(A) Concerning the Aryabhata International Belongings Fund

The Aryabhata International Asset Fund is a part of the Aryabhata International Belongings Funds ICAV, an Irish collective funding automobile regulated by the Central Financial institution of Eire beneath UCITS guidelines. Moreover, the Aryabhata India Fund focuses on Indian equities, having a various portfolio that features monetary companies, know-how, and industrials. The fund, managed by expert professionals comparable to Sunil Singhania, goals to offer capital appreciation in addition to revenue. It’s out there to each retail and institutional traders and affords quite a lot of share courses with options comparable to revenue reinvestment and distribution.

(B) What are International Asset Funds?

International asset funds enable international residents to spend money on markets of different international locations, comparable to India, utilizing dollar-denominated investments. These funds are sometimes out there internationally and settle for investments in {dollars} or different foreign exchange. Buyers don’t want to fret about foreign money conversion, because the fund manages the method of changing {dollars} into Indian rupees to spend money on Indian markets. Any returns or revenue generated from these investments are transformed again into {dollars} and credited to the investor’s account, making your entire course of easy and handy.

(C) Primary Particulars

| Fund Construction | An open-ended Article 8 UCITS sub-fund of Aryabhata International Belongings Funds ICAV |

| Launch & Begin Date | 03-Aug-2023 |

| Reference foreign money | USD, GBP, EURO, CHF, JPY, AUD, SGD, AED |

| Sort | Open-ended |

| AUM | $ 78.6 Mn (As on 29 Nov 2024) |

| Accessible at NAV of | $ 14.9 (As on 29 Nov 2024) |

(D) Funding Technique

(E) Classification Portfolio of the fund

(i) Portfolio Combine by Market Cap Measurement

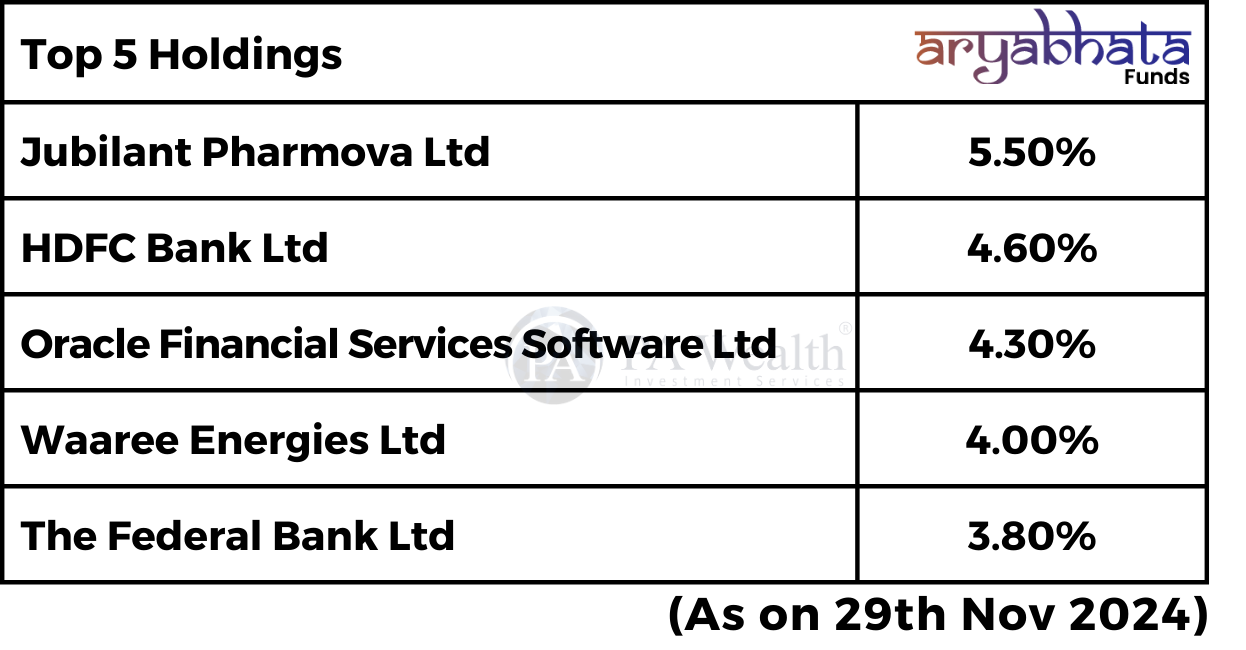

(ii) High 5 Holdings of the fund

(iii) High 5 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Aryabhata International Belongings Fund – Funding Particulars

