Are you aware what occurs when you find yourself unable to repay again your own home mortgage?

After what number of missed EMI’s will the lender pay money for your property and throw you out of it? What are your rights as a shopper and what precisely are the steps concerned within the foreclosures course of?

After we purchase a house with a house mortgage, there may be a number of enthusiasm as we have gotten the proprietor of our dream dwelling, and the longer term appears to be like brilliant, however the actuality of life is that there are a lot of householders who face monetary difficulties of their life resulting from job loss, accidents, medical issues that they’re unable to pay again their House mortgage EMI’s for a lot of months and ultimately get right into a state of affairs when they don’t seem to be in a position to repay again.

At this time I’m going to inform you all you should learn about this subject. Let’s begin

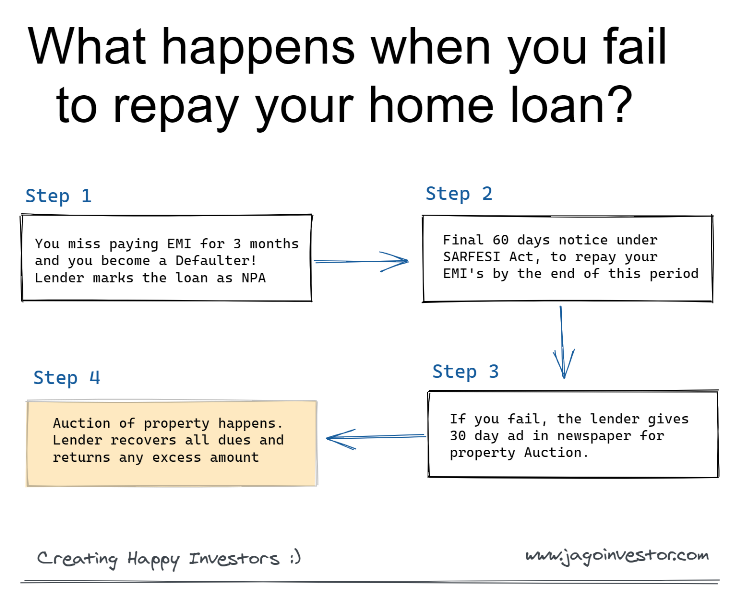

#1 – If you miss paying 3 months EMI

It might occur that you’re miss 1-2 EMI funds resulting from some purpose, during which case the financial institution provides you with a reminder about it or give a small warning to pay again the missed EM subsequent month. However if you happen to miss paying the EMI for 3 consecutive months, that’s an enormous purple sign and at this level, your mortgage account will likely be marked as NPA within the lender’s guide.

This can be a critical state of affairs. The financial institution will mark you as a defaulter and the financial institution will ship you a discover about it.

At this level be sure to don’t ignore the financial institution discover and reply to them asap explaining to them about your state of affairs and the rationale why you missed paying the EMI’s. In case your credit score historical past is sweet and your causes are very real, there’s a risk that the lender might provide you with some grace interval for compensation.

Your CIBIL will even get impacted resulting from you getting marked as a defaulter.

#2 – Last 60 days’ Discover

If the financial institution is certain that they wish to transfer forward after you might be marked as Defaulter, they’ll then ship a full and last 60 days discover below a legislation referred to as SARFESI Act (Securitization and Reconstruction of Monetary Property and Enforcement of Safety Pursuits Act).

Sarfesi Act empowers banks and different monetary establishments to instantly public sale residential or industrial properties which have been pledged with them to recuperate loans from debtors and lays down all of the processes to be adopted.

Earlier than this act got here into energy in 2002, the lenders needed to file a case in opposition to the home-owner and the matter went to courtroom which was a prolonged course of and really time-consuming. However after this act, now the lender can instantly public sale your property and evict you out of it. Even Co-operative banks are coated below the Sarfesi Act

This 60 days interval is your last likelihood to repay your EMI’s, else the lender can grasp the property and promote it off after 60 days’ discover. After this 60 days interval, you might be anticipated to cool down all the cash you owe to the financial institution which is the excellent mortgage quantity. Both you pay it again to the lender by yourself or the lender will public sale the home and recuperate again their cash.

