Choose Quick Rising Firms

Discover high-growth firms with key monetary metrics

Your Favourite Firms

No firms saved but.

Introduction

Methods to consider the fastest-growing firms in India? This text can shed some gentle on the best way to do it. All of us need to purchase a potential ‘progress inventory’, however we regularly find yourself shopping for the flawed one. Methods to remove this miss? Learn extra about shares with the best final 10Y returns.

Record of quickest rising firms in India

(Up to date: 22-Might-2025) Verify The Inventory Engine

| SL | Title | Worth | Market Cap(Cr) | Op. Rev. Progress | Internet Revenue Progress | GMR Rating |

|---|---|---|---|---|---|---|

| 1 | SOLARINDS:[532725] | 15,069.30 | 1,36,277.97 | 19.27 | 17.77 | 97.94 |

| 2 | PIIND:[523642] | 3,657.30 | 55,643.22 | 27.36 | 20.57 | 97.77 |

| 3 | CHOLAFIN:[511243] | 1,626.70 | 1,36,935.33 | 20.02 | 22.02 | 97.47 |

| 4 | GRAVITA:[533282] | 2,056.50 | 14,901.71 | 31.26 | 21.13 | 97.1 |

| 5 | IREDA:[544026] | 170.7 | 45,882.86 | 27.59 | 17.75 | 96.92 |

What I need to clarify right here is the idea of “quick progress”. Why know the idea? As a result of the way in which we seek for fast-growing firms will not be a protected method. Why do I say so? [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

As a result of to unearth a fast-growing inventory, we should look deeper. A superficial search is not going to spotlight a really fast-growing firm. Then, the best way to go about it?

Recommended Studying: Self-financeable Progress (SFG) Charge

The Idea of Progress – Look Deeper

Suppose I ask you this query, “that are the doubtless quickest rising shares in India in 2022”? How you’ll reply this query? Our first instinctive response will probably be to take a look at the historic costs.

Individuals who know extra about shares will see progress charges of gross sales, web revenue, EPS, dividends, web price, property, and so forth, and make a guess.

The query is, are these the correct method?

The method will not be flawed, however a worth investor wish to see deeper. Indicators like gross sales progress, revenue progress, and so forth are solely the tip of the iceberg.

What lies beneath is what’s making these metrics develop.

How does a enterprise develop?

PAT, EPS, Dividend, and Internet Price of an organization can not develop by itself. It should be grown. To ensure that the corporate to develop, it should take motion. What are these actions?

- Reinvestment of Retained Revenue: What are retained earnings? Internet Revenue minus Dividend. It’s that portion of web revenue, which has not been paid to shareholders as dividends. Cumulative of all of the passing years’ retained earnings are proven on the corporate’s stability sheet as “reserves”. Firms use their reserves to fund progress.

- Making Firm Extra Environment friendly: Companies make the most of sources to generate earnings. Firms that effectively generate extra earnings per unit of useful resource utilized. Such environment friendly profit-generating firms have a greater likelihood to develop sooner sooner or later.

So let’s sum up. How does an organization develop?

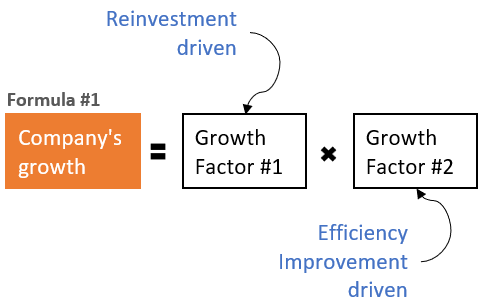

Firm Progress = Progress as a result of (Reinvestment + Effectivity enchancment)

A. How briskly an organization can develop?

Estimating future progress is like appearing god. Why? As a result of future prediction is unimaginable.

No one can declare to know what’s going to occur tomorrow. Neither Warren Buffett nor you, nor anybody. However what may be carried out is that this:

Estimate future progress based mostly on enterprise fundamentals of an organization.

What does it imply? Estimating future progress based mostly on enterprise fundamentals is extra maths than fortunetelling. I’m positive, you’ll agree that arithmetic is extra dependable.

However maths will forecast excessive future progress provided that the “enterprise fundamentals” are good.

Which fundamentals will guarantee quick progress? Like progress is an element of reinvestment & effectivity, velocity of progress additionally has an interrelation. It has adopted two interrelations:

- How a lot is reinvested: Out of the overall revenue of the corporate, a portion of it’s paid to shareholders as dividends. The stability is retained by the corporate for reinvestment. The retained earnings are recorded on the stability sheet as Reserves. Out of those reserves, a portion is reinvested again into the corporate in type of CAPEX plans. The target of CAPEX is to make the corporate develop in measurement. The larger would be the CAPEX, the sooner the corporate will develop. Capex funding is mostly carried out from reserves plus debt.

