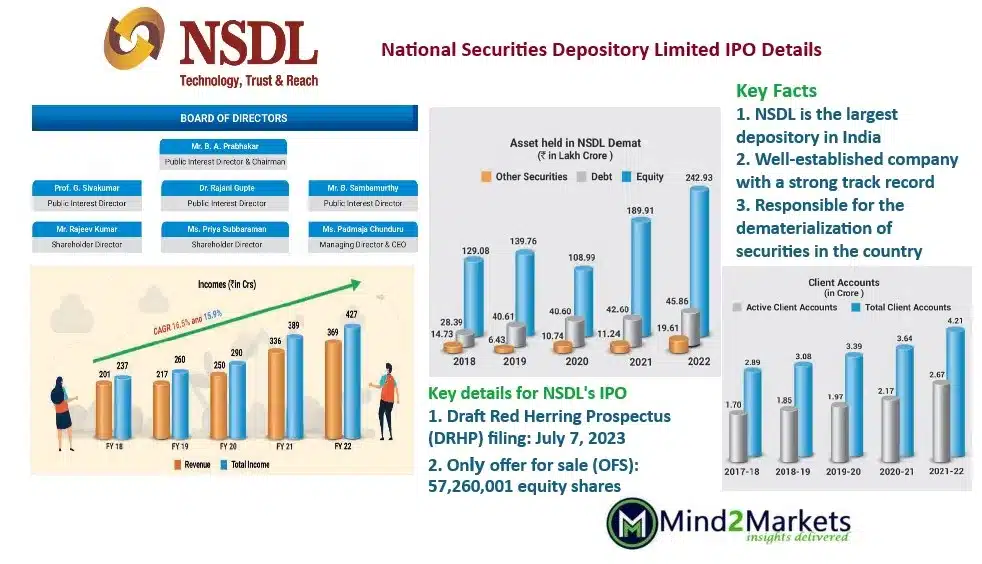

NSDL IPO particulars – Key Info

- NSDL is the biggest depository in India and is chargeable for the dematerialization of securities within the nation.

- Draft Pink Herring Prospectus (DRHP) submitting: July 7, 2023

- IPO opening: August 4, 2023 (tentative date)

- IPO consists of – OFS of 57.26 million shares

- Properly-established firm with a robust monitor report.

- Duopoly enterprise – One of many two gamers in India on this enterprise.

- Sturdy development potential for this enterprise in India and competitors is low.

- Ought to I put money into the NSDL IPO in the course of the IPO course of?

NSDL IPO Evaluation – Nationwide Securities Depository Restricted (NSDL) filed DRHP on 7th July 2023 to drift its Preliminary public providing. In response to DRHP, NSDL IPO consists of a suggestion for the sale of 57,260,001 Fairness Shares. There is no such thing as a contemporary subject on this providing. Promoter banks akin to HDFC financial institution, IDBI financial institution, State Financial institution of India, Union Financial institution of India, Specified Endeavor of the Unit Belief of India (SUUTI), and Nationwide Inventory Trade are promoting their stakes on this providing.

The web proceeds from NSDL IPO is not going to come to the corporate as it’s a full OFS. The promoter group entities will obtain the web proceeds from this IPO. Now the large query is – Ought to I put money into the NSDL IPO? Allow us to discover out particulars concerning the firm and why you must contemplate investing on this firm in beneath NSDL IPO particulars part.

What does NSDL do?

Nationwide Securities Depository Restricted (NSDL) is the biggest depository in India. The corporate was based in 1996. NSDL is chargeable for the dematerialization of securities within the nation.

A safety depository is a monetary establishment that facilitates the holding and buying and selling of securities akin to shares, bonds, and mutual funds in an digital or dematerialized type. Each time you might be buying any of those monetary devices akin to shares or bonds by your DP (Demat account), these are recorded in an digital format with NSDL or CDSL. These two establishments are chargeable for the safekeeping, switch, and settlement of securities.

Duopoly enterprise: Two gamers in India – CDSL and NSDL

- Nationwide Securities Depositories Ltd (NSDL) and Central Securities Depositories Ltd (CDSL) each are depositories, accountable to carry your securities safely in dematerialized type and facilitate buying and selling in inventory exchanges.

- There is no such thing as a vital distinction between CDSL and NSDL.

- Each are regulated by SEBI and supply comparable buying and selling and investing companies

- CDSL is operated by the Bombay Inventory Trade (BSE)

- NSDL is operated by Nationwide Inventory Trade (NSE)

- Promoters are completely different – NSDL is promoted by IDBI financial institution, UTI, NSE, HDFC, and SBI, whereas CDSL is promoted by BSE and was based in December 1999.

