Be a part of Our Telegram channel to remain updated on breaking information protection

The Sui worth edged down a fraction of a share during the last 24 hours to commerce at $2.46 as of 4:00 a.m. EST on buying and selling quantity that plunged 21% to $843 million.

That’s at the same time as 21Shares up to date its Sui exchange-traded fund (ETF) software with the US Securities and Trade Fee (SEC).

The agency filed a second amended S-1 for its spot Sui ETF software after the market shut on Oct. 23. The issuer up to date its Sui ETF with essential info, however there isn’t any point out of the ticker and costs.

$SUI ETF Replace: @21shares $SUI Spot ETF S-1 Modification #2 filed with #SEC after market shut at the moment.@SuiNetwork @21shareshttps://t.co/U9NJcdqnDm pic.twitter.com/fxNKfG3ztz

— MartyParty (@martypartymusic) October 23, 2025

In the meantime, the submitting exhibits that 21Shares US LLC has entered right into a staking providers settlement with Coinbase Crypto Providers.

21Shares up to date the submitting by mentioning Nasdaq because the change for itemizing and buying and selling shares. The issuer added that the Financial institution of New York Mellon would be the ETF’s money custodian.

With the ETF poised to open a broader marketplace for Sui merchandise, might the token’s worth rise considerably?

SUI Value Poised For A Rebound Above Key Resistance Ranges

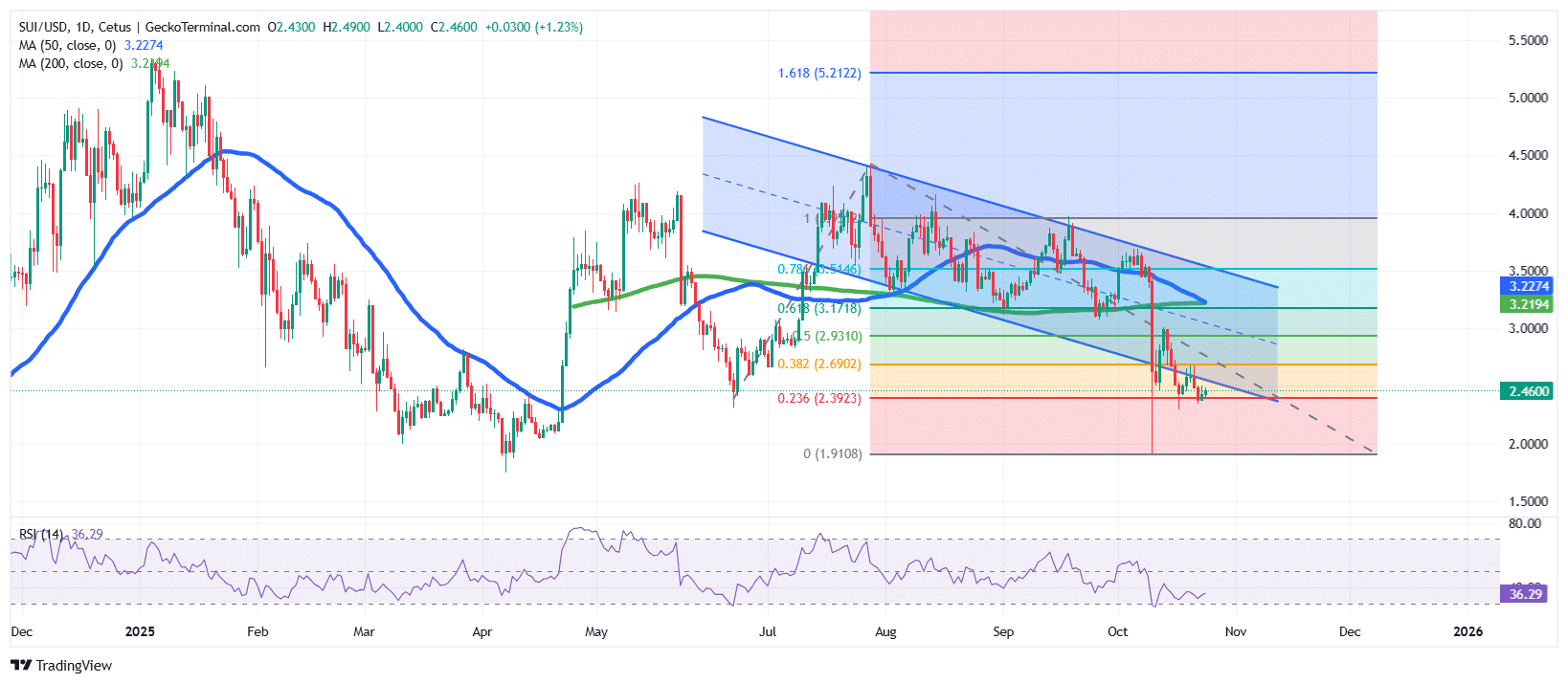

The SUI worth has been in a protracted downtrend since mid-July, persistently buying and selling inside a falling channel sample that has saved the token below intense bearish strain.

After reaching highs close to $5.21 earlier within the 12 months, the Sui worth progressively retraced, testing a number of Fibonacci retracement ranges earlier than settling close to $2.40, the place it at the moment hovers.

The downward motion has just lately discovered help on the 0.236 Fibonacci stage at $2.39, a key technical zone that has helped stabilize the SUI worth after an prolonged interval of promoting.

In the meantime, the 50-day Easy Transferring Common (SMA) sits at $3.22, which intently aligned with the 200-day SMA ($3.22). This overlap kinds a vital confluence resistance zone that SUI should reclaim as help to substantiate a shift from bearish to bullish momentum.

Moreover, the Relative Power Index (RSI) is round 36.29, indicating it’s close to oversold territory. This studying suggests bearish momentum could also be slowing, and patrons might quickly step in to drive a short-term bounce.

A push of the RSI above the 40–45 zone would additional verify strengthening shopping for curiosity and a attainable pattern reversal try.

SUI Value Prediction: Bulls Eye Restoration Towards $3.17 Resistance

In accordance with the present SUI/USD chart construction, the Sui worth is making an attempt to rebound from the decrease boundary of its falling channel.

The rapid resistance lies at $2.69, aligned with the 0.382 Fibonacci retracement, adopted by $2.93 and $3.17, representing the 0.5 and 0.618 Fibonacci retracement ranges, respectively. These ranges, notably the $3.17 area, coincide with each the 50-day and 200-day SMAs, forming a serious resistance cluster that can possible decide the following directional transfer.

If bulls push the worth of Sui above $3.20, it might set off a sustained restoration towards $3.54 (0.786 Fib) and probably greater towards the mid-channel area.

Nonetheless, failure to keep up help at $2.39 might expose SUI to additional draw back danger, with the following key help goal close to $2.00–$1.91, aligning with the decrease boundary of the Fibonacci retracement zone.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection