Abstract:

- On this weblog submit, I share the robust resolution to promote my favourite Indian IT inventory in 2025, revealing how emotional attachment clouded my judgment and the vital lesson I discovered about staying goal in investing.

A Monetary Calculator

Introduction

As a long run inventory investor, the shares that’s there in our portfolio can keep there for years. For instance, there are reviews which say that Warren Buffett began accumulating Coca Cola since 1988. He nonetheless have that inventory in his portfolio (35+ years). When one thing stays with you for thus lengthy, it begins to really feel like greater than only a cash factor. In our thoughts, every inventory turns into a narrative of its personal.

My funding journey shouldn’t be as lengthy, however there are few shares that’s there with me since a decade. One, such inventory I offered in 2025. The choice wasn’t simple. It taught me a lesson I’ll always remember. At this time, I wish to share that story with you. It’s not nearly one inventory. It’s about how we make decisions as traders.

The Inventory That Felt Shut

I first purchased this inventory in 2017. It was a widely known Indian IT firm.

You concentrate on it the strains of Infosys or TCS, however I received’t title it. Why? As a result of the lesson issues greater than the title.

I’d been studying about India’s tech growth. The corporate’s earnings have been stable. Its purchasers have been world giants. I invested about Rs.45,000. It felt like a wise transfer.

Through the years, the inventory grew decently. By 2021, my funding was price Rs.80,000. I used to be proud. It wasn’t simply the cash. The corporate survived the 2020 and 2021 market crash. It even paid dividends.

I’d test its worth throughout my lunch breaks. I’d smile when it hit new highs. Have you ever ever felt that method a few inventory? Prefer it’s proof you’re doing one thing proper?

The First Indicators of Hassle

Issues modified in 2024.

The Indian market was risky. The indices was swinging wildly. International rates of interest have been excessive. The US Federal Reserve stored charges at 5.5%. The RBI adopted with a 6.5% repo fee.

Progress shares, like my IT firm, began to wrestle. I observed the inventory’s worth stalling. It wasn’t crashing. However it wasn’t climbing both.

Then got here the corporate’s Q2 2024 earnings. Income progress was flat. Margins have been shrinking. The administration blamed “shopper funds cuts” within the US. I wasn’t too anxious. Each firm has a foul quarter, proper? I advised myself to remain affected person.

Lengthy-term investing is about holding via the noise. That’s what I’d at all times believed.

The Second Doubt Crept In

By early 2025, the cracks have been more durable to disregard. The inventory was down 15% from its 2021 peak.

I began digging deeper. The corporate’s debt had grown. It was borrowing to fund new AI tasks. I learn analyst reviews. Some have been downgrading the inventory. Others have been impartial.

I checked technical charts. The inventory had fallen beneath its 200-day transferring common. That’s a purple flag for a lot of traders.

I additionally appeared on the broader market. India’s IT sector was underneath strain. Purchasers have been spending much less on conventional IT providers. They needed AI and cloud options. My firm was late to that sport. Rivals have been transferring sooner.

I started to marvel, Was this inventory nonetheless the winner I believed it was?

The Arduous Determination to Promote

In April 2025, I discovered an excellent firm to put money into, however I had no spare money.

The worth of my holding inventory instantly began transferring up (after the Trump’s 90 Day pause to the reciprocal tariff). It moved up by 14-15% in a matter of every week.

I wanted this money urgently as a result of my new inventory’s worth was additionally transferring up. My portfolio had different shares. However this IT inventory was underneath my unfavourable radar as a consequence of all sort of noise associated to this sector. I believed, promoting it could cowl the hole.

The concept made my abdomen churn. How can I promote this inventory, which for a very long time was my favourite? After so a few years of loyalty, I used to be very hesitant to promote it.

Therefore, I spent extra days analyzing.

I in contrast the corporate’s fundamentals to its friends. Its price-to-earnings ratio was within the 30s. Rivals have been at additionally in 30s vary. Its income progress was 3%, however others have been rising sooner at 8%. The numbers weren’t mendacity. The inventory wasn’t a frontrunner anymore. Even my Inventory Engines’ algorithm scores weren’t favouring this inventory.

