Picture supply: Getty Photographs

For me, the perfect method to earn a second earnings is by placing cash in an ISA and following a well-trodden funding technique so as construct wealth. After all, the more cash an investor has, the simpler it’s to generate a big passive earnings.

Sadly, most Britons nonetheless elect to construct wealth by financial savings accounts, which with annualised returns sometimes beneath 3%, that cash isn’t rising in a short time.

Inventory markets sometimes carry out higher than financial savings

Investing in inventory markets sometimes yields considerably greater returns in comparison with conventional financial savings accounts. Many people, significantly novices, go for index-tracking funds, which purpose to duplicate the efficiency of main market indexes. Historic information underscores the long-term progress potential of such investments.

As an example, the FTSE 100 has delivered a median annual return of 6.3% over the previous 20 years, with the FTSE 250 outperforming its large-cap counterpart. Within the US, the S&P 500‘s averaged a formidable 10.5% yearly since its inception in 1957, climbing to an excellent greater common of 13.3% within the decade main as much as 2024. Equally, the Nasdaq posted an distinctive 19.8% common return over the previous decade.

These figures starkly distinction with the comparatively modest rates of interest supplied by financial savings accounts, emphasising the benefit of inventory market investments for constructing wealth over the long run.

Doing the maths

Personally, I favor to choose particular person shares, trusts and particular funds, over index-tracking funds. That’s as a result of I imagine I can beat the market — in spite of everything, researching shares is actually what I do.

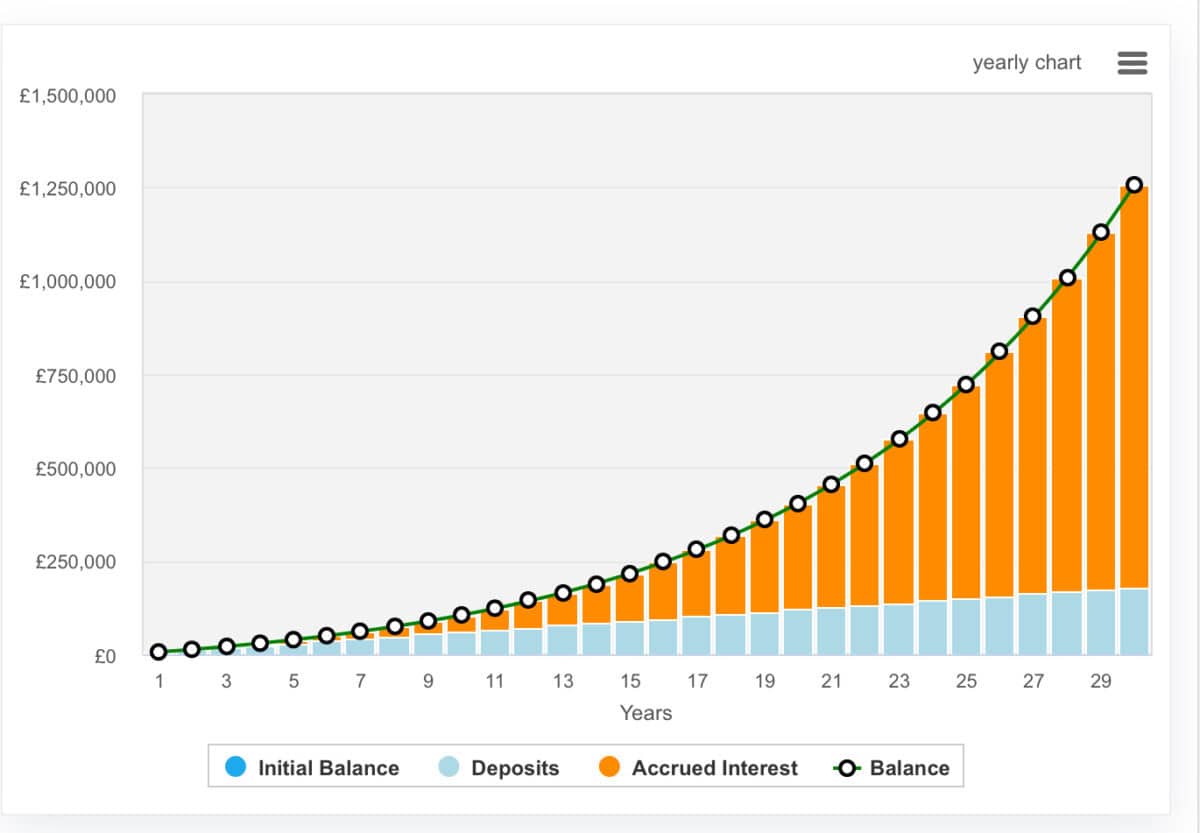

Nonetheless, if an investor had chosen a tracker of any of the above main indexes during the last decade, they’d have vastly surpassed the returns they may have achieved in a financial savings account. Let’s assume an investor places £500 a month into an index tracker. Right here’s how that cash may carry out in an S&P 500 tracker, based mostly on the beforehand famous historic progress charges (however observe, previous efficiency isn’t any assure of future success).

Why did I take advantage of the S&P 500 information? Effectively, as a result of it fairly conveniently works out to simply over £1.2m over 30 years. Placing that cash in shares with a median dividend yield of 5% would generate £5,000 of month-to-month passive earnings — and tax-free. That is what I’m aiming to do, however by cherry-picking shares, I’m hoping to develop my cash sooner.

Please observe that tax therapy will depend on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

One to contemplate for the expansion section

Whereas index trackers are a good way to begin investing, buyers could wish to contemplate an thrilling growth-oriented belief like Edinburgh Worldwide Funding Belief (LSE:EWI). It’s a Baillie Gifford-run fund — just like the well-known Scottish Mortgage Funding Belief — and it’s a very fascinating, albeit dangerous proposition. The fund goals to speculate initially in entrepreneurial corporations after they’re nonetheless nascent.

The belief’s largest funding is SpaceX, which represents a major 12.3% of the portfolio. That is adopted by PsiQuantum at 7.5% and Alnylam Prescribed drugs. These are pretty high-risk investments, however given supportive traits in synthetic intelligence (AI), house exploration, and even quantum computing, this might be the fitting time to take a diversified method to rising applied sciences.

Nonetheless, a few of its holdings aren’t publicly listed, and solely listed corporations are required to reveal earnings studies, which implies essential information on these personal entities is scarce, heightening uncertainty for buyers.