Synopsis– The actual property market in India in 2025 has numerous alternatives for all actual property buyers, fueled by urbanization tendencies, financial development, and infrastructure enhancements. This text showcases ten cities for potential buyers, identifies the important thing influences setting places for demand for property, presents solutions for buyers, outlines the advantages and dangers of investing.

India’s actual property market is increasing steadily in 2025, supported by city development, stronger economies, and ongoing infrastructure initiatives. Each main cities and rising cities are seeing elevated property demand. This text highlights the ten cities providing the very best funding alternatives, specializing in components like rental earnings, value development, and market stability.

Key Elements Driving Actual Property Funding

- Infrastructure Improvement: Metro rail expansions, expressways, and sensible metropolis initiatives are radically remodeling connectivity, elevating actual property costs, and creating development alternatives for buyers.

- Financial Development: The federal government’s concentrate on creating profitable IT hubs, company corridors, manufacturing clusters, and up-and-coming service sectors drives demand for each residential and business actual property, particularly among the many skilled courses, resulting in continued demand for leases.

- Authorities Insurance policies: The broader acceptance of RERA, tax incentives, enhancements in property registration, and enhancements from Good Cities Mission reforms create the principles of the sport with an elevated degree of transparency, safety, and thereby investor confidence.

- Rental Yields & Appreciation Potential: Rising cities that present constant rental earnings in addition to sturdy long-term capital appreciation create an equal stability of rapid earnings and wealth creation.

- Affordability & Market Stability: Affordable value entry factors with regular, sustained market development prospects entail a low threat and strong worthwhile funding alternative.

High 10 Cities for Actual Property Funding

1. Bengaluru (Silicon Valley of India)

- Why Make investments: With an excellent number of IT and startup ecosystems, there may be all the time development, all the time demand.

- Drivers: Metro traces pushing outward, outer ring highway openings and holes being crammed with infrastructure initiatives.

- Scorching Spots: Whitefield, Koramangala, Sarjapur Street.

- Rental & Appreciation: Sturdy rental yield returns and good appreciation development potential.

2. Hyderabad

- Why Make investments: Reasonably priced costs, burgeoning IT sector and company divisions persevering with to develop.

- Drivers: Infrastructure development, HITEC Metropolis, connecting early main thoroughfares.

- Scorching Spots: Kondapur, Gachibowli, HITEC Metropolis.

- Rental & Appreciation: Balanced rental calls for with out sacrificing long-term value development potential.

3. Pune

- Why Make investments: An IT and schooling hub attracting younger professionals and college students largely.

- Drivers: Built-in township, metro traces expanded, life-style residential initiatives.

- Scorching Spots: Hinjewadi, Kharadi, Baner-Balewadi

- Rental & Appreciation: Regular demand helps ample rental yield and capital appreciation.

4. Mumbai Metropolitan Area (MMR)

- Why Make investments: India’s monetary capital fuels residential and business demand.

- Drivers: restricted land, midsize new developments (Navi Mumbai Worldwide Airport).

- Hotspots: Thane, Mulund, Navi Mumbai, Panvel.

- Rental & Appreciation: Excessive yields (10% plus), premium long-term development.

Additionally learn: High 10 Indian Cities With the Finest Air High quality in 2025

5. Chennai

- Why Make investments: IT, manufacturing, and land-based economic system develop collectively, creating constant property demand.

- Drivers: Chennai Part II early opening, like several sprawling metropolis present process fast, lifestyle-driven housing enlargement.

- Scorching Spots: OMR, Guindy, Sholinganallur, Porur.

- Rental & Appreciation: Balanced rental yield mixed with longer-term appreciation potential.

6. Ahmedabad

- Causes to Make investments: A quick-growth situation, particularly in manufacturing and providers, working as a Good metropolis.

- Drivers: A conducive atmosphere for enterprise, deliberate infrastructure, and numerous residential codecs.

- Hotspots: Vastrapur, Prahlad Nagar, SG Freeway, and Bopal.

