Picture supply: Getty Photos

One UK inventory that I’ve been following is Fevertree Drinks (LSE: FEVR). Yesterday (25 March), it jumped 4.4% to 778p after the premium mixers maker launched its preliminary 2024 outcomes.

This implies the share value is up 16% to date this month, however nonetheless down 71% since late 2021.

Ought to I make investments? Let’s have a look at some particulars.

Recovering earnings

Fevertree’s worthwhile progress got here to a shuddering halt in 2022 when the enterprise was hit by surging glass and transatlantic freight prices. Its gross margin fell sharply, inflicting the share value to plummet.

Nevertheless, there are indicators that issues are getting again on observe. Group income rose 3% at fixed foreign money to £368.5m final yr, whereas core Fever-Tree model income progress accelerated 7% within the second half of the yr.

This resulted in full-year model income progress of 4% because the agency capitalised on rising demand for non-alcoholic drinks.

In the important thing US market, Fevertree recorded spectacular fixed foreign money income progress of 12%, with the model outpacing all of its rivals. And it prolonged its market-leading share in each the tonic and ginger beer classes.

Nevertheless, UK gross sales fell 3% because of subdued client spending, whereas there was additionally softness in Europe. The remaining-of-the-world area did a lot better, rising 22% on a continuing foreign money foundation, but it surely stays a small a part of the general enterprise (round 8% of gross sales).

Much more encouraging, the corporate’s gross margin improved by 540 foundation factors to 37.5%, largely because of decrease glass and freight prices. This resulted in adjusted EBITDA of £50.7m, a 66% enhance. Normalised earnings per share surged 82% to twenty-eight.01p.

The inventory presently carries a 2.1% dividend yield.

Potential game-changing deal

In January, Fevertree signed a strategic partnership with Molson Coors, the North American drinks agency that owns beer labels like Carling, Staropramen, and Coors Mild.

This grants Molson Coors unique rights to promote, distribute, and produce the model within the US. As a part of the deal, Molson Coors acquired an 8.5% stake for £71m, together with the US buying and selling entity for $23.9m.

Fevertree plans to make use of the proceeds to extend its share buyback programme by £29m, including to the £71m introduced in February.

The corporate will profit from Molson Coors’ huge distribution community, with considerably extra advertising funding going into the model. In the meantime, Molson Coors will handle the on-shoring of US manufacturing, lowering publicity to risky transatlantic freight prices.

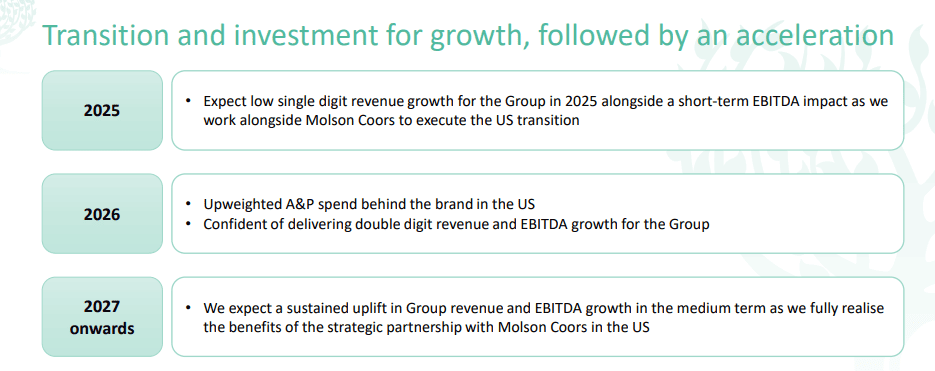

The corporate will recognise a assured share of earnings via royalty charges between 2026 and 2030. And from 2027 onwards, administration expects a “sustained uplift in group income and EBITDA progress” because it absolutely realises the advantages of the partnership.

My transfer

The Molson Coors deal may finally show to be a gamechanger for Fevertree’s profitability. In that case, the inventory at the moment might show to be a cut price, regardless of buying and selling at 31 occasions ahead earnings.

Nevertheless, I’m aware that client spending stays weak within the UK and Europe, whereas the US may nonetheless enter a recession. These are dangers to progress right here.

In the meantime, administration has warned that 2025 can be a “transition” yr, with low single-digit income progress and a short-term impression on margins.

I’m not able to spend money on Fevertree but, however I’m going to maintain the inventory on my radar. I reckon it has massive turnaround potential.