Picture supply: Getty Pictures

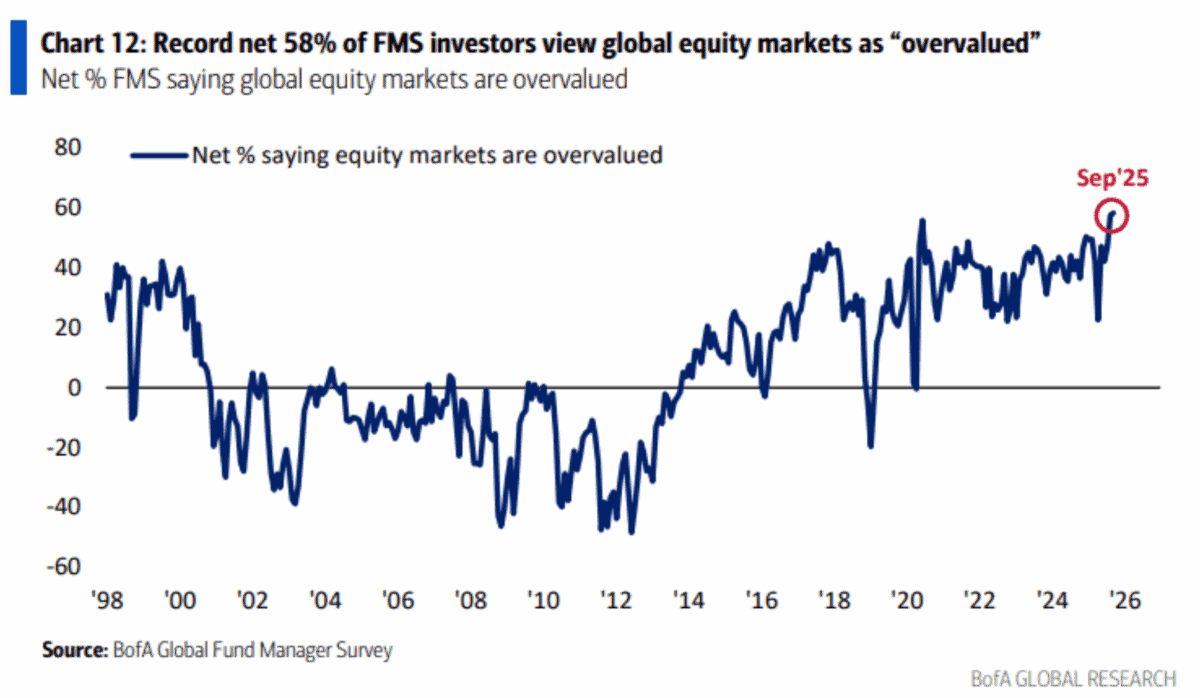

In line with the newest knowledge from Financial institution of America, most hedge fund managers suppose the worldwide inventory market is overvalued proper now. And it’s been a very long time since they felt this strongly about it.

Not all shares are the identical, although, and enormous components of the market don’t look costly in the meanwhile. However the important thing for buyers is realizing the place to look.

Crowded trades

The key funding theme of the 12 months to date has been synthetic intelligence (AI). And the obvious beneficiaries of this have been the gathering of shares often called the ‘Magnificent Seven.’

Through the second quarter of this 12 months, the Magnificent Seven collectively grew earnings at 26.6%. Against this, the remainder of the S&P 500 managed earnings progress of seven.4%.

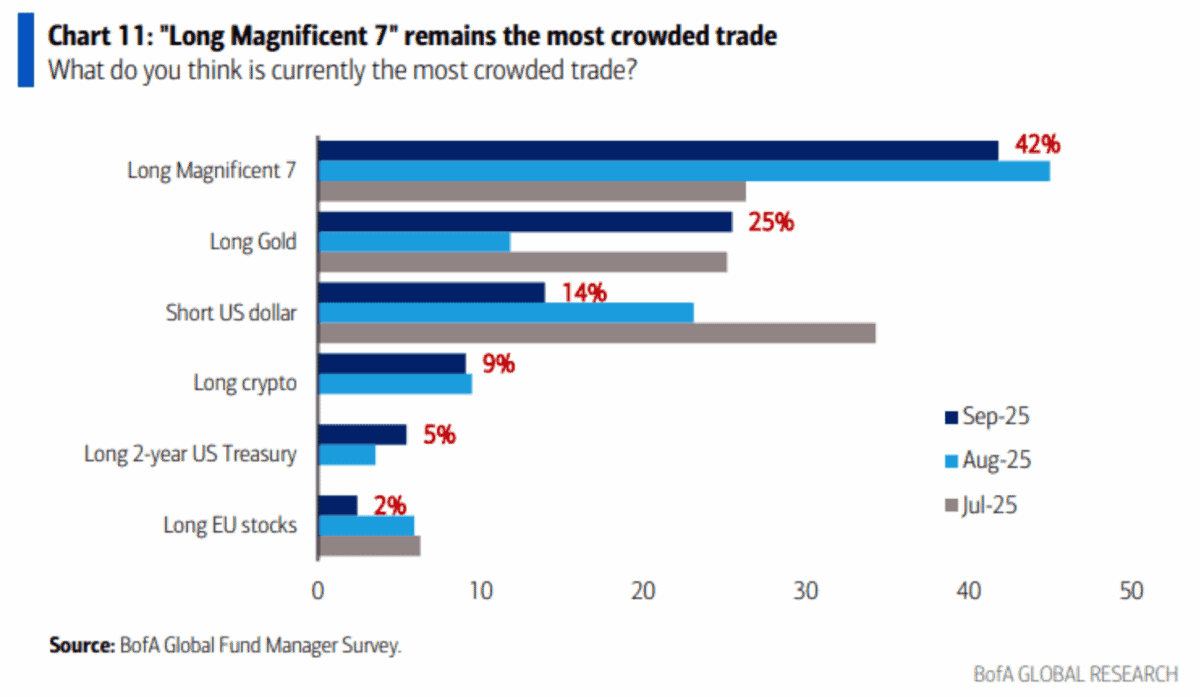

That form of progress – particularly relative to the broader market – has naturally been catching the eye of buyers. However fund managers are beginning to suppose the commerce is getting crowded.

When buyers begin doing the identical factor, issues can get dangerous. It might probably result in sudden reversions within the quick time period, however there are additionally long-term points to think about.

Warren Buffett

Relating to searching for missed alternatives, Warren Buffett is likely one of the greatest within the enterprise. And the Berkshire Hathaway CEO has some recommendation for buyers seeking to do the identical: “The longer term is rarely clear – you pay a really excessive worth within the inventory marketplace for a cheery consensus. Uncertainty, really, is the pal of the client of long-term values.”

In different phrases, buyers searching for long-term returns must be cautious of crowded trades. As a substitute, they need to search for alternatives in locations the place others are much less optimistic.

There are just a few of those that spring to thoughts. However by way of the S&P 500, there’s one specifically that I believe is value being attentive to in the meanwhile.

Prescription drugs

Danaher (NYSE:DHR) shares are down 30% within the final 12 months. And the US administration’s shift in healthcare coverage away from treatment is a danger that buyers ought to take critically.

Gross sales have been falling because of this, however the agency is beginning to present indicators of restoration. Earnings per share have are available forward of expectations in each the primary two quarters of this 12 months.

Regardless of a difficult setting, Danaher nonetheless has a robust aggressive place, which relies on operational effectivity and good acquisitions. And it is a promising long-term signal.

Supply: TradingView

Proper now, although, the inventory is buying and selling at an unusually low cost degree on a price-to-book (P/B) foundation. Because of this, I believe it’s properly value contemplating as a possible shopping for alternative.

Discovering alternatives

I believe there are at all times shopping for alternatives to be discovered someplace within the inventory market. However as Warren Buffett factors out, these are often not within the locations that everybody else is wanting.

The rise of AI has resulted in real progress for the businesses often called the Magnificent Seven. That commerce, nevertheless, is beginning to look crowded and that’s one thing to be cautious of proper now.

On the opposite facet, issues look much less constructive within the healthcare house. However with Danaher beginning to present some constructive indicators after a tough few years, I believe that is the place buyers ought to look.