Throughout this 60 day discover interval, you may put up your case in entrance of the assigned officer and share with them what greatest you are able to do to repay the EMI quickly. In the event that they settle for your rationalization, then nicely and good, in any other case they should provide you with a written letter of rejection inside 7 days after which the following step begins.

Throughout this 60 day interval itself, you might also get restoration brokers to your doorways who might demand that you just settle your dues. Observe that as per the RBI guidelines you may have sure rights in terms of restoration brokers like.

- You may ask for the id of the gathering brokers if you want. They should carry their ID Playing cards and an authorization letter from the financial institution

- Restoration agent have to be a licensed agent as per the Indian Institute of Banking and Finance

- The restoration agent can go to solely between 7 am to 7 pm and shall solely speak to the defaulter and never members of the family (except the defaulter is out of attain)

- The mortgage restoration agent can’t be disrespectful or shall use any objectionable language or behaviour

In actual life, the above guidelines should not adopted correctly and restoration brokers are notorious to threaten and humiliate mortgage prospects. If that occurs, you shall complain to the financial institution and in addition take up the matter with the banking ombudsman

#3 – 30 days’ discover within the newspaper for Public sale

As the following step, the lender will get the property valued from their valuer’s to seek out out the honest worth of the property. Now begins the property public sale course of.

The lender will promote the property particulars and point out all particulars just like the reserve worth (shall be across the honest worth of the property), the date & time, deal with for the public sale of the property.

If the property proprietor feels that the honest worth of the property is simply too much less or not appropriate, then they will object and speak to the lender.

#4 – Public sale of property and refund of extra cash

And because the last step, the property will likely be auctioned within the open market and the financial institution will recuperate again all its dues. Observe that the financial institution is barely liable to recuperate the dues and never the surplus quantity. If there may be any steadiness left, it needs to be paid again to the home-owner. So regulate the public sale quantity. These days a lot of the dwelling auctions occur on-line (e-auctions) and you’ve got the info on-line.

Unload your own home if you happen to grow to be a defaulter

Let me information you a bit on what you must do if you’re unable to repay again your own home mortgage quantity and are marked as a defaulter. Sure!, The perfect factor to do is to unload your own home by yourself and pay again the dues to the financial institution.

Listed below are 2 the explanation why you must unload the home by yourself

- You’ll not get the perfect worth in Public sale – House Auctions are misery sale from the financial institution aspect. Financial institution simply needs to recuperate again their mortgage excellent. Therefore their focus isn’t on getting the perfect worth for your own home. In case you promote the home by yourself, you could get a a lot better worth

- It is going to take quite a lot of time because the property will likely be caught on the financial institution hand – The public sale course of is prolonged and should take quite a lot of time which will not be appropriate to your timeline. In case you unload the home your self, you could do it sooner as you could be open to negotiating and able to give some nice offers to potential consumers. You too can provide the brokers further or double fee to allow them to additionally put all their vitality into discovering a purchaser.

Learn how to keep away from entering into the defaulter listing in future?

What are a number of the greatest practices you must comply with in order that you don’t get into the defaulter listing? Listed below are some issues

- Attempt to preserve your EMI quantity lower than 40% of your take-home – All the time guarantee that the EMI isn’t an enormous burden for you. Don’t go overboard and take a mortgage which is sort of a huge burden for you.

- Attempt to pay as a lot down fee as you may – If doable, do be sure to pay an enormous down fee in order that your mortgage excellent is a smaller quantity that’s manageable for you. I’d recommend that you just pay greater than 40% within the down fee.

- Restructure the mortgage – If the EMI is an enormous quantity for you and every month you might be on the sting of default, do attempt to deliver down the EMI quantity by rising the tenure.

- In case you have any investments in debt property like FD, Saving account, Insurance coverage insurance policies, PPF and even EPF. you need to use that to pre-pay your mortgage to deliver down the mortgage excellent. That is just for these people who find themselves overburdened with excessive EMI quantities every month

I hope this was useful and you bought some new data!. Do tell us when you’ve got any questions!