Be a part of Our Telegram channel to remain updated on breaking information protection

The Solana value has surged 1.5% within the final 24 hours to commerce at $207.83 on a 36% lower in day by day buying and selling quantity to $5.64 billion.

The drop within the SOL value comes as Solana makes headlines within the cryptocurrency world because it outpaces each Bitcoin and Ethereum in current efficiency, stirring pleasure about its value outlook.

In keeping with Arca CIO Jeff Dorman, Solana’s sturdy fundamentals, rising demand, and institutional curiosity recommend it might emulate Ethereum’s nearly 200% surge since April.

📊 INSIGHT: #Solana is up 33% since early August, outperforming #Bitcoin. Arca’s Jeff Dorman says $SOL is “the obvious lengthy proper now,” doubtlessly set to reflect ETH’s ~200% rally.

Explanation why @solana is bullish proper now 👇

🔹 Potential $2.6B treasury inflows

🔹 Pending… pic.twitter.com/d9P3R3yeRq— CryptosRus (@CryptosR_Us) September 3, 2025

Solana has surged 22% previously month and about 33% since August, dramatically outperforming rivals Bitcoin and Ethereum over the identical interval.

Dorman says SOL may gain advantage from as much as $2.6 billion in recent treasury inflows, with a number of digital asset treasuries elevating funds set to channel important funding into Solana over the subsequent month.

🔥 #Solana is outperforming #Bitcoin; it is probably poised to comply with #Ether‘s current 200% rally.

📌 #SOL is the obvious lengthy place proper now, pushed by demand for as much as $2.6 billion in #crypto autos over the subsequent month, in line with #JeffDorman, chief funding… pic.twitter.com/qz0ZvfjLaU

— The Bit Bunker (@NEWLINEDIGITAL1) September 3, 2025

If these inflows materialise, the SOL value could react strongly, particularly as a result of Solana’s market capitalisation is just one-fifth that of Ethereum, making it extra conscious of new demand. In July, the primary U.S.-listed Solana ETF launched, regardless that it was futures-based.

Prime asset managers like VanEck and Constancy are ready for spot Solana ETF approval, which might additional gas demand. Galaxy Digital additionally lately tokenized shares on the Solana blockchain, and the Alpenglow improve is poised to enhance transaction speeds.

