Picture supply: Getty Photos

Having fallen by greater than half since November 2020, the Persimmon (LSE:PSN) share value is the worst performer in my Shares and Shares ISA.

I first purchased the FTSE 100 housebuilder simply earlier than the pandemic and was primarily attracted by the inventory’s beneficiant dividend. On the time, it was paying 235p a share. These days, issues are very completely different.

After a slowdown within the housing market and a interval of sustained post-Covid supply-chain inflation, Persimmon’s earnings in 2024 have been round half their five-year common. Consequently, the group’s needed to lower its dividend by 75%. This can be a beneficial reminder that payouts can’t be assured.

Nonetheless, this disciplined strategy to returning money to shareholders has helped be sure that its stability sheet stays wholesome. At 30 June, the group had no debt, which is uncommon for one of many UK’s largest listed companies.

‘Skilled’ opinion

Encouragingly, a have a look at the newest forecast of analysts means that I may get better a few of my losses over the following 12 months. That’s as a result of the consensus is for a 24% capital achieve. That is primarily based on a median value goal of 1,500p.

Okay, even when this proves to be appropriate, it’s a great distance shy of its pre-pandemic degree. However that’s my downside — it could possibly be a distinct story for these eager to take a stake now. If the brokers are proper, when mixed with the group’s present dividend of 60p, the entire return could possibly be as excessive as 29%. And I’m positive most traders can be proud of that.

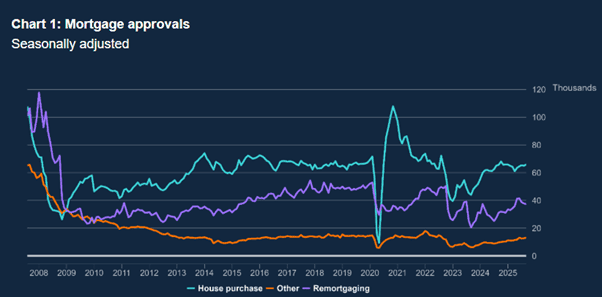

Nonetheless, the UK housing market is cyclical and whereas it seems to have turned the nook — mortgage approvals are slowly rising — a restoration is much from sure.

All eyes on the Finances

And for my part, the Autumn Finances on the finish of November is essential in figuring out the path of Persimmon’s share value over the following 12 months or so. Relying on the Chancellor’s selections — and the way her speech is acquired by bond traders – the housing market may go one in all two methods.

If Rachel Reeves breaks her personal fiscal guidelines, gilt charges may surge. Mortgages would then grow to be dearer and demand for brand new homes would fall. However even when the markets welcome her prudence, there’s a danger that the anticipated tax will increase may injury shopper confidence and squeeze incomes additional. All housebuilders would then undergo.

Alternatively, elevating the stamp obligation threshold — or introducing different incentives for first-time patrons — may assist a brand new era of patrons get on the housing ladder. In these circumstances, Persimmon could possibly be one of many beneficiaries. The reason is its properties are usually priced on the cheaper finish of the market.

Nonetheless, no matter what occurs on 26 November, there’s nonetheless going to be a housing scarcity within the nation. The federal government desires to deal with this by streamlining the planning course of. And it sees housebuilding as a key component of its financial development technique.

On this foundation, Persimmon could possibly be a inventory for affected person traders to contemplate. However even when the housing market restoration stalls, there’s all the time the group’s dividend to be grateful for. And savvy traders know that utilizing this revenue stream to purchase extra of the group’s shares at their present traditionally low degree could possibly be a successful long-term technique.