Rajesh Mehta, a 35-year-old advertising supervisor within the busy metropolis of Mumbai, needed to make a monetary choice that many individuals on salaries should make: between India’s previous and new tax regimes. Given the substantial modifications led to by the Union Finances 2025, Rajesh needed to assess which regime can be the very best for his monetary wants.

Understanding the Outdated and New Tax Regimes

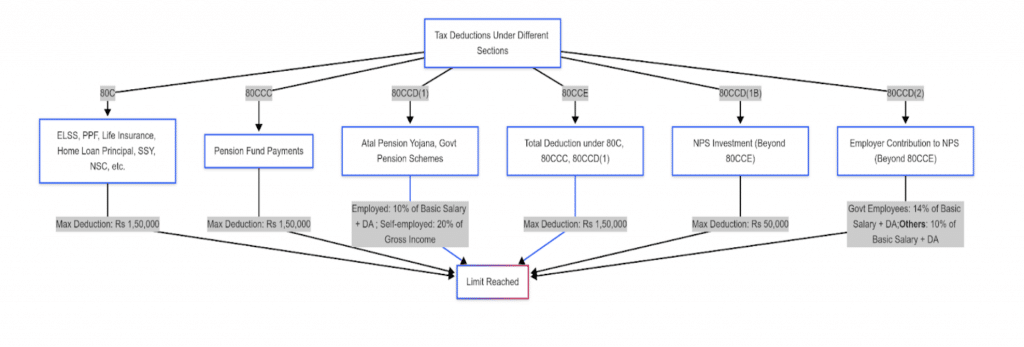

The previous tax regime in India provides taxpayers numerous deductions and exemptions which will be claimed by people and HUFs, such deductions are:

Therefore, the previous tax regime permits people to scale back their taxable earnings by claiming these advantages.

In distinction, the brand new tax regime, launched in 2020 and additional revamped within the 2025 funds, provides decrease tax charges however eliminates most deductions and exemptions. The intent is to simplify the tax submitting course of and supply reduction to taxpayers who don’t spend money on conventional tax-saving choices.

Key Highlights from the 2025 Union Finances

The Union Finances 2025 introduced notable modifications to the brand new tax regime:

1. Elevated Tax Exemption Restrict

People with an annual earnings as much as ₹12 lakh are exempt from paying earnings tax below the brand new regime. (pib.gov.in)

2. Revised Tax Slabs

For incomes above ₹12 lakh, the next tax charges apply:

- ₹12,00,001 to ₹16,00,000: 15%

- ₹16,00,001 to ₹20,00,000: 20%

- ₹20,00,001 to ₹24,00,000: 25%

- Above ₹24,00,000: 30%

3. Normal Deduction

An ordinary deduction of ₹75,000 is obtainable below the brand new regime.

Rajesh’s Monetary Profile

Rajesh, incomes ₹20 lakh yearly, has monetary commitments together with ₹3 lakh HRA, ₹1.5 lakh EPF, ₹50,000 PPF, ₹25,000 medical health insurance, and a ₹50,000 normal deduction (Outdated Regime). These deductions cut back his taxable earnings below the Outdated Tax Regime, making it useful if he prioritises tax financial savings.

Evaluating the Outdated Tax Regime

Beneath the previous tax regime, Rajesh can declare numerous deductions:

- Normal Deduction: ₹50,000

- HRA Exemption: Assuming he pays ₹25,000 per thirty days as hire and meets different situations, he can declare an HRA exemption of roughly ₹1,50,000.

- Part 80C Deductions: EPF (₹1,50,000) and PPF (₹50,000) contributions complete ₹2,00,000. Nevertheless, the utmost allowable deduction below Part 80C is ₹1,50,000.

- Part 80D Deduction: Medical health insurance premium of ₹25,000.

| Particulars | Outdated Tax Regime (₹) | New Tax Regime (₹) |

|---|---|---|

| Gross Annual Revenue | 20,00,000 | 20,00,000 |

| Normal Deduction | 50,000 | 75,000 |

| HRA Exemption | 1,50,000 | Not Relevant |

| Part 80C Deductions | 1,50,000 | Not Relevant |

| Part 80D Deduction | 25,000 | Not Relevant |

| Whole Deductions | 3,75,000 | 75,000 |

| Taxable Revenue | 16,25,000 | 19,25,000 |

| Whole Tax Payable | 3,00,000 | 1,85,000 |

| Tax Financial savings | – | 1,15,000 |

For Rajesh, the New Tax Regime leads to a tax saving of ₹1,15,000 in comparison with the Outdated Tax Regime. Nevertheless, he loses out on advantages like HRA exemption and 80C deductions, that are helpful for long-term monetary planning. The selection depends upon his funding habits—if he prefers simplicity and instant financial savings, the New Regime is best. If he values long-term wealth constructing, the Outdated Regime should still be preferable.

