Wealth-Constructing Readiness Quiz

Introduction

My as we speak’s matter makes many curious. We’ll focus on the way to really construct substantial wealth within the inventory market over the long run. We regularly hear tales of unimaginable success, however what really goes into it? It’s not nearly choosing the right inventory; it’s a profound mix of funding technique and, crucially, a really particular mindset.

I name it SSM (Inventory, Technique, Mindset).

Just lately, I had the privilege of listening to insights from one in every of India’s most revered buyers. He’s somebody who began from humble beginnings in a small village and constructed immense wealth.

His journey, and the knowledge he shared, gives a outstanding blueprint for anybody aspiring to construct wealth from scratch. His insights inform us the way to navigate the inventory market’s ups and down with one final focus in thoughts – wealth creation.

Taking this interview as our reference, let’s discover what really units aside the few who succeed from the numerous.

1. Why Is Wealth Creation So Tough for Most Pepole?

You recognize, wealth constructing usually seems to be straightforward in hindsight. “Oh, I ought to have purchased this, or I ought to have offered that.” However the actuality is much more complicated.

After virtually a decade lengthy journey in wealth creation, I personally beleive that our psychology performs a giant position ultimately objective.

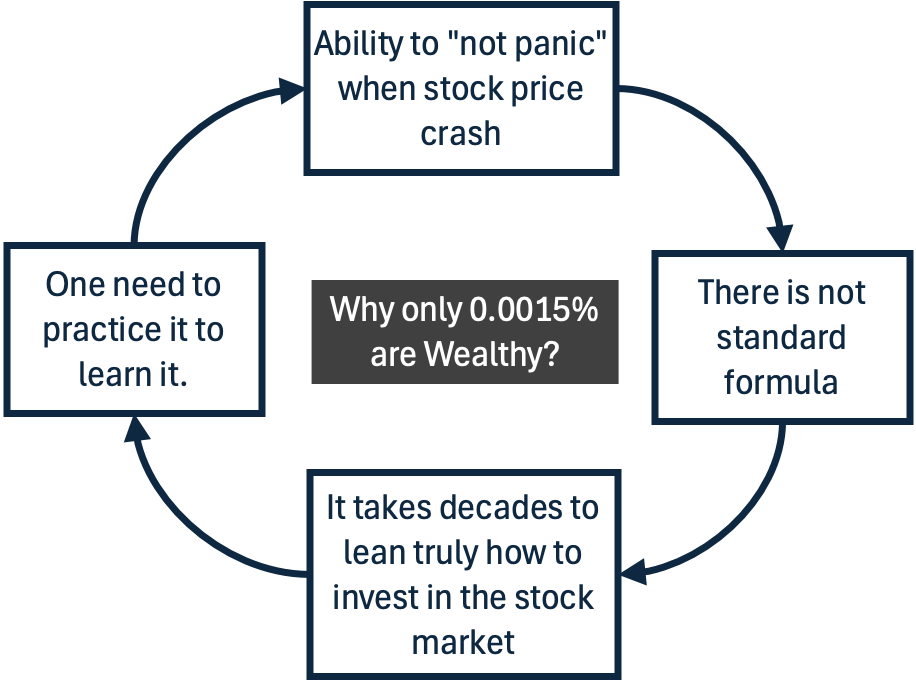

Out of 1.4 billion folks in India, maybe solely a tiny fraction, perhaps solely about 20,000 (0.0015%) have created vital wealth for themselves. The worth will even go down after we’ll search for individuals who executed it within the inventory market.

Why such a small quantity (0.0015%)?

- Firstly, you’re coping with cash, and that brings a really completely different mindset. Think about shopping for a share at Rs.100, and in a month, it drops to Rs.60 or Rs.70. Seeing these losses proper in entrance of your eyes will be extremely troublesome to take care of.

- Secondly, the markets are inherently unpredictable. There’s no customary components, like “purchase at 10 P/E and promote at 25 P/E,” that ensures success. Exterior occasions, like a change in international commerce insurance policies or perhaps a pandemic like occasion, can briefly derail whole enterprise fashions.

- Thirdly, it requires time (say a decade) to develop true skilled experience and a deep understanding of markets and firms. Sadly, now many individuals have the resilience to proceed studying in regards to the market yr after yr.

- Lastly, one must follow to grow to be an excellent investor. It’s a really difficult topic, akin to studying the way to biking; you don’t be taught it by simply studying a guide. As Mr. Madhu Kela jokindly mentioned “kisi to bina mare jannat nahi milti.” The purpose is, you to go deep into inventory investing and that’s the place the true studying begings to take form.

