Abstract Factors:

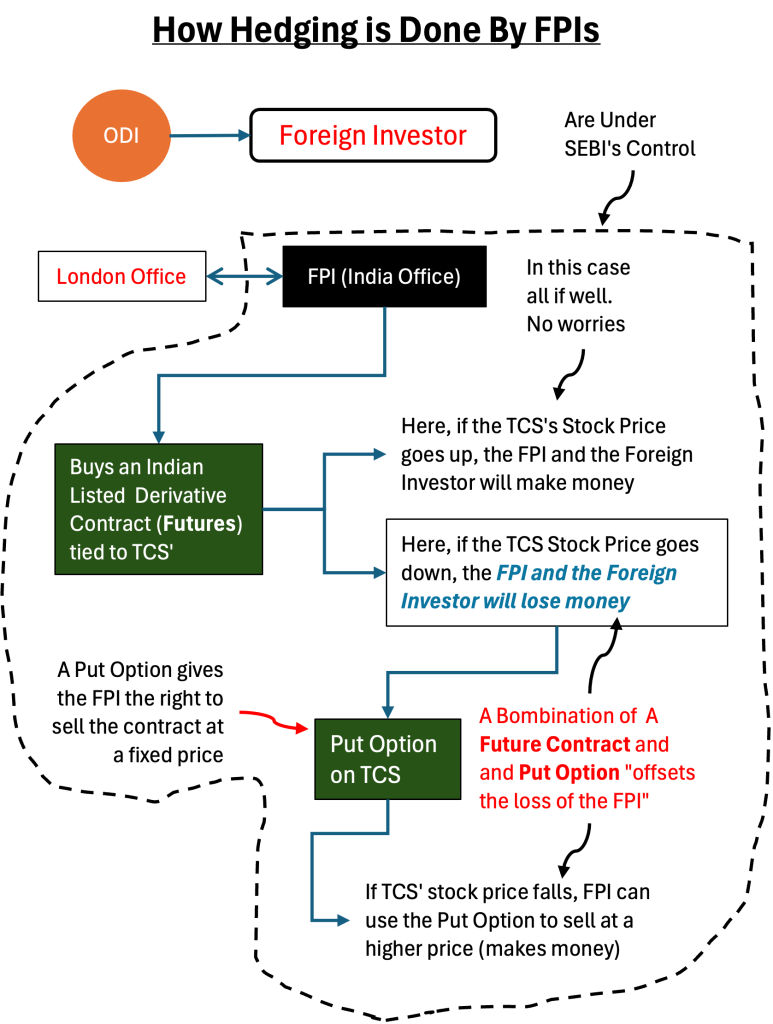

- ODIs let overseas buyers guess on Indian shares.See the stream chart #1

- FPIs used derivatives to create and hedge ODIs. See the stream chart #2

- SEBI’s new rule bans derivative-based ODIs for FPIs.

- FPIs should now use precise shares, not derivatives.

- Large ODI customers must disclose extra particulars.

- This would possibly cut back FPI exercise, impacting market volatility.

- Transparency may construct belief, however rupee might weaken in brief time period. Learn the conclusion

Introduction

There was a SEBI’s round issued on December 17, 2024. The round was titled “Measures to deal with regulatory arbitrage with respect to Offshore By-product Devices (ODIs) and Overseas Portfolio Traders (FPIs) with segregated portfolios vis-à-vis FPIs.” You may learn the SEBI’s authentic round right here.

Feels like a sentence stuffed with jargons, proper? Don’t fear, I’ll declutter it down for you and likewise clarify the importance of it for we small retail buyers.

So, as the subject is sophisticated, I might take a step-by-step method to clear the subject. I’ll first clarify the fundamentals associated to Offshore By-product Devices (ODIs) and Threat Hedging. When these ideas turn out to be clear, I’ll clarify what the SEBI’s round is saying (or controlling).

Lastly, I’ll additionally share my views on how this SEBI round is effecting our entire inventory market basically and likewise particular person shares.

So, keep put. This would possibly seem like a boring subject to start out with, however for those who learn it by way of, I’m certain you’ll definitely study a whole lot of new issues on this one single piece. Let me additionally guarantee you this, my explanations will likely be easy and simple to know.

1. What are Offshore By-product Instrument (ODI)?

Let’s see how a typical Offshore By-product Instrument (ODI) comes into being.

First up, the ODI deal occurs throughout borders (not in India – Offshore).

Take into account a overseas investor who’s somebody based mostly in London. Say, he desires to faucet into the Indian inventory market however doesn’t need to get into the trouble of straight shopping for shares on the NSE or BSE. Perhaps they need to keep away from the registration formalities, straight paying taxes, or the paperwork that comes with investing in India as a foreigner. That is the place an FPI (Overseas Portfolio Traders) steps in.

FPIs are world monetary gamers, already registered with SEBI, who’re allowed to commerce in Indian markets. They know the SEBI guidelines and SEBI is aware of them. These FPIs are sometimes a giant financial institution or funding agency like Goldman Sachs or Citi, with places of work in and outdoors India.

The story begins when a overseas investor approaches the FPI (say in London). The investor says, “I need to revenue from Indian shares say TCS, however I don’t need to personal them myself.”

The FPI agrees and creates an ODI, which is actually a contract or certificates. This contract guarantees to reflect the efficiency of particular Indian belongings. This asset might be both TCS shares straight, or a by-product contract like futures tied to the TCS inventory.

Within the subsequent step, FPI goes to the Indian market (their Indian Workplace), buys the underlying belongings (say, TCS shares or futures), and holds them on behalf of the overseas investor.

Now, that is that half that I would love you to learn fastidiously and keep in mind for future reference. The overseas investor doesn’t personal any shares or derivatives, solely the FPI has the holding in India. The ODI is issued offshore, that means it’s a deal struck outdoors India. It’s ruled by the legal guidelines of that overseas nation, not India straight. They don’t fall beneath the ambit of SEBI.

Now, the investor pays the FPI for this ODI. In return, they get the monetary final result – earnings if the inventory rises, losses if it falls. Recall, they can get this with out ever touching the Indian market themselves. So they aren’t bothered about how FPIs (In India) are managing these investments. They solely know or are bothered about, whether or not they have made cash from ODI or not. In the event that they generate income they might make investments once more or else say bye-bye to the FPI.

Whereas, in India, FPIs should not okay to free cash of their ODI contract. In order that they get inventive and so they use “different derivatives” to guard their ODI linked derivatives from any potential loss. That is what is named hedging.

Once more keep in mind this level, in all this by-product transactions occurring in India (associated to derivatives), the originator of those actions (the Overseas Investor) is sitting in London whose id is beneath the wraps.

Now we’ve reached a state the place we should know the subsequent intricate a part of this advanced story, hedging.

I wish to remind you that every one I’m explaining you listed here are associated to the SEBI’s new round. To grasp its implications we should first know these fundamentals.

2. What’s Hedging?

Let’s perceive how FPIs use “different derivatives” to hedge their “derivatives tied to the ODI” and restrict their dangers.

Think about an FPI points an ODI based mostly on a by-product, like a futures contract on TCS inventory. The FPI purchase this future contract in India.

This futures contract guarantees the FPIs (and therefore the overseas investor) the positive factors is TCS value goes up and losses within the value goes down.

However right here is the issue. The FPIs are able to cross on the loss to the overseas investor, however they need themselves to remain protected (in some case they will additionally supply this capital safety to their overseas investor). The best way to get the safety?

If the TCS’ value drops, the futures contract will even lose worth. To guard themselves from this loss, the FPI use “different derivatives” as their hedge.

They may purchase one other by-product known as an choices contract. For instance, they may purchase a “put possibility” on TCS, which provides them the suitable to promote TCS shares at a hard and fast value. If TCS’ value crashes, as FPIs has additionally purchased a Put-Choices, they will promote their contract at the next pre-defined fastened value. This acquire from the Put-Choice will offset the loss from the futures contract.

[You can ask, what happens to the Put Options if the TCS’ price goes up? The FPI won’t exercise their right to sell at the fixed price since the stock price is higher, so the put option contract expires worthless, without causing any additional loss to the FPI beyond the premium they paid for the option.]

This balancing act of utilizing one by-product (the put possibility) to counter the chance of one other (the futures), is named hedging. It limits the FPI’s threat of loss in case the worth acton of the inventory will not be as anticipated.

3. What The New SEBI Round, dated December 17, 2024, is Saying?

This round has introduced the next essential adjustments:

- First, FPIs can now not challenge ODIs based mostly on derivatives like futures or choices.

- As a substitute, should use precise shares.

- In addition they can’t use derivatives to guard (or hedge) their ODIs anymore. They’ve to carry the very same shares because the ODIs, one-to-one, on a regular basis.

- Subsequent, FPIs issuing ODIs want a separate registration only for that, with “ODI” within the identify.

- FPIs can’t combine their very own investments in that account.

- If large ODI customers maintain an excessive amount of in a single Indian firm group (over 50%) or have an enormous stake within the Indian market (over Rs.25,000 crore), they need to share extra particulars about who they’re and what they personal.

- FPIs are getting one 12 months, till December 16, 2025, to observe these new guidelines in the event that they’re already utilizing ODIs with derivatives.

SEBI is doing this to cease difficult loopholes, make the market fairer, and hold a more in-depth eye on overseas cash coming into India.

4. How This SEBI’s New ODI Rule May Impact The Indian Inventory Market?

The brand new shift may cut back the general exercise of FPIs within the Indian market.

Why? As a result of ODIs with derivatives have been a versatile, low-cost means for overseas buyers to guess on Indian shares with out straight proudly owning them. Eradicating this selection would possibly make India much less enticing for some FPIs, particularly those that relied on derivatives for fast, speculative trades.

If fewer FPIs take part, the market may see much less overseas cash flowing in. This would possibly result in decrease buying and selling volumes and liquidity within the general market. Decrease liquidity usually means extra volatility, inventory costs may swing extra wildly as a result of there are fewer patrons and sellers to steadiness issues out.

There may be results on particular person shares, particularly these with derivatives like futures and choices (instance, HDFC Financial institution, Reliance, TCS, and so on)

Earlier than this round, FPIs may challenge ODIs based mostly on derivatives of those shares. They might additionally hedge their threat utilizing different derivatives (like a put possibility) on Indian exchanges.

This created a whole lot of buying and selling exercise within the derivatives market, which frequently influenced the underlying inventory costs within the money market as effectively as a result of sentiments (Learn this text to know the distinction between money market and by-product market).

With the brand new guidelines, FPIs can’t use derivatives for ODIs anymore. Now, they’ve to purchase the precise shares. This would possibly cut back buying and selling within the derivatives section for these shares. This might make their futures and choices much less energetic.

Much less exercise in derivatives can result in wider bid-ask spreads (the hole between shopping for and promoting costs), making it costlier for merchants to take positions. This might additional dampen speculative buying and selling, doubtlessly stabilizing the inventory costs within the quick time period. However on the draw back, it would additionally decreasing the general buzz round these shares.

5. It Will Construct Belief In The Inventory Market

The SEBI round will even carry transparency. It requires FPIs with massive stakes (over Rs.25,000 crore or greater than 50% in a single company group) to reveal extra particulars. One of these step would possibly construct belief available in the market over time.

If FPIs have to carry precise shares as an alternative of derivatives, their investments would possibly turn out to be extra long-term and fewer speculative. It’ll cut back sudden sell-offs that crash inventory costs.

Nonetheless, within the quick time period, as FPIs regulate to those guidelines by December 2025, some would possibly select to exit or reduce their positions, particularly in the event that they discover the brand new necessities too cumbersome. This might put downward strain on inventory costs, significantly for large-cap shares the place FPIs have large stakes, like these within the Nifty 50 or Sensex.

6. Impact of the ODI Rule on Indian Rupee

If FPIs dump shares to adjust to the brand new guidelines, they’ll convert rupees to {dollars}. This can enhance the demand for overseas foreign money (say USD, Euro, and so on). Such excessive demand for a overseas foreign money may additionally may weaken the rupee.

What’s the impression of a weak Rupee? It’ll make imports costlier and including inflationary strain.

In an inflationary market, inventory costs get harm in the end dampening the financial development.

Conclusion

Is it a superb step or a nasty step.

On the face of it, it appears to be like like a really optimistic step. However Actually, it’s a blended bag.

- On one hand, I like that SEBI’s attempting to make the market extra clear. When overseas buyers play by clearer guidelines, it’s much less seemingly we’ll see sudden shocks, like a giant FPI dumping shares due to some hidden by-product mess. That’s good for us small buyers who simply desire a secure market to develop our financial savings.

- However however, I ponder if this would possibly scare off some overseas cash. Extra guidelines imply extra paperwork, and never each FPI would possibly need to take care of that problem. India’s been a scorching spot for overseas funding, will this cool issues down? Solely time will inform.

Whereas SEBI says ODIs with derivatives have been barely used (simply Rs.75 crore in mid-2023), so why make such a giant fuss now? Perhaps they’re simply getting forward of an issue earlier than it grows. Or, there are issues that they don’t need us to hassle about however in any case need to repair the difficulty. For instance, just lately there was allegation of shares costs staying artificially inflated. Perhaps, SEBI has came upon it has one thing to do with ODIs (I’m solely speculating).

For us, the takeaway is straightforward, we solely know the inventory market from the attitude of “money market.” However far more buying and selling occurs within the by-product market. Furthermore, there may be additionally one thing known as ODIs that are function remotely utilizing each shares and derivatives as their devices.

I hope I used to be in a position to clarify the subject in a easy approach to you. If did like my effort, might I request you to kindly put up your suggestions within the remark part beneath.

Have a cheerful investing.