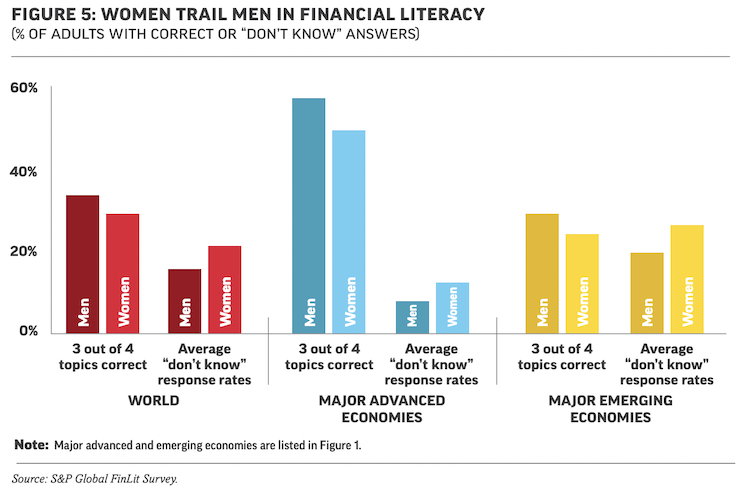

The survey highlights a transparent hole in monetary literacy between women and men. Globally, 35% of males are financially literate, whereas solely 30% of ladies obtain the identical stage. This 5-percentage-point distinction is constant throughout each superior and rising economies, displaying that ladies typically wrestle extra with monetary ideas. What’s extra, ladies usually tend to say “I don’t know” when requested monetary literacy questions, a development seen in different research too.

This gender hole doesn’t change a lot even if you account for components like age, training, or revenue. In rising economies, the hole stays at 5 proportion factors, although it disappears in locations like China and South Africa, the place each women and men have equally low monetary literacy. Determine 5 within the report reveals this clearly, males persistently rating greater on answering 3 out of 4 monetary subjects accurately, whereas ladies have greater “don’t know” response charges, particularly in superior economies.

Revenue additionally performs a giant position, particularly within the BRICS international locations (Brazil, Russia, India, China, South Africa). Right here, 31% of the wealthy are financially literate, in comparison with simply 23% of the poor, an 8-percentage-point hole. This reveals that monetary literacy isn’t only a gender subject, it’s tied to wealth too. The info means that each ladies and poorer communities want extra focused training to bridge these gaps and enhance their monetary decision-making.

9. Monetary Literacy And Age

The Survey reveals how monetary literacy varies by age throughout completely different economies. Globally, the information reveals a sample the place monetary literacy tends to peak in center age. For the world as an entire, adults aged 36–50 have a literacy fee of round 35%, whereas each the youngest (15–35) and oldest (65+) teams hover round 30%, indicating that middle-aged adults are typically extra financially educated.

In main superior economies like america and Germany, the development is barely completely different. Right here, 56% of younger adults (ages 15–35) are financially literate, which rises to 63% for these aged 36–50. Nonetheless, literacy drops for older adults, with solely about 40% of these over 65 being financially literate. This implies that in richer international locations, the youngest and oldest wrestle probably the most with monetary ideas, presumably as a result of much less publicity or outdated data among the many aged.

In main rising economies like India and Brazil, the image flips. Younger adults aged 15–35 have the best monetary literacy at 32%, whereas the oldest group (65+) has the bottom at simply 17%. This hole reveals that youthful folks in these economies are extra financially conscious, possible as a result of higher entry to training and expertise, whereas older adults might lack the sources or alternatives to study, highlighting a necessity for focused monetary training for seniors.