Wealth constructing in inventory market calls for plenty of persistence. Even if you find yourself doing it, your persistence shall be examined each single day, whether or not the market goes up or down.

2. The Core Pillars of Funding Technique

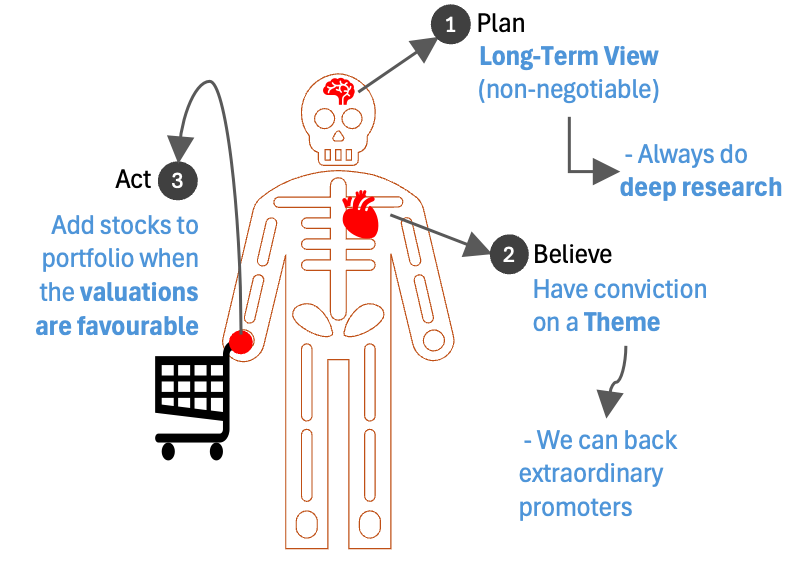

So, what are the actionable methods that these profitable buyers make use of?

2. 1 The Unwavering Lengthy-Time period View

That is maybe essentially the most elementary precept.

There’s completely little question that it’s a must to be a long-term investor. Why so?

- Instance #1: Firms like Divi’s Laboratories, as an illustration, had a market cap of Rs.140 crores at IPO (2003) and grew to Rs.1.8 lakh crores. That is an absolute progress of 74,000% (35% CAGR in 22 Years). If you happen to had merely reinvested dividends and stayed put, you could possibly have multiplied your cash 1,000 occasions.

- One other instance is Radico Khaitan. This shares which went from a Rs.100 crore market cap to Rs.35,000 crores. It’s IPO additionally got here in 2003, about 22 years again. Since its IPO, its inventory value has appreciated on the charge of 30% CAGR (absoluted progress of 34,000%).

The ability of investing is really realised over lengthy durations. That is what makes a profitable investor.

They’ve seen a number of market cycles and understood that staying invested by means of these cycles is vital to creating substantial cash.

2.2 Deep Analysis and Unshakeable Idea

Constructing wealth isn’t about blind luck; it’s about preparedness.

Your whole thought course of, from analysis to your funding idea, must be strong.

Typically, it’s not even about large analysis, however a profound visualisation.

Take into consideration somebody who understood the web’s potential in 2000. It was a time when Yahoo’s, MSN, and Google’s of the world have been of their nascenet phases. Even Orkut or Fb weren’t even born in these days. Microsoft and its Window’s utility was the one factor that was frequent amongst majority.

What occurred after 2000 was an explosion of internt associated utility. Google as a result of the following mega firm firm of the world.

The web idea by itself led to an addition of trillions of {dollars} in wealth globally.

The factor is, as soon as we’ve got a funding associated idea, we should constantly work to strengthen it. However it’s equally vital to take heed to the market. This conviction is significant. Why?

As a result of this conviction in your idea that may assist when your portfolio sees vital crashes of like 35% corrections. The sort of 35%+ correction will can occur a number of occasions over 20 years for even the most effective firms.

The capacity to undergo such drawdowns and nonetheless stay satisfied requires a really completely different degree of emotional energy, agility, and deep data.

2.3 Shopping for with a Margin of Security

This implies shopping for at a value the place the draw back threat is minimal.

As an example, an funding like Radico Khaitan, purchased at Rs.120, later went to Rs.500, then fell to Rs.220 throughout COVID.

If you happen to purchase at a value with a really excessive margin of security, you might be higher outfitted to trip out such volatility.

2.4 Backing Extraordinary Promoters

The standard of the promoter and administration is extremely essential.