- CDSL is a listed entity and is buying and selling on each the exchanges – BSE and NSE

- NSDL is planning to provide you with an IPO, possibly in 2023. DRHP doc filed on 7th July 2023.

- The Demat Account (DP) can have 16 numeric digits with CDSL. The DP with – IN, adopted by 14 digits with NSDL.

- As of March 31, 2023, there have been a complete of 114.46 million Demat accounts in India.

- Of those, 80.51 million had been lively Demat accounts with CDSL (70%) and 31.46 million had been lively demat accounts with NSDL (30%).

- As of March 31, 2023 – 283 lively Depository Contributors (DPs) in NSDL and 580 lively DPs in CDSL.

- The payment construction in CDSL is decrease than in NSDL.

- When it comes to the variety of issuers, variety of lively devices, market share in demat worth of settlement quantity, and worth of belongings held beneath custody, NSDL holds a better share in comparison with CDSL

NSDL IPO overview – Enterprise Description

Being a key participant within the Indian monetary markets, the Nationwide Securities Depository Restricted IPO (NSDL) IPO is vital for retail buyers. It’s a well-established firm with a robust monitor report. Let’s talk about NSDL IPO advantages with its enterprise description.

- Manages “Demat Accounts” held with it by depository members.

- Offers with varied asset courses specifically equities, choice shares, warrants, funds (mutual funds, REITs, InvITs, and AIFs), debt devices (company debt, business paper, certificates of deposit, pass-through certificates, safety receipts, authorities securities, sovereign gold bonds, municipal debt, treasury invoice) and digital gold receipts.

- Facilitates the holders of securities to carry and switch their securities in digital type and permits settlement options of those securities.

- The corporate earns its income primarily by annual custody charges and transaction charges that the corporate prices issuers of securities and annual upkeep charges.

- Operates by NSDL and its subsidiaries – NSDL Database Administration Restricted (“NDML”) and NSDL Funds Financial institution Restricted (“NPBL”).

NSDL IPO Evaluation

NSDL filed DRHP with market regulator SEBI on 7th July 2023. This IPO is an entire provide on the market (OFS) the place promoter teams are promoting their stake within the course of. The NSDL IPO will see gross sales of 57.26 million shares by its six shareholders.

As per the shareholding, IDBI Financial institution and Nationwide Inventory Trade (NSE) maintain 26% and 24% stakes within the firm, respectively. HDFC Financial institution (8.95%), State Financial institution of India (5%), Union Financial institution of India (2.8%), and Canara Financial institution (2.3%) are different key stakeholders.

HDFC Financial institution will promote 4 million shares (2% stake) within the preliminary public providing (IPO), Nationwide Inventory Trade will promote 18 million shares it owns within the depository whereas IDBI Financial institution will promote as much as 22.2 million shares.

Union Financial institution of India will promote 5.62 million shares, and State Financial institution of India, and Administrator of the Specified Endeavor of the Unit Belief of India (SUUTI) will promote 4 million and three.4 million shares, respectively.

Nationwide Securities Depository Restricted (NSDL) Management crew

Mr. Padmaja Chunduru is the Managing Director and Chief Govt Officer of the corporate. Mr. Parveen Kumar Gupta is the Chairman and Public Curiosity Director.

Nationwide Securities Depository Restricted Income and Revenue

The corporate has a monitor report of development in income and income. Between Monetary Years 2021 and Monetary Years 2023, the income from operations grew from ₹4,675.69 million to ₹10,219.88 million. The revenue after tax grew from ₹1,885.65 million to ₹2,348.11 million. The EBITDA additionally grew at a CAGR of 11.41% from ₹2,644.62 million within the Monetary Yr 2021 to ₹3,282.50 million within the Monetary Yr 2023.

| Time Interval Ended | 31-Mar-21 | 31-Mar-22 | 31-Mar-23 |

|---|---|---|---|

| Whole Belongings | 15,040.06 | 16,927.47 | 20,934.75 |

| Whole Income | 5,261.24 | 8,212.92 | 10,998.14 |

| Revenue After Tax | 1,885.65 | 2,125.94 | 2,348.10 |

| RoNW (%) | 18.50 | 17.55 | 16.43 |

| EPS (diluted in ₹) | 9.43 | 10.63 | 11.74 |

| NAV/ Fairness Share (in ₹) | 50.96 | 60.58 | 71.44 |

Goal Behind the NSDL IPO

- The corporate is not going to obtain any proceeds from the Supply.

- The web proceeds from this NSDL IPO will go to the Promoting Shareholders, in proportion to the Provided Shares bought by the respective Promoting Shareholder as a part of the Supply.