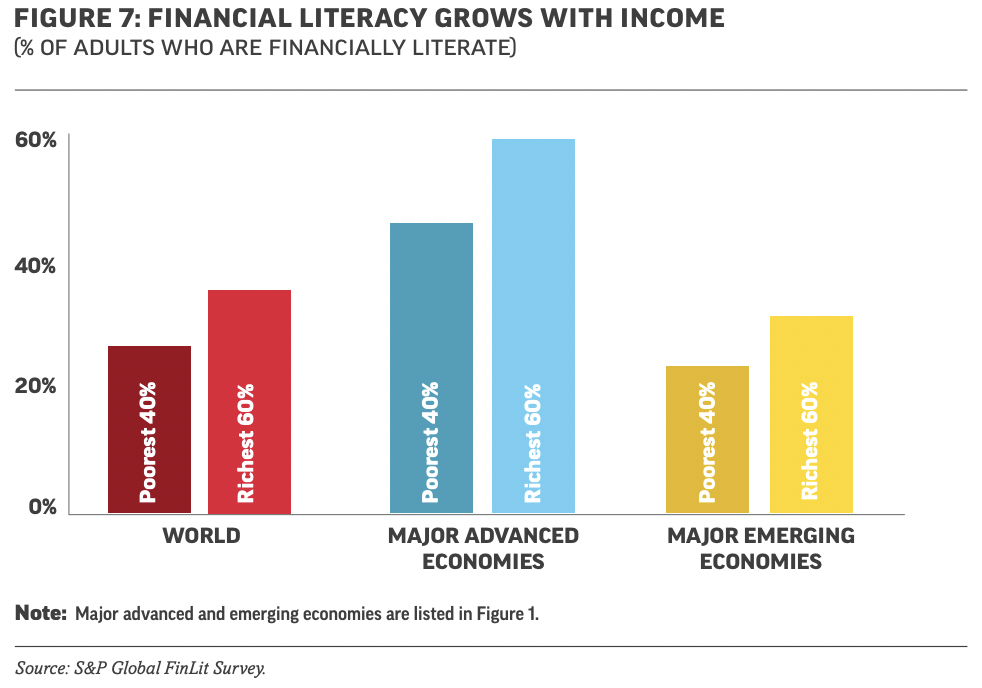

10. Monetary Literacy And Revenue

The survey reveals a transparent hyperlink between revenue and monetary literacy. Globally, richer adults are likely to have higher monetary abilities than poorer ones. In main rising economies like India and Brazil, 31% of adults within the richest 60% of households are financially literate, whereas solely 23% of these within the poorest 40% attain this stage, displaying an 8-percentage-point hole. This distinction highlights how entry to sources and training, typically tied to revenue, impacts monetary data.

In main superior economies comparable to america and Germany, the revenue hole in monetary literacy is comparable however may be even wider in some instances. As an illustration, in Italy, 44% of adults within the richest 60% of households are financially literate, in comparison with simply 27% within the poorest 40%, a stark 17-percentage-point distinction. This implies that wealthier people in superior economies profit from better publicity to monetary techniques and training, widening the literacy hole.

Determine 7 visually confirms this development internationally, main superior economies, and main rising economies. The constant hole underscores the necessity for focused monetary teaching programs for lower-income teams. With out addressing this divide, poorer households might wrestle extra with monetary choices, doubtlessly deepening financial inequality.

11. Monetary Literacy & Training

The survey reveals a robust connection between training and monetary literacy. Globally, there’s a 15-percentage-point hole between adults with completely different training ranges. In main superior economies just like the U.S. and Germany, 52% of adults with secondary training (9–15 years of education) are financially literate, however this drops to 31% for these with solely major training (as much as 8 years). For these with tertiary training (15+ years), the speed jumps to 73%, highlighting how extra training, particularly in math, helps folks perceive monetary ideas higher.

The report additionally hyperlinks math abilities to monetary literacy, utilizing the 2012 OECD PISA math check scores for 15-year-olds. International locations the place college students scored greater in math are likely to have greater monetary literacy charges. Determine 8 reveals a transparent development: as PISA math scores rise from 350 to 650, monetary literacy charges improve from round 20% to 60%. This implies {that a} sturdy basis in math, typically gained by way of training, equips folks to deal with monetary choices like budgeting or investing extra successfully.

Nonetheless, there are outliers like South Korea, China, Portugal, and Vietnam, the place excessive math scores don’t totally translate into monetary literacy. In South Korea, 48% of adults aged 35 or youthful are financially literate, in comparison with 27% of these aged 51–65, regardless of sturdy math abilities among the many youth. In Portugal, the hole is comparable, with 38% of youthful adults versus 20% of older ones. This means that whereas math abilities assist, different components like entry to monetary training or real-world expertise additionally play a giant position in constructing monetary literacy.

