Be a part of Our Telegram channel to remain updated on breaking information protection

Funds large Stripe is pushing crypto nearer to mainstream enterprise by letting US firms settle for stablecoin subscriptions in USDC on Base and Polygon wallets, settled robotically in fiat.

The characteristic is aimed on the 30% of Stripe shoppers that depend on subscriptions and recurring income, letting clients pay with crypto whereas companies handle each fiat and crypto in a single dashboard, the corporate mentioned in an Oct. 14 weblog submit.

Stripe mentioned the stablecoin service, initially obtainable solely in non-public preview, makes it quicker, cheaper, and extra dependable for startups to obtain funds from worldwide clients.

The transfer may speed up on a regular basis crypto adoption whereas pressuring conventional fee processors.

“Stablecoins have served as a essential software for the speedy world growth of a few of the fastest-growing firms right this moment,” Stripe mentioned.

USDC is presently the second-largest stablecoin with a market capitalization of $76.26 billion, based on CoinMarketCap.

Stripe Goals To Capitalize On “Speedy International Growth” Of Startups

The funds large mentioned that the highest 20 AI firms on Stripe, 19 of that are primarily based within the US, draw 60% of their income from exterior of the nation.

However cross-border transactions are “costly to just accept, gradual to settle, and sometimes fail outright,” Stripe mentioned.

It mentioned that’s a key purpose why companies are beginning to transition to stablecoin funds, noting that AI firm Shadeform has seen roughly 20% of its fee quantity shift to stablecoins.

One of many obstacles to enabling recurring funds on the blockchain is the truth that the pockets proprietor has to manually “signal” every transaction, however Stripe mentioned it has addressed this limitation with a brand new modern good contract.

It lets customers save their pockets as a fee technique and authorize it to ship funds with out the necessity to re-sign every transaction. Prospects will be capable to try this with over 400 supported wallets.

Stripe Strikes Into Stablecoins After GENIUS Act Provides Regulatory Readability

In October final yr, Stripe acquired the stablecoin infrastructure agency Bridge in a $1.1 billion deal to combine blockchain-based funds into its world service provider community.

Bridge not too long ago filed an utility with the Workplace of the Comptroller of the Foreign money (OCC) to prepare a nationwide belief financial institution.

The proposed Bridge Nationwide Belief Financial institution would allow Stripe to subject, redeem, and custody stablecoins inside a federally regulated framework.

In line with Bridge co-founder Zack Abrams, the nationwide constitution would allow Bridge “to tokenize trillions of {dollars}” if authorized.

Right now, @Stablecoin submitted its utility for organizing a nationwide belief financial institution to the Workplace of the Comptroller of the Foreign money (OCC). The constitution would permit Bridge to function beneath a unified federal framework in step with the GENIUS Act.

By this financial institution, we’ll present:…

— Zach (@zcabrams) October 14, 2025

The appliance for a nationwide constitution additionally comes after US President Donald Trump signed the GENIUS Act into legislation in July this yr. The Act establishes a federal regulatory framework for “funds stablecoins” within the US, giving long-awaited regulatory readability.

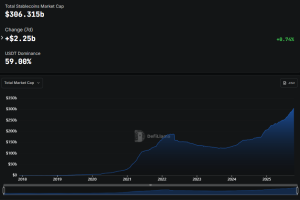

That has led to a growth within the stablecoin market, with the sector’s capitalization not too long ago hovering previous the $300 billion mark.

Stablecoin market cap (Supply: DefiLlama)

Knowledge from DefiLlama reveals that the stablecoin market cap stands at round $306.315 billion after seeing $2.25 billion in development over the previous seven days.

Stripe’s transfer to use for OCC oversight is the most recent in a collection of comparable strikes made by crypto companies trying to receive their very own nationwide charters.

The identical month that the GENIUS Act was signed into legislation, USDC issuer Circle filed for a nationwide belief license to supervise reserves for its stablecoin beneath OCC oversight.

Shortly thereafter, XRP guardian firm Ripple, which launched its RLUSD stablecoin in December 2024, joined the queue with its personal OCC constitution for each federal and state oversight.

Paxos then adopted a month later. Earlier this month, US crypto change Coinbase additionally introduced that it had utilized for a Nationwide Belief Firm Constitution.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection