Index funds have turn into a preferred selection amongst traders in search of broad market publicity with low prices. Among the many most important indices in India, the Nifty 50 and Nifty Subsequent 50 supply completely different risk-return profiles. Allow us to discover some facets of the Nifty 50 and Nifty Subsequent 50 Index Funds within the following method:

Understanding Nifty 50 and Nifty 50 Index Funds

Nifty 50 Index funds are mutual funds that passively put money into shares constituting the Nifty 50 Index. The Nifty 50 Index is India’s premier inventory market index, comprising the 50 largest and most liquid corporations listed on the Nationwide Inventory Alternate (NSE). The index serves as a benchmark for large-cap shares and represents roughly 54% of the entire market capitalisation of the NSE.

The fund supervisor tries to copy the index’s efficiency by holding shares in the identical proportion as within the Nifty 50. These funds are categorized as Giant-Cap Index Funds, as per SEBI’s mutual fund categorisation.

Options of Nifty 50 Index Funds

1. Market Management

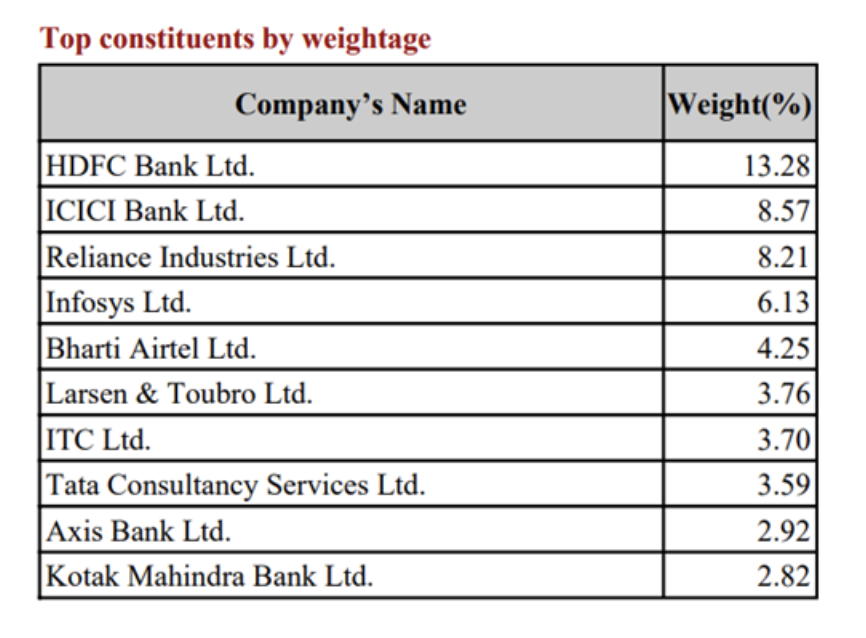

The sectoral distribution of Nifty 50 has main share of Monetary Companies (36.53%), Info Know-how (13.15%), Oil, Gasoline and Consumable Fuels (10.40%), amongst numerous others. The index contains numerous trade leaders that are recognized for his or her stability and powerful monetary efficiency.

Supply: Supply: NSE Indices, Factsheet.

2. Decrease Volatility

For the reason that Nifty 50 includes established blue-chip corporations, it’s much less unstable in comparison with mid-cap and small-cap indices.

3. Regular Progress

Traditionally, Nifty 50 has supplied constant, inflation-beating returns, making it appropriate for long-term wealth creation.

4. Defensive in Downturns

Throughout market corrections, large-cap shares have a tendency to say no much less in comparison with mid- and small-cap shares, offering a cushion towards extreme losses.

5. Excessive Liquidity

The shares on this index have excessive buying and selling volumes, making index funds based mostly on Nifty 50 extremely liquid.

Understanding Nifty Subsequent 50 and Nifty Subsequent 50 Index Funds

The Nifty Subsequent 50 Index Funds monitor Nifty Subsequent 50 Index which represents the following 50 largest corporations by market capitalisation after these included within the Nifty 50. As per NSE Indices, Nifty Subsequent 50 is computed utilizing Free Float Market Capitalisation weighted technique, whereby the extent of index displays the free float market capitalisation of all shares in Index.