12. Monetary Literacy & Residence Possession

The survey reveals that owners in main superior economies typically have higher monetary abilities. About 26% of adults in these international locations, just like the U.S. and Japan, have a housing mortgage, and since managing a mortgage includes advanced calculations, they are typically extra financially literate than the common individual. Determine 12 confirms this development, with the next proportion of householders being financially literate in comparison with these with out loans throughout international locations like Canada, France, and Germany.

Nonetheless, there are nonetheless gaps in monetary data amongst owners. In america, practically a 3rd of adults have a housing mortgage, and whereas 70% of them can accurately reply questions on compound curiosity, 30% can not. That is worrying as a result of misunderstanding curiosity can result in debt issues, an element that contributed to the worldwide monetary disaster by way of mortgage defaults. It reveals that even owners, who’re anticipated to be financially savvy, can wrestle with primary ideas.

The problem isn’t restricted to the U.S. In Japan, about 20% of adults have a housing mortgage, however solely half are financially literate, and simply 37% perceive compound curiosity. This hole highlights a broader concern: many owners in superior economies lack the abilities to totally handle their loans. Policymakers have to give attention to bettering monetary training for owners to forestall future monetary troubles.

Desk: Monetary Literacy (% Adults Who Are Financially Literate) by Nation

| SL | Nation/Economic system | % Adults Who Are Financially Literate |

| 1 | Denmark | 71% |

| 2 | Norway | 71% |

| 3 | Sweden | 71% |

| 4 | Canada | 68% |

| 5 | Israel | 68% |

| 6 | United Kingdom | 67% |

| 7 | Germany | 66% |

| 8 | Netherlands | 66% |

| 9 | Australia | 64% |

| 10 | Finland | 63% |

| 11 | New Zealand | 61% |

| 12 | Singapore | 59% |

| 13 | Czech Republic | 58% |

| 14 | Switzerland | 57% |

| 15 | United States | 57% |

| 16 | Belgium | 55% |

| 17 | Eire | 55% |

| 18 | Bhutan | 54% |

| 19 | Estonia | 54% |

| 20 | Hungary | 54% |

| 21 | Austria | 53% |

| 22 | Luxembourg | 53% |

| 23 | Botswana | 52% |

| 24 | France | 52% |

| 25 | Myanmar | 52% |

| 26 | Spain | 49% |

| 27 | Latvia | 48% |

| 28 | Montenegro | 48% |

| 29 | Slovak Republic | 48% |

| 30 | Greece | 45% |

| 31 | Tunisia | 45% |

| 32 | Uruguay | 45% |

| 33 | Croatia | 44% |

| 34 | Kuwait | 44% |

| 35 | Lebanon | 44% |

| 36 | Malta | 44% |

| 37 | Slovenia | 44% |

| 38 | Hong Kong SAR, China | 43% |

| 39 | Japan | 43% |

| 40 | Poland | 42% |

| 41 | South Africa | 42% |

| 42 | Chile | 41% |

| 43 | Mongolia | 41% |

| 44 | Turkmenistan | 41% |

| 45 | Zimbabwe | 41% |

| 46 | Bahrain | 40% |

| 47 | Kazakhstan | 40% |

| 48 | Senegal | 40% |

| 49 | Tanzania | 40% |

| 50 | Ukraine | 40% |

| 51 | Zambia | 40% |

| 52 | Lithuania | 39% |

| 53 | Mauritius | 39% |

| 54 | Belarus | 38% |

| 55 | Cameroon | 38% |

| 56 | Kenya | 38% |

