Picture supply: Getty Pictures

Demand for Barclays (LSE:BARC) shares hasn’t been dampened by alarm bells ringing for the UK financial system and uncertainty within the US.

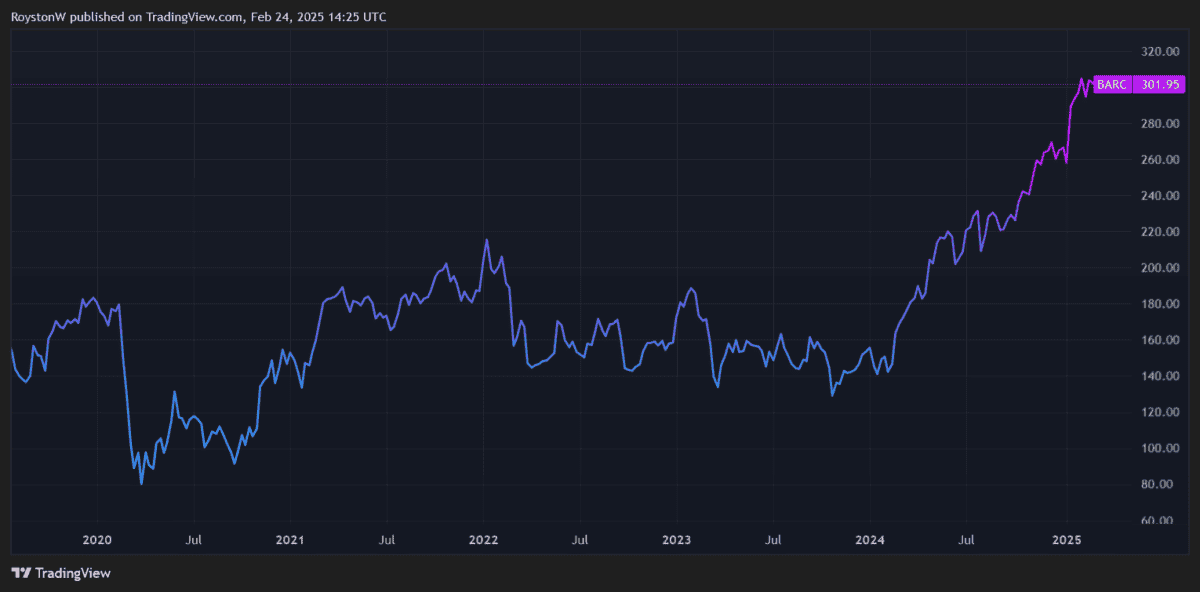

At 302p per share, the Barclays share worth is up 14% for the reason that begin of 2025. This takes complete beneficial properties for the previous 12 months to a whopping 83%.

Metropolis analysts don’t consider the FTSE 100‘s bull run is completed but both. They’re tipping extra double-digit will increase over the subsequent 12 months.

Ought to I take into account snapping up Barclays shares?

11% extra to go?

First, it’s price noting that there are some giant variances throughout brokers’ present forecasts.

One notably bullish analyst thinks Barclays’ share worth will rise an additional 29% over the subsequent 12 months, to 390p. On the different finish of the dimensions, one pessimistic forecaster has set a 12-month worth goal of 230p, down 24% from present ranges.

Having mentioned this, the general image painted by Metropolis brokers is fairly upbeat. The typical worth goal amongst 17 brokers is 335.20p per share. That represents an 11% premium to at the moment’s worth.