- The corporate will obtain the advantages of itemizing the Fairness Shares on BSE

- This may also improve the visibility and model picture of the corporate in addition to present a public marketplace for Fairness Shares in India.

Ought to I put money into the NSDL IPO?

- NSDL is the nation’s largest safety depositor promoted by the Nationwide inventory change (NSE).

- The depository market in India is a duopoly with excessive obstacles to entry.

- Capital market participation in India is rising and there may be large potential for this trade in India as a result of larger financial development potential, and better youth inhabitants compared to developed international locations.

- Penetration of mutual funds and fairness members is decrease in India in comparison with different developed international locations

- The variety of new demat accounts opened with depository members in India within the Monetary Yr 2023 was 24.78 million as in comparison with 4.96 million within the Monetary Yr 2020.

- The corporate has recorded robust income development over time.

- Contemplating the above components NSDL is a robust firm to put money into.

- To reply the query – Ought to I put money into the NSDL IPO?

- Sure, I might like to put money into NSDL IPO each for itemizing acquire and long-term funding.

NSDL IPO itemizing date and Different particulars

| NSDL IPO Particulars | NSDL IPO Itemizing date, Worth and different particulars |

| IPO Date | – |

| IPO Worth band | – |

| IPO Allotment date | – |

| Refunds Initiation date | – |

| Credit score of Shares to Demat Account | – |

| NSDL IPO Itemizing Date | – |

| Recent Concern | Nil |

| Supply for Sale | 57.26 million shares |

| Most bid (lot measurement) For retail investor | 1 lot of – shares Whole Funding of ₹- |

| Minimal bid (lot measurement) For retail investor | 1 lot of – shares Whole Funding of ₹- |

| NSDL Share Face Worth | INR 2 per share |

| NSDL Share Itemizing on | BSE, NSE Trade |

Steadily Requested Questions (FAQs) on NSDL IPO particulars

- NSDL Filed DRHP?

- Sure, right here is the NSDL IPO DRHP doc to your reference

- How can I put money into NSDL IPO?

- If you’re eager about investing in NSDL IPO, it is advisable open a Demat account and buying and selling account with a dealer. You’ll be able to then apply for shares in the course of the IPO opening interval.

- When is the NSDL IPO itemizing date?

- The NSDL IPO itemizing date will not be but introduced. Nonetheless, it could be open for subscription in August 2023.

- What’s the NSDL IPO Worth?

- The NSDL IPO Worth has not but been introduced

- What are the dangers of investing in NSDL IPO?

- As with all funding, there are dangers related to investing in NSDL IPO. These dangers could embody as beneath.

- There could also be regulatory modifications within the nation.

- The corporate could not carry out effectively as anticipated.

- The corporate could face regulatory or authorized challenges from market regulator.

- There could also be financial decelerate which can have unfavourable impression on capital market.

- What’s the NSDL IPO Measurement

- The NSDL IPO is full OFS. The provide measurement is as much as 57,260,001 shares, which represents 28.63% of the post-issue fairness share capital of NSDL.

- The anchor buyers’ portion is 25% of the provide measurement, or as much as 14,315,000 shares.

- Ought to I Spend money on the NSDL IPO?

- The NSDL IPO is predicted to be a hotly-contested subject. Regulate the subscription date and worth to put money into it for long run.

NSDL IPO Lead Managers & Registrar

| Lead Supervisor | Registrar |

| ICICI Securities Restricted Axis Capital Restricted HSBC Securities and Capital Markets (India) Personal Restricted IDBI Capital Markets & Securities Restricted Motilal Oswal Funding Advisors Restricted SBI Capital Markets Restricted | Hyperlink Intime India Personal Restricted Phone: +91 810 811 4949 E-mail: nsdl.ipo@linkintime.co.in |

Nationwide Securities Depository Restricted Firm Contact Info

| Nationwide Securities Depository Restricted Commerce World, ‘A’ Wing, 4th Flooring, Kamala Mills Compound, Senapati Bapat Marg, Decrease Parel (West), Mumbai – 400 013, Maharashtra, India E-mail: cs_nsdl@nsdl.com Phone: +91 22 2499 4200 https://nsdl.co.in |

Extra From Throughout our Web site

We endeavor that can assist you to grasp completely different features of an organization earlier than you put money into the corporate’s IPO. Study all firm insights for funding in new corporations within the Indian share market 2023. To know extra details about firm insights for funding, enterprise overview of corporations for funding, listed here are some prompt readings on firm insights for funding –10 Finest IPOs in 2022, Tata Motors Inventory Worth, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Inventory Worth, Tata Applied sciences IPO.

mind2markets is in information

Feedstop has talked about mind2markets web site as the most effective website to offer inventory evaluation and insights concerning the firm to put money into. Communicate.