This index is commonly thought of a gateway to future large-cap shares, as a lot of its constituents finally graduate to the Nifty 50.

Options of Nifty Subsequent 50 Index Funds

1. Progress Potential

Shares on this index are on their solution to turning into large-cap leaders, providing larger development potential in comparison with Nifty 50.

2. Larger Volatility

Since these corporations are nonetheless rising, their inventory costs are usually extra unstable than these within the Nifty 50.

3. Sectoral Diversification

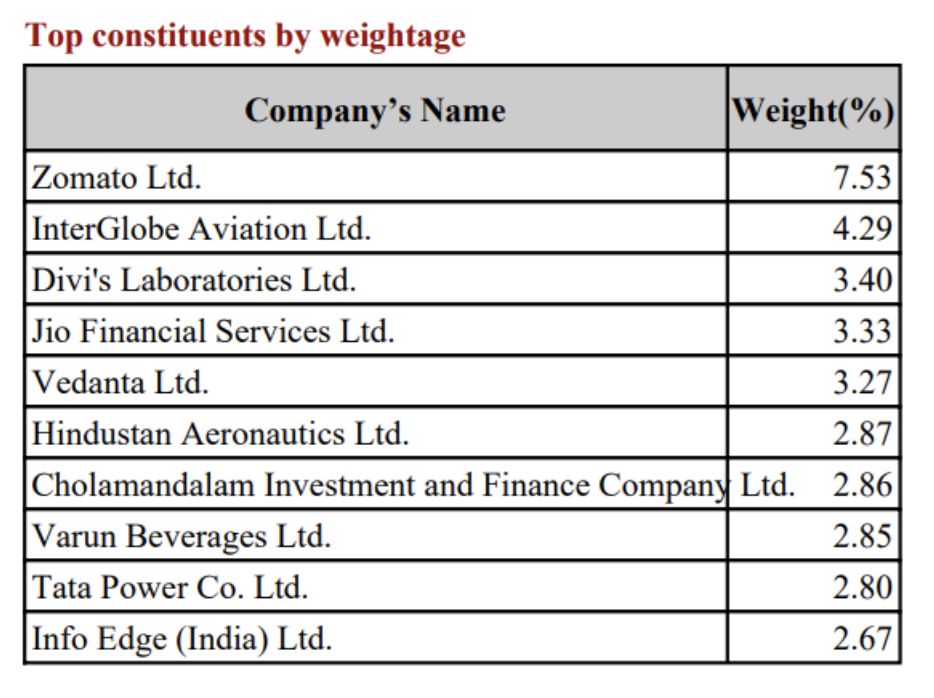

The index supplies publicity to rising leaders throughout numerous sectors, the place in monetary companies accounts for 23.76% distribution adopted by the patron companies with 12.92% distribution and Energy sector being third main element with the distribution of 9.78%. Varied different sectors such because the fast paced shopper durables, capital items, healthcare, oil gasoline and consumable fuels and many others. additionally contribution distinctively to the sectoral diversification. The highest corporations within the NIFTY Subsequent 50 listing are as follows:

Supply: NSE Indices, Factsheet.

4. Larger Returns Over Time

Traditionally, the Nifty Subsequent 50 has outperformed the Nifty 50 over longer intervals. The diversified profile of this class has potential of upper return with elevated volatility.

5. Potential for Upgradation

Many Nifty Subsequent 50 shares finally enter the Nifty 50, permitting traders to learn from corporations transitioning into blue-chip standing. During the last 20 years roughly greater than 40 shares from the Nifty Subsequent 50 have been promoted to the Nifty 50.