- How effectively it’s reinvested: Even when the corporate is reinvesting its reserves, vital is to get the ultimate outcomes. What’s the closing consequence? Enhancement of revenue, and profitability of the corporate. If both of those parameters is rising, it’s a signal that the reinvestment is being carried out effectively by the corporate.

Typically, a fast-growing firm reinvests most of its revenue again into the enterprise. The result’s that its revenue and profitability develop sooner with time.

That are the inventory metrics which might inform us, how a lot is reinvested and the way effectively it’s reinvested? Please learn additional…

A1. How a lot is reinvested:

With the intention to perceive how a lot is getting reinvested, one can use the under two metrics.

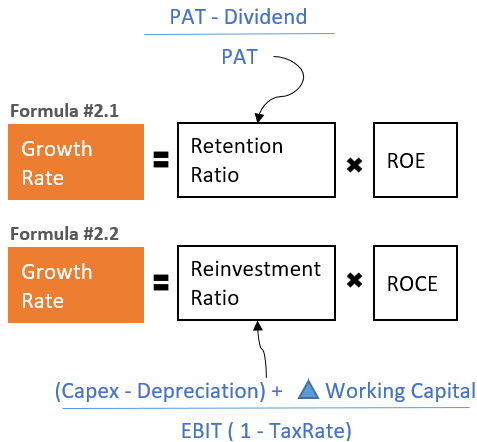

- Retention Charge [(PAT-Dividend) / PAT ]: The upper the retention ratio means the corporate is giving out fewer dividends and retaining extra revenue for reinvestment. For such firms, the “reserves” within the stability sheet develop sooner.

- Reinvestment Charge [(Net Capex+Change in WC) / {EBIT x (1-t)}]: How a lot is reinvested out of reserves is extra vital. Methods to realize it? This may be recognized by calculating the reinvestment ratio.

Larger reserves additionally make further funds out there for the corporate. How?

As reserves go up, the corporate’s fairness base turns into richer. This brings down the corporate’s Debt/Fairness ratio. Therefore it turns into eligible for extra loans. Which loans?

- Lengthy-term debt: It will additional enhance the employed capital of the corporate. Firms can even use this additional fund to additional enhance their growth and modernization plans.

- Brief-term debt: This may even enhance the corporate’s present property. Firms can use this fund for his or her enterprise operations (working capital and so forth).

An organization that has a excessive retention ratio will get double advantages. On one hand, it has extra funds out there for CAPEX. On different hand, it may possibly additionally borrow extra from banks (loans) and additional enhance its liquidity.

A2. How effectively earnings are reinvested:

The target of reinvestment shouldn’t solely be to extend income and revenue. It also needs to improve effectivity. If the effectivity is rising with revenue, it’s a signal that the corporate is dealing with each priorities effectively. The priorities are, (1) the growth of the scale of operations, and (2) the modernization of the present facility.

Methods to know if the effectivity is rising or not? By taking a look at ROE and ROCE historical past.

- ROE (PAT / Guide Worth).

- ROCE [ EBIT / (Total Asset – Current Liability).

[Read more on how to calculate ROE – Example.]

A3. Method#1 for velocity of progress

A mix of retention ratio, reinvestment ratio, ROE, and ROCE will reply how briskly the corporate will develop sooner or later. A mix of the 2 formulation, proven under, will inform us concerning the velocity of progress of an organization.

What do the above formulation signify? To develop, an organization reinvests its earnings again into the enterprise. This reinvested cash ensured future progress. How briskly would be the progress?

There are two methods to take a look at it. (a) A basic statement – by means of retention ratio and ROE. (b) Extra particular statement – by means of reinvestment ratio and ROC.

- Retention Ratio * ROE: talks about how a lot an organization provides to its fairness to generate additional earnings.

- Reinvestment Ratio * ROC: talks about how a lot an organization provides to its property to generate additional earnings.

One can use both of the above formulae to estimate the expansion fee of the corporate as a result of reinvestment.

Abbreviations used:

- PAT = Revenue After Tax.

- CAPEX = Capital Expenditure.

- WC = Working Capital.

- EBIT = Revenue Earlier than Curiosity & Tax.

- t = Efficient Tax Charge.

- ROE = Return on Fairness.

- ROC = Return on Capital.

