Picture supply: Getty Photos

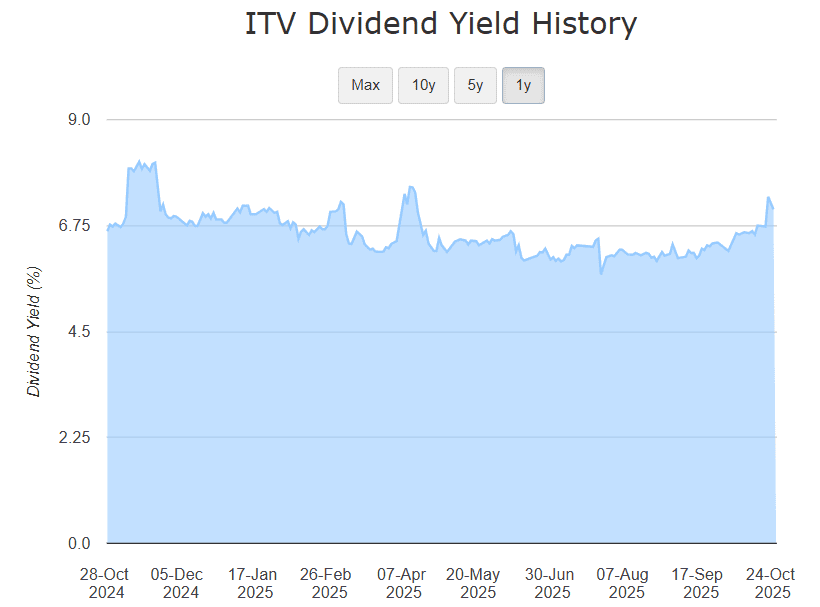

ITV (LSE: ITV) misplaced a little bit of its shine earlier this yr when its dividend yield fell under 6%. However because the share value has slipped virtually 13% previously six months, the yield has slowly climbed again above 7%.

That would current a possibility for traders to scoop up some shares whereas low-cost and goal to spice up their dividend revenue.

However what number of shares could be wanted? Properly, for the previous three years, ITV’s paid out a full-year dividend of 5p per share. It hasn’t but declared its remaining dividend for 2025 but it surely seems more likely to stay the identical.

Which means 100,000 shares would usher in £5,000 price of dividends a yr.

With the shares now altering arms at round 70p every, that might require a hefty £70,000 funding. No small quantity — however achievable with common contributions compounded over a number of years.

How would that look? Let’s see.

Calculating returns

Say, as an example, an investor buys 500 shares a month for £350. In simply over 10 years, by reinvesting the dividends, the pot would have grown to £70,000 (assuming the 7% yield held).

Within the funding world, that’s not a very long time to dedicate in direction of constructing a good passive revenue stream.

However is ITV the very best dividend inventory to decide on at this time? Let’s contemplate the professionals and cons of investing on this well-known British broadcasting firm.

Altering tides

ITV’s engaged on a brand new technique dubbed ‘Extra Than TV’ to diversify and develop past conventional broadcasting. Whereas there are some encouraging indicators, the enterprise stays uncovered to promoting cyclicality, regulatory shifts and margin pressures.

In its first-half outcomes to 30 June, it confirmed complete income of £1,848m. Promoting income dipped 7% to £824m whereas digital income rose 9% to £271m. That is indicative of the continued shift in media consumption tendencies.

It additionally introduced further cost-cutting measures to the tune of about £15m on high of current financial savings, and trimmed its content material spend to £1.23bn to higher replicate shifting viewer patterns.

What does this imply for potential traders? From a monetary standpoint, ITV nonetheless has some strengths. Its manufacturing arm, ITV Studios, noticed UK income progress of seven% to £420m in H1, for instance.

With streaming hours up and digital advert income rising, the technique to maneuver away from broadcasting and shift to digital is promising. Nevertheless, revenue earlier than tax for the interval fell markedly, revealing the challenges of this new enterprise mannequin.

With the dearth of a serious soccer event, promoting income took successful this yr. This was compounded by new UK laws limiting the promoting of less-healthy meals. These are simply two examples of the continued regulatory and cyclicality dangers the broadcaster faces.

Ultimate ideas

As conventional broadcasting continues to slide, future income rely fairly closely on the success of ITV Studios and its digital choices.

With restricted progress potential, the 7% dividend yield is the important thing attraction right here. However I wouldn’t depend on it alone. ITV may make an incredible addition to an revenue portfolio, however ought to solely be thought-about as a part of a extremely diversified number of shares.

Luckily, the FTSE 100 and FTSE 250 are chock-a-block with dependable, high-yielding dividend shares to select from.