Understanding the Efficiency of Nifty 50 and Nifty Subsequent 50 Index Funds

| Sr. No. | Nifty 50 Index Fund Schemes | Return | Expense Ratio | |

| 1 12 months | 3 12 months | TER | ||

| 1 | IDBI Nifty 50 Index Progress Direct Plan | 16.84% | 21.06% | 0.32% |

| 2 | Navi Nifty 50 Index Progress Direct Plan | 7.14% | 11.99% | 0.06% |

| 3 | DSP Nifty 50 Index Progress Direct Plan | 7.13% | 11.96% | 0.18% |

| 4 | Axis Nifty 50 Index Progress Direct Plan | 7.13% | 12.02% | 0.12% |

| 5 | UTI Nifty 50 Index Progress Direct Plan | 7.13% | 11.97% | 0.17% |

| Sr. No. | Nifty 50 Index Fund Schemes | Return | Expense Ratio | |

| 1 12 months | 3 12 months | TER | ||

| 1 | Kotak Nifty Subsequent 50 Index Progress Direct Plan | 7.16% | 16.41% | 0.11% |

| 2 | Edelweiss Nifty Subsequent 50 Index Progress Direct Plan | 7.12% | NA | 0.09% |

| 3 | UTI Nifty Subsequent 50 Index Progress Direct Plan | 7.12% | 16.21% | 0.35% |

| 4 | SBI Nifty Subsequent 50 Index Progress Direct Plan | 7.07% | 16.19% | 0.35% |

| 5 | Axis Nifty Subsequent 50 Index Progress Direct Plan | 7% | 16.18% | 0.15% |

Supply: Kuvera, March 23, 2025.

1. Efficiency Divergence

Nifty Subsequent 50 Index Funds present superior long-term returns, making them extra engaging for traders with the next danger urge for food. Nevertheless, their short-term efficiency stays average. For example, IDBI Nifty 50 Index Fund has considerably outperformed different Nifty 50 funds in each 1-year (16.84%) and 3-year (21.06%) returns.

2. Expense Ratio Variation

Nifty Subsequent 50 Index Funds usually have larger expense ratios resulting from elevated volatility, with UTI and SBI charging 0.35%. Navi Nifty 50 Index Fund has the bottom expense ratio at 0.06%, making it probably the most cost-effective choice.

3. Danger-Return Commerce-Off

Nifty 50 Index Funds supply stability and decrease danger, making them appropriate for conservative traders. Nevertheless, Nifty Subsequent 50 Index Funds present larger returns however larger danger, making them extra appropriate for aggressive traders searching for long-term capital appreciation. For example, UTI and Axis Nifty Subsequent 50 Index Funds have proven constant long-term efficiency.

Specialists’ Views on Nifty 50 and Nifty Subsequent 50

Dev Ashish, a SEBI Registered Funding Advisor and Founding father of StableInvestor, means that combining Nifty 50 and Nifty Subsequent 50 can successfully cowl large-cap allocations. He advocates for a mix of passive investments in these indices alongside energetic funds concentrating on mid- and small-cap segments to attain a well-diversified, risk-optimized portfolio. (Moneycontrol)

Which Index Fund is Appropriate for You?

Choosing the best index fund will depend on your danger urge for food, funding horizon, and monetary objectives. Nifty 50 Index Funds are perfect for stability and regular compounding, making them appropriate for retirees and risk-averse traders. Nifty Subsequent 50 Index Funds supply larger development potential however with larger danger, making them extra acceptable for long-term, aggressive traders. A 70:30 mixture of Nifty 50 and Nifty Subsequent 50 may help steadiness danger and reward successfully.

Wrapping Up

Each Nifty 50 and Nifty Subsequent 50 Index Funds supply distinct benefits based mostly on an investor’s monetary aims. Nifty 50 is a dependable, lower-risk funding for steady long-term development, whereas Nifty Subsequent 50 supplies larger return potential at the price of elevated volatility. Specialists view a balanced portfolio incorporating each indices can present optimum development and danger administration.

Understanding these variations and aligning them with funding objectives is essential for monetary planning. As an investor, you need to seek the advice of with a monetary advisor to tailor your funding technique based mostly in your danger tolerance and monetary aspirations.

Concerned with how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Is UPI Killing the Toffee Enterprise?