Zeta World Holdings Corp ZETA, a advertising and marketing know-how firm specializing in AI-powered advertising and marketing options has outperformed the NYSE Composite index in 2024, whereas its friends have underperformed the market. Based mostly on its basic and technical evaluation, must you purchase, promote, or maintain the inventory? Right here’s what analysts are saying.

Shares of Zeta have been up 1.23% at $18.97 per share as of Thursday’s shut. The inventory was up 125.83% this 12 months outperforming NYSE Composite, which rose by 14.98%.

Its friends, Freshworks Inc FRSH was down 27.26%, and Temenos ADR TMSNY was down 21.52% in the identical interval.

The technical evaluation of each day transferring averages signifies a short-term bearish development.

The inventory ended at $18.97 apiece on Thursday. This was under its eight and 50-day easy transferring common of $19.52 and $21.69, respectively. Nevertheless, as per Benzinga Professional information, its present inventory worth was additionally decrease than the 50-day transferring common of $24.42, and its 200-day transferring common of $24.42.

This suggests that the inventory is in a downtrend. However, the relative power index of 38.38 suggests the inventory’s motion is reasonably oversold however nonetheless within the impartial zone.

See Additionally: NVDA May Go Up To $170 In Q1 After Breaching $145 Degree As Merchants Flip Bullish On Jensen Huang’s AI Large

Two Of Zeta’s Purchasers Merge

Zeta World stands to learn from Omnicom’s acquisition of Interpublic. David A. Steinberg, the co-founder, chairman, and CEO of Zeta, in a press release on Dec. 9 mentioned that “We’re pleased with our intensive relationships with the highest Holdcos, together with each Omnicom and IPG, and consider that as we speak’s announcement is a constructive one for the trade and Zeta. Like everybody else, we will probably be watching carefully as this progresses and provide help as wanted.”

Throughout its investor summit, Zeta mentioned it could leverage the mixed entity’s huge information infrastructure and enhanced monetary power. This presents alternatives for Zeta to deepen AI-powered buyer insights, increase scale and attain and speed up progress.

New Acquisition By Zeta

Zeta World’s acquisition of LiveIntent is projected to contribute “Huge information property, direct channel capabilities and premium writer community to the Zeta Advertising Platform. The mixing of LiveIntent into the ZMP will increase gross margins whereas accelerating the shift of our income derived from company prospects to direct channels,” added Steinberg in a press release dated Oct. 8, 2024. This information basis will additional place Zeta to capitalize on the mixed Omnicom-Interpublic entity, providing options to this main consumer phase.

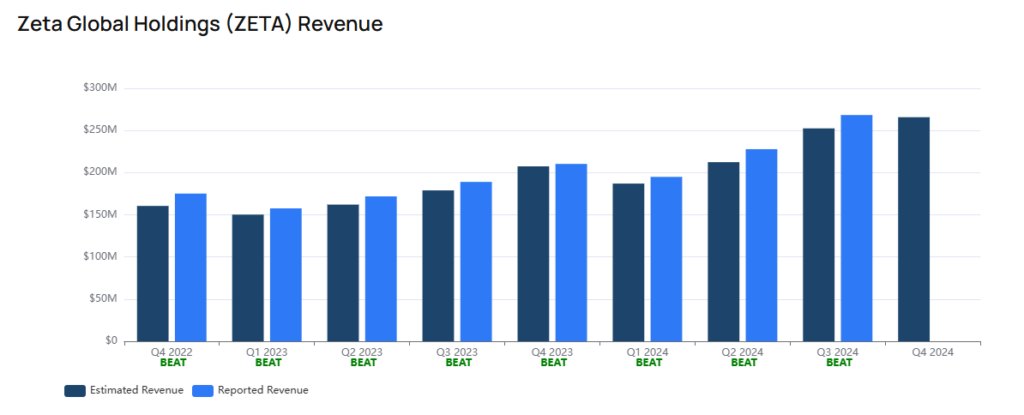

ZETA’s Estimated Topline And Bottomline

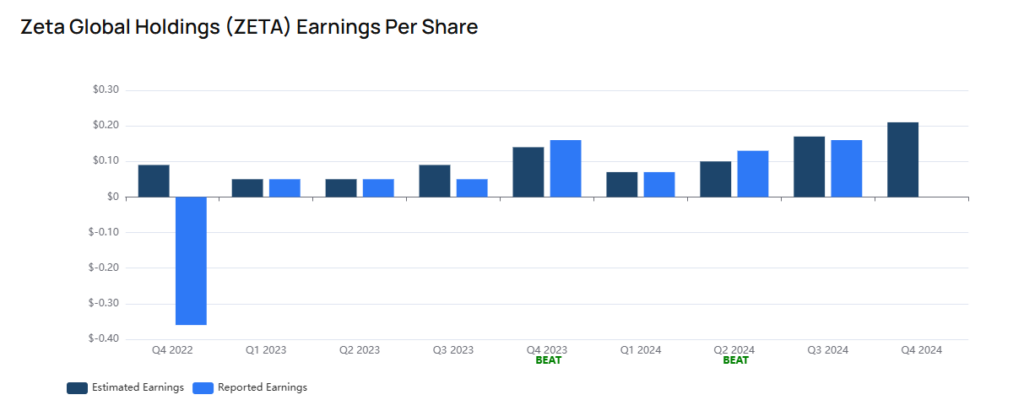

Benzinga’s estimate for the fourth quarter income is pegged at $265.73 million, suggesting 26.34% progress from final 12 months’s topline of $210.32 in the identical quarter.

The consensus estimate for earnings within the fourth quarter is pegged at 21 cents per share, as in comparison with 16 cents in the identical quarter of the earlier fiscal, suggesting a 31.25% improve from the prior 12 months’s precise.

Zeta Has Greater Liquidity To Meet Obligations

The corporate had a present ratio of three.319 on the finish of the third quarter, exceeding the trade common of two.16, based on Benzinga Professional information. This ratio, indicating a strong capability to fulfill short-term obligations, has surged 67.7% from the earlier quarter.

See Additionally: Ought to You Purchase or Promote This Nvidia Rival? Analysts Weigh In As Technicals Sign A Downtrend

What Are Analysts Saying: Based on Benzinga, Zeta has a consensus ‘maintain’ with a worth goal of $32.59 based mostly on the rankings of 17 analysts.

The best worth goal out of all of the analysts tracked by Benzinga is $45 issued by Craig-Hallum with a ‘purchase’ score on Nov. 12, 2024. Analyst Jason Kreyer highlights Zeta World’s robust efficiency, pushed by the profitable LiveIntent acquisition and cross-selling alternatives. Analyst is constructive on the deepening penetration inside the present $100 billion plus buyer base by replicating profitable high-spend buyer relationships.

Goldman Sachs analyst Gabriela Borges initiated protection on Zeta with a ‘impartial’ score and introduced a worth goal of $30 apiece. The be aware highlighted key medium-term dangers. Together with a chance of its proprietary information’s worth erosion as information accessibility and evolving client preferences might diminish, requiring steady innovation. Sturdy 2024 efficiency, partly pushed by one-time occasions, might make year-over-year comparisons difficult in 2025. Additionally, based on the analyst stricter privateness legal guidelines pose a long-term threat to Zeta’s data-driven enterprise mannequin, as evidenced by latest underperformance amid trade scrutiny.

The bottom goal worth was sustaining a ‘impartial’ from Credit score Suisse was adjusted to $9.5 from $12 per share on Aug. 4, 2022. The common worth goal of $38.67 between Goldman Sachs, RBC Capital, and Needham implies a 105.13% upside for Zeta.

Learn Subsequent:

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.