| 57 | Madagascar | 38% |

| 58 | Russian Federation | 38% |

| 59 | Serbia | 38% |

| 60 | Togo | 38% |

| 61 | United Arab Emirates | 38% |

| 62 | Benin | 37% |

| 63 | Italy | 37% |

| 64 | Taiwan, China | 37% |

| 65 | Azerbaijan | 36% |

| 66 | Malaysia | 36% |

| 67 | Brazil | 35% |

| 68 | Bulgaria | 35% |

| 69 | Costa Rica | 35% |

| 70 | Cyprus | 35% |

| 71 | Côte d’Ivoire | 35% |

| 72 | Dominican Republic | 35% |

| 73 | Gabon | 35% |

| 74 | Malawi | 35% |

| 75 | Sri Lanka | 35% |

| 76 | Uganda | 34% |

| 77 | Algeria | 33% |

| 78 | Belize | 33% |

| 79 | Burkina Faso | 33% |

| 80 | Jamaica | 33% |

| 81 | Korea, Rep. | 33% |

| 82 | Mali | 33% |

| 83 | Mauritania | 33% |

| 84 | Colombia | 32% |

| 85 | Congo, Dem. Rep. | 32% |

| 86 | Ethiopia | 32% |

| 87 | Ghana | 32% |

| 88 | Indonesia | 32% |

| 89 | Mexico | 32% |

| 90 | Puerto Rico | 32% |

| 91 | Congo, Rep. | 31% |

| 92 | Niger | 31% |

| 93 | Saudi Arabia | 31% |

| 94 | Ecuador | 30% |

| 95 | Georgia | 30% |

| 96 | Guinea | 30% |

| 97 | Argentina | 28% |

| 98 | China | 28% |

| 99 | Peru | 28% |

| 100 | Bosnia and Herzegovina | 27% |

| 101 | Egypt, Arab Rep. | 27% |

| 102 | Iraq | 27% |

| 103 | Moldova | 27% |

| 104 | Namibia | 27% |

| 105 | Panama | 27% |

| 106 | Thailand | 27% |

| 107 | Chad | 26% |

| 108 | Guatemala | 26% |

| 109 | Nigeria | 26% |

| 110 | Pakistan | 26% |

| 111 | Portugal | 26% |

| 112 | Rwanda | 26% |

| 113 | Philippines | 25% |

| 114 | Venezuela, RB | 25% |

| 115 | West Financial institution and Gaza | 25% |

| 116 | Bolivia | 24% |

| 117 | Burundi | 24% |

| 118 | India | 24% |

| 119 | Jordan | 24% |

| 120 | Turkey | 24% |

| 121 | Vietnam | 24% |

| 122 | Honduras | 23% |

| 123 | Romania | 22% |

| 124 | El Salvador | 21% |

| 125 | Macedonia, FYR | 21% |

| 126 | Sierra Leone | 21% |

| 127 | Sudan | 21% |

| 128 | Uzbekistan | 21% |

| 129 | Iran, Islamic Rep. | 20% |

| 130 | Kosovo | 20% |

| 131 | Nicaragua | 20% |

| 132 | Bangladesh | 19% |

| 133 | Kyrgyz Republic | 19% |

| 134 | Armenia | 18% |

| 135 | Cambodia | 18% |

| 136 | Haiti | 18% |

| 137 | Nepal | 18% |

| 138 | Tajikistan | 17% |

| 139 | Angola | 15% |

| 140 | Somalia | 15% |

| 141 | Afghanistan | 14% |

| 142 | Albania | 14% |

| 143 | Yemen, Rep. | 13% |

| A | South Asian International locations (Common) | 0–24% (as per web page 8, “South Asia… solely 1 / 4 or fewer”) |

| B | Southern Europe (Common) | 25–54% (as per web page 8, e.g., Greece 45%, Spain 49%) |

| C | EU International locations (Joined since 2004, Common) | 22–58% (as per web page 8, e.g., Romania 22%, Czech Republic 58%) |

Entry Monetary Literacy Knowledge of just about all international locations of the world

Supply: SP& World FinLit Survey

![Monetary Literacy Knowledge By Nation [S&P Survey] — Our Wealth Insights Monetary Literacy Knowledge By Nation [S&P Survey] — Our Wealth Insights](https://i3.wp.com/ourwealthinsights.com/wp-content/uploads/2025/04/Financial-Literacy-Across-Countries-Survey-Report-GDP-Per-Capita.png?w=860&resize=860,0&ssl=1)