Low cost on paper

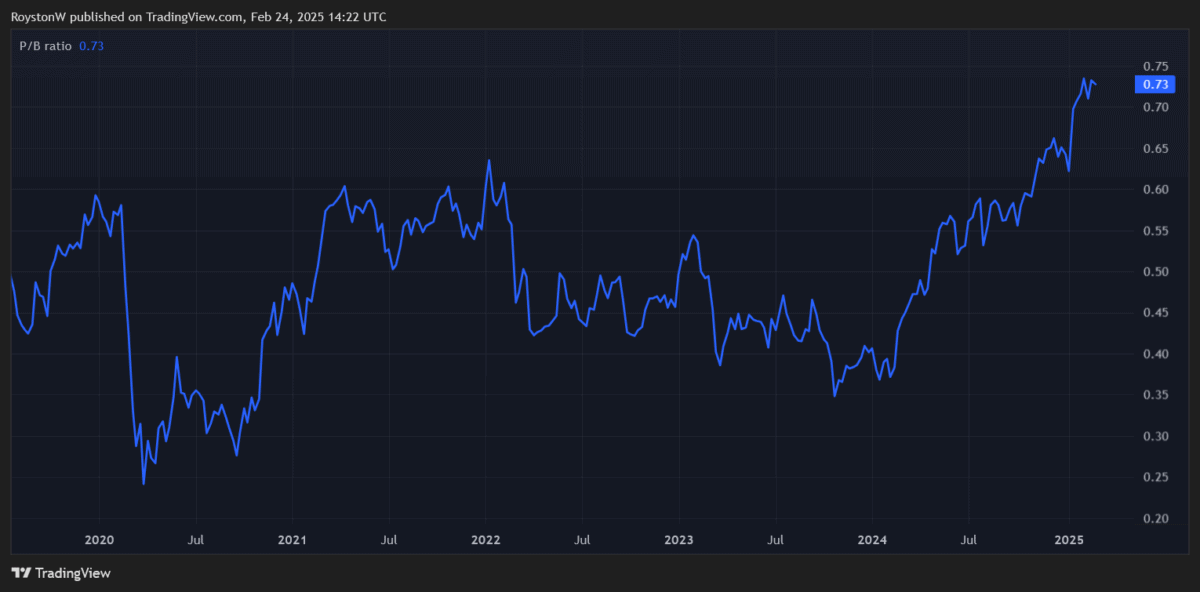

One motive why analysts suppose Barclays shares will rise could possibly be due to its relative cheapness.

The quantity crunchers suppose the financial institution’s annual earnings will leap 17% in 2025. This leaves it buying and selling on a price-to-earnings-to-growth (PEG) ratio of 0.4.

Any studying beneath one signifies {that a} share is undervalued.

Moreover, Barclays’ price-to-book (P/B) worth can be beneath one, indicating it trades at a reduction to the worth of its belongings.

Lastly, the agency’s price-to-earnings (P/E) ratio of seven.1 instances for this monetary 12 months can be extraordinarily low, together with relative to these of its friends.

Different UK-focused banks Lloyds and NatWest carry ahead earnings multiples of 9.9 instances and eight instances, respectively.

Reward vs threat

With brokers tipping an 11% worth rise, and the Footsie financial institution additionally providing a 3% dividend yield, it’s simple to see why Barclays shares are so well-liked at the moment.

The corporate’s forecast-beating outcomes for 2024 and revised medium-term targets have additionally boosted investor urge for food. The financial institution now expects to ship a return on tangible fairness (ROTE) of 11% and 12%-plus in 2025 and 2026, respectively, up from 10.5% final 12 months.

That is thanks largely to spectacular performances on the agency’s giant funding financial institution.

However with inflationary pressures rising, and different new hazards (like recent commerce tariffs) threatening the delicate financial system, buying and selling circumstances right here would possibly turn out to be so much more durable from this level.

On the similar time, the threats to Barclays’ retail enterprise are additionally appreciable. Internet curiosity margins (NIMs) might shrink sharply because of a double-whammy of rising competitors and falling rates of interest.

I’m additionally frightened of the prospect of weak mortgage progress and rising impairments if financial circumstances stay robust. Worryingly, the financial institution incurred a forecast-topping £2bn price of credit score impairment expenses final 12 months, up 5% from 2023 ranges.

Lastly, Barclays dangers going through substantial monetary penalties if discovered responsible of mis-selling automobile finance. It’s put aside £90m to cowl potential prices, although consultants warn the precise determine could possibly be far larger.

Whereas Metropolis brokers are bullish on Barclays’ share worth, I don’t plan so as to add the financial institution to my very own portfolio. The dangers are too nice for my liking, even regardless of the cheapness of its shares.