- Rental & Appreciation: Straightforward entry for many buyers and an excellent long-term prospect for appreciation.

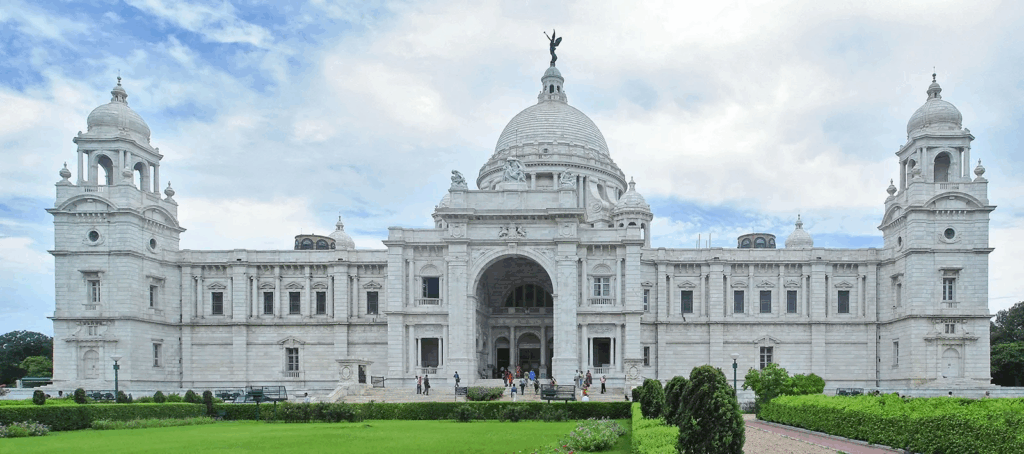

7. Kolkata

- Why Make investments: Property costs are fairly reasonably priced within the rising market.

- Drivers: Quick residential and business growth with elevated necessities for city areas.

- Hotspots: Rajarhat, New City, Salt Lake Metropolis.

- Rental & Appreciation: A lower-cost choice for first-time buyers, with first rate appreciation prospects.

8. Gurgaon (Gurugram)

- Why Make investments: A longtime company hall close to Delhi, with luxurious and mid-tier housing.

- Drivers: Wonderful infrastructure, availability of company places of work, and metro connectivity.

- Hotspots: Golf Course Street and Dwarka Expressway.

- Rental & Appreciation: Residential and business funding, with premium prospects for returns.

9. Noida

- Why Make investments: A part of Delhi-NCR and witnessing fast development in company exercise and concrete developments.

- Drivers: Wonderful connectivity by way of metro and appreciable mixed-use growth potential, with good facilities anticipated.

- Hotspots: Sector 150 and Central Noida, & Better Noida.

- Rental & Appreciation: Excessive rental exercise potential and good prospects for value development in the long run.

10. Kochi

- Why Make investments: Alongside the coast with exterior NRIs and rising market buyers.

- Drivers: Metro growth and important coastal revamp, and development within the economic system

- Hotspots: Kakkanad, Edapally, Vyttila, Panampilly Nagar.

- Rental & Appreciation: A continuing rental demand and significant appreciation potential.

Ideas for Actual Property Traders

Affirm property titles, approvals, and compliance with rules earlier than making a purchase order. Perceive the potential for development, connections, and different present or potential infrastructure initiatives to establish areas with potential. Place anticipated rental yield in context of capital appreciation, relying on whether or not you’re aligned with a long-term or short-term technique. Pay attention to modifications or presentation of rules, incentives and different reform processes that happen in the actual property market. Make your funding selections primarily based on the standard of the initiatives you need to construct with development professionals who’ve a protracted monitor report of high quality, well timed supply, and challenge possession.

Conclusion

India’s numerous actual property market consists of a number of funding choices all through established and rising cities. Choosing places relative to their realization (rental earnings, future appreciation, or each—mixed with analysis and due diligence) maximizes returns and minimizes dangers and finally realizes strategic and worthwhile funding selections via knowledgeable decision-making.

Written by N G Sai Rohith