Picture supply: Getty Photographs

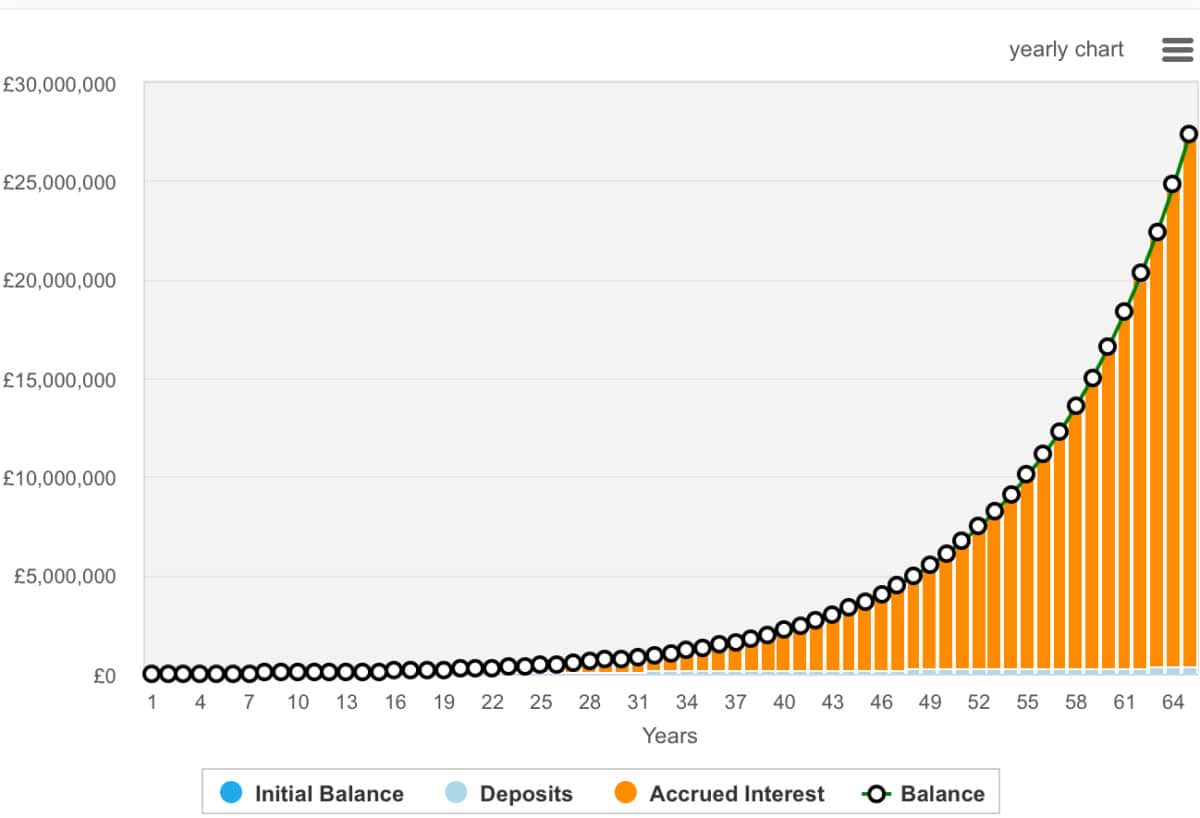

It sounds implausible. A £27m Self-Invested Private Pension (SIPP) from just some thousand kilos a 12 months. However with a protracted sufficient runway and the facility of compounding, it turns into a mathematical risk.

A SIPP opened at start and topped up persistently may, in concept, accumulate a fortune over time. Utilizing HMRC’s most youngster SIPP contribution of £3,600 a 12 months (together with tax aid), the numbers stack up compellingly if invested properly from day one.

Assuming a mean annual return of 10% — reflective of US market returns over the previous decade — the stability grows modestly at first. By age 10, the pot may stand round £68,000. However the compounding impact gathers tempo. By 25, it may high £450,000. By 40, it might cross £2m.

Hold going, and at age 65 — with out growing contributions past inflation — the stability may exceed £27m. The key? Time, tax aid, and long-term publicity to progress property like equities. This calculation additionally features a 1% improve in annual contributions annually to account for doubtlessly bigger contributions sooner or later.

After all, future returns aren’t assured, and inflation would eat into buying energy. UK buyers can also earn extra modest returns with UK-focused investments and poor funding choices can see us lose cash. However even beneath extra conservative assumptions, a toddler’s SIPP may grow to be a significant monetary asset later in life.

Dad and mom, grandparents, or guardians funding early SIPP contributions may give a toddler a unprecedented head begin. And it’s not simply monetary, however contributes to an understanding the worth of investing early and infrequently. This calculation additionally includes the kid occurring to make a contribution themselves as they begin working. It requires a long-term dedication.

It’s not the flashiest technique. It doesn’t need to contain hefty bets on tech disrupters or shorting overvalued shares. It’s merely about beginning early and letting compound returns do the heavy lifting.

The place to speculate?

Anybody opening a SIPP for a kid or beloved one has a number of choices relating to investing. A easy, hands-off strategy may contain low-cost index-tracking funds or funding trusts. These supply prompt diversification and a long-term progress orientation, making them ideally suited for compounding over many years.

Alternatively, extra lively buyers may choose to construct a portfolio one or two shares at a time. One firm I’m watching intently proper now’s Synectics (LSE:SNX). It’s an AIM-listed specialist in superior safety and surveillance programs.

At simply over £53m in market-cap, Synectics trades on simply 12.2 occasions ahead earnings, falling to 9.5 occasions by 2027. Adjusting for its web money place of £12.1m, that offers a price-to-earnings-to-growth (PEG) ratio of 0.72. This suggests the shares may very well be considerably undervalued primarily based on progress forecasts.

Latest interim outcomes confirmed income up 35%, working revenue up 48%, and earnings per share up 59%. Its rising order guide, worldwide enlargement, and debt-free stability sheet are all actually optimistic function.

After all, as a small-cap, it carries extra dangers. This together with contract focus and macroeconomic sensitivity in addition to a big unfold between shopping for and promoting costs. However for long-term buyers, Synectics may be price a more in-depth look. I’ve added it to my watchlist.