Shall you purchase a single huge medical insurance coverage or divide it between two insurance policies (Base cowl + an excellent top-up coverage) for a less expensive premium?

The entire insurance coverage business is busy selling and promoting tremendous top-up insurance policies as a “cheaper method of upgrading” your medical insurance cowl. However nobody is educating buyers on the constraints of such combo or precisely why they’re cheaper in comparison with a single cowl.

At the moment, I’ll do this to the most effective of my talents.

Traders have purchased numerous mixtures of base plan + tremendous topup plan

- 5 lacs + 5 lacs

- 5 lacs + 10 lacs

- 10 lacs + 10 lacs

- 3 lacs + 7 lacs

- 10 lacs + 20 lacs

and plenty of extra…

Lately, we additionally noticed medical insurance insurance policies of “Rs 1 crore” sum assured for unbelievable premiums and plenty of buyers have additionally opted for these. Mainly, they’re merely a combo of Rs 5 lacs + 95 lacs cowl (with 5 lacs deductible).

Was that an awesome alternative?

Let’s dive deeper!

Let’s begin with an instance!

A household of three folks (with age 37 yrs, 36 yrs and 6 yrs) needs to purchase a 25 lacs medical insurance cowl. They will do two issues

[su_table responsive=”yes”]

| Choice | Coverage | Premium |

|---|---|---|

| 1st Choice |

| Rs 28,091 |

| 2nd Choice |

| Rs 17,907 |

[/su_table]

On this case, the premiums of the combo (2nd choice) is 37% cheaper.

Many of the buyers assume that each the insurance policies are a “25 lacs cowl coverage” and the 2nd choice is precisely the identical as the first choice however with a less expensive premium.

That is clearly not true!

How is it potential that you just get the very same factor, however with a less expensive premium?

If a combo is cheaper, certainly it should even have its personal limitations or will fall in need of in some conditions? That’s precisely what we’re going to have a look at at this time.

Disclaimer – “Tremendous Prime-up” insurance policies are an awesome alternative

I don’t wish to sound in opposition to tremendous topup plans. They’re an exquisite product and have an awesome function in medical insurance, however downside is that persons are shopping for them as a alternative for a powerful base cowl coverage and dwelling within the phantasm that they’re getting the very same deal as an enormous cowl.

Let’s begin to get into particulars now.

1. Two Claims as a substitute of a single declare

What does an individual want for on the time of a medical insurance declare?

The reply is a clean and hassle-free declare expertise.

I’ve already made 3 completely different claims (2 in my very own coverage and 1 in my father in legislation coverage) in the previous couple of years and therefore I can let you know that the declare course of is one thing you dont wish to complicate.

When you have got a single coverage, it means a single declare every time.

What occurs when you have got a combo plan? Let’s see!

If each insurance policies are from the identical insurer

If the bottom coverage and tremendous topup cowl are from the identical firm, then it’s fairly a clean and seamless course of, as they will internally cross-check issues and coordination is a lot better. Mainly, they must technically anyhow settle each claims, so they are going to mix them and course of the entire thing sooner and simply.

If each insurance policies are from a distinct insurer

Nonetheless, if each your insurance policies are from completely different insurers, then it will probably get difficult and complicated. Don’t fear, you aren’t dropping any cash right here, however certainly it’s a little bit of problem and delay in follow-ups and coordination if the tremendous topup plan will get triggered (which is able to occur when your base plan just isn’t giant sufficient). Additionally,

- You’ll have to preserve maintain of two medical insurance playing cards

- Coping with 2 declare types particularly for pre & submit hospitalization claims (even in case of a cashless declare)

- Communication for two insurance policies (this can be straightforward when the insurer is identical)

- And eventually, in case of reimbursements, extra documentation (hospital payments/prescriptions)

- With 2 insurers, there can also be a wait time concerned for getting the xerox of the payments/declare settlement letter

Additionally, think about the state of affairs of how your loved ones will have the ability to declare should you your self will get hospitalized (attributable to any emergency). Will your partner/household have sufficient understanding to observe the intimation and declare course of from each the insurance policies.

2. Decrease Protection attributable to NCB lacking in Tremendous topup

Opposite to in style perception, the combo (base + tremendous top-up) offers you a decrease protection in comparison with a single giant cowl, merely due to the NCB element which many don’t think about!

Stunned?

Virtually all of the insurance policies include the NCB function (No Declare Bonus), the place your sum assured retains going up for each claim-free yr. Listed here are among the examples

[su_table responsive=”yes”]

| Coverage | NCB |

|---|---|

| Care Insurance coverage | 10% enhance in sum assured as much as a most of fifty% of sum assured |

| Max Bupa Companion | 20% enhance in sum assured per yr as much as a most of 100% of sum assured |

| HDFC Ergo Optima Restore | 50% enhance in sum assured per yr as much as a most of 100% of sum assured |

[/su_table]

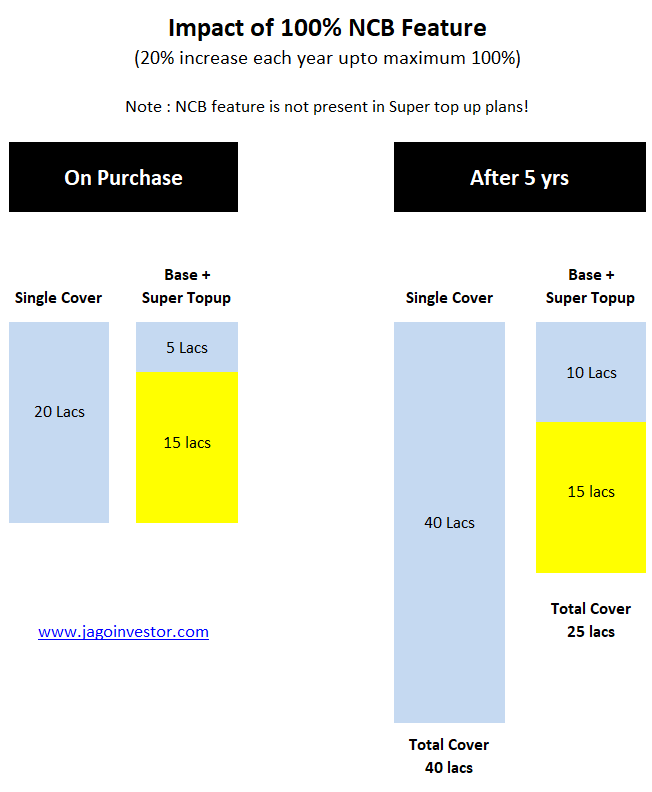

Now let’s see a case.

Assume an individual needs to purchase a coverage with a sum assured of 20 lacs. He has two choices

[su_table responsive=”yes”]

| Choice | Choice 1 – Single Cowl | Choice 2 – Combo |

|---|---|---|

| Mixture! | The one coverage of 20 lacs | The one coverage of 5 lacs (base plan) Tremendous Topup cowl of 15 lacs (with 5 lacs deductible) |

| NCB Profit | 20% annually (as much as 100%) | 20% annually (as much as 100%) applies solely on the bottom plan NCB function is NOT relevant in Tremendous topup insurance policies |

| Complete Sum Assured at first (while you purchase coverage) | 20 Lacs | 20 Lacs |

| Complete Sum Assured after 5 yrs (claim-free years) | 40 lacs (base coverage X 2) | 25 lacs (base coverage X 2 + tremendous topup) |

[/su_table]

Now you perceive why the premiums for tremendous topup cowl is lower than the only giant cowl.

Right here is the pictorial illustration of the above instance

So, you may see how after a couple of years there will probably be a niche of 15 lacs in sum assured within the combo plan. Now do the maths for a complete cowl of 10 lacs. What’s going to occur should you divide it right into a 5+5 combo?

3. Decrease Protection attributable to Recharge Profit (2 giant claims in a single yr)

There’s something referred to as “Recharge profit” in medical insurance insurance policies today, which refills your coverage once more as much as the sum assured when the sum assured reduces attributable to any declare. Like you probably have a ten lacs cowl, and also you declare for 4 lacs, then the coverage will come down to six lacs, however then attributable to recharge profit, the sum assured will once more rise to 10 lacs (the added sum assured can’t be utilized by the identical particular person for identical sickness for which he/she claimed)

Now, let’s think about a case

Assume, that within the worst case there are two huge claims in the identical monetary yr. Like what occurred with few folks on this Pandemic. Think about one particular person getting hospitalized attributable to corona after which after 4-5 months, one other particular person within the household additionally getting hospitalized. Or think about somebody within the household getting handled for an enormous sickness after which after a couple of months, one other member of the family getting hospitalized attributable to a extreme accident additionally.

Very low possibilities of this taking place. RIGHT?

Sure, nevertheless it can’t be dominated out in any respect!. It’s the intense finish I do know.

