Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum ETFs (exchange-traded funds) posted their highest web each day outflows in a month, extending their damaging streak to 5 days.

In accordance with information from Farside Buyers, $446.8 million left the funds’ reserves on Sept. 5, the biggest web each day outflow since Aug. 4, when $465.1 million flowed out of the merchandise.

BlackRock’s Spot Ethereum ETF Takes The Largest Blow

The ETH ETF that noticed the biggest web each day outflow was BlackRock’s ETHA. Buyers withdrew $309.9 million from the ETF on Sept. 5. It had chalked up an influx of $148.8 million a day earlier.

Constancy’s FETH, 21Shares’ TETH, and each Grayscale’s ETHE and ETH funds additionally recorded outflows.

Grayscale’s ETHE suffered the second-biggest each day outflow, with $51.8 million exiting the fund, whereas the asset supervisor’s ETH product noticed $32.6 million go away its reserves.

In the meantime, Constancy’s FETH recorded $37.8 million in outflows and traders pulled $14.7 million from 21Shares’ TETH. The remaining 4 funds recorded no new flows for the day.

Over the previous 5 days mixed, $952.2 million has left the funds.

Buyers Additionally Retreat From Bitcoin Funds

BTC ETFs are additionally bleeding, racking up their second consecutive day of web each day outflow after shedding $160.1 million yesterday. BlackRock’s IBIT, Bitwise’s BITB, and Grayscale’s GBTC all recorded outflows, whereas the rest recorded no information flows on the day.

𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗘𝗧𝗙 𝗙𝗹𝗼𝘄 (𝗨𝗦$ 𝗺𝗶𝗹𝗹𝗶𝗼𝗻) – 2025-09-05

TOTAL NET FLOW: -160.1

IBIT: -63.2

FBTC: 0

BITB: -49.6

ARKB: 0

BTCO: 0

EZBC: 0

BRRR: 0

HODL: 0

BTCW: 0

GBTC: -47.3

BTC: 0For all the information & disclaimers go to:https://t.co/Wg6Qpn0Pqw

— Farside Buyers (@FarsideUK) September 6, 2025

A lot of the damaging flows got here from IBIT, with $63.2 million leaving the fund, whereas BITB and GBTC noticed $49.6 million and $47.3 million in outflows, respectively.

On Sept. 4, $222.9 million had exited the Bitcoin merchandise collectively.

Investor Sentiment Stays Impartial

Within the final 24 hours, the full crypto market cap dropped by a fraction of a p.c with nearly all the prime ten cryptos recording losses. Solely Binance Coin (BNB), Dogecoin (DOGE) and Cardano (ADA) managed positive aspects.

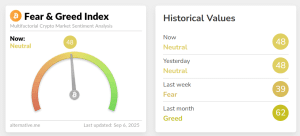

Regardless of capital flowing out of Bitcoin and Ethereum ETFs, and the market present process a minor pullback, crypto investor sentiment stays impartial, in accordance to the Crypto Worry and Greed Index.

Crypto Worry and Greed Index (Supply: different.me)

The “Impartial” studying of 48 is an enchancment from every week earlier, when the index dipped to a “Worry” degree of 39. The index has although slumped from a “Greed” rating of 62 a month in the past.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection