NTPC Inexperienced Power

The world is fast-paced in direction of a sustainable vitality future. India, because the fastest-growing economic system globally, is main this journey from the entrance. The nation is stepping up its efforts to cut back carbon emissions and meet its renewable vitality targets for 2030.

NTPC Inexperienced Power Restricted (NGEL), a subsidiary of NTPC Restricted, the nation’s largest vitality conglomerate is main this mission of transition to wash vitality. The corporate has been a front-runner in renewable energy sources like photo voltaic, wind, and inexperienced hydrogen.

The federal government of India has set a goal to cut back using fuel-based vitality and is dedicated to growing non-fossil fuel-based vitality capability to 500 GW by 2030. To realize this aim, the federal government of India has set some insurance policies akin to Nationwide Inexperienced Hydrogen Mission, Renewable Power Buy Obligation insurance policies, Power storage obligations, Renewable Era Obligations, and Efficiency Hyperlink Incentives, and so forth. to advertise the manufacturing of renewable vitality at each doable locations.

NTPC Inexperienced Power: Main Inexperienced Hydrogen Firm

The Authorities of India authorised the Nationwide Inexperienced Hydrogen Mission, aspiring to develop a inexperienced hydrogen manufacturing capability of 5 million metric tonnes (MMT) and an related RE capability addition of about 125 GW by 2030.

NTPC Inexperienced Power (NGEL) is the pioneer in reaching the renewable vitality aim of the federal government. NGEL has been chosen because the expertise accomplice for 1 GW capability for inexperienced hydrogen electrolyzers.

Additionally Learn

The Inexperienced Imaginative and prescient

NTPC Inexperienced Power Restricted (NGEL) is an entirely Owned Subsidiary of NTPC Restricted. To realize renewable vitality targets, the federal government of India assigned the duty to NGEL to develop large-scale inexperienced vitality tasks to make sure a greener vitality combine for the nation.

NGEL is focusing broadly on 4 main sectors as under.

Extremely-Mega Renewable Power Energy Park

NGEL is implementing and planning a cumulative capability of 36GW in numerous states by the UMREPP scheme. Rajasthan (20 GW) and Gujarat (4.8 GW), Maharashtra (2.6 GW), Uttar Pradesh (2GW), Andhra Pradesh (4 GW), Madhya Pradesh (0.6 GW) and DVC (2 GW) for realizing 60 GW RE capability plan.

Greatest Inexperienced Hydrogen Firm

NTPC is the expertise accomplice for 1 GW capability for inexperienced hydrogen electrolyzers.

Chief in Power Storage

CEA has projected a Battery Power Storage (BES) capability of 208 GWh as part of the put in capability by 2032. NTPC has tendered 500 MW/3 GWh and 1500 MW/9 GWh of Storage capability.

The corporate can also be planning for vitality storage tasks for inexperienced hydrogen at appropriate location(s) throughout India.

Planning for Offshore Wind Power

NTPC can also be exploring collaborations with world companions to share experience and leverage their expertise in growing offshore wind vitality tasks.

NTPC Inexperienced Power unlisted share worth

As per the BharatInvest web site, NTPC Inexperienced Power unlisted share worth is buying and selling at Rs 500 per fairness share. That is unlisted share worth, the corporate has not but listed in exchanges in India for normal public buying and selling.

The corporate has filed DRHP with SEBI for approval and planning for a listed in each BSE and NSE alternate as main-board IPO. Allow us to talk about in regards to the NGEL IPO particulars.

NTPC Inexperienced Power IPO Particulars: Key Information

- NGEL filed a Draft Crimson Herring Prospectus for an preliminary public providing on September 18, 2024.

- NTPC inexperienced vitality IPO Date is but to be introduced: –

- CRISIL has given CRISIL AAA/Steady (Reaffirmed) for long-term score whereas CRISIL A1+ (Reaffirmed) for the short-term.

- Governments throughout the globe together with India have been specializing in renewable vitality and inexperienced hydrogen vitality as a serious supply for future vitality wants.

- The corporate has robust progress potential to excel on this section regardless of competitors.

- NTPC inexperienced vitality IPO subject dimension will likely be roughly ₹ 10000 crore at a face worth of ₹ 10 every.

