Waaree Energies IPO particulars: Key Information

- Waaree Photo voltaic Firm filed Draft Crimson Herring Prospectus (IREDA DRHP) for an preliminary public providing on December 28, 2023.

- Waaree Vitality is likely one of the pioneer firms in renewable power.

- The corporate claims to be one of many world’s largest photo voltaic power producers and largest photo voltaic module producer exterior of China.

- Waaree Energies IPO Date is but to be introduced: – October 21, 2024 to October 23, 2024

- Waaree IPO GMP on 18th October 2024 is ₹1330 and the IPO could also be listed at ₹2833

- CRISIL has given BBB+/Optimistic for long-term ranking whereas CARE has given a ranking of A-; Steady

- Governments throughout the globe together with India have been specializing in renewable power and inexperienced hydrogen power as a serious supply for future power wants.

- The corporate has sturdy development potential to excel on this phase regardless of competitors.

Waaree Energies DRHP filed on 28th December 2023 to drift its Preliminary public providing. In response to DRHP, Waree Energies Ltd is elevating Rs 3,600 crore recent fairness at a face worth of ₹10 every. Promoters of this firm may also promote as much as 3,200,000 Fairness Shares as a proposal on the market on this preliminary public providing concern.

The web proceeds from the Waaree Energies IPO from the Contemporary Problem will likely be utilized in direction of the price of establishing the 6GW of Ingot Wafer, Photo voltaic Cell, and Photo voltaic PV Module manufacturing facility in Odisha, India.

Waaree Energies IPO particulars

Now the large query is – do you put money into the Waaree Energies Ltd IPO? Allow us to discover out particulars concerning the firm and why you need to take into account investing on this firm.

Waaree energies IPO Date Worth Particulars

| Waaree energies ipo particulars | Waaree energies ipo particulars date, Worth and different |

| Waaree energies IPO date | October 21, 2024 to October 23, 2024 |

| Waaree energies IPO Worth band | ₹1427 to ₹1503 per share |

| IPO date of allotment | October 24, 2024 |

| Refunds Initiation date | October 25, 2024 |

| Credit score of Shares to Demat Account | October 25, 2024 |

| Waaree energies IPO date of itemizing | October 28, 2024 |

| Complete IPO dimension | 28,752,095 shares (aggregating as much as ₹4,321.44 Cr) |

| Contemporary Problem | 23,952,095 shares (aggregating as much as ₹3,600.00 Cr) |

| Supply for Sale | 4,800,000 shares of ₹10 (aggregating as much as ₹721.44 Cr) |

| Retail Utility (Min) | 1 lot 9 shares ₹13,527 |

| Retail Utility (Max) | 14 lot 126 shares ₹189,378 |

| Waaree energies share value Face Worth | ₹ 10 per share |

| Waaree energies share value Itemizing on | BSE & NSE |

| Fairness Shares excellent previous to the Supply | 263,331,104 Fairness Shares |

Waaree Energies IPO: Voice of Administration

Administration Interview Video

As of June 30, 2023, Waaree Energies Ltd is the most important producer of photo voltaic PV modules in India with the most important mixture put in capability of 12GW. The corporate commenced operations in 2007 specializing in photo voltaic PV module manufacturing. Over time, Waaree Energies Ltd has considerably expanded its mixture put in capability from 2 GW in Fiscal 2021 to 9 GW, as of March 31, 2023, which additional elevated to 12 GW as of June 30, 2023. The corporate sells its PV modules below the “Waaree” model.

Waaree Energies IPO: Monetary Energy

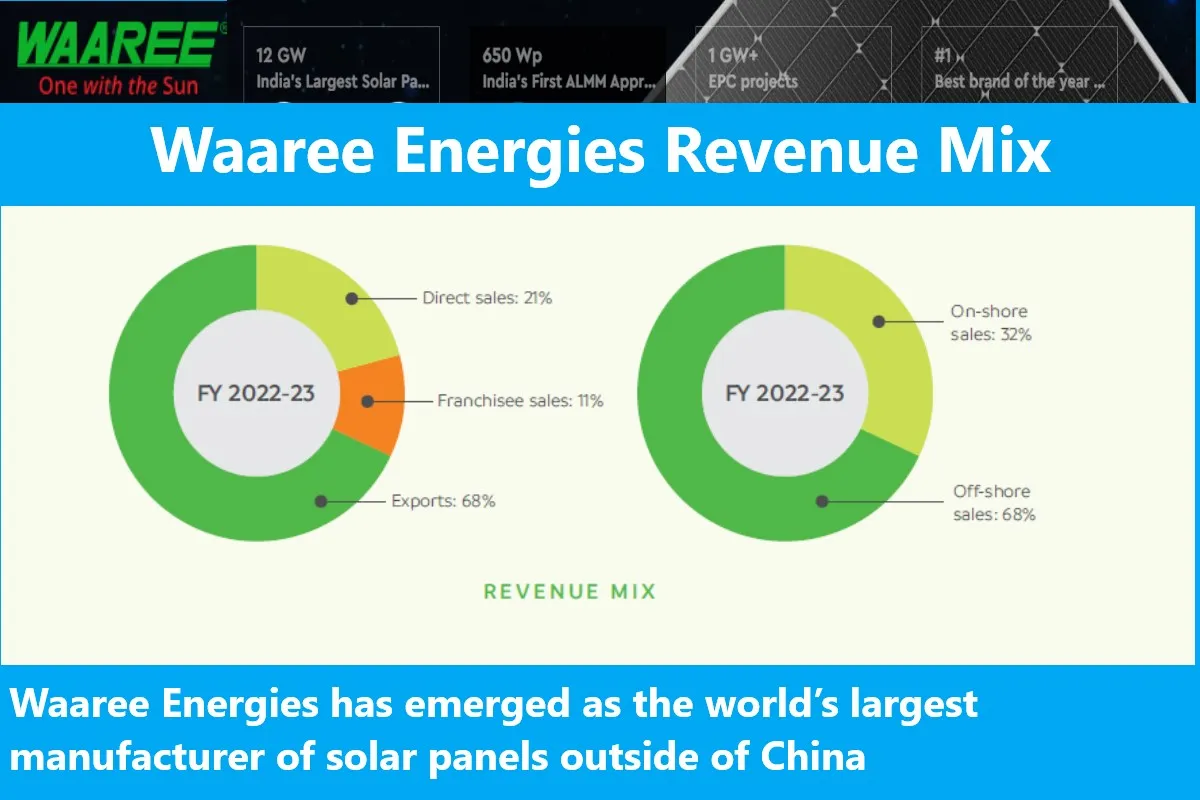

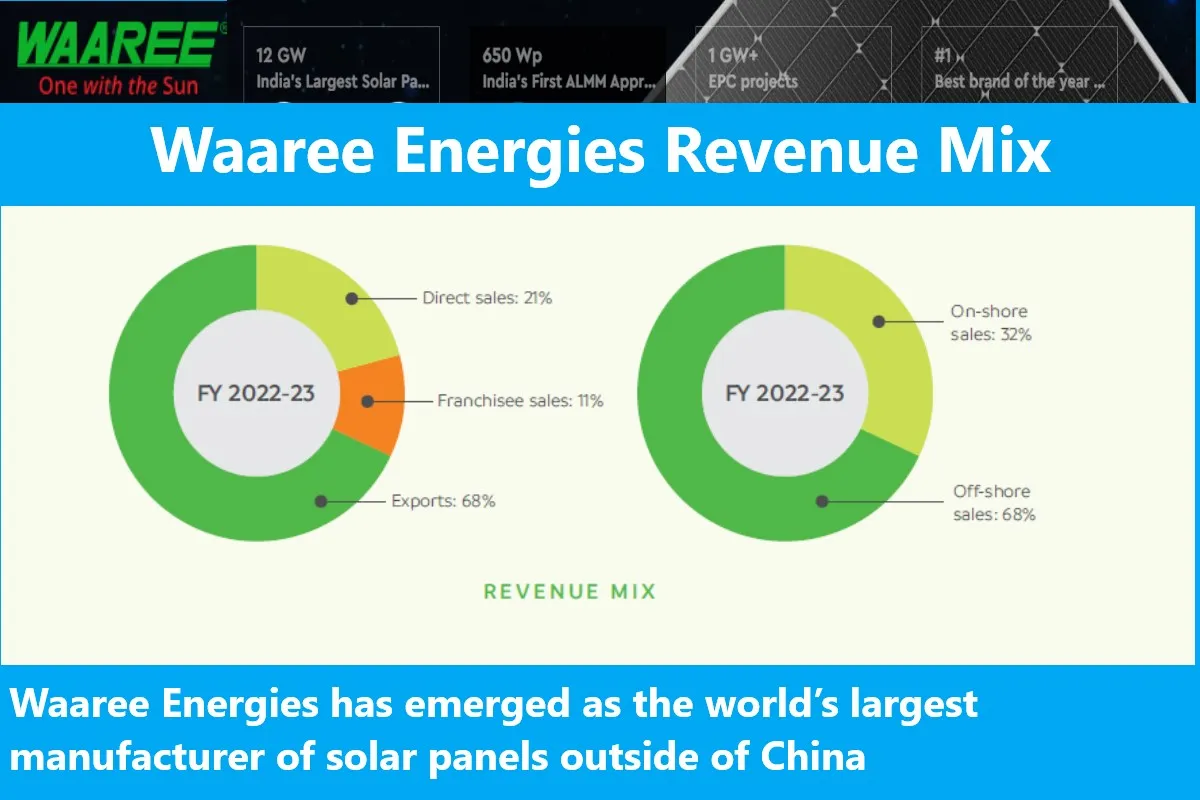

Waaree Energies Ltd has reported a rise in Export Gross sales from ₹ 4,809.10 million representing 24.62% of the whole income from operations in Fiscal 2021 to to ₹ 46,165.39 million representing 68.38% of the income from operations in Fiscal 2023. The income from operation has additionally elevated from ₹ 19,530.39 million in Fiscal 2021 to ₹67,508.73 million in fiscal 2023.

Waaree Energies Monetary Snapshot

| Waaree Energies Monetary Energy | FY2021 | FY2022 | FY2023 | Q1FY2024 |

|---|---|---|---|---|

| Income from Operation (Rs million) | 19,530 | 28,534 | 67,509 | 33,283 |

| Complete Revenue (Rs million) | 19,830 | 29,459 | 68,604 | 34,150 |

| Revenue of the 12 months (Rs million) | 456 | 797 | 5,003 | 3,383 |

| EBITDA (Rs million) | 1,257 | 2,025 | 9,441 | 5,543 |

| EBITDA Margin (%) | 6.34 | 6.88 | 13.76 | 16.23 |

| Debt to Fairness Ratio | 0.79 | 0.72 | 0.18 | 0.08 |

| PAT Margin (%) | 2.3 | 2.7 | 7.29 | 9.91 |

| ROE (%) | 13.22 | 17.69 | 26.26 | 12.36 |

| ROCE (%) | 14.87 | 21.89 | 31.61 | 15.86 |

| Capability (MW) | 2,000 | 4,000 | 9,000 | 12,000 |

Waaree Energies IPO GMP

| Date | IPO Worth | Waaree IPO GMP | Estimated Itemizing Worth |

|---|---|---|---|

| 18-10-2024 | ₹1503 | ₹1330 | ₹2833 |

| 17-10-2024 | ₹ 1503 | ₹1330 | ₹ 2833 |

| 16-10-2024 | ₹ 1503 | ₹ 1545 | ₹ 3048 |

Goal Behind the Waaree Energies IPO

- The corporate is not going to obtain any proceeds from the Supply on the market. The promoter of the corporate will take the online proceeds from the OFS.

- The web proceeds from the recent concern of Rs 2500 crore will likely be deployed within the Monetary Years 2025 and 2026 to finance the price of establishing the 6GW of Ingot Wafer, Photo voltaic Cell, and Photo voltaic PV Module manufacturing facility in Odisha, India.

- The remainder of Rs 5000 crore will likely be used for common company functions.

- The corporate will obtain the advantages of itemizing the Fairness Shares on exchanges.

- This may also improve the visibility and model picture of the corporate in addition to present a public marketplace for Fairness Shares in India.

Waaree Energies IPO evaluation: Good or Dangerous?

- Waaree Energies is likely one of the largest Photo voltaic PV producers globally and the most important in India with over 30 years of expertise within the business.

- World renewable power market dimension is predicted to develop from USD 900 Billion in 2022 to USD 3200 Billion by 2030.

- India’s renewable power market dimension is predicted to be value as much as $80 billion by 2030 from round $20 billion in 2022.

- The Authorities of India has set a goal to attain a 500 GW renewables goal earlier than 2030 from round 180 GW in 2022.

- Overseas direct funding (FDI) in India’s renewable power sector stood at $251 million/ Rs 20.5 billion within the third quarter (Q3) of the monetary yr (FY) 2023.

- There’s a big market to seize for this firm.

- The corporate has recorded sturdy income development over time.

- Contemplating the above components Waaree Energies has sturdy development potential.

Additionally Learn

Ceaselessly Requested Questions (FAQs)

The place is Waaree energies Ltd HQ?

Registered and Company Workplace: 602, sixth Flooring, Western Edge – I, Western Specific Freeway, Borivali (East), Mumbai – 400 066, Maharashtra, India; Phone: +91 22 6644 4444;

Contact Individual: Rajesh Ghanshyam Gaur, Firm Secretary and Compliance Officer; Phone: +91 22 6644 4415;

E-mail: investorrelations@waaree.com;

Web site: www.waaree.com

Is Waaree Energies Ltd a part of Waaree Group Corporations?

Sure, Waaree Energies Ltd is part of Waaree Group Corporations

How can I put money into Waaree Energies’s IPO?

In case you are excited by investing in Waaree Energies’s IPO, you have to to open a demat account and buying and selling account with a dealer. You may then apply for shares throughout the book-building course of.

When is the Waaree Energies IPO date?

The Waaree Energies IPO date is October 21, 2024 to October 23, 2024.

What’s the Waaree Energies IPO Worth?

The Waaree Energies IPO Worth is Rs 1503

What are the dangers of investing in Waaree Energies’s IPO?

As with all funding, there are dangers related to investing in Waaree Energies’s IPO. These dangers embrace:

1. The value of the shares could fall after the IPO.

2. The corporate could not carry out in addition to anticipated.

3. The corporate could face regulatory or authorized challenges.

Extra From Throughout our Web site

We endeavor that will help you to know totally different elements of an organization earlier than you put money into the corporate’s IPO. Study all firm insights for funding in new firms within the Indian share market 2023. To know extra details about firm insights for funding, enterprise overview of firms for funding, listed here are some instructed readings on firm insights for funding – Inexperienced Hydrogen Shares in India, 10 Finest IPOs in 2022, Tata Motors Inventory Worth, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Inventory Worth, Tata Applied sciences IPO, AI Shares in India.