On-Chain Indicators: Monitoring Solana Worth Demand

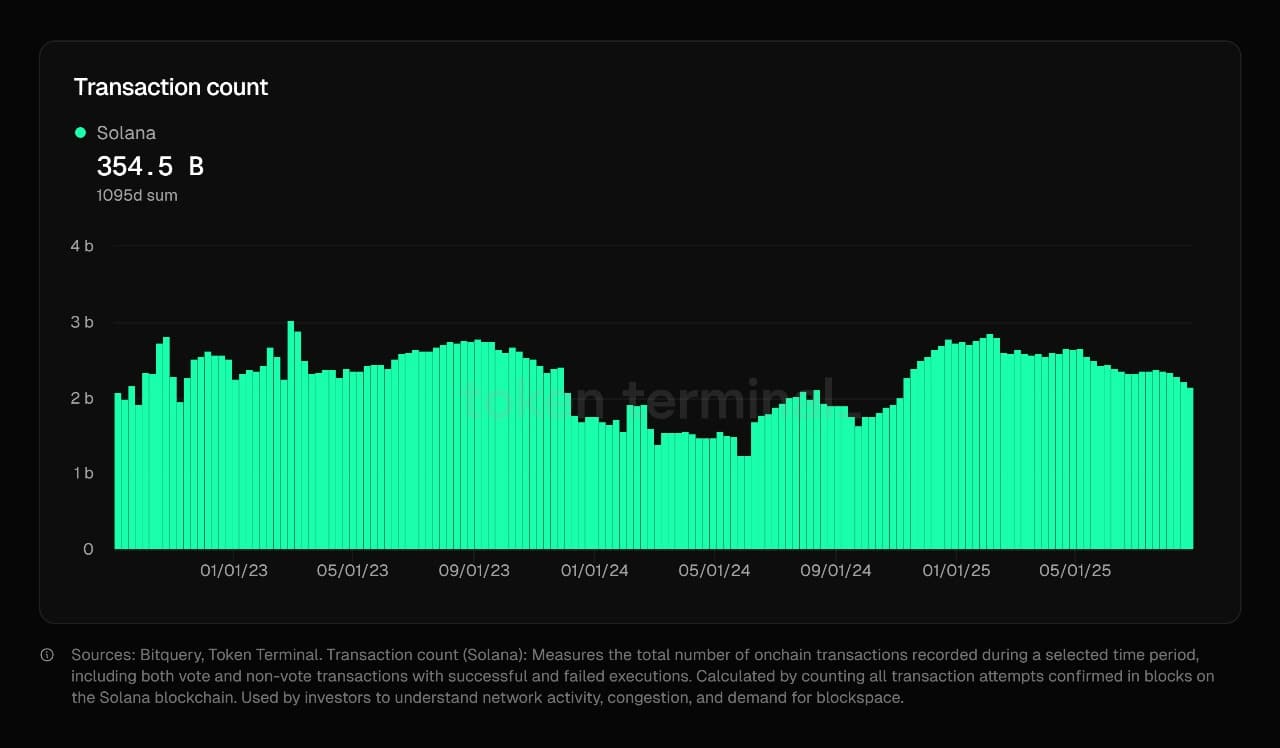

On-chain metrics present rising actual community exercise and robust accumulation. Pockets addresses and normal transaction exercise on the Solana blockchain have elevated considerably, demonstrating lively participation and engagement by customers.

Solana Transaction Rely Supply: Token Terminal

Extra holders are shifting cash off exchanges and into wallets, signalling long-term confidence and decreasing quick sell-off dangers. Institutional flows are additionally already beginning to present up on-chain.

The community’s staking participation is growing, additional underlining sturdy neighborhood and investor perception in Solana’s future. With treasury merchandise coming on-line, these metrics could surge even larger, supporting expectations for the coin value.

With a rising value and earnings, on-chain indicators recommend the potential for profit-taking within the near-term, which might briefly gradual Solana’s momentum. Regardless of these dangers, the general on-chain story helps a bullish outlook, particularly if new funds arrive as anticipated.

Solana Worth Holds Key Assist Ranges

Solana value is holding regular close to $207.95, staying above essential assist at $187.19. This space is the place the 50-day easy shifting common (SMA) sits, making it a key degree for merchants. The coin can be effectively above the long-term 200-day SMA at $157.53, which helps the concept the market continues to be leaning constructive.

SOLUSDT Evaluation Supply: Tradingview

Wanting on the value chart, Solana has been making larger highs and better lows since early August. This implies the value retains forming new peaks and rebounds, displaying that patrons are in management and the uptrend is robust.

A “Golden Cross” occurred when the 50-day SMA crossed above the 200-day SMA. That is usually seen as a superb signal for extra positive factors. The $187.19 and $157.53 ranges assist shield the draw back, giving house for small dips with out panicking the market.

Proper now, the closest resistance is at $218. If Solana’s value breaks above this degree, it might shortly transfer up in direction of $230 and even $252 if sufficient patrons enter the market.

Technical indicators agree with this constructive view. The Relative Power Index (RSI) is at 57.42, displaying that the value is shifting up, however isn’t but too excessive to fret a few sharp drop. The MACD indicator can be pointing up, which implies patrons are in cost. The Common Directional Index (ADX) is at 26.99, displaying the uptrend is getting stronger, however isn’t overdone but.

Every time the value dips near $187–$190, new patrons seem and value shortly bounces again up. This tells us that patrons are watching this space intently and belief that the development will keep sturdy.

If present momentum holds, Solana might break above $218 and hold climbing within the subsequent couple of weeks. But when the value falls beneath $187.19, it would head right down to retest decrease helps, which might trigger some short-term promoting earlier than new patrons step in.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection