Picture supply: Getty Pictures

Low-cost international index funds are widespread lately and it’s simple to see why. Over the long term, these merchandise – which offer broad publicity to the inventory market – have a tendency to offer enticing returns.

However may there be a strategy to beat the market and generate greater long-term returns? Doubtlessly.

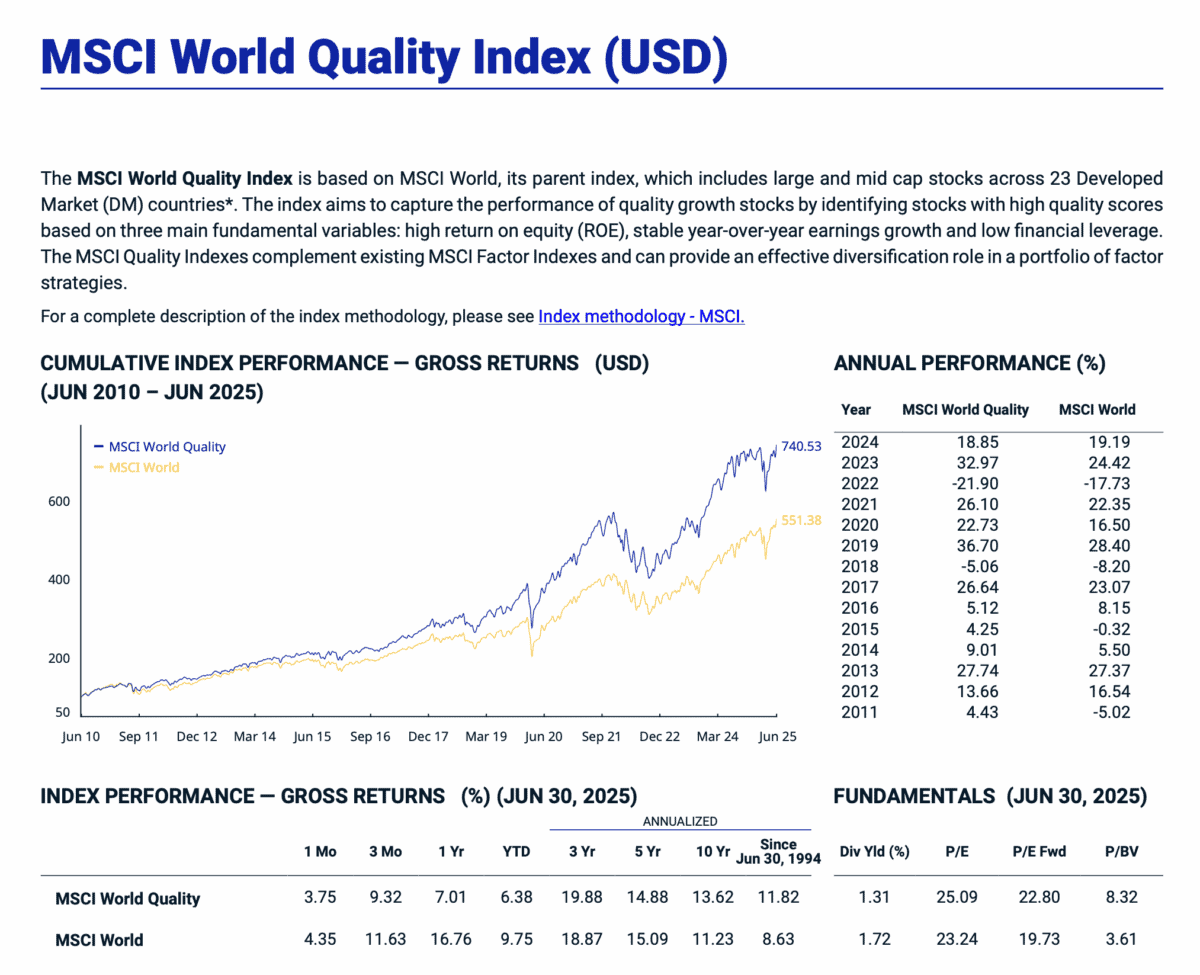

Take a look at the returns from the MSCI World High quality index. Over the past 31 years, this index has smashed the broader market.

A give attention to high quality

The MSCI World High quality index is predicated on the MSCI World index (which a variety of fundamental index funds observe). Nevertheless, it has a give attention to ‘high quality’.

The intention is to seize the efficiency of high-quality companies (which frequently present greater funding returns than low-quality ones) by figuring out firms with:

- A excessive return on fairness (a excessive stage of profitability)

- Steady year-on-year earnings development

- Low monetary leverage (low debt)

Be aware that it comprises most of the similar names because the MSCI World (Apple, Nvidia, Visa, and many others). Nevertheless, the weightings are sometimes fairly totally different.

Sturdy long-term efficiency

Zooming in on efficiency, since 30 June 1994, this index has returned 11.8% per yr (in US greenback phrases). That compares to an annualised return of 8.6% for the common MSCI World.

That’s a fairly important outperformance. It’s value stating that 30 years is a very long time within the inventory market (that means that this efficiency wasn’t a fluke or a short-term phenomenon).

Intervals of underperformance

In fact, no technique outperforms on a regular basis. And there are occasions now and again when high quality lags the broader market.

It has really lagged this yr. For the primary half, the MSCI World High quality index returned 6.4% versus 9.8% for the MSCI World.

Over the long term, nevertheless, it has clearly outperformed. So I feel the technique is value contemplating as a part of one’s total funding method.

A top quality ETF

Now, it’s not doable to take a position straight within the MSCI World High quality index. Nevertheless, UK traders have entry to a spread of merchandise that observe derivatives of the index.

One instance right here is the iShares Edge MSCI World High quality Issue UCITS ETF (LSE: IWQU). That is designed to trace the MSCI World Sector Impartial High quality index, which is similar to the MSCI World High quality index.

I feel there’s loads to love about this product. Just like the index, it screens out low-quality firms and focuses on firms with excessive profitably, steady earnings, and powerful steadiness sheets.

In the meantime, charges are low at simply 0.25% per yr.

Now, there’s no assure that this ETF will present superior returns within the years forward. As I stated above, high quality methods typically lag the broader market (particularly when cyclical shares are in favour).

All issues thought of although, I see it as a strong core holding. I feel it’s value contemplating as a part of a diversified portfolio.