Synopsis– Wish to know what’s delivering larger returns proper now? It’s not gold! We’re diving deep into silver’s huge value surge, breaking down the important thing components driving its outperformance, and the most effective methods so that you can bounce into this steel’s rally.

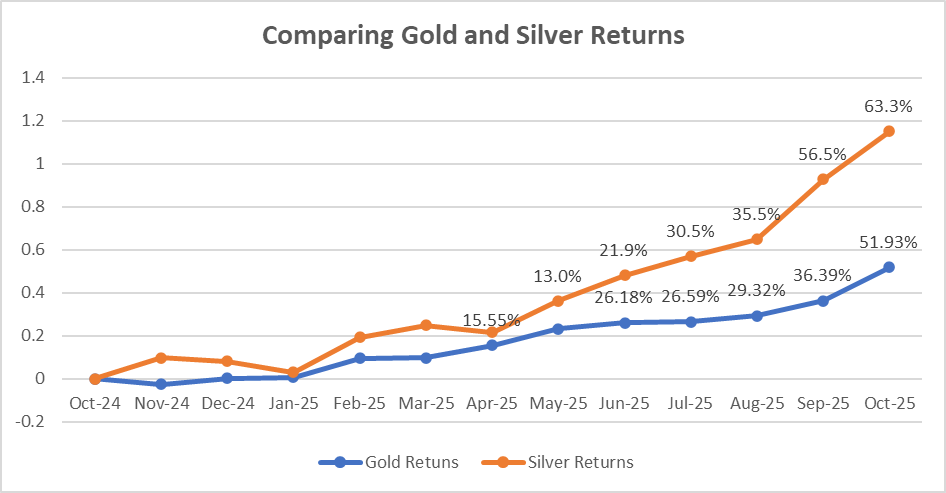

In the event you’ve been watching the markets, you realize that gold and silver are on an absolute tear. The dear metals sector is on hearth. As of immediately, gold has rocketed previous ₹1,24,000 per 10 grams, delivering a shocking 50.1% achieve to date this yr (2025). Silver has truly performed higher! It’s at present up an unimaginable 63.4%, crossing ₹1,67,000 per kilogram. That’s proper, So Why is the worth of silver spiking so dramatically, and what’s the neatest option to put money into it proper now?

Value comparability

| Metallic | 1st October 2024 | 1st October 2025 |

| Gold 22k ( per 10 gram) | ₹71,650 | ₹1,08,020 |

| Silver ( per 10 gram) | ₹910 | ₹ 1,484 |

As you possibly can see, the return on silver is a jaw-dropping over 63%, handily beating gold’s still-fantastic over 50%

Cause for Enhance in Silver Value

- Industrial Demand: Not like gold, silver is a vital industrial steel. Demand from Electrical Autos (EVs), photo voltaic panels, and common electronics (the “inexperienced expertise” motion) is surging so quick that silver mining merely can’t sustain. Provide deficit!

- A Provide Chain Bottleneck: Silver is a persistent provide deficit in silver manufacturing, largely as a result of silver is usually produced as a byproduct of different base metals mining, limiting its availability

- Geopolitical Stress: Financial uncertainty has attracted buyers to silver due to geopolitical points as a retailer of worth.

- Rate of interest cuts by the U.S. The Federal Reserve has boosted demand for non-yielding metals like silver.

- Native Foreign money Woes: The weakening of the Indian Rupee in opposition to the U.S. Greenback makes imported commodities, together with silver dearer within the native market, driving up the worth you see on the jewelers.

- Momentum and Hypothesis: Traders are more and more utilizing silver ETFs and bodily silver to diversify their portfolios. The steel’s well-known volatility (it strikes extra sharply than gold) is attracting momentum merchants searching for huge, quick positive aspects.

All these highly effective components mixed are what have pushed silver costs up by over 63% in only one yr.

Additionally learn: Gold Costs on the Rise: Can 10g Gold Attain ₹2 Lakh in Subsequent 5 Years?

The Smartest Methods to Spend money on Silver

1. Silver Trade Traded Funds (ETFs):

- Why it really works: That is the only and most cost-effective path, particularly for Indian buyers. You get wonderful liquidity, low expense ratios, and also you utterly skip the concern about storage or whether or not your bar is 99.9% pure.

- The Bonus: They help you make investments systematically, like doing a month-to-month SIP, making diversification extremely simple. They observe the home silver value and assure excessive purity.

2. Digital Silver:

- Platforms like eBullion allow you to purchase digital silver. You should purchase tiny quantities, take pleasure in prompt liquidity, and profit from assured excessive purity (99.99%), all whereas the steel sits securely in a vault.

3. Bodily Silver:

- Shopping for bodily issues like cash, bars, and even jewellery. The standard option to maintain tangible wealth, however bear in mind the trade-offs storage, insurance coverage, and verifying purity whenever you purchase or promote.

4. Silver Mutual Funds:

- That is an oblique option to make investments, the place a fund supervisor focuses on property associated to the silver market. It’s excellent for individuals who need publicity to the steel’s efficiency with none of the bodily or purity considerations.

Gold or Silver; Which One is Higher?

| Parameters | Gold | Silver |

| Value Stability | Extra steady, much less risky | Extra Unstable and value swings giant |

| Common Annual Return | Round 10.6% | Round 7.6% traditionally |

| Value Fluctuations | Decrease- 14.7% | Greater- 26.6% |

| Demand Driver | Jewellery,secure haven, reserves | Jewellery+ vital industrial use( EVs, electronics, photo voltaic) |

| Funding Goal | Stability, inflation hedge, secure haven | Progress potential, financial restoration performs |

| Industrial Publicity | Low | Excessive |

| Portfolio Function | Highly effective diversifier, regular retailer of worth | Extra dynamic, riskier progress asset |

Gold continues to be the muse of any portfolio, your key anchor for preservation and stability. Silver is the dynamo progress engine, with high-octane promise for the investor courageous sufficient to surf the tidal waves. The actually good transfer isn’t to go for one however to stability the opposite. By using the tried-and-true security of gold and the robust potential for achieve of silver, you’ll have a portfolio that’s robust for unhealthy instances and good for good instances.

Conclusion

Silver has surged effectively forward of gold by advantage of pure returns within the span of just one yr. That win is pushed by a triple risk consisting of exploding industrial demand, provide bottlenecks, in addition to plain previous market momentum.

Written by Yatheendra N