Picture supply: Getty Photographs

On paper, a £100,000 funding in Tesla (NASDAQ: TSLA) made a decade in the past would now be value roughly £2.4m, reflecting share worth progress of two,340%.

This progress trajectory masks vital turbulence, notably earlier this 12 months as shares plunged 30% from their December peak of $488.54. Nonetheless, this progress’s big.

Nonetheless, it will get higher. That’s as a result of the pound has depreciated round 20% during the last decade. Primarily, £100,000 again then would have purchased be $150,000 of Tesla inventory. At present, that $150,000 of inventory could be value $3.5m, or £2.7m.

Ought to traders money in?

Tesla’s decade-long ascent reworked early traders into millionaires, fuelled by its electrical car (EV) market dominance and cult-like shareholder loyalty. Nonetheless, the corporate and its inventory is at one thing of a crossroads.

So after such a bull run, why would traders contemplate promoting? Properly, Tesla’s monetary metrics defy automotive sector norms, buying and selling at 147 occasions trailing earnings – an 860% premium to the industrials sector median.

This premium can also be current in ahead metrics — these primarily based on analysts’ forecasts — with the ahead price-to-earnings-to-growth (PEG) ratio of 8.5 representing a 450% premium to the industrials sector common.

On paper, this seems to be like a chance to promote. The inventory’s surged and the valuation metrics definitely aren’t engaging. The truth is, the inventory’s worth seems completely disconnected with its fundamentals.

In fact, the worth proposition lies in Elon Musk’s plans for Tesla. The boss sees the corporate dominating in self-driving and robotics. In brief, it has plenty of money, and grand plans, however up to now it seems to be falling a way behind its friends.

Overreach and unpopularity

What’s extra, Musk’s simultaneous roles as Tesla CEO, head of SpaceX, and Trump administration’s Division of Authorities Effectivity (DOGE) chief have diluted focus, and this seems to be impacting shareholder conviction.

In spite of everything, he can’t realistically run all these corporations without delay. And that’s a difficulty given Musk has been so central to Tesla’s rise.

Concerningly, this function within the Trump administration doesn’t look like bearing any fruit for Tesla shareholders both. The truth is, the administration’s cancellation of a $5bn EV charging initiative and new 25% metal/aluminium tariffs have disrupted Tesla’s China-dependent provide chain.

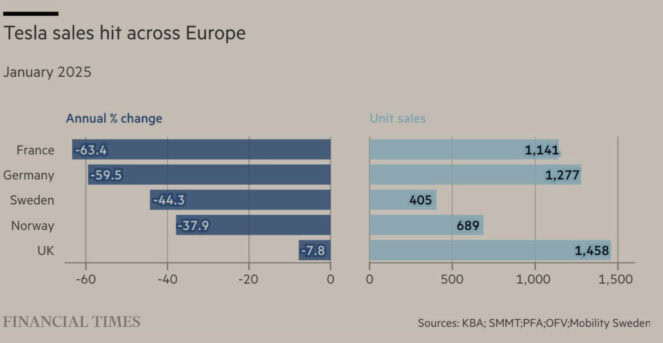

As well as, Morning Seek the advice of knowledge exhibits Musk’s client favourability plummeting to three% in early 2025 from 33% in 2018, eroding the model’s cultural capital. That is notably obvious once we take a look at latest gross sales knowledge in Europe.

Because the Monetary Instances knowledge under highlights, Tesla gross sales fell 63.4% in France in January. Musk’s personal picture could have one thing to do with this. Gross sales in Germany additionally plummeted the place he’s proven help for the extra radical AFD celebration.

In fact, none of this can actually matter if Tesla delivers a dominant product in self-driving and humanoid robots. Nonetheless, that’s an enormous ‘if’ given the shortage of publicised progress.

I’d like to be bullish on this Western know-how chief, however I merely can’t get behind the valuation and the speculative nature of investing in unproven know-how. I received’t contemplate shopping for.