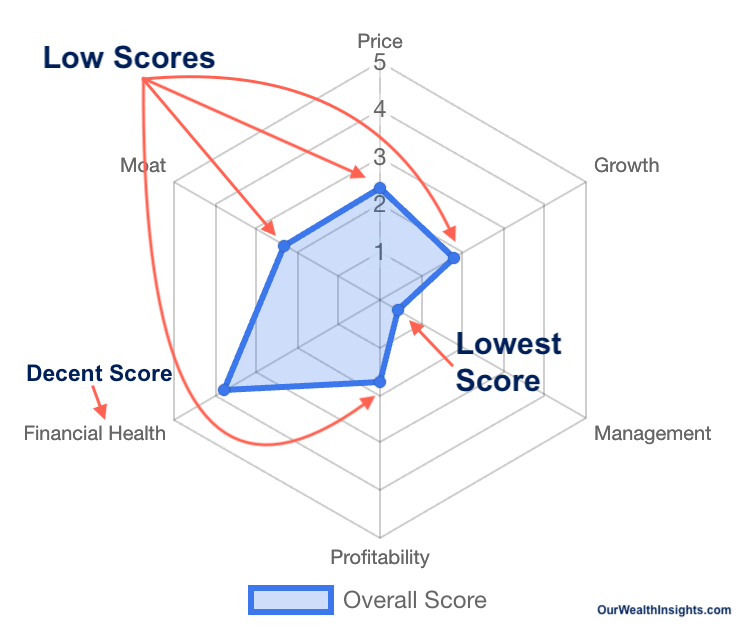

Its spider diagram was exhibiting weak administration calls (just lately). Progress, worth valaution, Moat, and profitability scores have been additionally low. The one factor that was moving into its favour was its monetary well being.

Emotionally, I didn’t wish to let go. Logically, I knew I needed to. I offered the inventory in April, 2025. The worth was at round Rs.1,450 ranges. I made a revenue. However it felt like a loss.

Have you ever ever offered one thing you liked, even when it was the fitting name? That’s the way it felt.

What I Realized From Letting Go

Promoting that inventory taught me one thing essential. Investing isn’t about falling in love. It’s about staying goal.

I’d held onto the inventory too lengthy. Why? As a result of I used to be connected. I ignored early warning indicators. I let my feelings cloud my judgment. That’s a mistake I received’t make once more.

The lesson isn’t nearly promoting. It’s about how we predict as traders. Markets change. Firms change. We have to adapt.

In 2025, India’s market is stuffed with alternatives. However it’s additionally stuffed with dangers. The Nifty 50 is at report highs. Valuations are stretched. International uncertainty is actual.

As traders, we have to ask robust questions. Is that this inventory nonetheless price holding? Does it match my targets? Am I holding it for the fitting causes?

Making use of the Lesson to Your Portfolio

Now, enable me to recommend you some issues that are sensible.

Have a look at your individual portfolio. Decide one inventory you’ve held for some time. Ask your self, Why am I nonetheless holding it? Is it due to its efficiency? Or since you’re snug? Examine its fundamentals. Have a look at its income progress, debt, and valuation.

Additionally, examine it to its opponents. If you’d like, you may as well test the technicals. Is it above or beneath its key transferring averages?

If the solutions don’t add up, you’ll be able to think about promoting.

It’s not about giving up. It’s about making room for higher alternatives.

In 2025, sectors like renewable vitality, fintech, personal banks are wanting much better seeing 10 years therefore. Possibly your cash may work more durable there.

The secret’s to remain disciplined. Don’t let feelings drive your selections.

Inventory Traders Ought to Keep a Birds Eye View

This expertise made me rethink my strategy to investing.

In India, we regularly make investments with our hearts. We purchase shares due to a model’s fame. Or as a result of a good friend advisable it. Or as a result of it’s been good for years. That’s not sufficient anymore.

The market is extra advanced now. International elements matter. Know-how is altering industries. We have to keep knowledgeable.

I’m not saying you need to promote each inventory you’re keen on. Some need to be held for many years. However it’s essential check them.

Overview your portfolio each quarter. Learn firm reviews. Observe market tendencies. If a inventory isn’t performing, don’t look ahead to a miracle. Act.

That’s what separates good traders from common ones.

Conclusion

Promoting my favourite inventory was robust. However it was the fitting transfer.

It freed up money for my subsequent high quality buy. It taught me to prioritize logic over emotion. It made me a greater investor.

I hope my story helps you consider your individual investments. Possibly you’re holding a inventory you’re keen on. That’s okay. Simply be sure it’s nonetheless incomes its place in your portfolio.

What about you? Have you ever ever needed to promote a inventory you cared about? What did you be taught? Inform me your story within the feedback part beneath.

![The Gensol Engineering Saga: From Photo voltaic Desires To a Monetary Fraud [BluSmart Story] The Gensol Engineering Saga: From Photo voltaic Desires To a Monetary Fraud [BluSmart Story]](https://i2.wp.com/getmoneyrich.com/wp-content/uploads/2025/04/The-Gensol-Engineering-Saga-From-Solar-Dreams-To-a-Financial-Fraud-BluSmart-Story-Thumbnail.png?w=150&resize=150,150&ssl=1)