Let’s discover further eventualities to see how completely different wage ranges and deductions affect the selection between the Outdated Tax Regime and New Tax Regime.

Situation 1: Decrease Revenue Bracket (₹8 lakh every year)

Let’s take into account Anita Sharma, a 28-year-old software program developer in Mumbai, incomes ₹8,00,000 every year.

Assumptions:

- HRA Exemption: ₹1,00,000

- Part 80C (EPF + ELSS): ₹1,50,000

- Well being Insurance coverage (80D): ₹25,000

- Normal Deduction: ₹50,000

| Particulars | Outdated Tax Regime (₹) | New Tax Regime (₹) |

|---|---|---|

| Gross Annual Revenue | 8,00,000 | 8,00,000 |

| Normal Deduction | 50,000 | 75,000 |

| HRA Exemption | 1,00,000 | Not Relevant |

| Part 80C Deductions | 1,50,000 | Not Relevant |

| Part 80D (Well being Insurance coverage) | 25,000 | Not Relevant |

| Whole Deductions | 3,25,000 | 75,000 |

| Taxable Revenue | 4,75,000 | 7,25,000 |

Tax Calculation:

| As much as ₹2,50,000 (Outdated) / ₹4,00,000 (New) | Nil | Nil |

| ₹2,50,001 – ₹5,00,000 (5%) | 11,250 | 16,250 |

| ₹5,00,001 – ₹7,25,000 (10%) | 22,500 | 22,500 |

| Whole Tax Payable | ₹33,750 | ₹38,750 |

|---|

Since Anita advantages from a number of deductions, the Outdated Tax Regime is best in her case, as she saves ₹5,000 greater than below the New Tax Regime.

Situation 2: Larger Revenue Bracket (₹25 lakh every year)

Vikram Nair, a 42-year-old senior guide in Mumbai, earns ₹25 lakh every year. His tax-saving investments embody ₹3 lakh HRA exemption, ₹1.5 lakh below Part 80C (EPF + PPF), ₹50,000 for medical health insurance (80D), and a ₹50,000 normal deduction. These deductions considerably cut back his taxable earnings below the Outdated Tax Regime. Allow us to see his tax calculation:

| Particulars | Outdated Tax Regime (₹) | New Tax Regime (₹) |

|---|---|---|

| Gross Annual Revenue | 25,00,000 | 25,00,000 |

| Normal Deduction | 50,000 | 75,000 |

| HRA Exemption | 3,00,000 | Not Relevant |

| Part 80C Deductions | 1,50,000 | Not Relevant |

| Part 80D (Well being Insurance coverage) | 50,000 | Not Relevant |

| Whole Deductions | 5,50,000 | 75,000 |

| Taxable Revenue | 19,50,000 | 24,25,000 |

Tax Calculation:

| As much as ₹2,50,000 (Outdated) / ₹4,00,000 (New) | Nil | Nil |

| ₹2,50,001 – ₹5,00,000 (5%) | 12,500 | 20,000 |

| ₹5,00,001 – ₹10,00,000 (20%) | 1,00,000 | 1,00,000 |

| ₹10,00,001 – ₹19,50,000 (30%) | 2,85,000 | 1,42,500 |

| ₹19,50,001 – ₹24,25,000 (25%) | Not Relevant | 1,18,750 |

| Whole Tax Payable | ₹3,97,500 | ₹3,81,250 |

|---|

For Vikram, the New Tax Regime saves ₹16,250 in taxes, making it a greater possibility regardless of dropping out on exemptions.

Key Takeaways

- For lower-income earners (₹8 lakh), the Outdated Regime is best if tax-saving investments are used, whereas the New Regime provides simplicity however could result in increased tax.

- For middle-income earners (₹15-20 lakh), the New Regime is normally extra useful as a consequence of decrease tax charges, although the Outdated Regime can nonetheless work if deductions are maximised.

- For prime-income earners (₹25 lakh+), the New Regime usually leads to financial savings until vital deductions make the Outdated Regime preferable.

Wrapping Up

To wrap up, the Outdated Tax Regime provides deductions (HRA, 80C, 80D) for tax financial savings, whereas the New Tax Regime supplies decrease tax charges however eliminates most exemptions. The 2025 Finances elevated the tax exemption restrict to ₹12 lakh and launched revised slabs, making the New Regime extra engaging for middle- and high-income earners. Those that spend money on tax-saving schemes could profit from the Outdated Regime, however for simplicity and better take-home pay, the New Regime is preferable. For extra readability, you might learn this.

Keen on how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Is UPI Killing the Toffee Enterprise?