NTPC inexperienced vitality IPO – Monetary Power

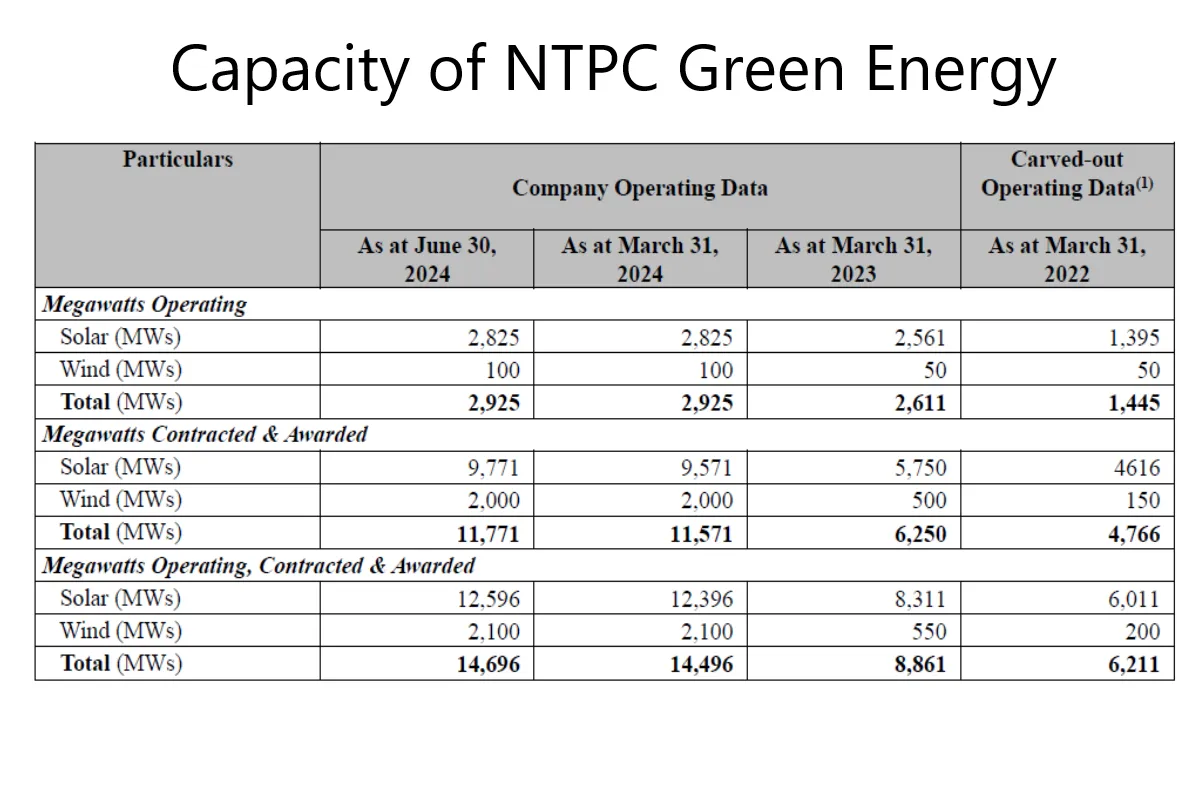

- Within the three months ended June 30, 2024, and Fiscal 2024, renewable vitality gross sales accounted for 96.48% and 96.17%, respectively, of the full income from operations.

- In Fiscal 2023 and Fiscal 2022, renewable vitality gross sales accounted for 96.94% and 97.19%, respectively, of its income from operations.

- In Fiscal 2023 and Fiscal 2024, income from operations grew by 59% and 35.4% respectively from the earlier interval.

- In Fiscal 2023 and Fiscal 2024, the working EBITDA Margin grew by 90% and 89% respectively from its earlier interval.

Goal Behind the NGEL IPO

- The web proceeds from the recent subject, ₹ 7500 crore will likely be used for the funding in its Subsidiary, NTPC Renewable Power Restricted (NREL) for reimbursement/ prepayment, in full or in a part of sure excellent borrowings availed by NREL.

- The remainder of Rs 2500 crore will likely be used for normal company functions.

- This may also improve the visibility and model picture of the corporate in addition to present a public marketplace for Fairness Shares in India.

NTPC inexperienced vitality IPO evaluation: Good or Unhealthy?

- NTPC Inexperienced Power is without doubt one of the Maharatna firms of the federal government of India.

- International renewable vitality market dimension is predicted to develop from USD 900 Billion in 2022 to USD 3200 Billion by 2030.

- India’s renewable vitality market dimension is predicted to be price as much as $80 billion by 2030 from round $20 billion in 2022.

- The Authorities of India has set a goal to attain a 500 GW renewables goal earlier than 2030 from round 180 GW in 2022.

- International direct funding (FDI) in India’s renewable vitality sector stood at $251 million/ Rs 20.5 billion within the third quarter (Q3) of the monetary yr (FY) 2023.

- There’s a large market to seize for this firm.

- The federal government of India is specializing in inexperienced hydrogen to make India a hub of this vitality.

- NTPC Inexperienced Power will play a pivotal function in reaching this goal.

- The corporate has recorded robust income progress through the years.

- Contemplating the above elements NTPC Inexperienced Power has robust progress potential.

NTPC Inexperienced Power: Outlook

NTPC Inexperienced Power is enjoying a number one function in remodeling India’s vitality panorama from fossil gasoline to renewable vitality. With extremely superior technological innovation and a dedication to sustainability, NTPC Inexperienced Power Restricted is main the way forward for India’s vitality sector. This can be a good firm to search for funding. NTPC Inexperienced Power IPO is the suitable technique to enter into this section and put money into a Maharatna of the federal government of India.

Extra From Throughout our Web site

We endeavor that will help you to know totally different facets of an organization earlier than you put money into the corporate’s IPO. Be taught all firm insights for funding in new firms within the Indian share market in 2023. To know extra details about firm insights for funding, and enterprise overview of firms for funding, listed here are some prompt readings on firm insights for funding – Inexperienced Hydrogen Shares in India, 10 Greatest IPOs in 2022, Tata Motors Inventory Value, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Inventory Value, Tata Applied sciences IPO, AI Shares in India.