A number of shares from key sectors reminiscent of automotive, insurance coverage, finance, renewable power, and client durables have turned MACD bearish, indicating potential short-term weak spot in momentum regardless of sturdy fundamentals and long-term development prospects throughout industries.

MACD bearish shares are these the place the MACD line crosses beneath the sign line, indicating a possible shift in momentum from bullish to bearish. This implies that the inventory’s upward pattern could also be dropping energy, resulting in attainable short-term worth corrections or consolidation.

The automotive, insurance coverage, NBFC, renewable power, and client durables sector shares witnessed bearish MACD indicators, reflecting short-term promoting stress. Whereas underlying companies stay essentially sturdy, technical indicators recommend attainable consolidation or correction earlier than the subsequent upward transfer.

Bosch Ltd is a number one provider of expertise and providers in mobility options, industrial expertise, client items, and power programs. With a powerful give attention to innovation, automation, and electrification, the corporate performs a key position in India’s automotive and industrial ecosystem, supported by its sturdy German engineering legacy.

With market capitalization of Rs. 1,09,746 cr, the shares of Bosch Ltd are closed at Rs. 37,210 per share, from its earlier shut of Rs. 37,380 per share. This inventory has seen a MACD bearish crossover, signaling a possible weakening in bullish momentum and suggesting short-term draw back threat.

Star Well being is certainly one of India’s largest standalone medical insurance suppliers, providing a variety of particular person and company medical insurance merchandise. Backed by a powerful distribution community and digital attain, the corporate continues to learn from rising well being consciousness and rising insurance coverage penetration in India.

With market capitalization of Rs. 28,285 cr, the shares of Star Well being & Allied Insurance coverage Firm Ltd are closed at Rs. 481 per share, from its earlier shut of Rs. 480.40 per share. This inventory has seen a MACD bearish crossover, signaling a possible weakening in bullish momentum and suggesting short-term draw back threat.

Bajaj Finance is a number one non-banking monetary firm (NBFC) in India, recognized for its diversified portfolio overlaying client finance, SME lending, and industrial lending. The corporate has constructed a powerful presence throughout retail and digital platforms, sustaining sturdy asset high quality and constant profitability

With market capitalization of Rs. 6,54,574 cr, the shares of Bajaj Finance Ltd are closed at Rs. 1,052.30 per share, from its earlier shut of Rs. 1,062.95 per share. This inventory has seen a MACD bearish crossover, signaling a possible weakening in bullish momentum and suggesting short-term draw back threat.

Waaree Energies is India’s largest photo voltaic PV module producer and a serious participant in renewable power options. The corporate is engaged in photo voltaic module manufacturing, EPC providers, and photo voltaic undertaking growth, contributing to India’s clear power transition and rising world photo voltaic exports.

With market capitalization of Rs. 98,697 cr, the shares of Waaree Energies Ltd are closed at Rs. 3,432.20 per share, from its earlier shut of Rs. 3,477.60 per share. This inventory has seen a MACD bearish crossover, signaling a possible weakening in bullish momentum and suggesting short-term draw back threat.

