Bitcoin’s latest worth retreat has created a strategic entry level, in accordance with Tide Capital, as recession dangers and institutional dynamics sign a possible market backside. Regardless of macroeconomic headwinds, the agency highlights a confluence of technical and basic indicators pointing to a golden alternative for long-term buyers.

U.S. Recession Dangers Gasoline Secure-Haven Frenzy

U.S. financial turbulence has intensified in early 2025, triggering sharp corrections throughout danger property. The Nasdaq Index plunged -15% from latest highs, whereas Bitcoin tumbled over -25% amid flight-to-safety flows.

Tide Capital highlights information from the Atlanta Fed’s GDPNow mannequin, which signifies that Q1 2025 U.S. actual GDP progress projections have dropped sharply from 3.2% to -1.8%, signaling weak short-term financial efficiency.

Source: Federal Reserve Financial institution of Atlanta

The danger of recession has escalated amidst these progress considerations. Polymarket information cited by Tide Capital exhibits that the market-implied likelihood of a U.S. recession in 2025 has risen to 35%, a rise of 13 proportion factors because the starting of the yr. This rise underscores intensifying fears of a recession and elevated defensive positioning amongst buyers.

In opposition to this backdrop of financial weak spot, Tide Capital observes a surge in demand for safe-haven property. Goldman Sachs has just lately raised its gold worth goal to $3,300, reflecting heightened financial uncertainty and a booming demand for danger hedges.

Market Pessimism Hits Excessive, Backside Alerts Flash

Despite experiencing sharp corrections, markets seem to have totally built-in damaging expectations, in accordance with Tide Capital. The agency factors out that U.S. fairness CTA brief positions have reached a two-year excessive, exceeding $30 billion, as reported by Goldman Sachs. This surge in brief positions indicators peak bearish sentiment and suggests lowered draw back dangers shifting ahead.

The sudden choice by the Federal Reserve throughout its March FOMC assembly to sluggish the tempo of quantitative tightening—by lowering month-to-month Treasury roll-off caps from 25 billion to five billion—has considerably bolstered market confidence. This shift has contributed to a rebound in danger property, famous Tide Capital.

Source: TradingView

Whereas acknowledging the persistence of near-term challenges, Tide Capital emphasizes that present financial information doesn’t point out an inevitable disaster. With excessive pessimism already mirrored in asset costs, any minor financial enhancements may swiftly overturn prevailing recession narratives and ignite a strong restoration rally.

Bitcoin’s Path: Quick-Time period Ache, Lengthy-Time period Achieve

In response to information from CoinGlass, Bitcoin spot ETFs have seen 5 consecutive weeks of outflow since February 10, totaling $5.5 billion.

Source: CoinGlass

Regardless of the elevated outflows indicating short-term promoting strain, Tide Capital notes that historic patterns recommend these intervals usually coincide with market bottoms, presenting vital long-term entry alternatives for buyers.

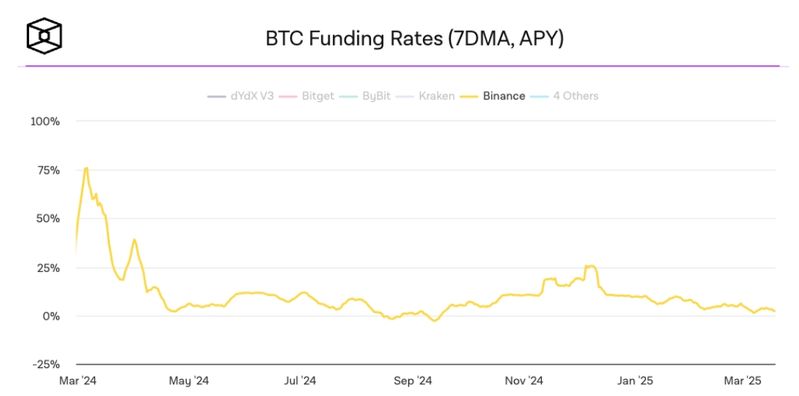

Moreover, Tide Capital highlights that BTC perpetual funding charges on Binance have dropped beneath 5% (7-day common), ranges not seen since September 2024, as reported by The Block. This decline in funding charges is indicative of weak bullish momentum and peak bearish sentiment—basic indicators of a market backside forming.

Source: The Block

Furthermore, regardless of BTC’s present worth being off its highs, stablecoin provides proceed to interrupt information, surpassing 230 billion—a 30 billion improve because the begin of 2025. Because the spine of liquidity inside the crypto markets, the growth of stablecoin reserves indicators institutional readiness to capitalize on the subsequent upcycle, offering gasoline for future progress.

Conclusion: Strategic Entry Window Opens

Tide Capital concludes that BTC’s present setting—marked by depressed funding charges, crowded shorts, and stablecoin accumulation—creates a uncommon shopping for alternative. “Any macro enchancment or coverage catalyst may set off simultaneous brief squeezes and capital inflows, propelling costs into a brand new upward cycle,” the agency emphasised.

Disclaimer: This press launch might include forward-looking statements. Ahead-looking statements describe future expectations, plans, outcomes, or methods (together with product choices, regulatory plans and enterprise plans) and will change with out discover. You’re cautioned that such statements are topic to a large number of dangers and uncertainties that might trigger future circumstances, occasions, or outcomes to vary materially from these projected within the forward-looking statements, together with the dangers that precise outcomes might differ materially from these projected within the forward-looking statements.