How would be the declare expertise in each instances? Let’s evaluate the identical instance (overlook NCB for the second)

[su_table responsive=”yes”]

| Choice | Choice 1 – Single Cowl | Choice 2 – Combo |

|---|---|---|

| What? | Single cowl of 10 lacs | Single Cowl of 5 lacs (base plan) Tremendous Topup cowl of 5 lacs (with 5 lacs deductible) |

| 1st Declare by husband for Rs 8 lacs | The declare will probably be paid for 8 lacs | 5 lacs declare paid by the first base coverage 3 lacs declare will probably be paid by tremendous topup coverage

|

| 2nd declare by a partner in the identical yr for Rs 10 lacs | Due to the recharge profit, the partner will have the ability to declare for a complete of Rs 10 lacs | Due to the recharge profit, the bottom coverage pays 5 lacs However the tremendous topup pays the remaining 2 lacs solely. 3 lacs should be paid by policy-holder LOSS of Rs 3 lacs right here in comparison with 1st choice |

[/su_table]

The purpose is that recharge profit may also come into play in some not possible conditions, however that function is lacking in tremendous topup plans.

4. Distinction in room lease restrict

One main factor it’s a must to think about is the distinction between room lease limits in each base and tremendous top-up.

Right here is an instance.

- On the time of writing this text MaxBupa Reassure plan (lately launched) has no room lease limits.

- Nonetheless, its Well being Recharge plan (the tremendous topup coverage) mentions that you just solely get a single non-public AC room within the plan.

Word that there are numerous sorts of single non-public AC rooms in a hospital. What you get out of your insurance coverage insurance policies is the most cost effective “Single Non-public AC room”.

Now let’s see 2 instances with an instance

- Complete well being cowl: 20 lacs

- The room class: The next grade single AC room (larger high quality and higher amenities). Think about the most cost effective AC single room was not out there otherwise you wished to go for the higher amenities.

- Remaining Invoice quantity: Rs 11 lacs

Case 1: You will have a single coverage of 20 lacs (Maxbupa Reassure, only for instance)

On this case, as a result of there is no such thing as a room lease restrict, your whole declare quantity is admissible and your declare course of will occur easily.

Case 2 : Now think about that you’ve got a 20 lacs cowl however in combo kind.

You will have a 5 lacs base plan (Reassure coverage) + 15 lacs of tremendous topup with a deductible of 5 lacs (Maxbupa Well being Recharge)

Now the primary coverage pays the declare of 5 lacs simply as a result of there was no room lease restrict within the coverage.

Nonetheless while you go to assert the extra 6 lacs within the tremendous topup, here’s what will occur.

If you happen to had chosen the most cost effective AC single room, your whole declare of 6 lacs would have gotten admissible and processed. Nonetheless, since you select a better class room, you’ll not be paid proportionately solely.

If the room lease for the most cost effective AC non-public room was Rs 8,000 per day whereas you select the one whose lease was Rs 12,000 per day. You may be paid simply 66.66% (2/third) of the declare quantity, which is barely Rs 4 lacs

That is referred to as a Proportionate declare in medical insurance. This will occur in actuality in case your base cowl is a small quantity and an enormous declare arises. If you happen to select the most cost effective single non-public AC room, then there received’t be any points, however in any other case, there might be points and this may occur even should you purchased the insurance policies from the identical insurer (like on this instance I gave)

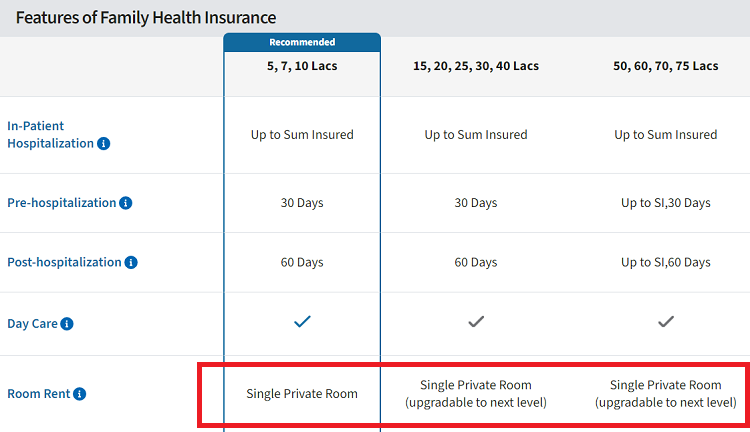

One other instance is of Care Plan from “Care Insurance coverage” formally often known as Religare Care.

In Care Insurance coverage the room lease for a 5 lacs base cowl and 15 lacs of tremendous topup cowl is “Single Non-public AC Room”

Whereas should you take a bigger single cowl, the room lease is “Single Non-public AC room (upgradable to subsequent degree). This offers you sufficient flexibility and freedom to get pleasure from higher high quality well being care and amenities. Typically, the only PVT AC room of the bottom class is probably not what you want for.

Think about you want an even bigger house and higher amenities within the room, in that case, extra deluxe rooms will probably be required by you. That is the place it’s possible you’ll lose in an enormous method (not at this time, however possibly in future or in case of enormous claims).

Right here is the snapshot from the Care Well being Insurance coverage web site.

Outdated Insurance policies – If somebody has taken 3-5 lacs of sum assured a couple of years again (particularly from PSU corporations), there’s a good likelihood that there’s a room lease restrict of 1% of sum assured (instance – Oriental Joyful household floater plan). Now in case you are shopping for an excellent topup plan, there’ll certainly be a distinction within the room lease restrict.

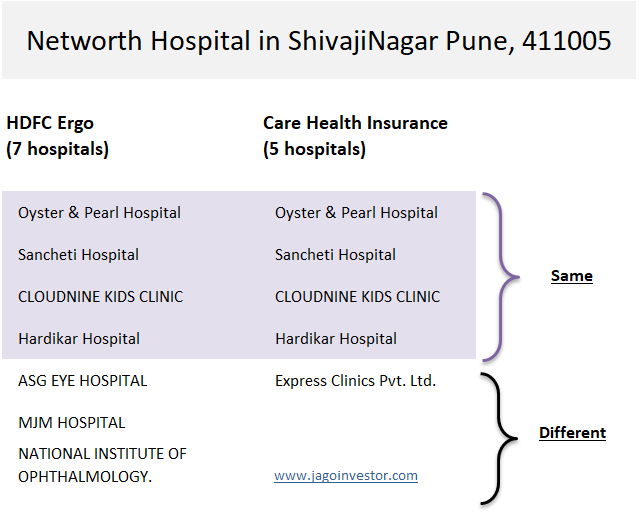

5. Completely different Cashless Community of Hospitals

In case your base coverage and tremendous topup insurance policies are from completely different corporations, there could also be a risk that the hospitals of their cashless community are completely different to some extent. Chances are you’ll face some points in future attributable to this.

Right here is an instance

I checked for community hospitals between HDFC Ergo and Care Insurance coverage for Pincode 411005, which is Shivajinagar, Pune.

I discovered that HDFC Ergo has 7 hospitals and Care Insurance coverage had solely 5 hospitals of their community (in March 2021). Out of those 4 hospitals have been frequent, the remainder have been completely different.

Now, what in case your first coverage is cashless however your sum assured within the first coverage is small. In that case, the 2nd coverage (tremendous topup) will get triggered, however right here you’ll first must spend the cash because it’s out of the community of the 2nd insurer)

You’ll then must file a reimbursement declare later and do the documentation half too.

This is not going to be the case should you had a single giant cowl from the first firm itself. Chances are you’ll argue that you’ll plan properly earlier than getting admitted to the hospital and attempt to match the one which is there in each insurance policies, however belief me, in actual life it will likely be robust.

When a physician tells you or recommends that you just get admitted to hospital XYZ (typically he’s additionally a practising physician in that very same hospital), it turns into fairly robust to problem that or counter his suggestion.

6. If coverage tenures are completely different for each insurance policies

In some instances, you may face points within the declare, should you bought each base and tremendous topup insurance policies in several months (identical or completely different insurer, doesn’t matter).

It could occur in some particular instances that your declare just isn’t admissible below any coverage.

That is defined very properly by Mahavir Chopra of Beshak.org in his article right here. I’m simply sharing what he wrote initially.

Say you have got the next Combo plan.

Base plan of Rs. 2 Lakh (Plan yr: January 2021 to December 2021)

Tremendous Prime-up of Rs. 5 Lakh with an annual deductible of Rs. 2 Lakhs (Plan yr: April 2021 to March 2022). (This implies for the Tremendous Prime-up to pay, the hospitalization bills ought to cross Rs. 2 Lakhs within the coverage interval in query – which is April 2021 and March 2022.)

Now, say you bear two hospitalizations within the yr 2021.

The primary one occurs in January 2021, the invoice quantity is Rs. 2 Lakh. Now that is lined by your base-plan there is no such thing as a confusion, and the declare quantity is paid.

Subsequent – you bear a hospitalization in April 2021. And the invoice involves 1.5 Lakhs.

Now, take a guess on – who pays for this?