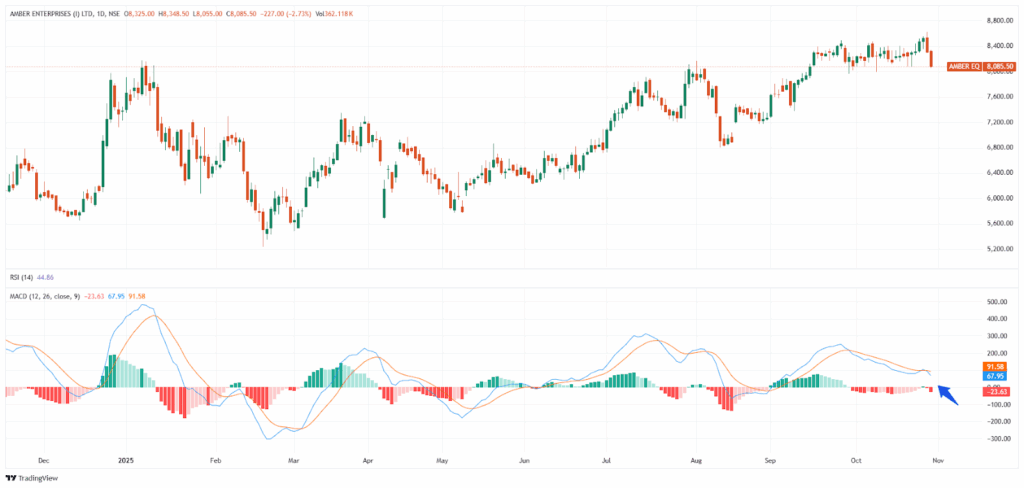

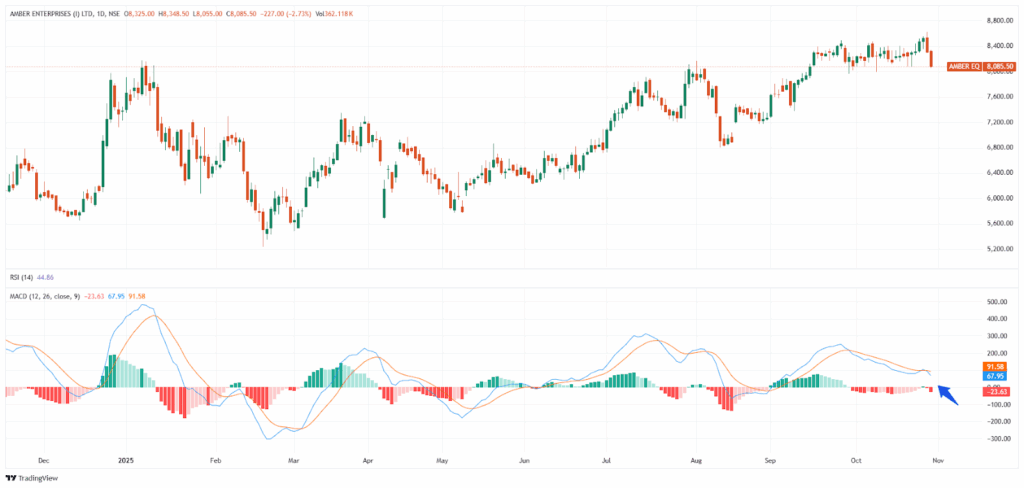

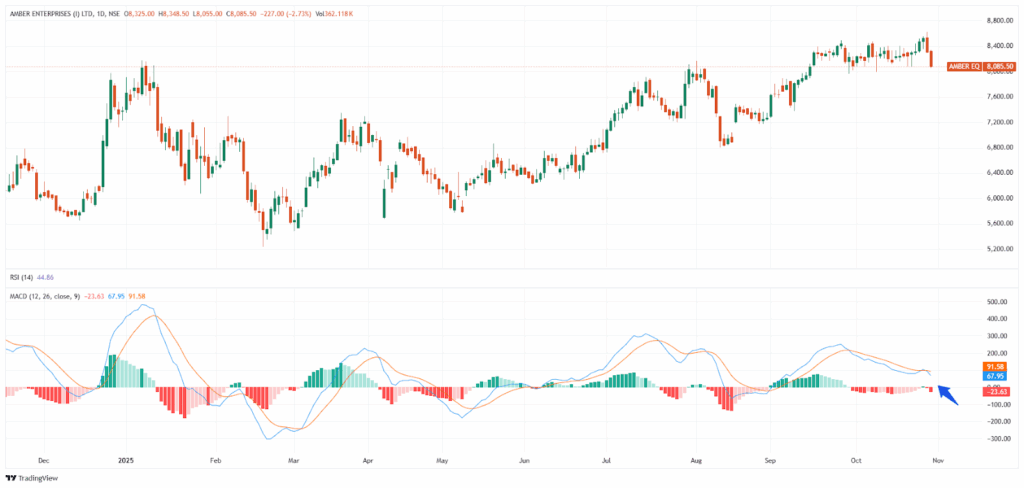

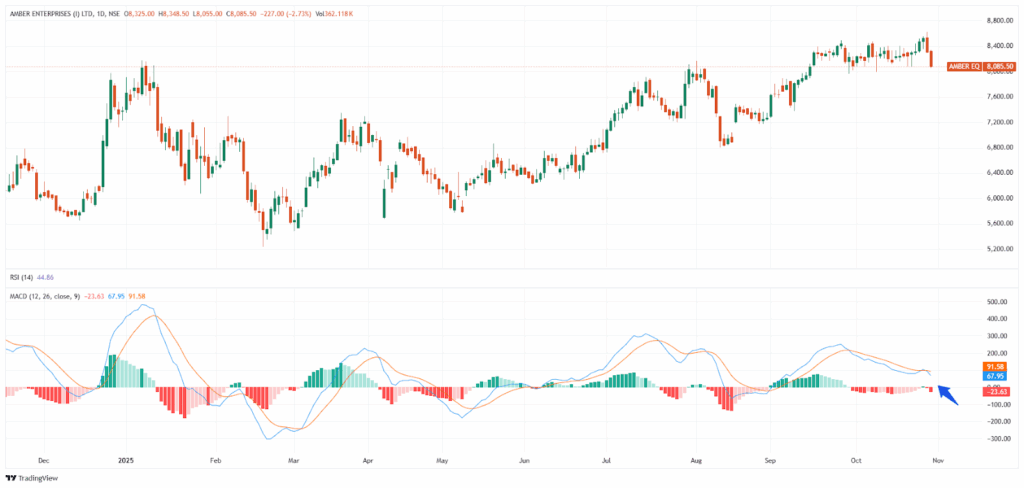

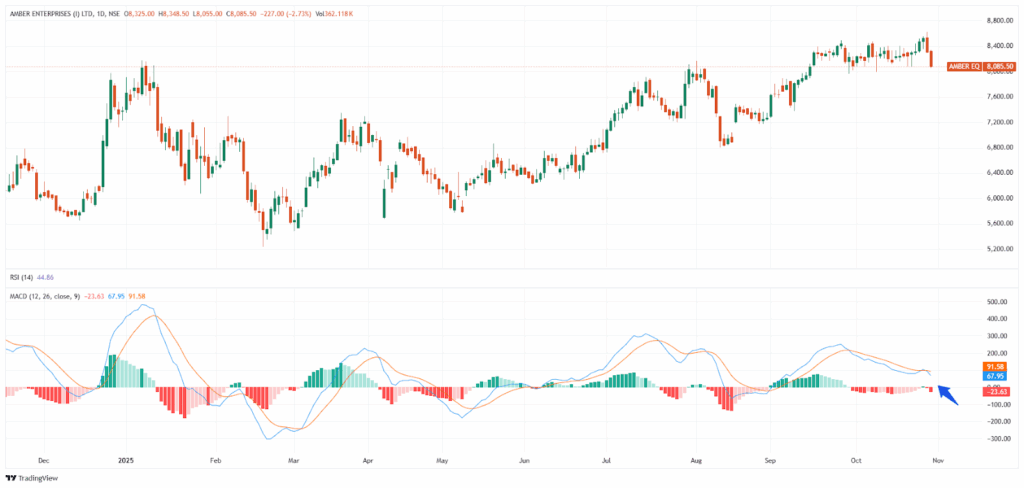

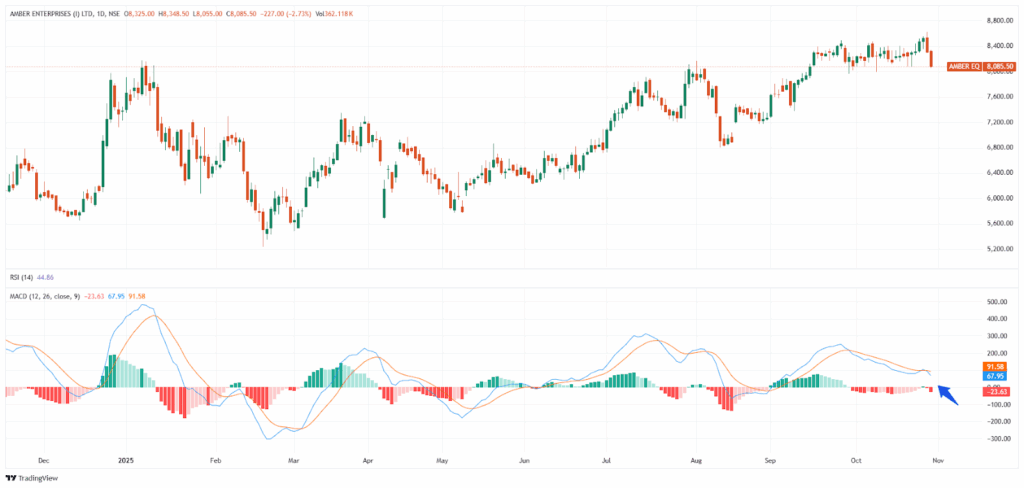

Amber Enterprises India Ltd

Amber Enterprises is a number one producer of room air conditioners and elements for main client sturdy manufacturers in India. With a powerful give attention to design, R&D, and backward integration, the corporate advantages from rising home demand, import substitution, and the federal government’s Make in India push.

With market capitalization of Rs. 28,552 cr, the shares of Amber Enterprises India Ltd are closed at Rs. 8,085.50 per share, from its earlier shut of Rs. 8,085.50 per share. This inventory has seen a MACD bearish crossover, signaling a possible weakening in bullish momentum and suggesting short-term draw back threat.

Written by Manideep Appana

Disclaimer

The views and funding ideas expressed by funding specialists/broking homes/ranking companies on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a threat of monetary losses. Traders should subsequently train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the creator are usually not answerable for any losses triggered because of the choice primarily based on this text. Please seek the advice of your funding advisor earlier than investing.