Picture supply: Vodafone Group plc

The Vodafone (LSE:VOD) share worth obtained a little bit of a lift on Tuesday (11 November), after the group printed its half-year outcomes for the 12 months ending 31 March 2026 (FY26).

Buyers despatched the telecom large’s inventory 8.3% increased after they reacted positively to the information that the group’s FY26 result’s now anticipated to be on the higher finish of steerage.

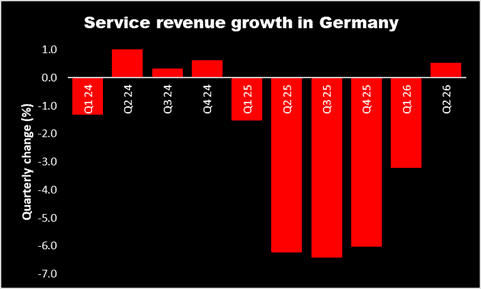

Nevertheless, extra importantly, service income in Germany returned to progress throughout the second three months of the monetary 12 months. Because the chart under exhibits, that is the primary quarterly improve for the reason that finish of FY24.

Vastly essential

That is notably important provided that throughout the first six months of FY26, the German market accounted for 30.6% of the group’s complete income and 38.3% of its adjusted EBITDAaL (earnings earlier than curiosity, tax, depreciation and amortisation, after leases).

This makes it the group’s most essential area. And it’s grow to be much more important given its current choice to downsize and offload a few of its underperforming divisions.

If the restoration within the nation’s prime line continues – and interprets into increased earnings — then it might have a big affect on Vodafone’s share worth. Of all its markets, Germany has the very best revenue margin.

Issues within the nation stem from the introduction of a brand new regulation that prohibited landlords bundling tv contracts with rents. The German authorities seen this as anti-competitive and launched laws to outlaw the transfer.

However Vodafone says it’s now seen the “ultimate affect of the TV regulation change”. On listening to the information, Morgan Stanley advised its purchasers: “After roughly 18 months of great top-line headwinds within the group’s largest market, we view this as a key optimistic milestone.”

Different actions in Germany embrace the persevering with improve of the group’s community to fibre, the introduction of a five-year guarantee and additional funding to assist enhance the client expertise. Vodafone claims that it’s “beginning to obtain market management in particular buyer segments”.

The group has additionally entered right into a binding settlement to accumulate Skaylink for €175m. It says the acquisition will allow its enterprise and public sector prospects to “entry an enhanced suite of digital providers and assist”.

One swallow doesn’t make a summer season

What’s taking place in Germany sounds optimistic to me. However one quarter’s progress in service income just isn’t sufficient to substantiate {that a} restoration is below means.

And Vodafone continues to face different challenges. The explanation for promoting a few of its belongings was to enhance its return on capital employed (ROCE). Nevertheless, throughout the first six months of FY26, its pre-tax ROCE was unchanged in comparison with the identical interval in FY25. This stays a priority.

Additionally, infrastructure within the telecoms sector is pricey.

But Vodafone has made important progress in addressing its massive borrowings. This had been seen by some buyers as a little bit of an Achilles heel. On a like-for-like foundation, internet debt has fallen from €31.8bn at 30 September 2024 to €25.9bn a 12 months later.

And as an indication of confidence, the group stated it expects to develop its dividend by 2.5% in FY26. That is the primary improve because it introduced a 50% reduce in Might 2024.

For these causes — together with indicators {that a} restoration in Germany is perhaps below means — I believe the inventory could possibly be one for long-term buyers to contemplate.