| Aryabhata International Asset Fund | |

|---|---|

| Software Quantity for contemporary Subscription (Lumpsum) | $150K USD |

| Exit load | No |

| Lock In | No |

| Expense Ratio | 1.5% p.a. (As on 29 Nov 2024) |

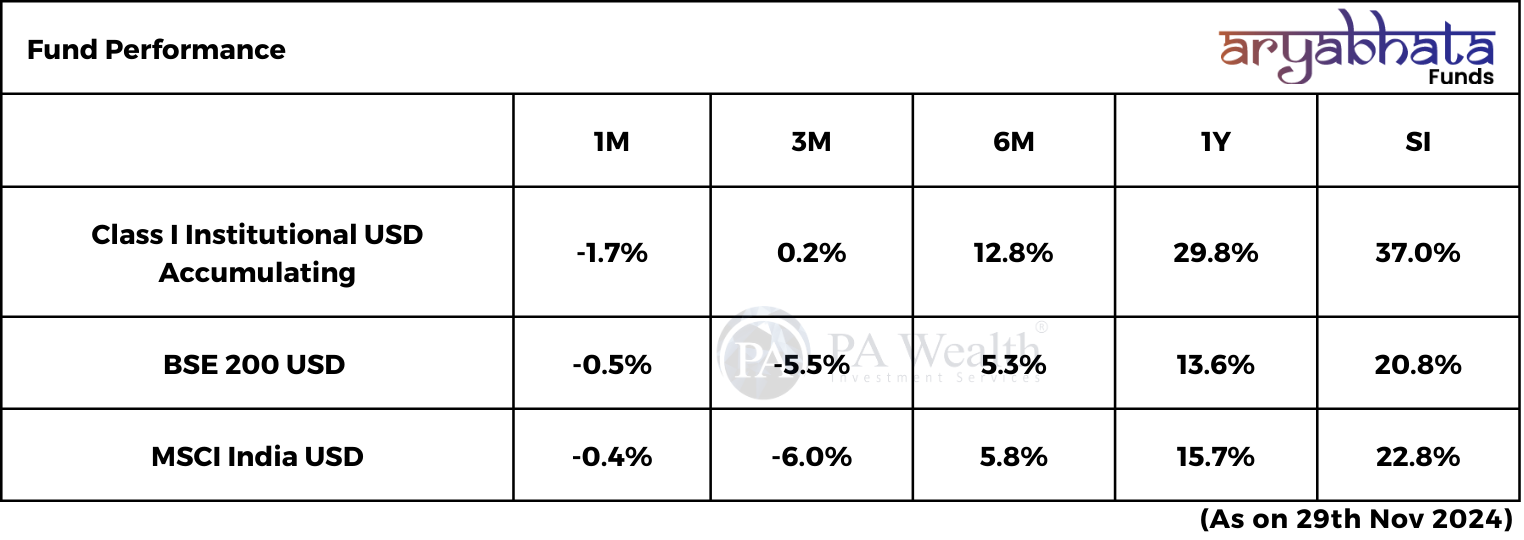

(F) Returns Generated By Aryabhata International Belongings Fund

(G) Danger Elements

(H) Funding Philosophy of Aryabhata International Belongings Fund

- Worth-conscious long-only type of investing in Indian equities having sturdy enterprise fashions and earnings progress.

- Aryabhata India Fund goals to realize returns by way of capital appreciation and/or revenue from fairness holdings of Indian corporations.

(I) Taxability on earnings

Taxation

Taxation for abroad funds depends upon the investor’s house nation, with relevant charges primarily based on their home tax legal guidelines.

Drop us your question at – information@pawealth.in or Go to pawealth.in

References: valueresearchonline.com, Business’s Publications, Information Publications, Mutual Fund Firm.

Disclaimer: The report solely represents private opinions and views of the creator. No a part of the report ought to be thought of as suggestion for purchasing/promoting any inventory. Thus, the report & references talked about are just for the knowledge of the readers concerning the business said.

Most profitable inventory advisors in India | Ludhiana Inventory Market Suggestions | Inventory Market Consultants in Ludhiana | High inventory advisors in India | Greatest Inventory Advisors in Gurugram | Funding Consultants in Ludhiana | High Inventory Brokers in Gurugram | Greatest inventory advisors in India | Ludhiana Inventory Advisors SEBI | Inventory Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | High inventory advisors in India | High inventory advisory companies in India | Greatest Inventory Advisors in Bangalore