A. Base-plan

B. Tremendous Prime-up

C. You

If you happen to guessed A or B – then you definitely’ll be up for a BIG shock! Right here’s how your two insurance coverage will have a look at the second declare.

Your base plan is not going to pay: As a result of – you have got already exhausted the duvet quantity out there for the yr (January 2021 – December 2021)

Your Tremendous Prime-up is not going to pay: As a result of the Tremendous Prime-up plan pays solely when the hospitalization bills through the coverage interval of April 2021 to March 2022 crosses the deductible of two Lakhs. On this case, the entire hospitalization bills through the interval in query (Apr 21 to Mar 22) are solely Rs. 1.5 Lakhs – therefore the declare received’t be payable.

These have been some limitations of the tremendous top-up you have to be conscious of. It’s higher to get educated about this facet, moderately than getting shocked and disillusioned in future.

Another small Variations

Aside from the most important factors mentioned above, there are different minor however essential factors you need to know

- Annual Well being Checkup Profit: With a single giant cowl, it’s possible you’ll get superior annual well being checkup packages that cowl extra assessments. However with combo plans, it’s possible you’ll get regular take a look at packages in each base coverage and tremendous topup, which is of much less use as nobody will do the take a look at twice only for the sake of it. Some insurance policies additionally supply well being checkups solely as soon as in two years for smaller covers.

- Hospital Money Profit – In lots of small base plans like 5-10 lacs, the hospital money restrict is Rs 1,000 per day. Nonetheless for an even bigger sum assured, the hospital money will probably be within the vary of 3000-4000. If you happen to keep within the hospital for 10 days, this implies getting 10k solely in combo plan vs 40,000 in a single greater cowl.

- Organ Donor Cowl / Ambulance Costs – Once more, a decrease sum assured plan night time have a decrease profit in comparison with a single huge cowl.

- Ready interval – It’d occur that the ready interval for pre-existing sickness is completely different in each insurance policies, simply examine that.

- Pre & Submit Hospitalization Tenure is completely different – It could additionally occur that each insurance policies have completely different pre & submit hospitalization tenure.

- Different Minor Adjustments – Aside from the factors above, there are numerous different minor variations within the greater sum assured (single coverage) which can be helpful for you in some particular instances, which we aren’t masking right here

How to take a look at Tremendous Prime-up insurance policies? What’s the proper mixture?

Everybody shall have a big sufficient cowl with a single coverage as step one.

With NCB profit, that enormous cowl may even get ballooned to each giant cowl. And with recharge advantages, additionally, you will get these edge instances lined. This may ensure that for a few years to come back, this single coverage will probably be sufficient for you.

There are very low possibilities that in some worst instances, you should still have a really huge declare when this single huge giant cowl is not going to be sufficient, and that’s when tremendous top-up cowl shall come into the image and that’s precisely why they have been designed for.

To cowl these excessive finish instances!!!

However buyers have simply began utilizing them with a small cowl for the sake of saving some premiums. Little doubt you’ll have a couple of thousand for a few years to come back, however there are additionally limitations which we talked about.

Contemplating the purpose above, the minimal base sum assured which I really feel one shall soak up 2021 is Rs 10 lacs. With NCB profit, it could change into a 15/20 lacs cowl, which is sweet sufficient for almost all of claims. Anyhow the typical declare is sort of small!

How huge was your final #healthinsurance declare?

(Solely for many who filed a declare, no matter how a lot was paid)

— jagoinvestor.com (@jagoinvestor_) March 17, 2021

Does it imply you could take a 50 lacs cowl? NO 🙂

So what mixture to purchase?

Talking for almost all, I feel a Rs 10 lacs base coverage with an NCB of fifty%/100% and an excellent topup of 30-40 lacs with Rs 10 lacs deductible is an effective sufficient alternative proper now. This may stability the premiums and protection. If you’d like a fair excessive single cowl coverage like 15-20 lacs, go forward!

But additionally keep in mind, that inside the subsequent 10-15 yrs, even the ten lacs protection could appear to be a small one and it’s possible you’ll really feel that the bottom coverage ought to have been for at the very least 20-30 lacs. So take your resolution after cautious thought.

You’ll be able to at all times improve your base cowl sum assured on the time of renewal.

Do let me know you probably have any queries or feedback?

Credit – Due to Mahavir Chopra of Beshak.org to appropriate me on some factors on this article and in addition give his beneficial insights occasionally due to which I used to be capable of carry depth to this text. Mahavir Chopra is a veteran and a widely known title within the insurance coverage business and they’re doing a little cool stuff on beshak.org within the space of insurance coverage. Do try their web site!