Are you planning to purchase a home? If sure then, you’ll have deliberate your investments and saving consistent with the “Value of the home”, you might be in search of. However, after we purchase a home, there are such a lot of different occasions/prices which comes throughout or after shopping for the home which we don’t plan nicely beforehand.

On this article, we’ll take a look at numerous issues the place we would must spend cash for. If you’re planning to purchase a model new home, this text gives you course on learn how to plan out your funds.

Listing of bills related to the acquisition of a brand new residence

1) Stamp Obligation

Stamp obligation is a tax, levied by the state authorities on each transaction of property i.e. purchase and promote, whether or not or not it’s industrial or residential property. As it’s levied by state govt. the speed varies from state to state. It ranges from 3% to 10%, relying on the slab determined by the actual state (in Maharashtra it’s 5% of market worth or agreed worth of property whichever is larger).

Stamp obligation is calculated on the upper worth of any of the next:

- The prepared reckoner price also called circle price/market worth which is predefined yearly by state authorities for each city, state or village, or

- The settlement worth of property. For instance, if the settlement worth of a property is Rs 50 lakhs and the worth in keeping with the prepared reckoner price is Rs 40 lakhs, then, the stamp obligation could be calculated on the upper worth, i.e., Rs 50 lakhs.

2) Registration value

For registering a property in your identify, the state authorities will cost you a registration payment. It varies from state to state. However a lot of the circumstances it’s 1% of Market worth of the property. Registration payment is lowered if the customer is a senior citizen or a lady. Usually, the builder will add this value after they quote the home worth to you.

3) Inside Value

While you get the brand new home, its the naked minimal home with partitions, electrical factors. It’s your job now to furnish it and enhance it as per your style. So, it’s advised to think about the price that you could be must spend on interiors. And that if you wish to do marble flooring, designer wallpapers, texture work on wall, chandelier, modular kitchen, and so on… the inside value will are inclined to go up.

4) Advance upkeep payment

After we transfer to a brand new home, and whether it is in a newly constructed challenge, often we’re requested to pay a upkeep payment for a 12 months or two by the builder. It may be a good quantity if you happen to think about advance fee, so please think about that.

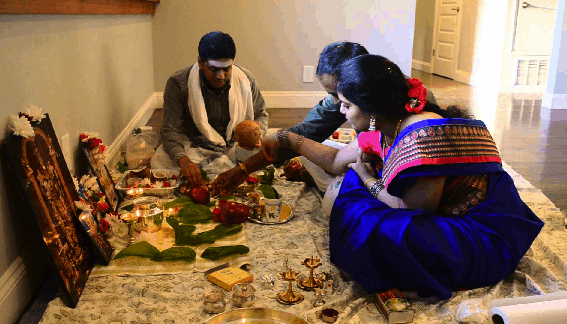

5) Home warming celebration

While you transfer to a brand new home, it’s possible you’ll really feel like celebrating it with your mates or household. Some folks might wish to have a grant celebration or some might wish to have a small celebration with shut mates & kinfolk. So, the price of home warming celebration varies from the style of individual to individual, learn how do you wish to have fun it? And accordingly, plan for that value individually.

6) Furnishings

Many individuals wish to arrange furnishings earlier than shifting to the brand new home and a few folks do it after 2 to three years of shifting in, which can be okay. So, if you wish to transfer in, to furnished new home then, you’ll require to purchase or appoint a carpenter to make your own home furnishings greatest appropriate as per your wants and necessities. It’s worthwhile to be ready for the price of furnishings reminiscent of couch, mattress, almirah, dressing desk, eating desk with chairs, shoe rack, research desk, electrical home equipment, and so on… relying in your wants.

7) Extra fees in flat

Now, these prices are subjective, it is dependent upon the wants of a household. These extra prices embody a video safety system and iron grill on the important entrance for safety functions, pigeon web in case your new home is having open balconies and mosquito web for home windows, and so on.

8) Sinking Fund

Sinking fund is a price, which you’ll must pay, to the society you can be dwelling in, yearly for a sure time period reminiscent of 5 to 10 years. These fees are paid by all the home house owners within the society, in order that society’s large upkeep value, which might be for Carry upkeep fees, Constructing portray, clubhouse renovation, parking area, and constructing renovation fees, and so on.

For instance, if the elevate of your constructing isn’t working and it requires 10 Lakhs to get repaired then it is going to be made out of the sinking fund collected by society.

9) Small home alteration

Now, this value once more is subjective, it could change from individual to individual. Many individuals wish to make some modifications within the present structure of the brand new home earlier than shifting. So, they are going to be needing more money for this. Examples of small alterations are modifications in keeping with Vastu Shastra & creating cupboard space (storage room or shelf) and so on.

10) Packers and Movers Costs

Shifting your own home stuff from one place to a different can even value a bit, particularly if its an inter-city transfer. Do think about this value as nicely when you’re shopping for a brand new home.

Conclusion

For many people shopping for a home is like reaching an enormous milestone in our lives. After we plan our financial savings and investments in keeping with, not just for the price of the property however, additionally for different extra bills to be incurred, then we could have extra readability & keep away from the burden of so many bills earlier than shopping for our dream residence.

And I might say round 10 – 20% of your own home value, needs to be saved apart to fulfill all these bills. eg. in case you are planning to purchase a home of Rs. 50 Lac then extra 5 – 10 Lac must be considered.

If anybody in your circle of family and friends is planning to purchase a home, allow them to learn about these extra prices. And in addition, if I’ve missed some factors so please add within the remark part.