A4. Method#2 for velocity of progress

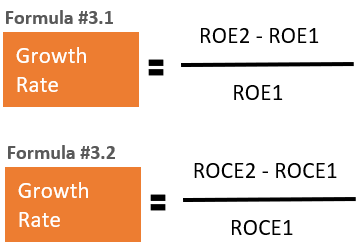

Suppose there’s a firm whose whole employed capital is say Rs.100 Crore. This firm generates EBIT of Rs.10 Crore. What’s its ROCE? 10% (EBIT/Capital Employed).

Now, this firm has a goal to enhance its ROCE from 10% to 12%. But it surely doesn’t intend to develop by means of the “reinvestment” route. What it may possibly do to enhance ROCE? By slicing down on its price. This manner firms’ EBIT will go up.

However this progress in EBIT has occurred with out including something to its asset base (zero capital expenditure).

Right here we are able to say that the corporate has been capable of enhance revenue by bettering its effectivity. Ideally, that is the easiest way to make sure progress. However such progress has two main limitations:

Past that, progress can solely occur from reinvestment (by asset enhancement). What’s the components that can be utilized to quantify progress as a result of effectivity enchancment?

Progress within the firm as a result of effectivity enchancment =

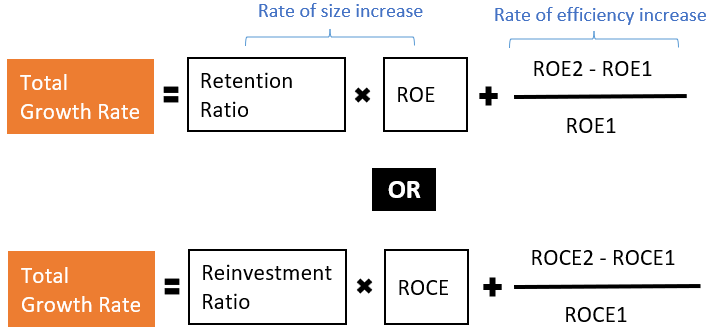

So this brings us to our closing conclusion. The overall progress of an organization can occur in two methods (each included).

- By reinvestment of its revenue again into the enterprise.

- By effectivity enchancment.

This manner the overall progress components comes out to be like this:

Instance of future progress fee estimation

How one can estimate the longer term progress fee of an organization? We will use the under two steps:

- Step #1. Pull out the numbers: Which numbers are to be obtained from the corporate’s monetary reviews? We have to pull out particular knowledge from firms’ “revenue and loss a/c” and from the “stability sheet”. The numbers that I’m speaking about are these:

- Step #2. Calculate: The pattern calculation is proven within the under picture. [P.Note: In rows “ab” & “ac” which is Efficiency Growth (ROE/ROC), will be zero if the preceding year’s ROE/ROC is more than 0.20. Why? Because, I have assumed that a company that already has a high ROE/ROC, cannot grow more on basis of efficiency improvement. Such companies must reinvest for future growth. The total growth of such companies will be a factor of reinvestment.

In the above example, we have two total growth numbers: (a) Total Growth (ROE based), and (b) Total Growth (ROC based).

Which one is to be referred to? Frankly speaking, there are no preferences. The selection is totally based on the researcher’s judgment. I generally prefer ROC-based total growth calculation. Why? Because it is based on “net capital expenditure and change in working capital”.

What shall be the growth rate for the above example stock? For me, a safe assumption for the future growth rate will be 7.5%. Why? The rationale behind this decision is shown below:

Conclusion

Let’s conclude the topic of “companies growth”. Using ROC Formula, the growth rate of a company is represented as:

Total Growth = Reinvestment Ratio * ROC + (ROC2 – ROC1) / ROC1

- Case-1: Company is not reinvesting: If the company is not reinvesting its capital, CAPEX + Change in working capital is zero. This means, its reinvestment ratio is zero. In this case, growth is totally dependent on efficiency improvement. Growth = (ROC2 – ROC1) / ROC1

- Case-2: Company is only reinvesting: If the company is only reinvesting, its growth due to efficiency improvement will be zero. In this case, growth is totally dependent on reinvestment. Growth = Reinvestment Ratio * ROC

What we can conclude from this article?

Companies which reinvest its money, and also has higher ROE / ROC is more likely to grow faster in future.

Handpicked Articles:

- High EPS stocks and their Growth Rates.

- Debt Free Companies in India.

- Fundamentally Strong Stocks in India.

- Best stocks to buy in India for the long term.

- PEG Ratio of Indian Stocks.