Picture supply: Getty Photos

The London inventory market is house to a various mixture of dividend shares. Because of years of underperformance, traders can seize a excessive dividend yield on numerous them.

Dealer forecasts aren’t all the time a dependable information to future returns. But when Metropolis estimates are correct, a £10,000 lump sum invested in THIS actual property funding belief (REIT) will present £1,589 price of dividends over the subsequent two years (with subsequent 12 months’s dividends reinvested).

I feel it’s price critical consideration main into the New Yr. Right here’s why.

Please observe that tax remedy is determined by the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

First, the dangerous information

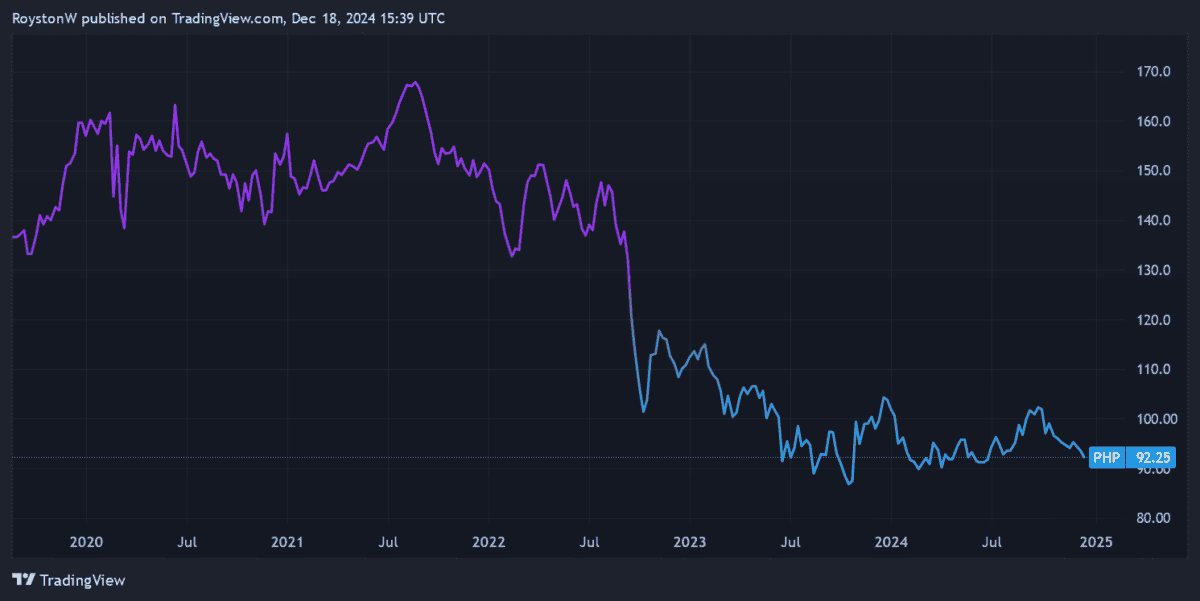

Many property shares like Main Well being Properties (LSE:PHP) have dropped in worth within the second half of 2024. This displays rising fears over the potential of rates of interest remaining increased than hoped.

In truth, this asset class has fallen sharply because the Financial institution of England began elevating rates of interest in late 2021.

Increased charges decrease property valuations and push up borrowing prices. This has made REITs akin to this a much less interesting funding extra just lately.

Sadly, investor demand might stay weak, too, if the path of latest inflationary knowledge turns into a pattern. Information that November’s Ponsumer Value Inflation (CPI) studying was an eight-month excessive has tapered expectations of considerable Financial institution of England price slicing in 2025.

But, regardless of the specter of additional share value weak point, I’m nonetheless tempted to purchase extra Main Well being shares for my portfolio. That is because of its glorious dividend prospects.

Take a look at these dividends!

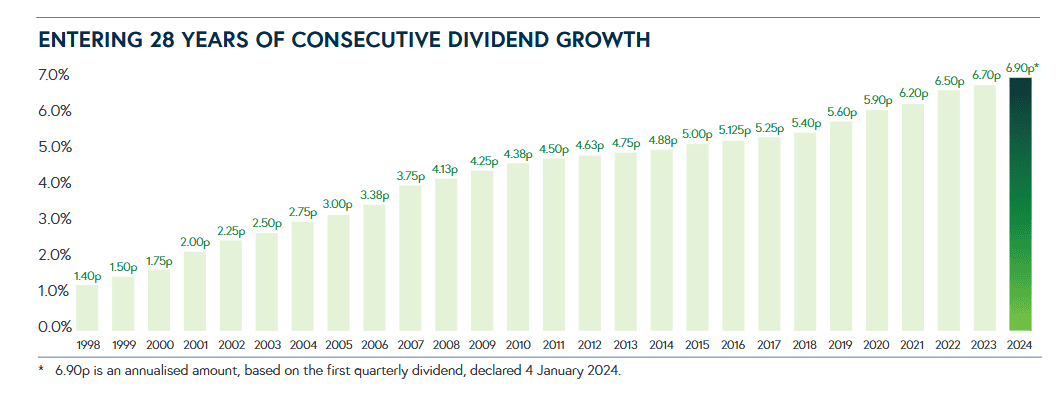

Because the chart above exhibits, the FTSE 250 enterprise has a formidable report of elevating dividends relationship again to the late Nineties.

That is all the way down to a number of components, together with:

- Its deal with the non-cyclical healthcare sector, offering secure earnings from 12 months to 12 months.

- Inflation-linked rental contracts permit it to soak up rising prices, defending earnings progress.

- The rents it receives are successfully assured by authorities our bodies just like the NHS.

- Occupancy is excessive and tenants are locked into long-term contracts.

- Virtually all (97%) of its debt is fastened or hedged, lowering the affect of rising rates of interest.

The lengthy report of earnings progress this has supplied has, in flip, meant Main Well being Properties has been in a position to constantly raised dividends.

Below REIT guidelines, the agency should pay at the very least 90% of annual rental earnings out to shareholders.

Brilliant future

Metropolis analysts count on earnings and dividends to maintain rising all through their three-year forecasts. And so the dividend yield on Main Well being shares stands at 7.6% and seven.7% for 2025 and 2026, respectively.

To place that in context, the common dividend yield on FTSE 100 shares sits manner again at 3.6%.

I opened a place in Main Well being in 2022 to spice up my passive revenue. And I plan to carry it for the long run. I imagine it’ll ship distinctive returns within the years forward as Britain’s rising aged inhabitants drives healthcare demand providers by way of the roof.

In truth, I’m contemplating including to my holdings within the New Yr.