You wish to again people who not solely have a “hearth within the stomach” but additionally deeply perceive of the next:

- Capital allocation,

- Tips on how to construct sturdy groups, and

- The deep know-how about the way to handle the related dangers within the enterprise.

It’s about backing promoters who’re targeted on execution relatively than simply speaking.

For instance, even throughout controversial occasions, just like the Adani episode, one seasoned investor noticed it as a shopping for alternative. Why? Due to the super entrepreneurship and two-decade historical past of the promoter. Although the alternative can also be true. There are some buyers, who after this episode, will maybe not contact Adani shares any time quickly.

The purpose is, having an indepth ‘knowledge-based-perception’ in regards to the firm’s promoters is the important thing within the strategy of long run wealth constructing from the inventory market.

2.5 Embracing Theme-Primarily based Investing

Whereas bottom-up inventory selecting is crucial, combining it with bigger, highly effective themes can present immense conviction.

For instance, after COVID, investing in PSUs as a theme usually made cash, whatever the particular PSU inventory.

One other long-term theme recognized is carbon neutrality and local weather change. These two themes will undoubtedly create many alternatives because the world addresses environmental challenges.

The trick is to establish the theme, then discover the proper shares inside it. When you’ve recognized, wait for market volatility to current alternatives, don’t begin shopping for but. Add the inventory to your watchlist. Then in time when the chance comes (deep correction or crash), purchase these shares at a proper worth.

3. The Psychology That Drives Success

Past technique, it’s the mindset that actually makes the distinction. That is what seperates true buyers from others.

- #3.1 Emotional Agility and Resilience: It’s the greatest differentiator. When the market is noisy and unstable, and also you see each day fluctuations, it’s straightforward to panic. Earlier than shopping for any inventory, a sensible investor asks: “If this inventory falls by 30%, will I purchase extra, or will I panic?” In case your funding idea stays intact, and the autumn is because of non permanent causes. Such a fall turns into a ravishing alternative to purchase extra. Nonetheless, it’s vital to differentiate between volatility (non permanent value swings) and precise threat (elementary adjustments within the firm or trade). Figuring out when to chop losses as a consequence of real threat can also be very important.

[Note: You can see, this what makes stock investing not so easy. On one side we are saying don’t panic and sell. On the other side, we saying don’t hold if risks are actual. In a pracical scenario, it is very tough to distinguish between volatility and actual risk. This is where deep knowledge of business and promoters comes in handy and this sort of insights comes with decades of investing.]

- #3.2 Extraordinary Ardour and Devotion: Investing, particularly full-time, isn’t one thing like a 9-to-5 job. It requires an “extraordinary ardour” and involvement. Nothing of significance is achieved in any area with out true devotion. Whether or not it’s a Sachin Tendulkar or an Amitabh Bachchan, devotion and onerous work are common guidelines for achievement. An investor should be taught to love the method, not simply concentrate on the ‘potential financial features.’

- #3.3 Humility and Steady Studying: Conceitedness has no place within the inventory market. The second you assume you “know all of it,” the market will train you a harsh you’ll bear in mind for lifetie. However the issue is, such classes are sometimes painful. That is why you’ll discover, profitable buyers stay humble, prepared to be taught, and prepared to confess their errors. The deep motive is, there are too many variable (in inventory market). It’s virtually unimaginable for a human thoughts to grasp and management all these variable. In a humble way of thinking, we stay cautious and keep in a studying temper.

- #3.4 Growing Your Personal Funding Idea: You can’t borrow the speculation of Warren Buffett or Rakesh Jhunjhunwala and anticipate to grow to be them. We will solely aspire to grow to be the most effective variations of ourselves. For that, we have to have our funding idea. For instance, in case you assume that the approaching decade shall be for renewable vitality, begin studying about it. Go to a lot depths that when an excellent alternative presents itself in from of you, you’ll be able to seize them with better of your capacity. Different who should not have the data as yours will in all probability ignore them, however you’ll not.

Conclusion

Constructing generational wealth isn’t about hitting a goal, say Rs.10 crore, after which retiring to get pleasure from life.

It’s about discovering one thing you might be so captivated with that you may envision doing it till your final breath.

It’s a endless journey of studying, evolving, and striving for excellence.

In essence, constructing giant wealth over the long run within the inventory market isn’t nearly monetary acumen; it’s a cautious mixing of persistence, resilience, steady studying, and an unyielding ardour for the method itself.

It calls for that you simply develop your personal funding idea, endure market volatility with emotional energy. And extra importantly, when you begin tasting success, it additionally vital to stay humble.

Have a contented investing.